Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 28 Sep, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Canada Offers Climate Debate in Microcosm

When wildfires in Quebec sent smoke billowing down the eastern seaboard, befouling the air from Toronto to Washington, DC, Canada became a talking point in the global climate debate. But the climate debate within Canada, and the way climate discussions quickly morph into fossil fuel and energy discussions, is little known outside the country. Canada, with its agricultural droughts, oil patch, nuclear power industry and devastating wildfires, provides a small-scale version of the global climate debate with all of its competing voices. A recent “ESG Insider” podcast by S&P Global Sustainble1 called “How the Canadian wildfires impact business, net-zero, health” sets the scene.

“2023 is really, yet again, an unprecedented year, and what is so unusual about this year’s wildfires is how early in the season they started,” explained Werner Kurz, senior research scientist with Natural Resources Canada’s Canadian Forest Service. “By the beginning of June, we had an area burned that we would normally not reach until the beginning of August. … And what’s also unusual this year is that the wildfires occurred across the country.”

While the wildfires affected businesses and health with the thick orange smoke that spread down the continent, the larger worry was that the forests, which traditionally act as a carbon sink, would become a net contributor of carbon to the atmosphere when they burned. This would create a positive feedback loop where more warming lead to more fires, perpetuating further warming and fires.

Canada’s massive agricultural sector has also suffered from rising temperatures and poor soil moisture levels. With the war in Ukraine affecting wheat supplies from Russia and Ukraine, Canadian farmers planted the country's widest wheat area since 1997, at 10.7 million hectares. A severe drought in the wheat-growing regions of southern Alberta and western Saskatchewan is expected to depress wheat output, exacerbating global wheat supply concerns and pushing futures prices higher.

While extreme events such as wildfires and drought have ravaged many parts of Canada, the oil-producing regions of Alberta are proving resistant to discussions on the energy transition. For many Albertans, oil sector jobs pay well, and a transition to a low-carbon economy could adversely affect their wealth.

"Oil and gas is the central pillar of the economy here, as it has been for my whole life," Chris Severson-Baker, executive director of the Pembina Institute, said at the World Petroleum Congress in Calgary. But because of the wildfires, "climate change was in your face every single day this summer. Tens of thousands of Albertans had to flee their homes as vast areas of the province burned."

Lost in the discussion about climate and extreme weather is a small piece of good news — greenhouse gas emissions from Canadian oil sands remained steady in 2022, despite a rise in production. Total greenhouse gas emissions in Canadian oil sands were down 23% since 2009.

To complete the picture of the global climate debate, there is also discussion about the long-term role of nuclear energy in Canada. In Ontario, the country’s most populous province, the government is looking to expand the use of nuclear energy to meet net-zero targets. Meanwhile, critics of nuclear power believe that wind, solar and hydroelectric capacity could meet the province’s growing energy needs.

Today is Thursday, September 28, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

