Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Energy Transition, Carbon, Emissions

November 03, 2025

HIGHLIGHTS

Regulator issues 600,000 ACCUs; marks largest issuance for CCS project

Santos likely to use credits for compliance, unlikely to enter secondary market: market source

Credits likely to be priced around Generic ACCU levels: market sources

Australian oil and gas producer Santos' Moomba carbon capture and storage project has received the largest single Australian Carbon Credit Units issuance, bringing in fresh supply into the market, although market participants said the credits were unlikely to be offloaded into the secondary market.

The credits issued under the carbon capture and storage method covered the project's first six months, as per Santos's media release, Nov. 3. Australia's Clean Energy Regulator confirmed in a press release by the regulator Nov. 3, 614,133 ACCUs were allocated to Santos for September 2024 to March 2025.

The scale of issuance was expected to stir the ACCUs market, but market participants said they observed a surprising lack of reaction.

"I expected the market to come off a little, but it hasn't really," a Sydney-based ACCU trader said, commenting on the impact of the announcement on ACCUs spot market.

Platts, part of S&P Global Energy, assessed Generic ACCU and Human-Induced Regeneration at A$38.50/mtCO2e, both up 10 Australian cents/mtCO2e day over day, respectively, Nov. 3.

Santos is likely to use its own credits for compliance under the Safeguard Mechanism, sources said, and is unlikely to hit the open market, the trader added.

"How Santos or its partners use their ACCUs-- whether for their own compliance obligations or into the secondary market -- will depend on each company's trading and surrender strategies," Raphael Wood, Managing Director, Silva Capital, a Sydney-based carbon fund and developer, said.

Platts reached out to Santos for a comment on its intended usage of the credits, but did not receive any response.

Moomba CCS, operated by Santos, and co-owned by Beach Energy, another oil and gas company based in Australia, is covered under the Safeguard Mechanism, which mandates emissions reductions across Australia's industrial sectors.

ACCUs issued to CCS projects are added back to the facility's net emissions for compliance purposes, ensuring no double-counting, CER said Nov. 3.

An Australia-based developer and trader said that analysts tracking the market must already have incorporated the likely CCS supply into their forward modeling.

According to analytics data by S&P Global Energy, ACCU issuances under the CCUS from various projects are expected to be around 3 million/year.

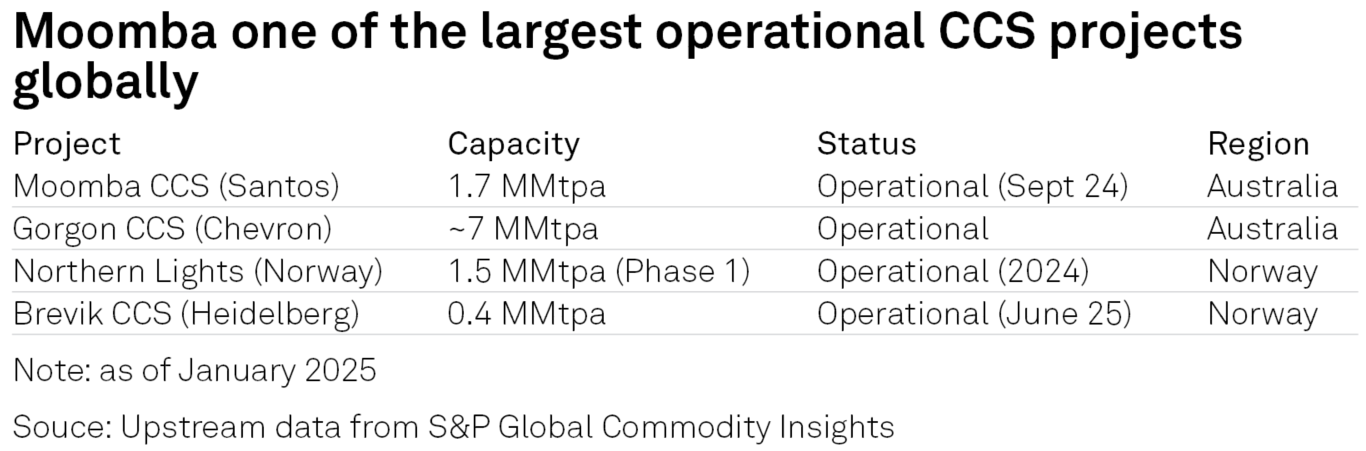

Moomba CCS, located in South Australia's Cooper Basin, is one of the world's largest CCS projects with a capacity of 1.7 million mtCO2e/year. It passed its first full year of operations in early November, with Santos reporting 1.3 million mtCO2e safely and permanently stored to date.

"ACCU supply is projected to more than double by 2040, rising from around 22 million mtCO2e in [compliance year ending March] 2025-26 to approximately 47 million mtCO2e by [compliance year ending March] 2039-40," Abhijeet Thakkar, Asia Carbon Markets Senior Analyst at S&P Global Energy, said.

Thakkar, commenting on CCUS in ACCUs market, said, Carbon capture, utilisation and storage is expected to scale to around 6 million tons by 2040 -- accounting for more than one-fifth of total supply growth.

"CCS is one of several valid pathways for generating ACCUs and will play a role in Australia's broader industrial and energy transition. If carbon is verifiably captured and permanently stored, it deserves to be credited on the same footing as any other eligible abatement activity," Silva Capital's Wood said.

The Moomba project is designed to sequester up to 1.7 million mtCO2e annually over its 25-year crediting period, according to CER.

According to the Safeguard Baselines and Emissions for compliance year ending March 2023-24 data, Santos, in total, surrendered 370,166 ACCUs from their nine facilities, while Beach Energy only surrendered 68,000 ACCUs.

In a company press release Nov. 3, Santos CEO Kevin Gallagher hailed the milestone as a historic achievement for Australia's decarbonization efforts in Santos' release, calling Moomba "a first for Santos, South Australia, and the nation in terms of large-scale, onshore CCS".

The issuances to the Moomba CCS project mark the first ACCUs supply from this methodology. CCUS, a tech-based method, is often regarded as cost-intensive, but Santos' Moomba project is among the world's lowest-cost CCS projects.

According to S&P Global Energy, the project cost is around $27-$28/mtCO2e.

Market participants said the compliance market might not differentiate between the ACCUs coming from the CCS facility and the most competitively priced ACCU Generic in the secondary market.

"The ACCU market remains a buyer's market, and at present most sellers are price-takers. CCS credits do not carry the additional co-benefits attached to some nature-based methods, so they are likely to trade around the generic ACCU price range," Wood said.

He added over time, as the current oversupply narrows and the market balances, prices will move toward each method's long-run marginal cost of production.

The Sydney-based trader echoed the same sentiment and said the market would likely still value them around the Generic ACCU level. Unless there is a specific buyer who sees a premium and would pay more.

Products & Solutions

Editor: