Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

The clean hydrogen market is moving from theory to practice as funding from solidified government support schemes begins to flow to first-of-a-kind projects around the world. As a result, the global hydrogen economy is entering a pivotal phase on the path to full commercialization. Real-world deployment, stable policy, strategic partnerships, and infrastructure will define the next chapter in the story of clean hydrogen markets.

The World Hydrogen Week conference, now a part of S&P Global, will address key issues in global hydrogen trade and geopolitics through guiding questions such as:

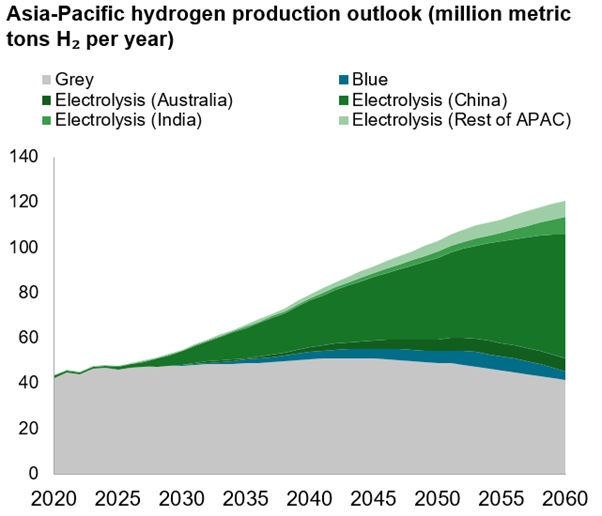

The Asia-Pacific region is expected to have half the world’s population by 2050, and the per-capita energy demand of that population is expected to increase as well. Asia has both energy exporting and importing nations, and a wide array of mature and growing economies and sectors.

This region encompasses energy production markets as well as markets heavily reliant on energy imports, featuring both mature and growing sectors. Many markets are striving to balance energy security, economic growth, and decarbonization, and they see opportunities to participate in this new clean energy market through one or more aspects of supply, consumption, and the equipment supply chain.

The governments of APAC’s largest economies – China, India, Japan, South Korea, and Australia – all have specific policies designed to boost the clean hydrogen economy and have begun to distribute funding. Notably, with the exception of China these countries are specifically looking to stimulate clean hydrogen trade: exports from South Asia and the Oceania, and imports into the Far East. Will the commitment of these governments to growing the clean hydrogen market combine with Chinese technological and manufacturing expertise to drive down costs and make Asia the center of gravity for the global hydrogen market? What role will hydrogen derivatives like ammonia, methanol, and e-methane play in the future market?

Data compiled June 1, 2025 - Source: S&P Global Energy

China has emerged as the global leader in electrolyzer manufacturing and deployment. Since 2023, China has added over 40 GW of nameplate electrolyzer manufacturing capacity and installed over 1 GW of operating electrolyzers. Intense domestic competition is rapidly decreasing prices for alkaline electrolyzer stacks, and we expect this competition will expand to electrical and physical balance of plant components. Most electrolysis projects in development are targeting domestic offtake, especially the refining, chemicals, fertilizer, and transportation markets. However, recent announcements suggest a growing interest in exports, and indicative price quotes suggest Chinese supply could be the cheapest on the market.

With energy security and industrial strategies tied to electrolytic hydrogen development, China is poised to participate in the global clean hydrogen market. Will it focus on exporting low-cost electrolyzers, green methanol, green ammonia, or invest in production projects near demand centers? In light of shifting geopolitics around trade, how will consumer countries respond to Chinese entry into this new market?