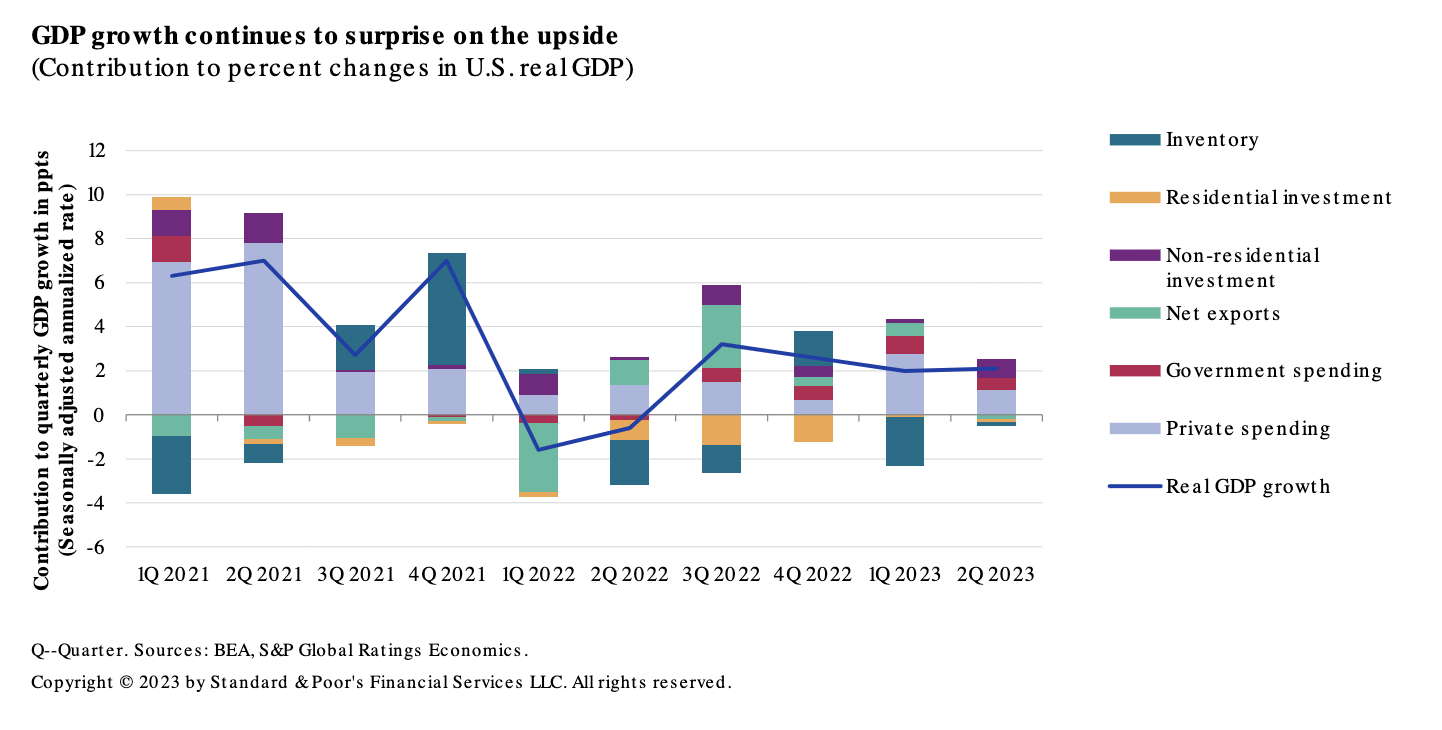

Economic Outlook US Q4 2023: Slowdown Delayed, Not Averted

S&P Global Ratings expects the US economy to slip below trend for a drawn-out period. While it now expects the economy to expand 2.3% this year (up from 1.7% in its June forecast), S&P Global Ratings sees growth slowing to 1.3% in 2024 and 1.4% in 2025, before converging to trend-like growth of 1.8% in 2026. It expects the unemployment rate to rise to 4.8% in 2025, above the longer-run steady state of 4.0%-4.5%. It continues to forecast core inflation finally falling closer to 2.0% by this time next year.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

Credit Conditions Emerging Markets Q4 2023: High Interest Rates Sour The Mood

Weakening growth, high interest rates and lingering cost pressures will likely test the relative stability of credit conditions across emerging markets. Economic resilience, which helped issuers weather the effects of higher costs, will likely fade over coming quarters. The balance of risks for emerging market credit conditions remains to the downside.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

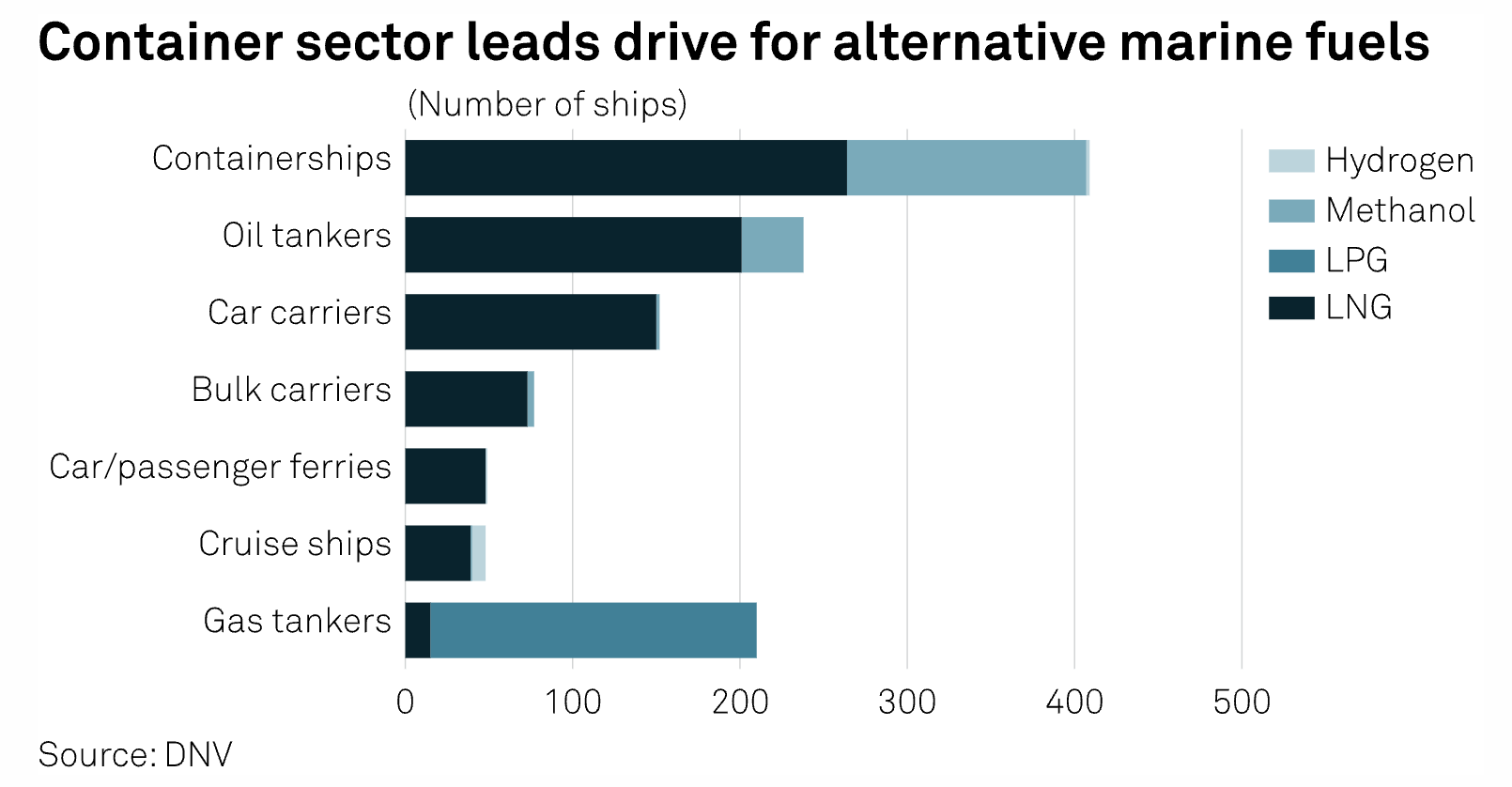

Box Lines Need Regulatory, Customer Support In Green Fuels Pursuit

Container lines have begun shifting to more sustainable marine fuels with support from eco-conscious customers, but robust emissions regulations on global shipping are needed for sector-wide decarbonization, World Shipping Council CEO John Butler told S&P Global Commodity Insights. Among all maritime transportation sectors, box shipping is the largest consumer of bunker fuels, the biggest source of greenhouse gas emissions as well as the top investor in vessels powered by alternatively fuels, according to data from S&P Global and other industry sources.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: At Climate Week NYC, Seeking Solutions At The Nexus Of Climate, Water And Social Issues

This week the ESG Insider podcast is on the ground at Climate Week NYC for a special series of interviews from the sidelines of The Nest Climate Campus. In this episode, hosts Lindsey Hall and Esther Whieldon sit down with Gayle Schueller, 3M's Senior Vice President and Chief Sustainability Officer. 3M is a technology and manufacturing company with more than 60,000 products in its portfolio ranging from office and home supplies to industrial products and solutions related to safety, transportation, electronics and healthcare.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Sustainable1

