Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 8 Jul, 2021

Introduction

COVID-19 looked set to shut down the market for application software acquisitions in early 2020. Instead, the side effects of the disease spurred this corner of tech M&A to new heights. The attempt to quash the pandemic forced classrooms into bedrooms and offices into kitchens. Retailers that had been prodded online for the past two decades were propelled to get there overnight. The changes accelerated both the addressable market and stock prices of many application vendors – giving them the motive and the money to go shopping.

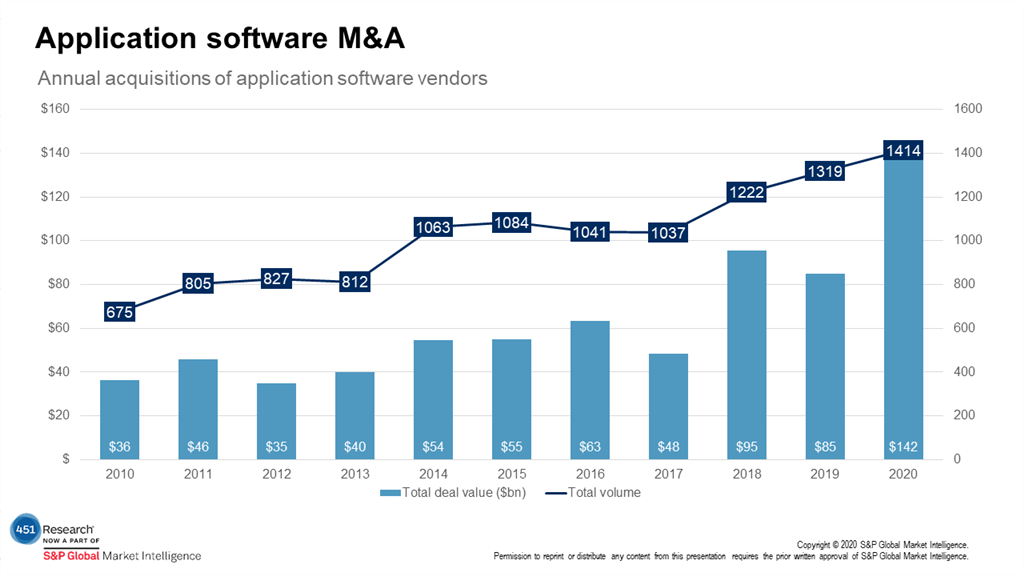

According to 451 Research's M&A KnowledgeBase, acquirers smashed the previous annual record, spending $142bn purchasing vendors that develop software for business users and consumers. That's a 49% bump from the 2018 record – a phenomenal outcome considering that nearly all of the spending came in the back half of the year. Less than $20bn went toward application software targets in the first two quarters of 2020. The momentum in the second half, along with the improving picture for company IT budgets, sets up 2021 for a significant start.

A Soaring Software Market

Source: 451 Research's M&A KnowledgeBase

Just a handful of big deals accounts for the difference between 2020's total and the previous record. Our data indicates that just seven application software providers have been bought for over $10bn and three of them were announced in 2020: Slack ($28.4bn), Ellie Mae ($11bn) and RealPage ($10.2bn). It wasn't just the high end of the market that fared well. The M&A KnowledgeBase shows that 1,414 companies in that market were acquired, also a record.

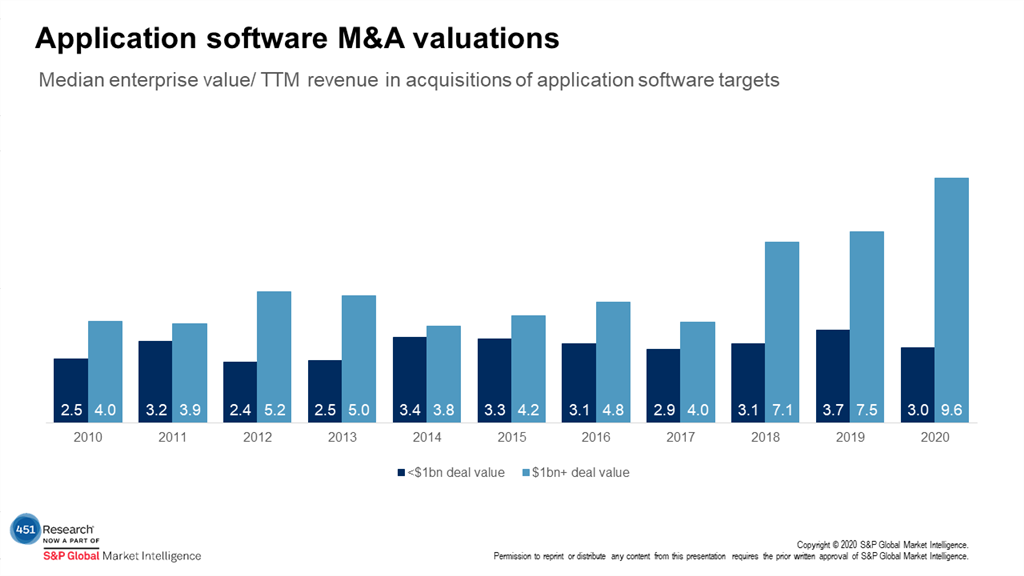

Still, the upper echelon fetched the heartiest valuations. Application software targets nabbed a median 9.6x trailing revenue in transactions worth $1bn or more last year, more than two turns higher than last year. In all other application software deals, however, the median fell more than half a turn to 3x, the lowest in three years.

Haves and Have-Nots in Software Acquisitions

Source: 451 Research's M&A KnowledgeBase

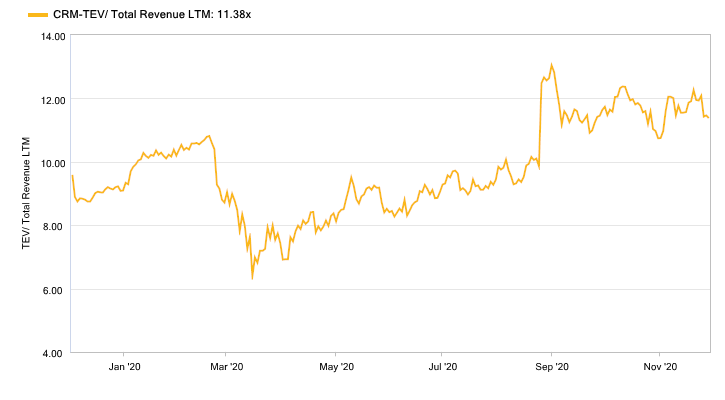

Rising equity prices underpinned 2020's rush of application software M&A. The S&P 500-Information Technology index surged 42% during the year, according to S&P Global Market Intelligence. As it did, valuations of both buyers and sellers ticked up. Salesforce, for example, was valued a bit above 9x trailing revenue at the start of 2020. The CRM giant was trading at 11.5-12x trailing revenue in the days leading up to its acquisition of Slack. No doubt that helped it justify paying 36x for the communications software maker.

Salesforce's Valuation in 12 Months Leading to Slack Buy

Source: S&P Global's Market Intelligence

The growing value of its own stock provided the currency and justification for the move. But it was the expansion of remote work that provided the rationale. Salesforce is betting that, even when coronavirus is history, there's a big future for software vendors that can help businesses communicate and collaborate. The acceleration of digital living sparked several other notable software deals:

Ahead of Salesforce's bet that remote work would make communications software more important, Adobe made a similar wager on project management software. With its $1.5bn pickup of Workfront, Adobe foresees a rise in the use of software to manage work.

SAP printed its first acquisition in two years, landing Emarsys. The target's marketing automation software could be bundled with hybris, SAP's e-commerce play, as demand for such software increases in line with the surge in online shopping.

Plummeting interest rates and a flight to the suburbs propelled the housing market, motivating Intercontinental Exchange to pay $11bn for mortgage software specialist Ellie Mae in its largest-ever software purchase.

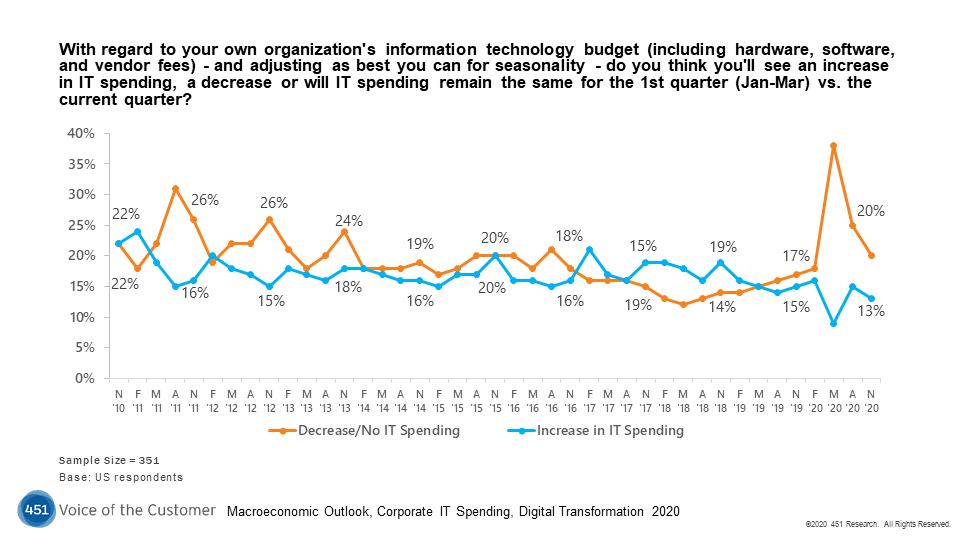

The stock market wasn't the only reason why buyers felt more confident about printing software transactions in the second half of 2020. The environment for selling software improved once people absorbed the initial shock of the lockdown. According to 451 Research's Macroeconomic Outlook, Corporate IT Spending, just 20% of businesses in November said they'd decrease their quarter-over-quarter IT spending, down from 35% in March. As the spread between increasing and decreasing budgets continues to narrow, buyers could gain further confidence to print deals.

Corporate IT Budget Outlook

Source: 451 Research's Voice of the Customer: Macroeconomic Outlook, Corporate IT Spending, Digital Transformation 2020

Signature Deals from 2020

|

Acquirer |

Target |

Deal value |

Comment |

|

Salesforce |

Slack Technologies |

$28.4bn |

In Slack, Salesforce lands a software company that resembles its younger self. The communications software business will shortly pass $1bn in annual revenue, with scorching growth. The difference: Salesforce was valued at 6x sales when it hit that milestone in 2008 – 30 turns lower than the price it paid for Slack. |

|

Intercontinental Exchange |

Ellie Mae |

$11bn |

Just 18 months after acquiring the mortgage software vendor, Thoma bravo flipped Ellie Mae at almost 3x its purchase price. The deal marks the largest-ever cash acquisition of a private equity (PE)-held tech provider. |

|

Microsoft |

ZeniMax Media |

$7.5bn |

Microsoft's pickup of console-game developer ZeniMax provides the latest – and clearest – evidence that it's turning toward growing its consumer business, after spending several years transitioning the enterprise software side of the house to the cloud. |

|

Twilio |

Segment |

$3.2bn |

After its stock price tripled through the first three quarters of the year, Twilio puts those gains to work with the all-stock acquisition of Segment. The deal brings the buyer into direct competition with marketing software heavyweights Adobe, Salesforce and Oracle. |

|

Adobe |

Workfront |

$1.5bn |

In Workfront, Adobe scored a workflow application specialist that connects marketers using Adobe's Creative Cloud and those pushing content to customers with Experience Cloud. Offering software to both groups was the rationale for the purchase of Omniture, the move that launched Adobe's marketing software business 11 years ago. |

|

Cornerstone OnDemand |

Saba Software |

$1.4bn |

Both companies offer similar corporate learning management systems (LMS), although Saba has more AI and analytics that could help extend Cornerstone's reach beyond customers seeking traditional LMS support for compliance, regulatory and management training. |

|

Salesforce |

Vlocity |

$1.3bn |

Vlocity, a maker of CRM software for vertical markets, could expand the buyer's growth in large, enterprise deployments that require specialty expertise but promise to embed Salesforce deep into those enterprises. The pairing could also help Salesforce nab midmarket customers with lightweight process automation. |

|

SAP |

Emarsys |

$940m* |

With Emarsys, SAP obtains a marketing automation product powered by machine learning. Many other acquirers are moving toward mature assets like Emarsys for machine learning capabilities and inking fewer 'acq-hires' to fill those gaps. |

|

TIBCO Software |

Information Builders |

$550m* |

This deal reinforces TIBCO's reporting capabilities, which it gained by snagging Jaspersoft back in 2014. In addition, it cements TIBCO's data management portfolio in support of data science and analytic use cases. |

|

Acquirer |

Target |

Deal value |

Comment |

|

Salesforce |

Slack Technologies |

$28.4bn |

In Slack, Salesforce lands a software company that resembles its younger self. The communications software business will shortly pass $1bn in annual revenue, with scorching growth. The difference: Salesforce was valued at 6x sales when it hit that milestone in 2008 – 30 turns lower than the price it paid for Slack. |

|

Intercontinental Exchange |

Ellie Mae |

$11bn |

Just 18 months after acquiring the mortgage software vendor, Thoma bravo flipped Ellie Mae at almost 3x its purchase price. The deal marks the largest-ever cash acquisition of a private equity (PE)-held tech provider. |

|

Microsoft |

ZeniMax Media |

$7.5bn |

Microsoft's pickup of console-game developer ZeniMax provides the latest – and clearest – evidence that it's turning toward growing its consumer business, after spending several years transitioning the enterprise software side of the house to the cloud. |

|

Twilio |

Segment |

$3.2bn |

After its stock price tripled through the first three quarters of the year, Twilio puts those gains to work with the all-stock acquisition of Segment. The deal brings the buyer into direct competition with marketing software heavyweights Adobe, Salesforce and Oracle. |

|

Adobe |

Workfront |

$1.5bn |

In Workfront, Adobe scored a workflow application specialist that connects marketers using Adobe's Creative Cloud and those pushing content to customers with Experience Cloud. Offering software to both groups was the rationale for the purchase of Omniture, the move that launched Adobe's marketing software business 11 years ago. |

|

Cornerstone OnDemand |

Saba Software |

$1.4bn |

Both companies offer similar corporate learning management systems (LMS), although Saba has more AI and analytics that could help extend Cornerstone's reach beyond customers seeking traditional LMS support for compliance, regulatory and management training. |

|

Salesforce |

Vlocity |

$1.3bn |

Vlocity, a maker of CRM software for vertical markets, could expand the buyer's growth in large, enterprise deployments that require specialty expertise but promise to embed Salesforce deep into those enterprises. The pairing could also help Salesforce nab midmarket customers with lightweight process automation. |

|

SAP |

Emarsys |

$940m* |

With Emarsys, SAP obtains a marketing automation product powered by machine learning. Many other acquirers are moving toward mature assets like Emarsys for machine learning capabilities and inking fewer 'acq-hires' to fill those gaps. |

|

TIBCO Software |

Information Builders |

$550m* |

This deal reinforces TIBCO's reporting capabilities, which it gained by snagging Jaspersoft back in 2014. In addition, it cements TIBCO's data management portfolio in support of data science and analytic use cases. |

Source: 451 Research's M&A KnowledgeBase *451 estimate

Macro-level drivers

Navigating a post-pandemic world with data analysis and machine learning

Making business decisions deploying AI and machine learning (ML) is becoming prevalent as organizations place large-scale data analytics, insights and automation center stage. Data-driven decision-making, often deeply entwined with digital transformation, is driving the growth of ML-based analysis and, by association, software vendors' M&A strategies. Mining and crunching data for insights to extract business value is, after all, why organizations view data as critical. And machine learning is the technology that enables that value extraction.

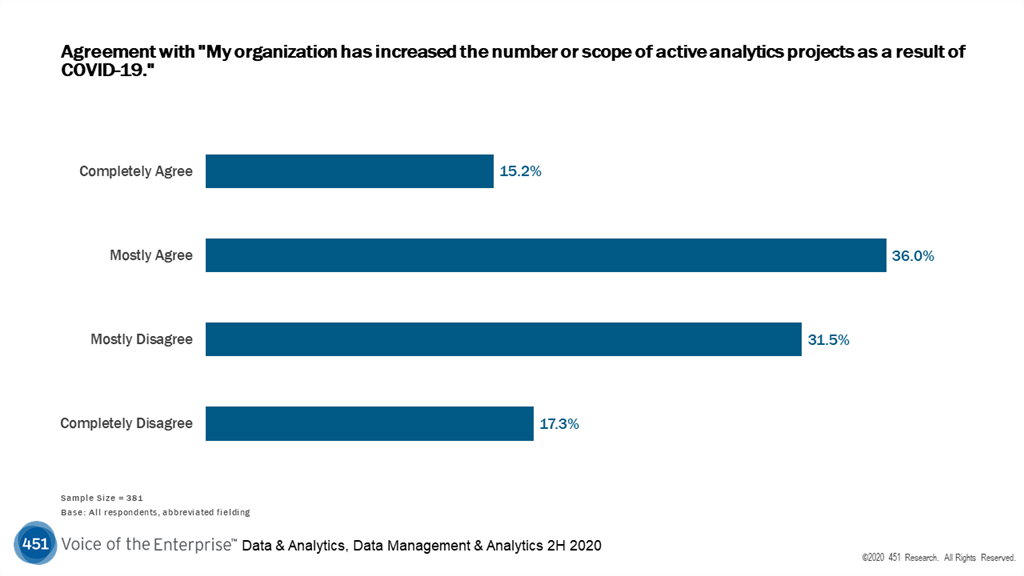

Like many corners of the tech market, the coronavirus outbreak has propelled this trend. Indeed, slightly more than half (51%) of respondents to 451 Research's Voice of the Enterprise (VotE): Data & Analytics, Data Management & Analytics 2020 survey agree that their organization increased the number or scope of active analytic projects as a result of COVID-19, indicating that companies are increasingly turning to analytics to navigate the 'new normal.'

COVID-19 Bolsters Analytics

Source: 451 Research's Voice of the Enterprise: Data & Analytics, Data Management & Analytics

As a result, software vendors that don't already have a full-fledged ML-based data science stack for ML teams to utilize to build, manage, monitor and explain AI-driven analysis will miss out on a growth opportunity. But that could be remedied by reaching for a specialist provider.

SAP is a case in point. Its strategy to essentially infuse AI across an organization's business processes through integration into its myriad applications makes perfect sense. But SAP could capitalize on the upswing in AI-driven analytics by acquiring an end-to-end enterprise data science platform specifically created for ML teams. 451 Research currently has 56 data science platforms under coverage, and while they all are by no means equal, this number demonstrates that there are rich pickings to be had. CognitiveScale and Dataiku are two targets SAP should consider. The former has a strong focus on addressing 'black box' data science, which is a prevalent issue in organizations, while Dataiku's enterprise data science slant would fit well with SAP's overarching strategy to pursue large enterprises.

Data, data, everywhere

Any thought of all IT workloads moving to the public cloud – let alone to a single cloud supplier – were misplaced. Over 40% of enterprises already have a hybrid IT environment, according to our VotE: Cloud, Hosting & Managed Services, Workloads & Key Projects 2020 survey. Additionally, nearly three-quarters (72%) of organizations using public cloud currently have more than one cloud provider.

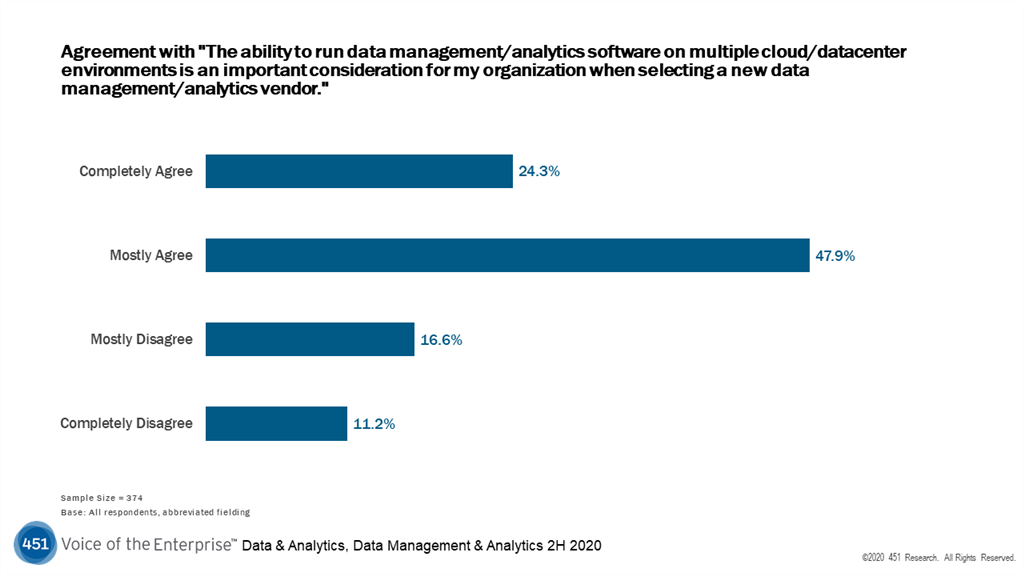

As enterprises increase their use of hybrid IT and multicloud, the ability to manage data across multiple datacenters/cloud becomes a concern for database users. Already, 85% of respondents to our VotE: Data & Analytics, Data Platforms 2020 survey agree that the ability to run the same database on multiple cloud/datacenter environments is an important consideration when selecting a new data platform.

Data Sprawl

Source: 451 Research's Voice of the Enterprise: Data & Analytics, Data Platforms 2020

Most, if not all, data platform specialists today offer support for deployment across multiple venues. The ability to secure, manage and govern data holistically across multiple locations, however, is not so widespread. Yet it's essential to avoid the creation of additional data silos and data duplication, as well as the unnecessary movement of data. These trends have highlighted the importance of data virtualization, query federation and acceleration, and orchestration.

The data and analytics space is dominated by industry giants such as Oracle, Microsoft, SAP, IBM and TIBCO, as well as AWS, Google Cloud and Salesforce, plus Teradata, Cloudera, Informatica, Actian, Qlik and Snowflake. These are the most likely suitors for specialist vendors – including Dremio, Starburst, Ahana, Denodo, Alluxio, Molecula, Varada, Incorta and Promethium – that are refining existing technologies and developing new approaches to address data virtualization, query federation and acceleration, and orchestration.

From remote work to managing a distributed work environment

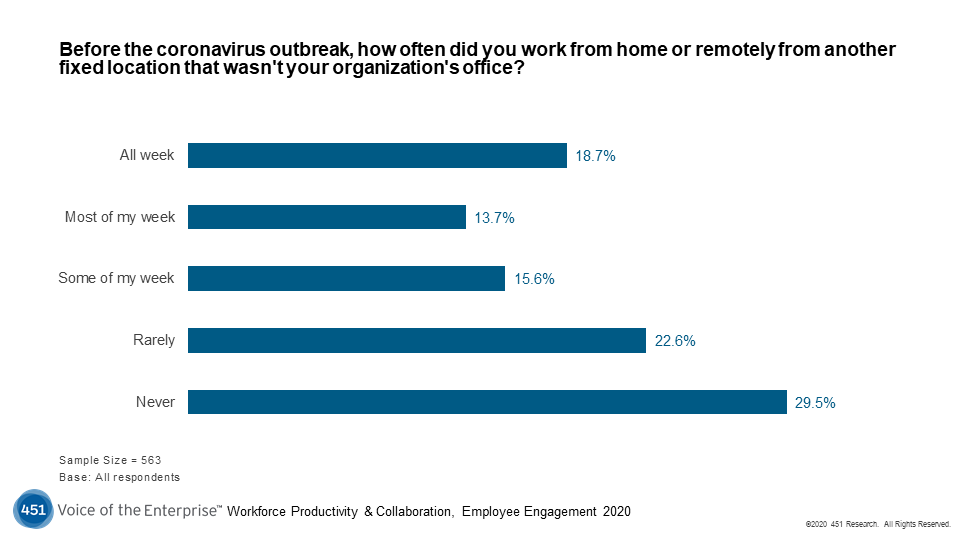

The past decade saw the emergence of the gig economy and nontraditional work arrangements – including flexible working hours and remote work – increasingly displacing the conventional office and nine-to-five work schedule. These emerging trends were gaining traction pre-pandemic – according to our VotE: Workforce Productivity & Collaboration survey, 70% of fast-growth company employees were already working at least some of their week on the go (e.g., in mobile or remote situations) by late 2019.