Data compiled June 15, 2025 - Source: S&P Global Energy

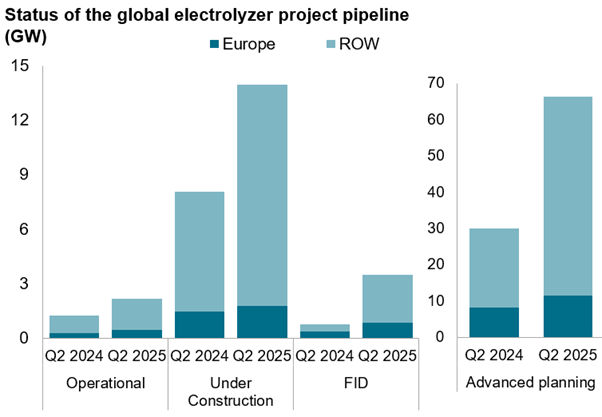

European clean hydrogen policy has been a key driver of market development globally, not only due to interest in developing local supply, but also in demand for facilities outside of Europe. Hydrogen market development has slowed recently, mostly due to a downshift in ambition in the face of high costs and insecure energy supply. European governments are still willing to commit public funding to support renewable hydrogen projects and innovation, but economic discipline and growing defence budgets are likely to apply pressure on the level of financial commitments.

Despite the slowdown, Europe still has more renewable hydrogen project capacity than any other region except China. Capacity in ‘advanced’ European projects has grown by 40% year-on-year, but whether this momentum continues is dependent in part on these policy-related questions:

Data compiled June 15, 2025 - Source: S&P Global Energy

Over €10 billion has already been committed in grants and production subsidies, by the EU and member states, but new funding could come under political pressure as 2030 nears. The appetite to continue supporting the nascent clean hydrogen industry may depend on the outcome of existing EU policy schemes, and the potential loss of support is a key risk faced by European project developers.

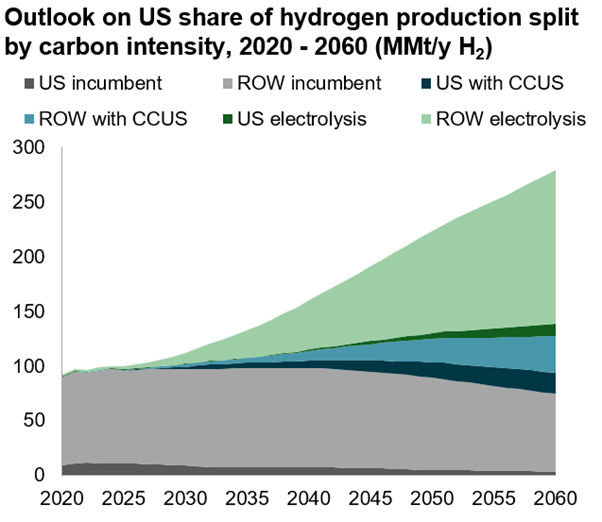

The US Congress has put forth draft bills that would sunset the 45V Clean Hydrogen Production Tax Credit at the end of the 2025, removing a key piece of policy support in the US market. Without access to the maximum $3/kg H2 subsidy available through 45V, a significant majority of US-based electrolysis projects will likely be canceled. Will the loss of this demand market have a significant impact on global growth? How many projects can move forward without tax credit support?

