India's agriculture, seafood and biofuel sectors are bracing for an additional 25% tariff on outflows to the US starting Aug. 27, as Washington plans to double overall duties to 50%, which threatens to make key exports, such as shrimp, uncompetitive in the market.

US President Donald Trump has imposed a 25% tariff, plus an additional "penalty," on imports from India, citing high trade barriers and continued energy and defense ties with Russia.

The US Department of Homeland Security confirmed an additional 25% tariff on Indian imports in an official notice Aug. 25, effective at 12:01 am Eastern Standard Time on Aug. 27.

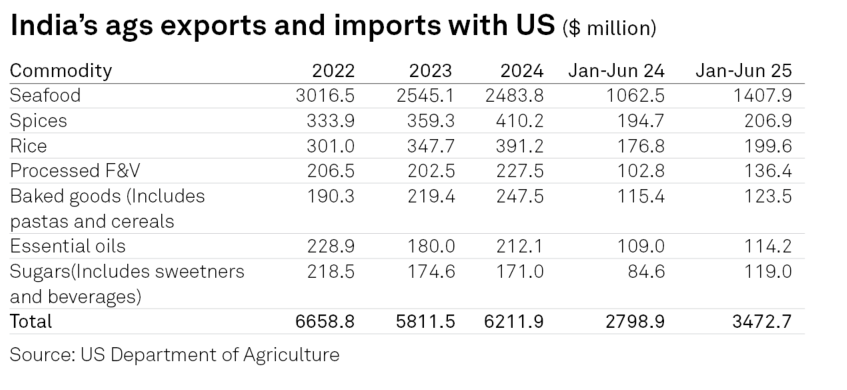

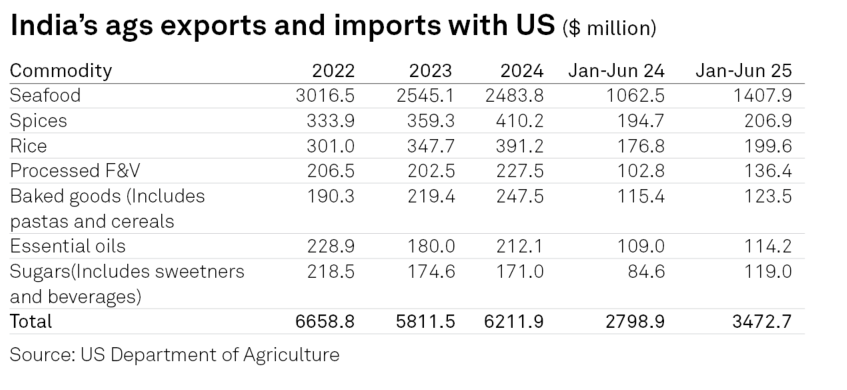

Agricultural goods accounted for about 5% of the total trade value between the US and India in 2024.

Total goods trade between the US and India was estimated at $128.9 billion in 2024, according to the US Trade Representative.

India's agricultural trade with the US was $6.21 billion in 2024, data from the US Department of Agriculture showed. Over January-June 2025, agricultural trade expanded to $3.47 billion, compared with about $2.80 billion during the same period a year earlier.

Trade

Analysts estimate nearly 70% of India's exports face risk from the new US tariffs. Exporters are already scouting buyers in China, Japan, the EU and the UK, while they rush to frontload shipments to beat the Aug. 27 deadline.

Seafood

- The seafood segment is the largest within the agricultural trade.

- Shrimp is India's top seafood export and its single-largest item to the US, accounting for more than 40% of its shrimp outflows.

- India exported $5.17 billion worth of shrimp in the financial year 2024-25 (April-March). Duties reaching nearly 50% now threaten to reduce export volumes and erode pricing power.

- Tariffs are expected to raise the combined levies on Indian shrimp to nearly 60%, significantly eroding its cost advantage compared with Ecuador, which faces an 18.8% duty on imports to the US (comprising a 15% tariff and a 3.78% countervailing duty), Vietnam, which faces a 20% duty, and Indonesia, which faces a 19% duty.

