Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 8 Sep, 2021 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Real estate investment trusts (REITs) hang in the balance as the rise of the coronavirus delta variant and other mutations of the contagion threaten to impede the global economic recovery. As the COVID-19 crisis has reshaped populations, commercial and residential real estate markets, workplace and commuting trends, and consumer behavior, the outlook for REITs—highly liquid public portfolios of income-generating properties traded like equities on major exchanges—has been largely tied to outcomes of countries’ social-distancing measures, labor market performance, and leasing activity. Some REIT markets in Asia-Pacific are showcasing strength and expanding their offerings, while others have weathered disruption in their search for stability. Investing in data centers may be the best way for Asian REITs to diversify after the pandemic accelerated companies’ digital transformations and put pressure the region’s real estate market. Singapore enjoys a strong reputation as a beneficial listing destination for REITs, and saw Keppel DC REIT, the sole Asian REIT focused on data centers as of the end of last year, record a 38% annualized total return in 2020—marking the REIT as the top performer in its home market, according to Cushman & Wakefield research. The country is also expected to see new products built around REITs debut as the market develops, business return to normal in a post-pandemic economy, and investors look to further diversify their holdings, analysts told S&P Global Market Intelligence. Meanwhile, S&P Global Ratings revised its rating outlooks on three Australian retail REITs to stable from negative in July due to how they’ve endured the pandemic and over whether they can maintain buffers to absorb further disruptions. Across Europe, the Middle East, and Africa, S&P Global Ratings has taken 12 ratings actions due to the coronavirus—of six downgrades and nine outlook changes—on the 61 rated REITs as of mid-July. Office REITs in Europe are likely to remain resilient and stay flat in a prolonged weakened market through 2022 even if tenant demand declines, according to S&P Global Ratings. Unlike the technological disruptions and negative credit outlooks seen in Asia and Australia alongside the low-tier stability seen across Europe, REITs in North America may see a thriving future after experiencing turbulent performance throughout the pandemic. For example, U.S. equity REITs raised $104.01 billion through capital offerings in 2020, up 2% from 2019, but saw their capital market activity plunge by nearly 80% month-over-month in July to $3.03 billion, the lowest total seen so far this year, according to S&P Global Market Intelligence data. Some major recent deals have failed. But the start of the summer saw the recovery for North American REITs broadly pick up speed. Now that earnings have rebounded so significantly, credit metrics have returned to stability, borrowing costs remain low, and capital markets are maintain activity, North American REITs are positioned for solid growth, according to S&P Global Ratings. Today is Wednesday, September 8, 2021, and here is today’s essential intelligence.

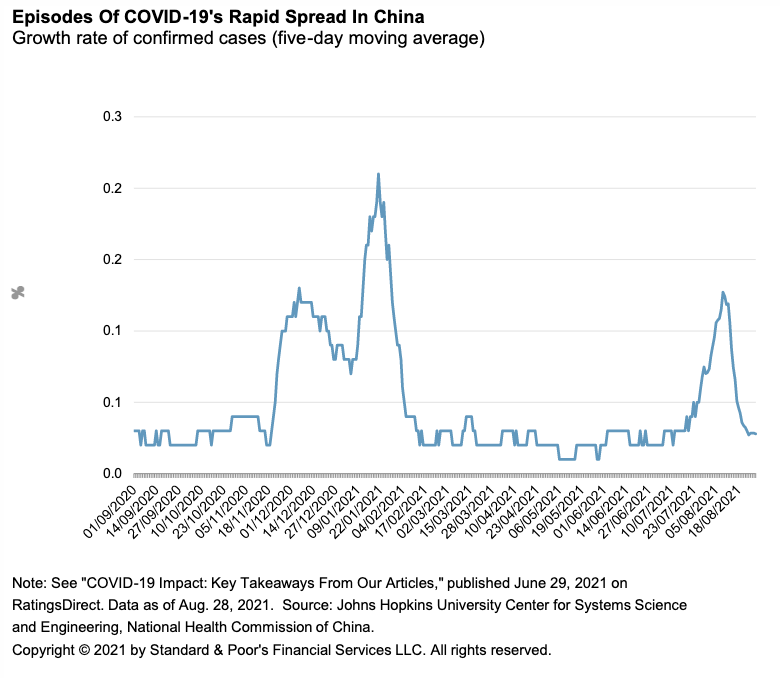

China's Zero-COVID Approach To Aggravate Rising Corporate Risks

COVID's global resurgence and China's zero-tolerance approach may further strain corporates if outbreaks continue to bring mobility restrictions and broad disruptions. These episodes add burdens to Chinese corporates, which are already showing weakening credit trends. Issuers in the country face higher leverage, weaker cash flows, tighter liquidity, and volatile financing conditions amid unprecedented distress events and regulatory risks.

—Read the full report from S&P Global Ratings

White House Warns Of Increased Hacking Around Holidays, Offers Mitigation Steps

The White House is warning critical infrastructure operators and others to be vigilant of ransomware and other cyber threats going into the Labor Day holiday weekend. While the White House had no specific threat information to share, Deputy National Security Advisor for Cyber and Emerging Technologies Anne Neuberger said historically malicious actors have looked to holiday weekends as prime times to launch attacks.

—Read the full article from S&P Global Platts

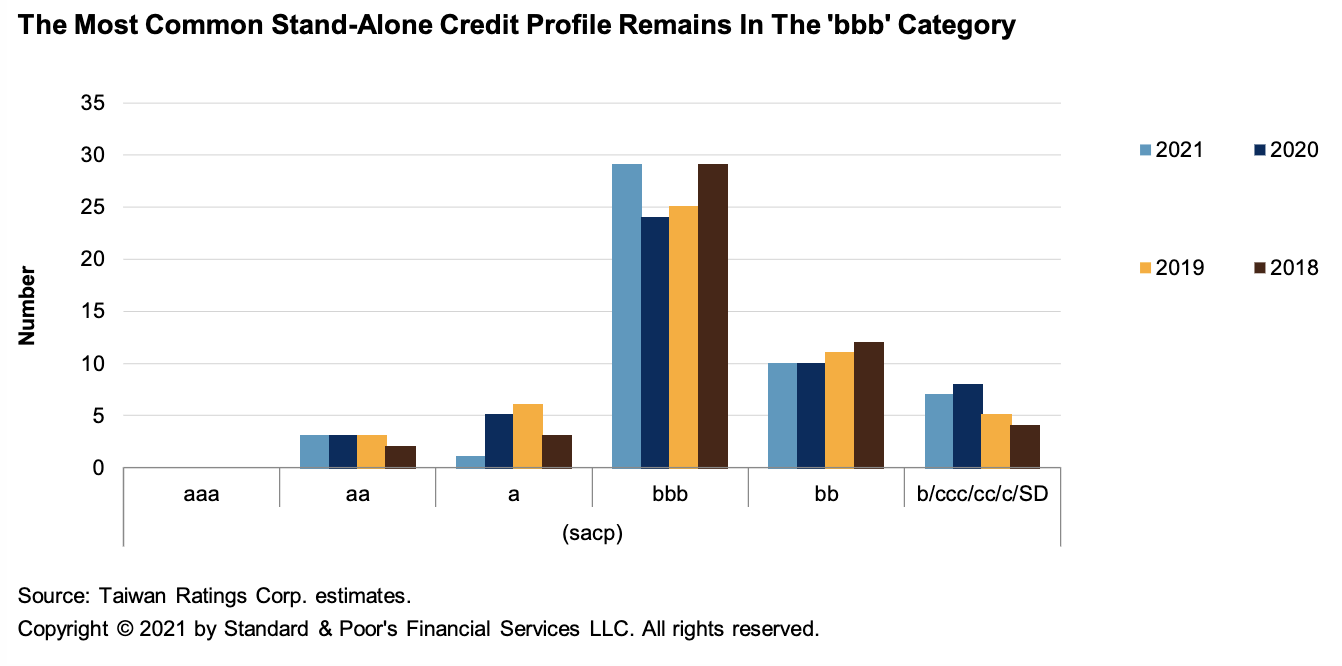

Sector Review: Global Recovery And High-Tech Demand Lift Taiwan Corporate Profitability To New Highs