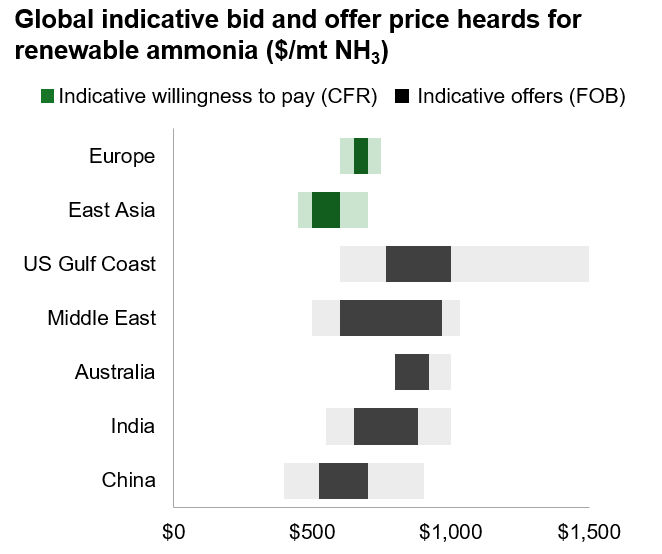

However, the 45Q Carbon Sequestration Tax Credit is expected to remain largely in place. 45Q supports projects using fossil fuels with CCUS, and the minor changes in draft legislation could impact projects on the margin. The US is emerging as a hub for CCUS in general, driven in part by “blue” hydrogen and ammonia project development. These projects are largely targeting export markets in Europe, East Asia, and global shipping. Is a modified 45Q credit still sufficient to allow these projects to compete in the global market for low-carbon ammonia? Can these projects compete with increasing LNG exports for gas supply? Could reduced US oil production, and by extension associated gas production, materially impact production economics?

Data compiled June 1, 2025 - Source: S&P Global Energy

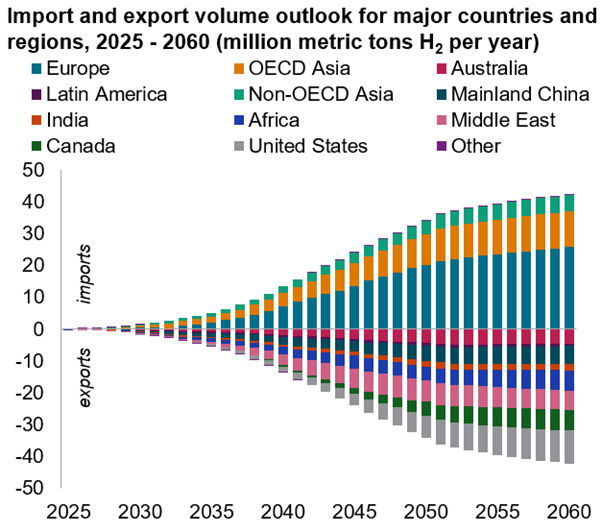

As interest in clean hydrogen increased in the early 2020s, countries with abundant renewable electricity resources announced long-term plans to use hydrogen to export this energy around the world. National hydrogen strategies from Chile, Brazil, Morocco, Egypt, Oman, India, Australia, Norway, Canada, and the US all included exports as a key demand market for domestic projects. Competition for the import markets in Europe, Japan, and Korea could become intense with so many regions vying for market access. Project selections from import-focused subsidy programs like H2Global and the Japanese government’s contract-for-difference scheme loom as major signposts in 2025. Who will win the race to supply clean hydrogen to the world, and what factors will be key in determining the market’s winners and losers?

OECD Asia category excludes Australia to avoid double counting, similarly Non-OECD Asia excludes Mainland China and India.

Data compiled June 1, 2025 - Source: S&P Global Energy

The Asia-Pacific region is expected to have half the world’s population by 2050, and the per-capita energy demand of that population is expected to increase as well. Asia has both energy exporting and importing nations, and a wide array of mature and growing economies and sectors.

This region encompasses energy production markets as well as markets heavily reliant on energy imports, featuring both mature and growing sectors. Many markets are striving to balance energy security, economic growth, and decarbonization, and they see opportunities to participate in this new clean energy market through one or more aspects of supply, consumption, and the equipment supply chain.

The governments of APAC’s largest economies – China, India, Japan, South Korea, and Australia – all have specific policies designed to boost the clean hydrogen economy and have begun to distribute funding. Notably, with the exception of China these countries are specifically looking to stimulate clean hydrogen trade: exports from South Asia and the Oceania, and imports into the Far East. Will the commitment of these governments to growing the clean hydrogen market combine with Chinese technological and manufacturing expertise to drive down costs and make Asia the center of gravity for the global hydrogen market? What role will hydrogen derivatives like ammonia, methanol, and e-methane play in the future market?