Working Beyond the Office

Source: 451 Research's Voice of the Enterprise: Workforce Productivity & Collaboration

The lockdown in the first half of 2020 accelerated these trends, with an unprecedented number of employees working remotely. Our research shows that after nearly one year since the outbreak, organizations are moving beyond their initial response and planning for the long term, with the assumption that they will continue to operate under altered conditions through 2021.

While the focus was initially on addressing the requirements of a distributed workforce – including remote and frontline workers – the focus is now shifting to managing a distributed work environment. The shift to a distributed work environment could lead communication and collaboration providers such as Cisco, Dialpad, Intermedia, RingCentral and Zoom to accelerate their product roadmap, targeting firms with capabilities for immersive collaboration, including digital whiteboard specialists like Lucid Software, Miro and Stormboard.

Similarly, the shift to remote work has added momentum to video collaboration, which has been an active area for M&A over the past two years. The M&A KnowledgeBase lists five transactions in 2020, including the acquisition of video collaboration specialist Highfive by Dialpad and Verizon's purchase of BlueJeans. We expect this trend to continue in 2021, with communications PaaS (CPaaS), unified communications and contact-center providers like Avaya and Genesys looking to expand their portfolios with capabilities for video collaboration. Vendors with WebRTC capabilities such as 2600Hz and Wazo could be attractive acquisition candidates, as well as firms with innovative offerings for synchronous and asynchronous video collaboration, including Around, Klaxoon and Remotion.

Remote possibilities drive productivity software acquisitions

Friction has always been the dominant story in workforce productivity software. The friction comes from employees switching among different apps, mixed with the various security and compliance restrictions that limit what they do on those apps. COVID-19, and the resulting sudden shift to remote work, has exacerbated that friction.

Our VotE: Workforce Productivity & Collaboration, Technology Ecosystems 2020 survey indicates that 26% of businesses believe it will be a very significant challenge to support their remote and distributed workers over the next two years (52% say somewhat of a challenge), rising to 40% among tech-laggard organizations. It's not surprising then that the same survey showed that enhancing employee collaboration and productivity tools was the main IT-led digital transformation priority (cited by 44% of respondents).

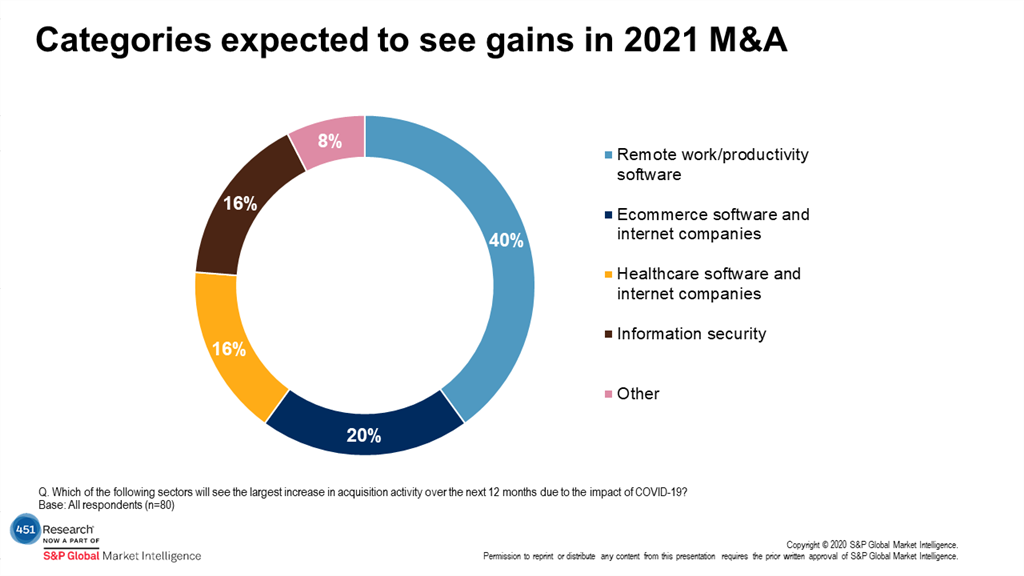

Our recent Tech M&A Leaders' Survey comprised of mostly bankers, investors and some C-level execs also demonstrated that 40% (the highest single category mention) believe remote work/productivity software will be the sector that will see the largest increase in M&A over the next 12 months due to the impact of coronavirus. This already began in 2020 as Adobe (via its $1.5bn purchase of Workfront) and Salesforce (with its blockbuster $28.4bn pickup of Slack) sought to use acquisitions in workforce productivity software to reduce friction among app usage and extend into new use cases.

High Expectations for Remote Work M&A

Source: Tech M&A Leaders' Survey 2020

We anticipate that others will follow their lead as they seek to use the productivity software space to extend their value proposition while entering new markets. There are several large, independent vendors such as Smartsheet, Asana, Monday.com and Airtable, as well as newer fast-growing firms like Notion and Coda with slightly different spins on the idea of improving knowledge work, that could attract interest. Additionally, there are plenty of potential suitors that already have one foot in this camp, including ServiceNow and Atlassian, along with others such as Zendesk that may look to unite their existing product focus with new workflow adjacencies.

Digital experience and commerce budgets accelerate

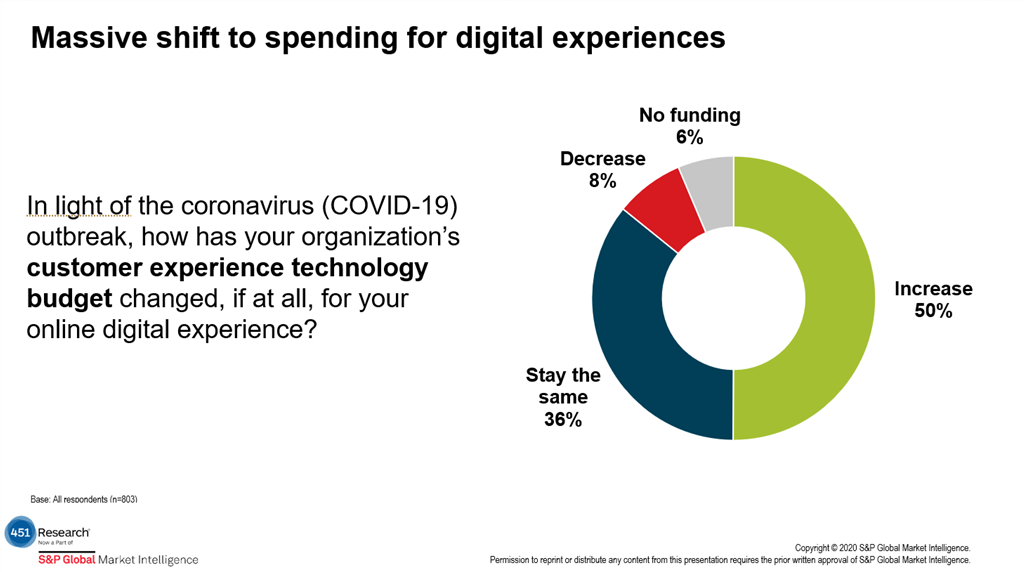

The pandemic instigated an unprecedented shift to digital. This led businesses to change technology priorities to meet demand for digital engagement and commerce. Many are funneling budget dollars into digital experiences – nearly half (50%) of enterprise respondents in our VotE: Customer Experience & Commerce, Merchant Study claim to have increased their organization's overall customer experience (CX) technology budget to enhance their online digital experiences as a result of the coronavirus outbreak.

