Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Metals & Mining Theme, Ferrous, Non-Ferrous

May 09, 2025

By Semra Ugur

HIGHLIGHTS

Scrap and rebar spot prices continue their upward trend

Weekly trading volumes for rebar improve

Volumes traded for the scrap futures contracts on the London Metal Exchange, which settle on the basis of the Platts assessment from S&P Global Energy, decreased on the week.

Weekly LME scrap futures trading volumes in the week to May 8 decreased to 98,070 mt, down from 129,780 mt in the week to May 1.

Platts assessed spot prices for physical Turkish imports of premium heavy melting scrap 1/2 (80:20) at $339/mt CFR May 8, increasing by $9/mt week over week from May 1, amid pockets of demand, with sellers targeting higher offer levels.

The May-August portion of the forward curve for Turkey scrap futures on the LME followed a contango structure, indicating that futures traders expect Turkish scrap prices in the physical market to follow an upward trend in the medium term.

Rebar futures volumes traded on the LME rose in the week to May 8.

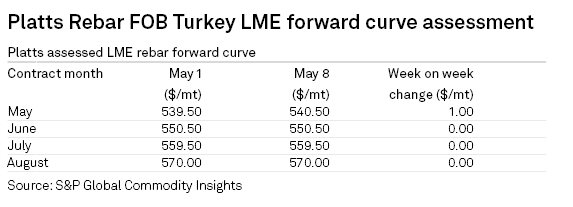

Platts assessed Turkish exported rebar at $547.50/mt FOB May 8, up $7.50/mt week over week from May 1, as imported scrap and improved sales activity supported Turkish mills' pricing.

Weekly LME rebar futures trading volumes grew to 1,420 mt in the week to May 8, up from 220 mt in the week to May 1.

The May-August portion of the forward curve for Turkey rebar futures on the LME followed a contango structure, indicating that futures traders expect Turkish rebar prices in the physical market to follow an upward trend in the medium term.

Products & Solutions

Editor: