Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Chemicals, Polymers

March 12, 2025

HIGHLIGHTS

Brazil's legislation fuels optimism despite competition from imports.

US' new administration raises concerns over sustainability policies.

Mexico's sustainability growth is driven by brands, not legislation.

This content is part of the WPC 2025 series, where we explore key themes from the 40th annual World Petrochemical Conference.

The markets for recycled polymers in the Americas continue to face underdeveloped regulatory frameworks that hinder progress in addressing key challenges. Recent developments have generated a blend of optimism and frustration among stakeholders in Brazil, Mexico and the US.

With major brand owners setting global targets, recycled material end-buyers can adjust their resin mix and regional strategies to enhance cost efficiency and comply with local regulations.

The US' state-by-state regulatory approach has resulted in slow progress, with only five states currently adopting Extended Producer Responsibility policies. EPR policies mandate producers to manage their products' life cycles, combined with post-consumer recycled content mandates, these measures are viewed by market participants as essential for a more predictable and self-sustained recycling industry.

In Brazil, EPR policies reportedly suffer from low enforcement and traceability; however, policy developments expected by mid-2025 have instilled hope in the market.

In Mexico, EPR framework faces challenges such as collection infrastructure and lack of incentives for companies to actively enforce EPR.

Brazil's waste import controls have not been updated following a January law banning such imports, while the National Circular Economy Plan seeks to promote circularity.

Prices for rPET feedstock surged throughout 2024 due to supply shortages and strong demand. Recyclers have turned to imported flakes as a solution, but the outdated regulations blocked some shipments, creating uncertainties.

Market prices have softened since late 2024 but remain elevated, pressured by announced expansions in recycling capacity set for 2025.

Platts, part of S&P Global Energy, last assessed post-consumer PET clear bottle bales (95/5) at Real 5.6/kg DDP São Paulo on March 11, up Real 1.1/kg from Aug. 12, 2024, when the assessment was launched. Recycled PET clear flakes were last assessed at Real 9.75/kg DDP São Paulo on March 11.

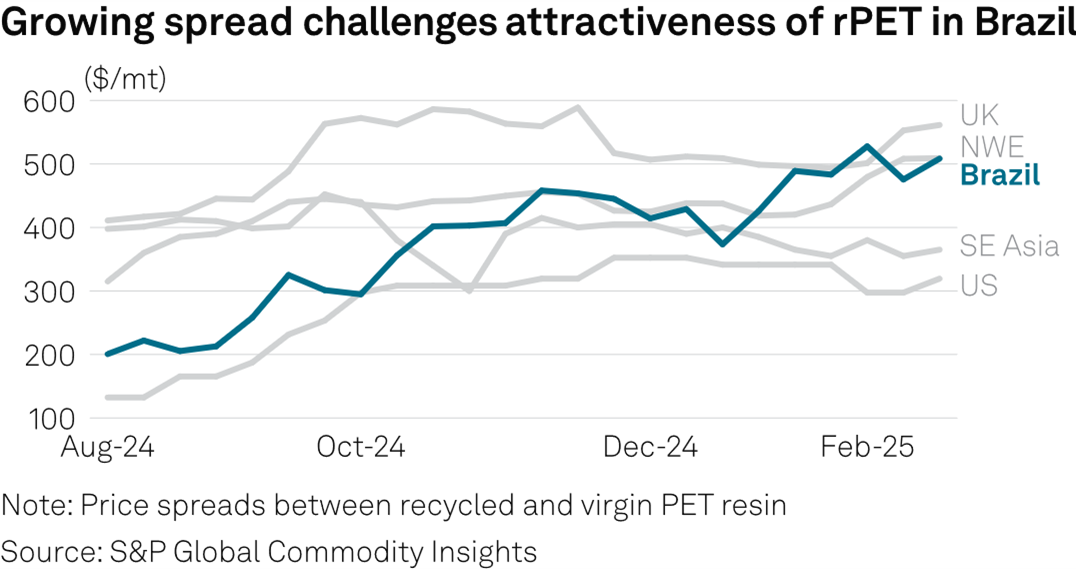

Cheap virgin resin continues to hinder the local recycled market's global appeal due to absent recycled content mandates. The price spread between recycled and virgin PET resin has surged in Brazil, ranking among the highest in the world.

One proposed action within the plan is to "encourage the use of secondary materials in the industrial production process by establishing a percentage for the use of secondary materials."

Expanding domestic recycling capacity and corporate sustainability commitments are driving the growth of the U.S. recycled plastics market, but legislative support remains a key concern.

Market participants are closely watching how the new administration will approach plastics policy.

While the Biden administration introduced measures such as phasing out single-use plastics in federal procurement by 2027 and eliminating them entirely by 2035, it remains uncertain if the new administration will uphold these commitments.

President Donald Trump's recent "Back to Plastic" executive order signals a policy shift, reinstating federal purchases of plastic straws and adding uncertainty to future regulations. In 2024, Republicans also urged the Biden administration to oppose caps on virgin plastic production and pushed back against the UN plastics treaty.

Amid federal uncertainty, state-led initiatives remain a critical force for change. EPR packaging programs aim to boost collection rates, develop markets for hard-to-recycle materials, and hold producers accountable for packaging waste.

So far, only California, Colorado, Maine, Minnesota and Oregon have adopted EPR legislation for packaging, leaving a fragmented regulatory landscape across the country.

Platts, part of S&P Global Energy, last assessed post-consumer recycled HDPE natural bales at 96 cents/lb FOB Chicago on March 11, which has risen 65 cents/lb from the beginning of 2024, when bale pricing started to skyrocket on tighter supply and high demand for brands' commitments to using more post-consumer recycled content.

Plastics recycling's profile has grown in Mexico in recent years on the back of industry initiatives and consumer awareness.

With the increasing demand for sustainable packaging nationwide, the market has experienced a mismatch between supply and demand, which has led to price volatility for recycled plastics.

Strong demand, coupled with limited supply, has sustained high bale prices since the second half of 2024, driven by the expansion of production lines among recycling companies in Mexico and the efforts of brand owners to meet their sustainability goals.

This has established a scenario where demand for bales outstrips supply, leading to price instability.

Platts last assessed post-consumer PET clear bottle bales at Peso 20.25/kg ex-works Central Mexico on March 11, up Peso 6.45/kg from Sept. 3, 2024, when bale pricing started to increase on tighter supply and high demand. Recycled PET clear flakes were last assessed at Peso 30/kg ex-works Central Mexico.

In Mexico, states with larger population tend to have higher collection rates. However, collection efforts in Mexico are somewhat centralized, making it challenging for bale sellers to gather post-consumer material outside of Central Mexico, sources said.

The climbs in bale pricing have been reflected in downstream flake and pellet pricing, increasing feedstock costs for PET packaging applications.

Market participants expect that legislation will bolster demand for recycled plastics and enhance investment in improving supply infrastructure, helping ease price volatility.