COVID-19's Impact on CX Tech

Source: 451 Research's Voice of the Enterprise: Customer Experience & Commerce, Merchant Study

The digital shift put a broader emphasis on tools such as sales enablement and improved commerce technology like cloud-native and headless architectures to offer greater flexibility and scalability. With digital experiences becoming more deeply embedded, businesses will need to integrate content and commerce capabilities more deeply across the digital experience stack. Tech giants Microsoft, Oracle, SAP and Salesforce could be interested in boosting digital content experiences by reaching for major players such as Acquia, Episerver (recently re-branded as Optimizely) and Sitecore, or smaller vendors like Contentful, e-spirit, Crownpeak, Cloudinary, CoreMedia, Liferay, Contentstack and Amplience. More B2B-focused targets could include Highspot, Seismic, Conga, Bloomfire, Bigtincan, Showpad, mediafly, Salesloft and Mindtickle.

Significant technological and competitive disruption, paired with the acceleration of digital commerce, continues to force the evolution of the entire commerce technology stack. Existing commerce software providers could modernize their stack with key architectural enhancements or go down-market by offering SMBs easier-to-use products. Companies such as SAP could be interested in midmarket vendors like Squarespace or Volusion. Microsoft could seek to broaden its commerce footprint by nabbing ElasticPath, BigCommerce or CommerceTools. Adobe could improve its headless and progressive web apps initiative by acquiring Vue Storefront.

The complexity of customer experience

Managing and measuring customer experience is complex and will become more so as new digital channels of engagement proliferate and the volume of customer data grows. The explosion in connectivity and intelligent devices has led to a rapidly compounding landscape of digital touchpoints and contextual channels that consumers use to engage and transact.

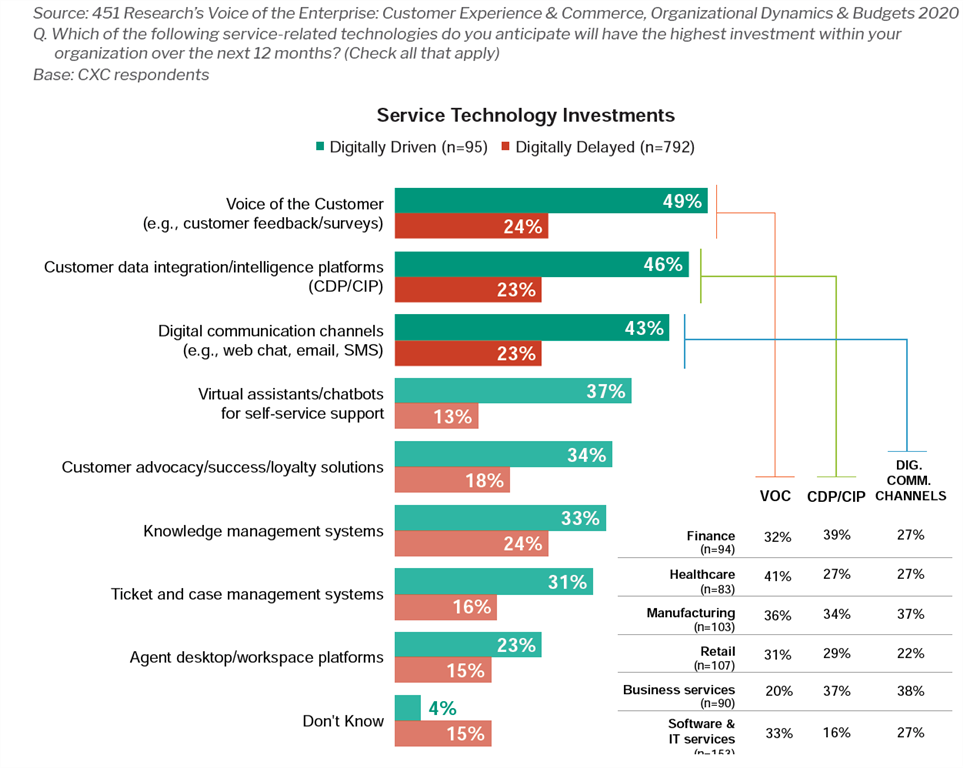

This has blurred the lines between customer service and marketing, leading to new categories of applications that businesses need to manage what used to be thought of as 'marketing.' In particular, demand will increase for three categories of software: voice of the customer tools (e.g., customer feedback/surveys), customer data platforms/customer information platforms, and digital communication channels (e.g., web chat, email, SMS).

Service Becomes the New Marketing

Source: 451 Research's Voice of the Enterprise: Customer Experience & Commerce, Organizational Dynamics & Budgets

Over half of enterprises note that voice of the customer tools are an integral part of getting insight into the customer relationship, with 75% of digitally driven enterprise respondents in our VotE: Customer Experience & Commerce, Organizational Dynamics & Budgets survey finding these tools to measure net promoter score and customer satisfaction important to enhancing CX. Marketing software firms such as Salesforce and Adobe looking to capitalize on that sentiment could buy Alida, Medallia, InMoment, Confirmit/FocusVision, Responsek, Clarabridge, FuelCycle or AskNicely.

To enhance the customer experience and capitalize on cross-channel strategies, businesses must be able to capture, analyze and act upon customer data and information. Managing oversight and orchestration of complex multichannel digital experiences involves dynamically maintaining a single repository of individual preferences and behaviors about each customer. In our VotE: Customer Experience & Commerce, Digital Transformation survey, 71% of digital leaders (e.g., those who actively invest in their digital transformation and adopt new technologies) assert that unifying business data to create more contextually relevant customer experiences is very important.

This will drive investment and consolidation among analytics, customer intelligence and customer engagement companies. Key targets include customer data unification and journey orchestration specialists such as ActionIQ, BlueVenn, Meiro, Yeti Data, Mparticle, Kitewheel, Thunderhead, Usermind, Gainsight and Totango. There are also marketing activation or personalization vendors with interesting footprints and customer bases such as BlueConic, Amperity, Blueshift, Gamooga, Formation.io, Reflektion, Zaius, Redpoint Global and Lytics.

Digital channels (e.g., mobile, SMS, email, social media, etc.) are the critical inflection point driving engagement, operating as the vehicle by which digital experiences and contextual content are delivered. In our VotE: Customer Experience & Commerce, Organizational Dynamics & Budgets survey, customer engagement tools (e.g., email, SMS, social) emerged as one of the top priorities for technology investments among the digitally driven over the next year.

This focus on channel integration will continue to be critical in scaling the accessibility of digital experiences. Salesforce has already made investments in improving digital channel engagement offerings with its massive purchase of Slack and could explore video and other communications platform enhancements. As marketing and service channels blur, Adobe, Microsoft, SAP and Oracle could also enhance their communication platforms by reaching for Glance, Acquire.io, Intelepeer, Ribbon Communications, Drift, LiveChat or Podium. Customer engagement tool suppliers Customer.io, Braze, Sparkcentral and Clevertap could also fill this need.