Access more insights on sustainability >

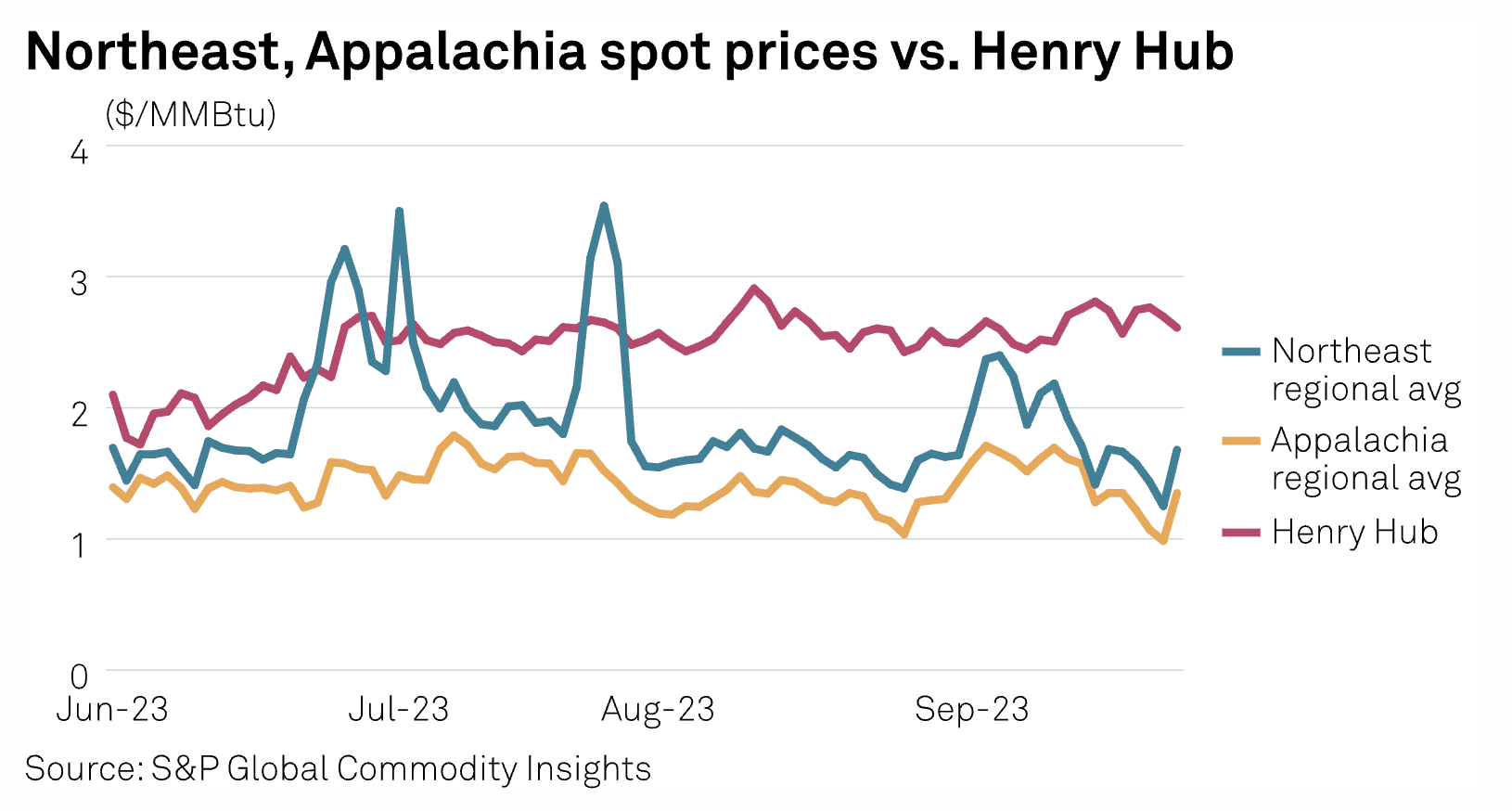

Marcellus' Cheaper Drilling, Operating Costs Helping Offset Anemic Pricing: Coterra CEO

Low operating costs in the Marcellus Shale have insulated Coterra Energy from the worst of what's been a challenging 2023 price environment for in-basin operators, CEO Tom Jorden said in an interview. "Our asset in Northeast Pennsylvania is dry gas, very low cost of supply, so even in current pricing, it gives very nice margins and very good profits. It's really a nice asset to have," Jorden said Sept. 25 on the sidelines of the Hamm Institute's American Energy Security Summit in Oklahoma City.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Tech Disruption In Retail Banking: Country-By-Country Analysis 2023: Leaders And Laggards Emerge

Digitalization and automation are driving significant changes to banks' products, systems and operational efficiency. Tech adoption rates are influenced by infrastructure, regulation, local preferences and competitive pressures, and are thus uneven. Emerging technology gaps between banks and countries will benefit or inhibit the wealth of clients and nations. S&P Global Ratings expects banks in many regions will have a greater capacity to innovate due to stronger earnings from rising interest rates, and thus create a virtuous circle in which tech-driven savings enable greater investment in tech. Emergent technologies, such as generative artificial intelligence, promise material change that could create opportunities and threats for banks and fintechs.

—Read the report from S&P Global Ratings

Content Type

Location

Language