Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Markets in Motion — Jan 13 2025

Climate-related disasters are leading to increased claims across the insurance industry. As floods, heat waves, fires, and extreme weather becomes more common, insurers are re-evaluating their exposure.

In this episode of the ESG Insider podcast we explore climate change and its implications for property insurance through the lens of the wildfires in Los Angeles.

The fires that broke out in LA in January killed at least 29 people and destroyed or damaged thousands of structures. Early estimates from AccuWeather put the total damage and economic losses at more than $250 billion.

Early estimates suggest insured losses from the wildfires spreading across Los Angeles (LA) County are significant, potentially matching the about $16 billion from the 2017 Tubbs Fires in Northern California.

Significant wildfire losses in the first two weeks of 2025 could rapidly deplete the catastrophe budgets of U.S. primary insurers. This early strain may lead to earnings pressure later in the year, especially if 2025 proves to be above-average for catastrophes.

Unless North America utilities enact significant wildfire mitigation protections, our ratings on investor-owned utilities with substantial wildfire exposure will likely come under pressure in the coming years.

Los Angeles area wildfires threatens utility-backed debt performance. Ongoing Wildfires pose prepayment risks for municipal bonds backed by California-based obligors.

Several wildfires erupted across the greater Los Angeles area on Jan. 7. Although the extent of the damages is still developing, with some figures estimating as high as $150 billion, credit deterioration has already begun.

Rapidly expanding wildfires in the Los Angeles area might pose significant financial and operational risks for rated entities, especially if not-for-profit electric utilities' infrastructure triggered the fires. S&P Global Ratings is monitoring rated U.S. public finance entities in the affected region to assess whether liability claims or disrupted revenues will lead to negative rating actions.

As of publication time, the two largest wildfires in the area have burned almost 28,000 acres, remain completely uncontained, and their causes are undetermined. Many entities we rate, including not-for-profit electric and water and sewer utilities, local governments, and school districts, have assets and tax bases in the areas with active fires.

Several wildfires sparked in the Los Angeles area on Jan. 7 and into Jan 8, then spread rapidly due to severe winds, low humidity, and extremely combustible terrain. Although only about 1% of Los Angeles County's total 2.6 million acres has burned, the affected area contains a broad range of homes and businesses with variable property values, including some very-high-value real estate. The Palisades Fire is already the most destructive to ever occur in Los Angeles County, according to CalFire. More than 2,000 structures have burned, the Los Angeles Times reported.

Webinar

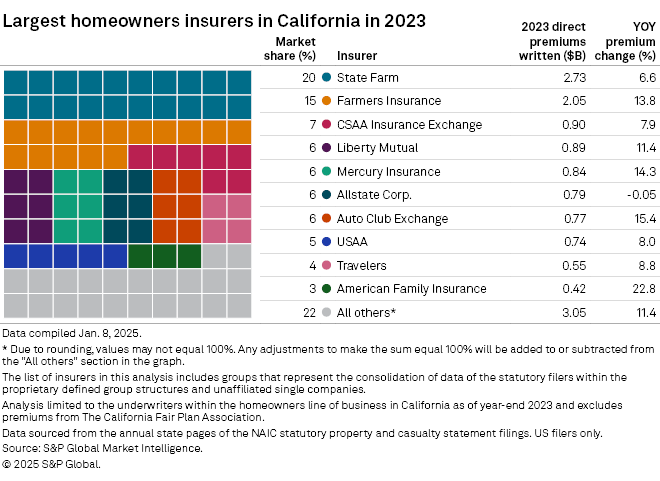

The impact of the wildfires sweeping through the Los Angeles area on California homeowners insurers is expected to be manageable despite the projection of heavy economic losses.

Three fires that broke out Jan. 7, the Palisades fire, the Eaton fire, and the Hurst fire, had scorched almost 28,000 acres as of 7:30 a.m. ET Jan. 9 and had caused between $52 billion and $57 billion in preliminary damage and economic loss, according to AccuWeather.

Even with the expected heavy losses, carriers should be able to handle insured losses from the event considering the recent rate hikes approved in the state, said Janet Ruiz of the Insurance Information Institute.

"These losses are going to be manageable," Ruiz said in an interview. "The companies are getting the necessary increases [and] it's all about collecting adequate premium to be able to pay off the losses."