Accelerated digital shift focuses payments M&A on omnichannel capabilities

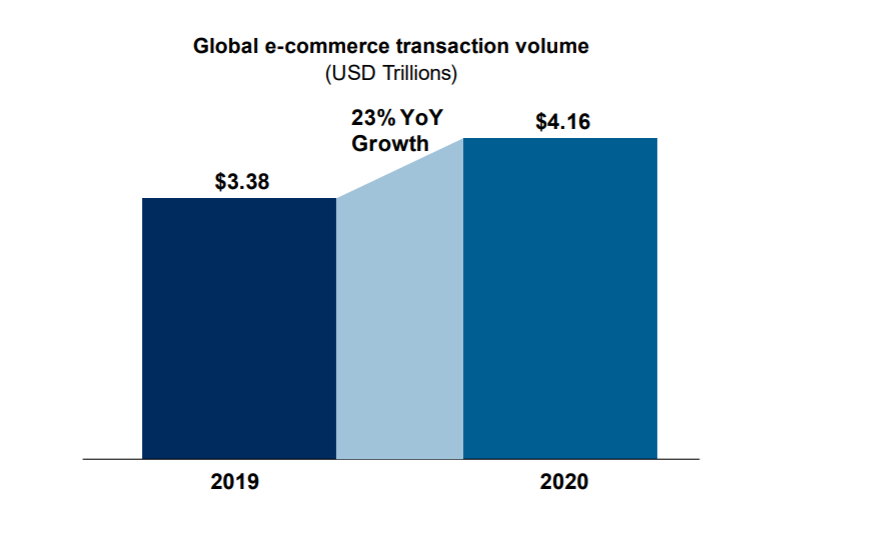

Global e-commerce volume is estimated to have exceeded $4 trillion in 2020 for the first time, representing 23% year-over-year growth, according to 451 Research's Global Unified Commerce Forecast: Payments Scenario Analysis. High-performing payments infrastructure is needed to accommodate this accelerated digital volume shift, along with the latest customer shopping demands and changes in the fraud environment that manifested throughout 2020.

More Than $4 Trillion in Global Digital Commerce Sales Projected in 2020

Source: 451 Research's Global Unified Commerce Forecast: Payments Scenario Analysis 2020

Unfortunately, many merchants were hamstrung last year by their payments infrastructure, which stood in the way of the integrated and seamless shopping experiences their customers desire. In turn, payment providers that were unable to fully deliver during the pandemic saw their gaps become increasingly apparent to customers. Addressing these gaps is fast becoming critical to securing relationships. Nearly one in three merchants cited 'modernizing payments infrastructure' as a highly important payments initiative for their organization, according to our VotE: Customer Experience and Commerce, Merchant Study.

In 2021, we anticipate that payment suppliers will increasingly look to address shortcomings in their capability set that were exposed by the outbreak. This is likely to position omnichannel as a key inorganic growth theme. We could envision a large payment processor targeting a point-of-sale software specialist such as Toast or Vend to build out a more compelling omnichannel proposition. Similarly, we could see a payments optimization firm like Spreedly, a midsized e-commerce processor like Bluesnap or a fraud prevention vendor like Kount targeted to build out a deeper digital commerce story.

Post-pandemic people management

COVID-19 brought workforce productivity to center stage as business leaders seek to understand the impact that mass-scale remote work and more dynamic workforce management models have on productivity. According to our VotE: Digital Pulse, Coronavirus Flash Survey October 2020, 33% of respondents said a coronavirus-induced reduction in employee productivity had been a moderate or significant driver of change to their organization's operations. Additionally, 37% of respondents said boosting productivity was now a greater budgetary or strategic concern than a year ago.

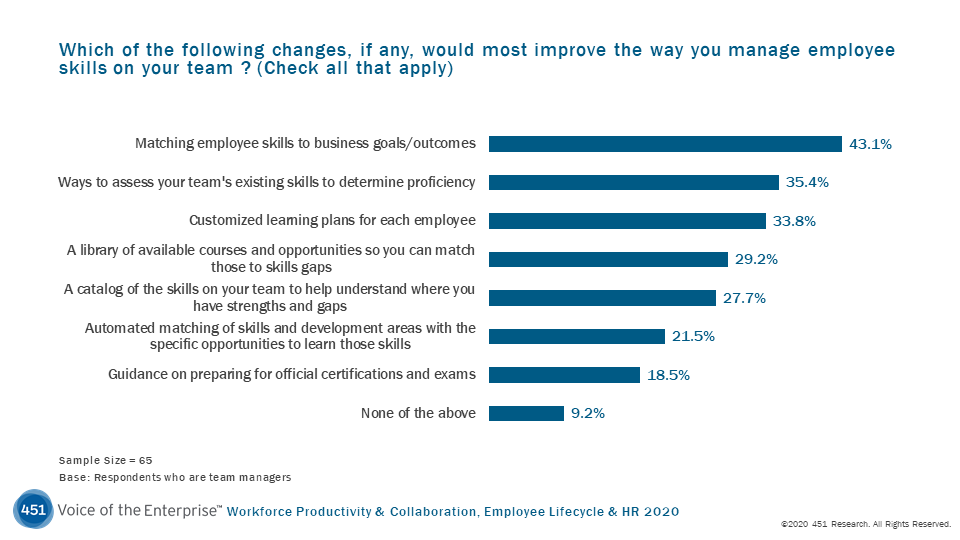

Other surveys highlight that these challenges are changing business' people priorities. In our VotE: Workforce Productivity & Collaboration, Work Execution Goals & Challenges 2020 survey, respondents at both the organizational (26%) and departmental (25%) levels list 'managing people resources effectively' as their top challenge in project management. Of course, work can only be executed if employees have the proper skills. In our VotE: Workforce Productivity & Collaboration, Employee Lifecycle & HR 2020 survey, we asked team managers how they wish they could enhance skills management and the top two responses were matching employee skills to business goals/outcomes (43%) and ways to test employee skills for proficiency (35%).

Managing Skills

Source: 451 Research's Voice of the Enterprise: Workforce Productivity & Collaboration, Employee Lifecycle & HR 2020

All of these trends and desires indicate a renewed interest in people analytics and are aligned across common metrics and KPIs. At an individual level, performance management and skills management will give further visibility into individual employee productivity, which will then drive upward into workforce management software for impactful team building and objectives and key results software for team execution. Team execution and KPIs will then eventually feed into broader corporate performance management (CPM) and financial planning and analysis software.

We could anticipate this playing out at any of these junction points. Workday, which owns CPM giant Adaptive Insights and already has forecasting capabilities and a skills analytics tool called Skills Cloud, could get the ball rolling from the top down by reaching for a more modular planning tools specialist like Kepion for more agile and role-based scenario modeling. Additionally, Workday could delve more into people analytics by picking up organizational planning and analysis firm Concentra or workforce analytics vendor Visier. Another option could be a rapidly growing work management provider such as Smartsheet or talent intelligence platform supplier like Eightfold to more contextually connect employees to projects.

Micro-level drivers

AI enables augmented analytics

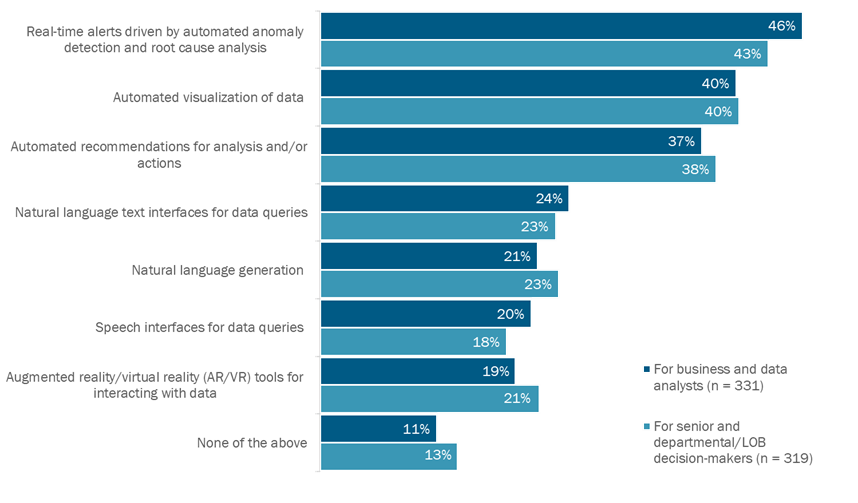

In the guise of augmented analytics, AI is sweeping across the BI sector owing to its promise to lower the barrier to adoption of BI tools by making them easier to deploy. Two years ago, when we asked about new interfaces for analytics insight (such as automated visualization recommendations as well as speech and natural language text queries), 32% of respondents declared themselves not interested. In contrast, the same survey conducted in 2H 2020 revealed that only 11% were not interested in this new breed of front ends for business and data analysts.