Credit strength has improved moderately among Taiwan's top 50 corporates over the past year, amid growing export demand. Growth in e-commerce, remote working and schooling, digital transformation, and swift economic recovery in developed markets underpin export growth.

—Read the full report from S&P Global Ratings

Credit FAQ: Can Egypt Weather Rising Global Interest Rates?

Since 2019, a key pillar of Egypt's macroeconomic strategy has been to keep real interest rates (RIRs) high. The benefits of high rates have included robust portfolio inflows, foreign exchange reserve accumulation, and a stable exchange rate. However, high RIRs come at an elevated fiscal cost. Egypt's interest-to-revenues ratio and its interest payments as a percentage of GDP are among the highest of all rated sovereigns.

—Read the full report from S&P Global Ratings

Car Rental Industry’s Credit Risk: A Bouncy Ride During The Pandemic

During the first half of 2020, many car rental firms found themselves in challenging positions with suppressed demand due to travel restrictions and lockdown measures. However, as lockdown measures eased, this sector became more popular as a safer and favorable means of public transportation because of the minimal exposure to the virus.

—Read the full article from S&P Global Market Intelligence

Fund Financing Through a Credit Lens: Digging Deeper on Credit Risk Factors for Alternative Investment Funds

The increased leverage within the AIF universe globally poses potential credit risks to various lenders to the funds. S&P Global Market Intelligence’s Credit Assessment Scorecards provide a framework to help navigate today’s climate and assess the probability of default.

—Read the full article from S&P Global Market Intelligence

Watch: A Diverse Approach to Sectors: Examining the S&P BSE SENSEX 50

How does index design influence sector diversification? Look under the hood of the S&P BSE SENSEX 50 Index with S&P DJI’s Ved Malla.

—Watch and share this video from S&P Dow Jones Indices

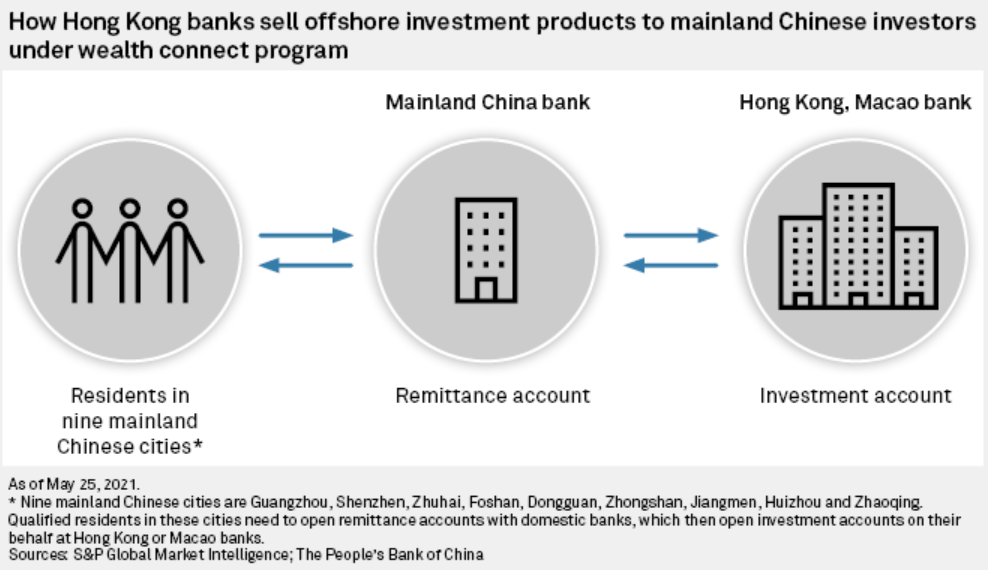

Bank Of China's Hong Kong Unit Aims At More Mainland Clients Via Wealth Connect

The main Hong Kong unit of Bank of China Ltd. expects to sustain a double-digit growth rate in its customer base with the next phase of a mutual market access program that would allow investors in nine mainland cities to buy wealth products in the Asian financial hub.