Data compiled June 1, 2025 - Source: S&P Global Energy

China has emerged as the global leader in electrolyzer manufacturing and deployment. Since 2023, China has added over 40 GW of nameplate electrolyzer manufacturing capacity and installed over 1 GW of operating electrolyzers. Intense domestic competition is rapidly decreasing prices for alkaline electrolyzer stacks, and we expect this competition will expand to electrical and physical balance of plant components. Most electrolysis projects in development are targeting domestic offtake, especially the refining, chemicals, fertilizer, and transportation markets. However, recent announcements suggest a growing interest in exports, and indicative price quotes suggest Chinese supply could be the cheapest on the market.

With energy security and industrial strategies tied to electrolytic hydrogen development, China is poised to participate in the global clean hydrogen market. Will it focus on exporting low-cost electrolyzers, green methanol, green ammonia, or invest in production projects near demand centers? In light of shifting geopolitics around trade, how will consumer countries respond to Chinese entry into this new market?

Data compiled June 15, 2025 - Source: S&P Global Energy

European clean hydrogen policy has been a key driver of market development globally, not only due to interest in developing local supply, but also in demand for facilities outside of Europe. Hydrogen market development has slowed recently, mostly due to a downshift in ambition in the face of high costs and insecure energy supply. European governments are still willing to commit public funding to support renewable hydrogen projects and innovation, but economic discipline and growing defence budgets are likely to apply pressure on the level of financial commitments.

Despite the slowdown, Europe still has more renewable hydrogen project capacity than any other region except China. Capacity in ‘advanced’ European projects has grown by 40% year-on-year, but whether this momentum continues is dependent in part on these policy-related questions:

Data compiled June 15, 2025 - Source: S&P Global Energy

Over €10 billion has already been committed in grants and production subsidies, by the EU and member states, but new funding could come under political pressure as 2030 nears. The appetite to continue supporting the nascent clean hydrogen industry may depend on the outcome of existing EU policy schemes, and the potential loss of support is a key risk faced by European project developers.

The US Congress has put forth draft bills that would sunset the 45V Clean Hydrogen Production Tax Credit at the end of the 2025, removing a key piece of policy support in the US market. Without access to the maximum $3/kg H2 subsidy available through 45V, a significant majority of US-based electrolysis projects will likely be canceled. Will the loss of this demand market have a significant impact on global growth? How many projects can move forward without tax credit support?

However, the 45Q Carbon Sequestration Tax Credit is expected to remain largely in place. 45Q supports projects using fossil fuels with CCUS, and the minor changes in draft legislation could impact projects on the margin. The US is emerging as a hub for CCUS in general, driven in part by “blue” hydrogen and ammonia project development. These projects are largely targeting export markets in Europe, East Asia, and global shipping. Is a modified 45Q credit still sufficient to allow these projects to compete in the global market for low-carbon ammonia? Can these projects compete with increasing LNG exports for gas supply? Could reduced US oil production, and by extension associated gas production, materially impact production economics?

Data compiled June 1, 2025 - Source: S&P Global Energy

As interest in clean hydrogen increased in the early 2020s, countries with abundant renewable electricity resources announced long-term plans to use hydrogen to export this energy around the world. National hydrogen strategies from Chile, Brazil, Morocco, Egypt, Oman, India, Australia, Norway, Canada, and the US all included exports as a key demand market for domestic projects. Competition for the import markets in Europe, Japan, and Korea could become intense with so many regions vying for market access. Project selections from import-focused subsidy programs like H2Global and the Japanese government’s contract-for-difference scheme loom as major signposts in 2025. Who will win the race to supply clean hydrogen to the world, and what factors will be key in determining the market’s winners and losers?

OECD Asia category excludes Australia to avoid double counting, similarly Non-OECD Asia excludes Mainland China and India.

Data compiled June 1, 2025 - Source: S&P Global Energy

Join us in Copenhagen for World Hydrogen Week

This report is a preview of the topics to be discussed in detail at the upcoming World Hydrogen Week.

The 6th annual World Hydrogen Week is your one-stop-shop for all things hydrogen, supporting the entire value chain through specialised training, intelligence and networking to accelerate projects through FID into operational phase and to optimise success. Across 5 days, there’s so much your whole team can benefit from, so discover what World Hydrogen Week has to offer below.