Furthermore, real-time alerts driven by automated anomaly detection and root cause analysis emerged as the approach with the most interest, suggesting that the likes of Anodot, Sisu, Unsupervised AI, Nodin, Tellius and Outlier AI have the potential to become acquisition targets for their specialism in this arena. Moreover, Oracle could put its M&A engine into gear to nab one of these targets to reinforce its BI credentials and approach to intelligent applications.

Interest in Augmented Analytics, by Job Role

Source: 451 Research's Voice of the Enterprise: Data & Analytics, Data Management & Analytics 2020

It's good to share

The ability to easily share data with partners, suppliers and even customers came into fresh focus in 2020 as the pandemic highlighted the potential fragility of supply-chain networks and the need for up-to-the-minute detailed data on stock levels and logistical performance. The UK's exit from the European single market will likely put fresh pressure on supply chains in EMEA in particular in 2021, further demonstrating the importance of sharing real-time data with partners and suppliers.

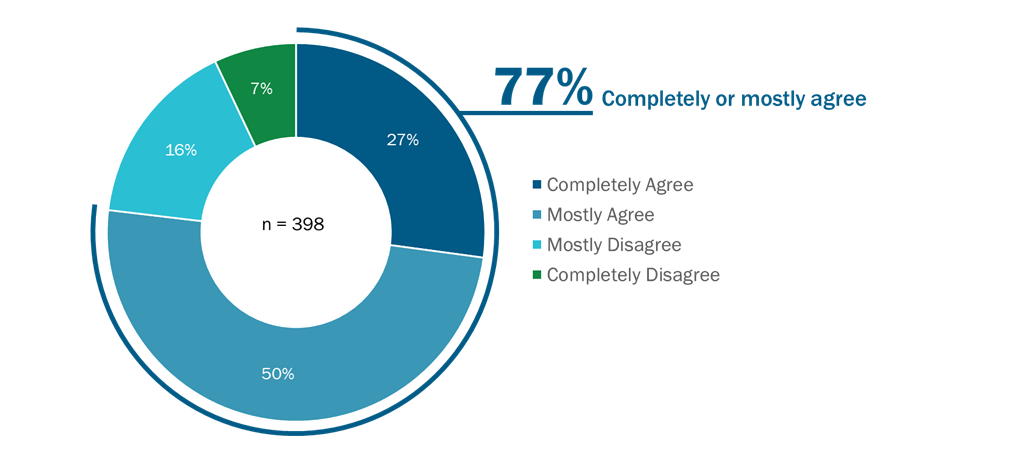

The renaissance of data marketplaces – both stand-alone third-party services and functionality delivered with data platforms – was an area of focus for 451 Research throughout 2020 and we estimate greater adoption of data marketplaces as a source of data for business decision-making in 2021, based on responses to our VotE: Data & Analytics, Data Management & Analytics 2020 survey.

One of the beneficiaries of this growing interest has been Snowflake. It was revealed on the company's recent earnings call that nearly one-quarter of its customers are deploying its Snowflake Data Marketplace to share data. Rival data platform vendors without data-sharing functionality will have taken note and be looking at potential R&D or M&A investments to close the gap. Cloudera is one firm that we think could be in the market to acquire, while potential targets might include Dawex and Harbr, while there are a variety of open source distributed ledger projects that could accelerate internal development.

Agreement with the Importance of Sharing Data with Partners, Suppliers or Customers

Source: 451 Research's Voice of the Enterprise: Data & Analytics, Data Management & Analytics 2020

More traditional links in the blockchain

More businesses could look to add blockchain and distributed-ledger technologies (DLT) via tuck-ins as enterprises integrate that tech into their long-term plans. In our VotE: Data & Analytics, Data Platforms 2020 survey, 68% of respondents are confident about blockchain/DLT being in their organization's top five strategic priorities over the next three years. In 2021, we will likely see more deals involving technology firms and more 'traditional' companies across different industries.

We noted some of this in 2020 when identity and access management specialist Ping Identity snagged decentralized identity startup ShoCard, and when healthcare provider Signify Health bought blockchain-based contract and payment management firm PatientBlox. Potential targets will be those startups that have grown some customer base and whose offerings have real-world impact by addressing prevalent business or social problems and potentially industry-level challenges. We believe payments giant PayPal in particular may be considering several blockchain-related acquisitions, including that of digital asset firm BitGo.

The living document could kill the traditional word processor

According to our VotE: Workforce Productivity & Collaboration, Work Execution Goals & Challenges 2020 survey, all-in-one suites that include documents, spreadsheets and slides were cited by 51% of respondents as the tool that contributes most to personal productivity at work. Vendors like Smartsheet have evolved the spreadsheet into an intelligent work management platform. The document is primed for a similar evolution as it has begun to marry real-time collaboration with live data integrations with relevant systems of record. However, word processing and document productivity providers will need more intelligence and automation to pull it off.

Dropbox's Paper allows for collaborative work with tasks and to-do list features to occur within a document and supports the embedding of multiple media types for broader presentations and more contextual deliverables. Adobe's Document Cloud is growing beyond PDF management with a workflow-forward approach featuring prebuilt integrations. Either of these vendors could purchase newer document-centric startups like Coda or Notion to kickstart their evolution into living document providers.

Digital adoption platforms find a new home

One of the biggest challenges in hiring new candidates, or shifting employees to new teams internally, is getting them up to speed quickly. According to our VotE: Workforce Productivity & Collaboration: Employee Lifecycle & HR 2020 survey, 42% of respondents said they took six months or longer to add value at work. Some 12% took a year or longer. On the technology side, one of the tools that has come into prominence to speed onboarding is digital adoption platform software, which enables users to publish in-app guidance or training content for specific processes, among other things.

On the HR side, a larger human capital management player like Ceridian, Workday or UKG could buy a digital adoption platform specialist like Whatfix, Appcues or Pendo to help get employees up to speed quickly on the tools they need for new roles. Another interesting opportunity could be for ServiceNow – which has evolved into a broader service delivery company for IT, HR and more – to acquire one of the aforementioned vendors or even a larger one like WalkMe to offer additional self-service capabilities to IT teams for training and onboarding in larger enterprises.

Secure collaboration and communications will be top of mind for IT decision-makers

The need to address the requirements of a distributed workforce – including remote and frontline workers – highlights use cases that traditional communication and collaboration tools – namely unified communications and contact center – have not typically addressed. These use cases will remain relevant post-pandemic, influencing market requirements for communications and collaboration.

According to our VotE: Information Security, Organizational Dynamics 2020 survey, most IT decision-makers are concerned about the security risks in enterprise collaboration tools. Survey results show that nearly three in four (74%) respondents are somewhat (52%) or very concerned (22%) about the level of security in the collaboration tools that remote workers are currently deploying. We expect that this will raise the profile of companies focused on secure collaboration such as Symphony, HighSide and Wire. These vendors have largely remained, until now, niche players but could become acquisition targets for large communication and collaboration providers such as AWS, Mitel and RingCentral aiming to accelerate their product roadmap with enhanced security capabilities, following the lead of video collaboration platform specialist Zoom, which announced the purchase of secure messaging service Keybase last May.

Network infrastructure will gain relevance for enabling a distributed work environment

Network infrastructure has always played a key role for business communications and collaboration. In recent years, though, the focus has been on the application level. This is exemplified by the growth that vendors such as Slack and Zoom experienced over the past year. However, the need to support remote workers has highlighted the role that network infrastructure plays for enabling a distributed work environment.

This is evident among network infrastructure providers like AWS and Microsoft that are expanding into CPaaS with formal offerings launched in the past year. It also influenced dealmaking in 2020, with 12 CPaaS-related transactions, according to the M&A KnowledgeBase. Looking ahead to the coming year, we anticipate that consolidation will continue to be influenced by firms looking to expand or enhance their market footprint and global network infrastructure footprint, following the lead of providers such as Bandwidth, which reached for European CPaaS specialist Voxbone last year, and 8x8, which had previously purchased Singapore-based CPaaS supplier Wavecell in 2019. This could result in CPaaS vendors such as Melrose Labs, Wazo, 2600Hz or Telestax becoming acquisition candidates for infrastructure suppliers – including global carriers such as AT&T, America Movil, Telefonica and T-Mobile – seeking to accelerate their transition to a platform-based approach for delivering real-time communications.