—Read the full article from S&P Global Market Intelligence

MENA Sovereigns, Corporates, And Banks Enter A New Chapter As COVID-19 Concerns Linger

Key Middle East and North African (MENA) countries' greater reliance on energy exports and travel and tourism meant last year’s regional economic loss closely tracked the world composite. Regional growth started to rebound in third-quarter 2020, but what seemed to be a sharp recovery path has been thwarted by subsequent virus waves. The pace of rebound is insufficient to bring these economies back to their prepandemic GDP trajectories by 2024.

—Read the full report from S&P Global Ratings

Italy's Deleveraging Success Could Help Limit Messy COVID-19 Defaults

Italy's financial system appears much better equipped to handle the impact of the coronavirus pandemic than previous adverse events thanks to a sharp reduction in the number of highly indebted companies since the global financial crisis, S&P Global Market Intelligence data shows.

—Read the full article from S&P Global Market Intelligence

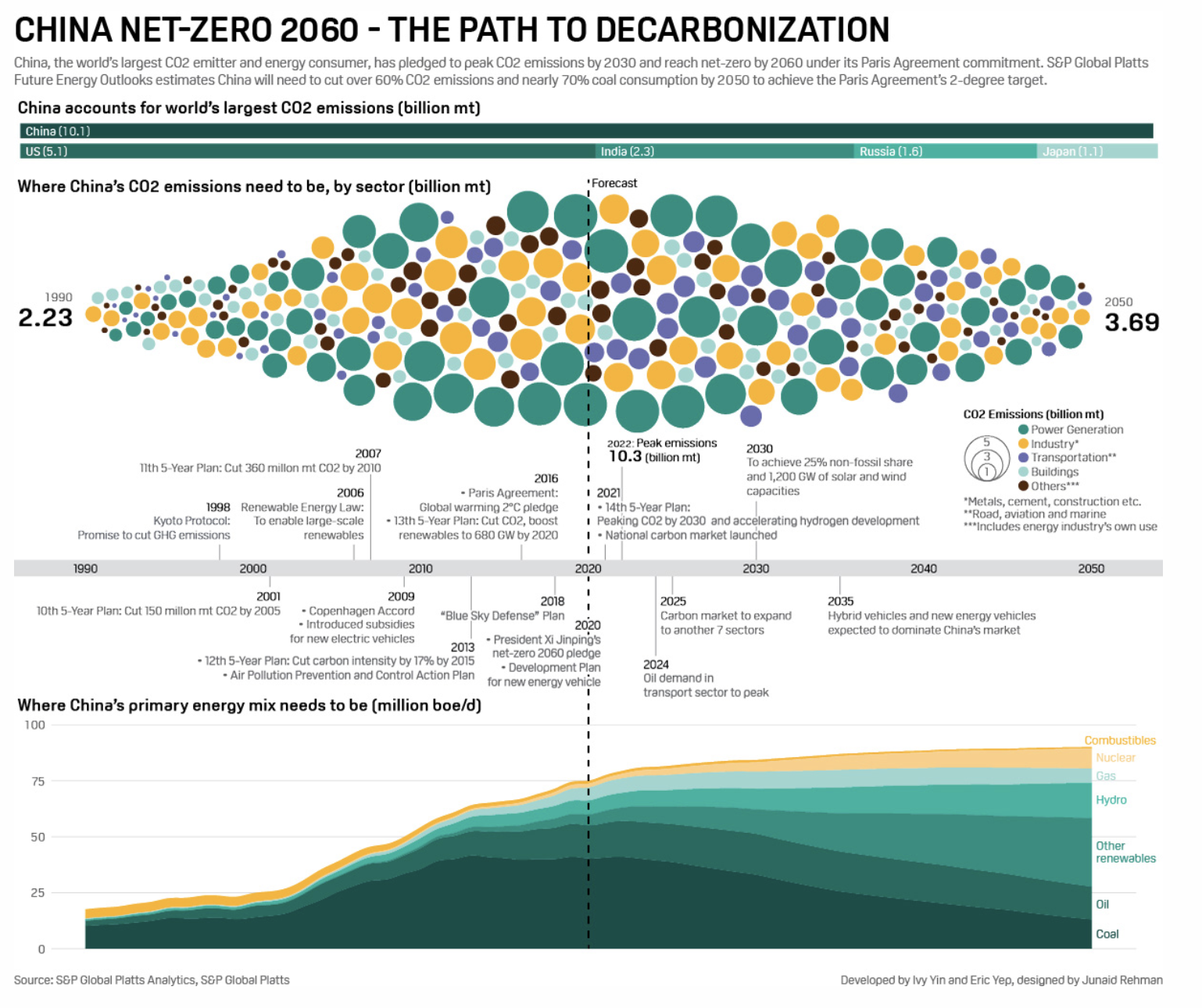

Infographic: China Net-Zero—The Path To Decarbonization

China, the world's largest CO2 emitter and energy consumer, has pledged to peak CO2 emissions by 2030 and reach net-zero by 2060 under its Paris Agreement commitment. S&P Global Platts Future Energy Outlooks estimates China will need to cut over 60% of C02 emissions and nearly 70% coal consumption by 2050 to achieve the Paris Agreement's 2-degree target.

—Read the full article from S&P Global Platts

Feature: China's Net-Zero 2060 Plan Will Need Full Power Grid Overhaul

China will need to fundamentally revamp its power generation and distribution system by 2060, as part of its roadmap to decarbonize the power sector and accommodate a fuel mix that largely replaces fossil fuels with cleaner energy sources, according to experts at a recent conference in Nanjing.