Rice

- Market participants expect Indian basmati exports to Europe to rise as Pakistan reallocates volumes to fulfill US demand.

- Europe may benefit from this trade dynamic, as over half of its imports are supplied by Pakistan (54%), with the remaining 46% coming from India.

- Market sources said Europe will have two major and competitive sourcing options, potentially enabling it to secure supplies on favorable terms.

- India shipped $337 million of Basmati rice to the US in FY 2024-25.

Farmgate and fuel

- US negotiators continue to seek access to India's market for dairy, genetically modified corn and soybeans -- products that New Delhi has identified as political "red lines." Indian farm groups remain opposed, citing concerns over livelihoods, smallholder farmers and sensitivities related to cattle. Prime Minister Narendra Modi has reiterated that farmers and fishermen remain "untouchable" in trade talks.

- India's ethanol production capacity rose to 18.1 billion litres in 2024, while consumption reached 7.1 billion litres, according to the USDA Foreign Agricultural Service. The USDA Biofuels Annual reports that the US exported ethanol to India in 2024, valued at $420 million for industrial and chemical use. US-supplied ethanol imports are crucial for these sectors, as any disruption could tighten pharmaceutical and chemical supply chains.

- India, once Asia's top corn exporter, became a net importer in 2024, according to the USDA FAS. Market estimates suggest that India's imports could reach 1 million mt in 2025, while exports may fall to 450,000 mt.

- US tariffs threaten $5 billion of processed food and protein exports, including guar gum, pulses, plant proteins, soy lecithin, and spices. According to India's Spices Board, India exported $4.72 billion worth of spices globally in 2024, with the US among the top three buyers. India's dairy exports to the US were 94,000 mt in FY 2023-24, worth $180 million.

Infrastructure

- Seafood exporters are diverting shipments to Europe and China at lower margins, but order books remain thin. Market sources have said that some shrimp farmers in Andhra Pradesh have switched to fish farming after successive price collapses. An analyst said some shrimp processing plants have sought certification to meet China's new radiation and food‐safety rules and Japan's stringent HACCP requirements.

- Cold-chain and warehousing infrastructures are under pressure as exporters hold back shipments awaiting tariff clarity. Local reports indicated that frozen‐seafood cold‐storage utilization in major hubs (Visakhapatnam, Chennai) exceeded 90% in August 2025, as exporters deferred shipments.

- Rice exporters have diverted cargoes to Europe and Africa, but have faced capacity bottlenecks at Kandla and Mundra ports. Experts warn of a short-term export slowdown, although India's quality advantage may preserve market share in the premium basmati segment. Some industry sources warn that continued congestion at Kandla and Mundra could delay shipments and erode India's premium basmati advantage.

- The US ethanol lobby sees India's rapidly expanding blending program as a major opening. However, India is prioritizing domestic sugar- and maize-based supply.

Price

- Shrimp farmgate prices in Andhra Pradesh slumped by Rupees 30-55/kg in early August. Platts, part of S&P Global Energy, assessed peeled, deveined, tail-on shrimp FCA India as unchanged at $6,945/mt on Aug. 25. No fresh peeled, deveined, tail-on or tail-off shrimp offers or trades were confirmed.

- The Indian parboiled 5% market weakened Aug. 25 amid subdued demand. Exporters were offering PB 5% at $352/mt FOB for September shipment.

- Corn imports into India have surged, and the prevailing tariff situation is driving domestic feed costs to record highs. In 2024, corn prices reached Rupees 2,800/quintal ($319.7/mt) in some markets, and poultry feed costs increased 40% to Rupees 40/kg ($456.6/mt).

- Domestic basmati prices have been under pressure, as the US accounts for 5% of India's high-value basmati rice exports. In the longer term, trade is expected to decline, potentially forcing farmers to rely on procurement at the minimum support price for paddy.

- Dairy processors estimate a 30% to 35% margin erosion from tariffs, before freight and antidumping costs.