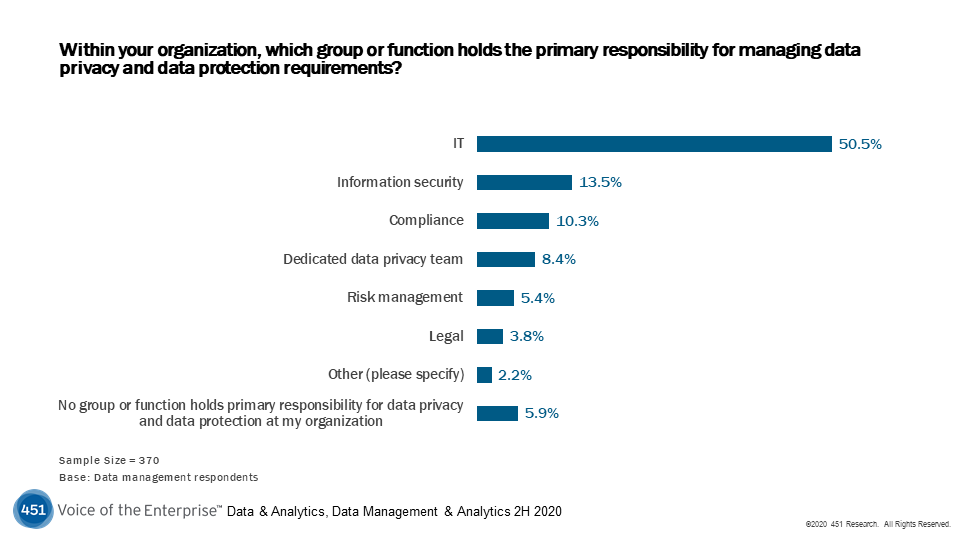

Data privacy efforts face a slight identity crisis

Enterprise data privacy programs are maturing as organizations tackle increasingly diverse global regulatory requirements. In doing so, efforts have become more multifaceted. Privacy initiatives are highly interdependent with all other data-driven functions, and a broad spectrum of business teams may have direct involvement. When so many stakeholders are involved, the challenge is the question of ownership. Who ultimately leads the data privacy effort? The answer isn't always clear.

According to our VotE: Data & Analytics, Data Management & Analytics 2H 2020 survey, 26% of respondents report that 'data privacy concerns' are a significant barrier their organization faces in attempting to be more data-driven. Yet when asked which business group or function holds the primary responsibility for managing data privacy and protection requirements, only 8% indicate that there is a dedicated data privacy team in charge. IT holds the de facto responsibility in half (51%) of organizations – this, of course, in addition to a bewildering array of other obligations.

Responsibility for Data Protection

Source: 451 Research's Voice of the Enterprise: Data & Analytics, Data Management & Analytics 2H 2020

Lack of clear ownership is reflected in the evolution of the PrivacyOps segment, where there is increasing overlap between technical data security execution and business-oriented workflow orchestration support. OneTrust's pickup of Integris Software brought the company's privacy coordination capabilities closer to the technical data layer for deep data discovery and classification. Conversely, data discovery specialist Dataguise expanded its privacy workflow functionality prior to being scooped up by security expert PKWARE. Continuing the trend to meld data security with data privacy orchestration, a privacy platform provider like TrustArc would be wise to acquire a data security upstart such as ShardSecure. On the other end of the spectrum, more security-oriented vendors like Spirion or Stealthbits might consider a privacy management platform firm such as 2B Advice attractive.

Fraud prevention strategies morph

While many merchants can skate by with a generic checkout flow in-store, the stakes online are much higher. Just one friction point can be enough to drive an abandoned cart and send shoppers looking elsewhere. This is an obvious area for improvement, with 57% of digital merchants strongly agreeing that their approach to fraud prevention makes it challenging to provide a smooth customer experience, according to our VotE: Customer Experience and Commerce, Merchant Study.

As e-commerce accelerates, the objective for fraud prevention teams must broaden from preventing losses to preserving – and ideally elevating – the customer experience. This is likely to register on the radars of CX-oriented e-commerce platform providers like Salesforce and Adobe, which could emerge as fraud prevention technology buyers. Forter, which could also be a plausible candidate, has risen to the occasion by augmenting its capabilities to help enterprises monitor shopper behavior across customer touchpoints.

Data-driven content is no longer in the back seat

For the first time, the enabling technologies for contextual, data-driven content experiences have emerged at the forefront of customer experience investments. In our VotE: Customer Experience & Commerce, Organizational Dynamics & Budgets 2020 survey, we note that digitally driven organizations anticipate that intelligent personalization technologies (47%) and customer data/intelligence platforms (43%) will be the top marketing technology investments over the next 12 months. We have already seen this shift begin to manifest in the market with Episerver's pickup of Optimizely.

As customer data and digital content continue to become ingrained within the customer journey, we anticipate that content management and personalization tools and platforms will likely become attractive targets for both mid- and large-sized CX vendors. Particularly as players like Adobe and Oracle have integrated strong content capabilities as a differentiator within their CX stacks, we can anticipate that they will likely seek to deepen these capabilities, while spurring greater competition from fellow players such as Microsoft and Salesforce that could look to bolster their customer intelligence smarts with a stronger content presence. While many content management systems have their own AI-driven content personalization technology baked in, potential attractive targets include firms like Cloudinary, Contentstack, Contentful, Uberflip, Personyze and Boxever.

Delivery startups deliver exits

Delivery startups enjoyed a favorable 2020 as social distancing concerns spurred rapid new user growth. Roughly one in seven consumers tried a delivery service for the first time over the past 90 days, according to our Voice of the Connected User Landscape: Connected Customer, Consumer Representative, Q3 2020 survey. The increasing appetite for on-demand delivery helped fuel a variety of deals beginning in the second quarter of 2020, including Target's acquisition of Deliv, Walmart's purchase of JoyRun, Uber's pickup of Postmates and FedEx's reach for ShopRunner.

In 2021, we expect that delivery startups will continue to be positioned attractively as M&A targets. Vendors such as Favor, Bringg, delivery.com and Roadie could help a large merchant like Costco or Amazon galvanize its on-demand delivery strategy. Similarly, they could help enable some of the early, also-ran delivery initiatives led by large enterprises such as eBay (eBay Now) and Google (Google Express) to take a second stab at building out a delivery capability now that the market has heated up.

IPO candidates

DataRobot: While automated machine learning remains its core competency, DataRobot has adapted to customer demand and market requirements via acquisitions and internal development to craft a broader enterprise data science platform for a wider audience. The vendor recently landed a $320m series F round, with a $2.8bn post-money valuation.

Confluent: The company has been enjoying rapid growth thanks to widespread adoption of the Apache Kafka stream processing and messaging platform, which was created by its founders. Confluent has raised $456m in total, most recently a $250m series E in April, giving it a valuation of $4.5bn.

Monday.com: On the back of a visually intuitive UI, Monday.com has raised $234m in financing. With rival work management providers Smartsheet and Asana already enjoying public company status, Monday.com could pursue an IPO of its own this year.

OneTrust: Anointed a unicorn in 2019, the privacy platform specialist has since hit the gas on funding with $120m series B and $300m series C rounds in 2020, bringing its valuation to $5.1bn. Aggressive growth and numerous strategic acquisitions have continued to expand its product's reach.

Sprinklr: From its roots as a social media marketing firm, Sprinklr has expanded its offering into a customer experience software suite that manages customer engagement across 36 different channels. The company, which has 2,200 employees, targets the high end of the market. We estimate that it has over 75 customers whose annual contracts reach into nine figures.

Marqeta: This modern card-issuing vendor powers the card programs of businesses that include Square, Affirm and Uber. Marqeta was one of the first to set its sights on disrupting the card issuer processor sector, occupied by large players such as Jack Henry and Fiserv. Founded in 2010, the company raised a $150m round of venture funding in May at a $4.3bn valuation. It now has more than 500 employees.

Download The Full Report

Download The Full Report