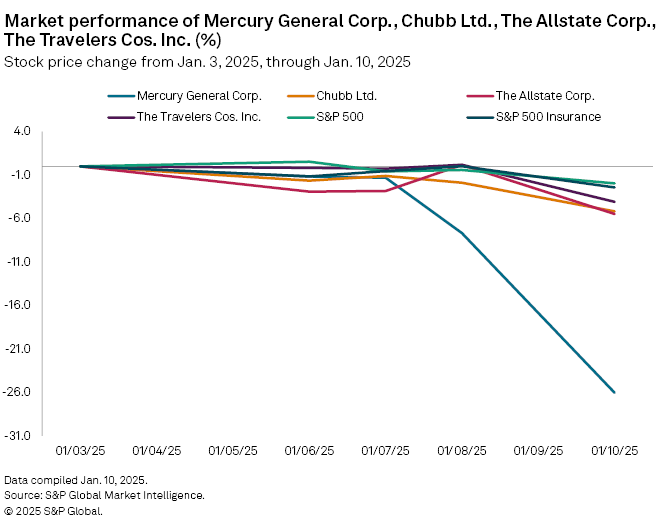

Los Angeles-based Mercury General Corp., which writes the bulk of its business in California, was the worst-performing insurance stock this week as historic wildfires raged through Southern California.

Mercury's share price plunged more than 27% for the week through 2:20 p.m. ET on Jan. 10. Other insurers with significant exposure in the Golden State also saw their shares decline as loss estimates from the Los Angeles-area fires continued to soar.

Chubb Ltd., which has exposure to high-value homes in the region, was down 5.3%. Other prominent P&C carriers in the state include The Allstate Corp. which was down 6.2%, while The Travelers Cos. Inc. and American International Group Inc. were down 3.8% and 3.2%, respectively.

The S&P 500 Insurance Index was down 2.89%, while the broader S&P 500 was off 1.73%.

Over the past week, a ring of fires fanned by the winds broke out in the outlying areas of the city, destroying thousands of homes and causing billions of dollars in damages. The impact of these losses on liability claims and revenue disruptions may take months to determine.

In S&P Global Ratings' view, a shift to inland damage from where the storms make landfall could require greater storm preparedness in such areas, adding to the region's need for storm hardening. Although federal and state disaster relief funds may partly offset the expenditures, costs for infrastructure investments could require additional debt and pressure issuers' fixed costs.

Early insured loss estimates of Hurricane Helene are in the mid-single to low-double-digit billions of dollars. Meanwhile, damage from Hurricane Milton could match that of Hurricane Ian, which struck in 2022 and resulted in about $60 billion of insured losses.

North Carolina Insurance Commissioner Mike Causey plans to petition the US Congress to abolish the Federal Insurance Office.

"I do plan to write a letter to all of our congressional delegations asking for [the Federal Insurance Office] to be abolished," Causey said in an interview with S&P Global Market Intelligence. "I don't think it's necessary that we have a federal insurance office."

Causey, who recently won reelection to a four-year term, said he believes that the Federal Insurance Office (FIO) is a "duplication of efforts" and called it a "waste of taxpayer dollars." Insurance is best regulated on a state level, he said. Causey plans to write his letter asking for the FIO's abolishment before the end of this year.

Reinsurers' earnings prospects for 2024-2026 look promising, following robust operating results in 2023. The industry has seen its highest profits in years, thanks to decade-high investment yields and consistent rate increases in property and property catastrophe lines (short-tail lines). Gains were bolstered by significant price hikes and structural changes since early 2023, such as higher attachment points, stricter terms and conditions, limited aggregate covers, and repricing of property catastrophe risk, laying a solid foundation for the property/casualty (P/C) reinsurance market.

In recent episodes of the ESG Insider podcast, we’ve explored how different sectors are approaching climate change. In today’s bonus episode, we’re focusing on the insurance industry in an interview with Liz Henderson.

Liz leads Climate Risk Advisory for Aon, a global insurance and reinsurance brokerage firm. In the episode she talks about her key takeaways from COP29, the UN climate conference that recently took place in Baku, Azerbaijan.

This event was widely known as the "finance COP," and Liz says that insurance plays a critical role alongside private finance. "You cannot have bankable high-value investment capital without risk capital alongside it to de-risk those investments," she tells us.

Environmental and social factors are material from both the stakeholder and credit perspectives, but less so than for most industrial sectors. Access and affordability, privacy protection, and climate transition and physical climate risks are among the most material factors.

Daily Update and Markets in Motion Newsletters