—Read the full article from S&P Global Platts

A Nationwide Push For Green Energy Could Strand $68B In Coal, Gas Assets

While the past decade has seen U.S. electric sector carbon emission declines, attributable mainly to the substitution of coal generation with natural gas generation, recent pricing trends indicate further emissions reductions via this avenue are unlikely. More recently, the advancement of renewable mandates and regulatory support for retiring coal generation in parts of the country indicate that a new round carbon emissions reductions are on the horizon.

—Read the full article from S&P Global Market Intelligence

New Data On Permian Basin Methane Emissions Add Support For Pending U.S. EPA Rule

The amount of methane being released from oil and gas fields in the Permian Basin is now consistently at pre-pandemic levels, according to researchers who collected new data this summer ahead of upcoming federal emissions regulations.

—Read the full article from S&P Global Market Intelligence

New FTC Chair Khan Not Afraid To Play Hardball With Oil, Gas Industry: Baker Botts

U.S. Federal Trade Commission Chair Lina Khan is not pulling any punches with the oil and natural gas sector as she sets out to enforce antitrust law as the youngest person ever to helm the agency, global law firm Baker Botts says. A 32-year-old former law professor, Khan has made a name for herself as a progressive voice with a get-tough approach to Big Tech's unchecked market power.

—Read the full article from S&P Global Platts

Venezuelan Talks Focus On Guyana Oil Dispute But Make Little Progress On U.S. Sanctions

The Venezuelan government and its political opposition found limited areas of agreement during a second round of negotiations in Mexico, but the talks remain the best opportunity for achieving broad U.S. sanctions relief, according to S&P Global Platts Analytics.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Language