Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 15 Sep, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

A Growth Recession in the U.S.

In warmer climates there are people who have never experienced sleet, that unwelcome form of precipitation consisting of ice pellets mixed with rain and snow. Sleet is neither rain nor snow, but it combines many of the most unpleasant aspects of both. Right now, the U.S. is experiencing the economic equivalent of sleet — something called a growth recession.

According to a recent article from the Economics & Country Risk team at S&P Global Market Intelligence, a growth recession is a period of sluggish real growth, whereby an economy grows, but not by much. The team projects gross domestic product to grow 0.6% in the third quarter and 1.0% in the fourth quarter. It also projects that GDP will grow 1.0% in 2023. This means U.S. economic growth is expected to be something between tepid and sluggish for the foreseeable future. While these numbers don’t merit celebration, they do not yet represent a true recession, as defined by the National Bureau of Economic Research, although a recession is still a strong possibility, according to S&P Global Ratings.

Tuesday’s unexpectedly high U.S. inflation number of 8.3% means the Federal Reserve is likely to continue a hawkish monetary policy, with another interest rate hike of 50 basis points or 75 bps likely to occur in the near term. Analysts at S&P Global Market Intelligence project that the upper end of the federal funds rate will rise to 4% by December, which they believe will be the peak of this tightening cycle.

Not all the economic news is bad. U.S. labor markets have shown remarkable resilience in the face of rising inflation. In August, nonfarm payrolls expanded by 315,000, while the unemployment rate increased slightly to 3.7%. In addition, while the U.S. is confronting unexpectedly high inflation, its inflation rate remains lower than the eurozone’s 9.1%. Global economic activity contracted in August, so even slow growth looks good by comparison.

Rate increases, while necessary to combat persistently high inflation, will make it more difficult for the U.S. economy to achieve a “soft landing.” It is challenging for central banks to cool off inflation without pushing the economy into recession. In some ways, a growth recession is the definition of a soft landing. In other ways, a growth recession is just sleet — everyone is cold, everyone gets wet.

Today is Thursday, September 15, 2022, and here is today’s essential intelligence.

Written by Nathan Hunt.

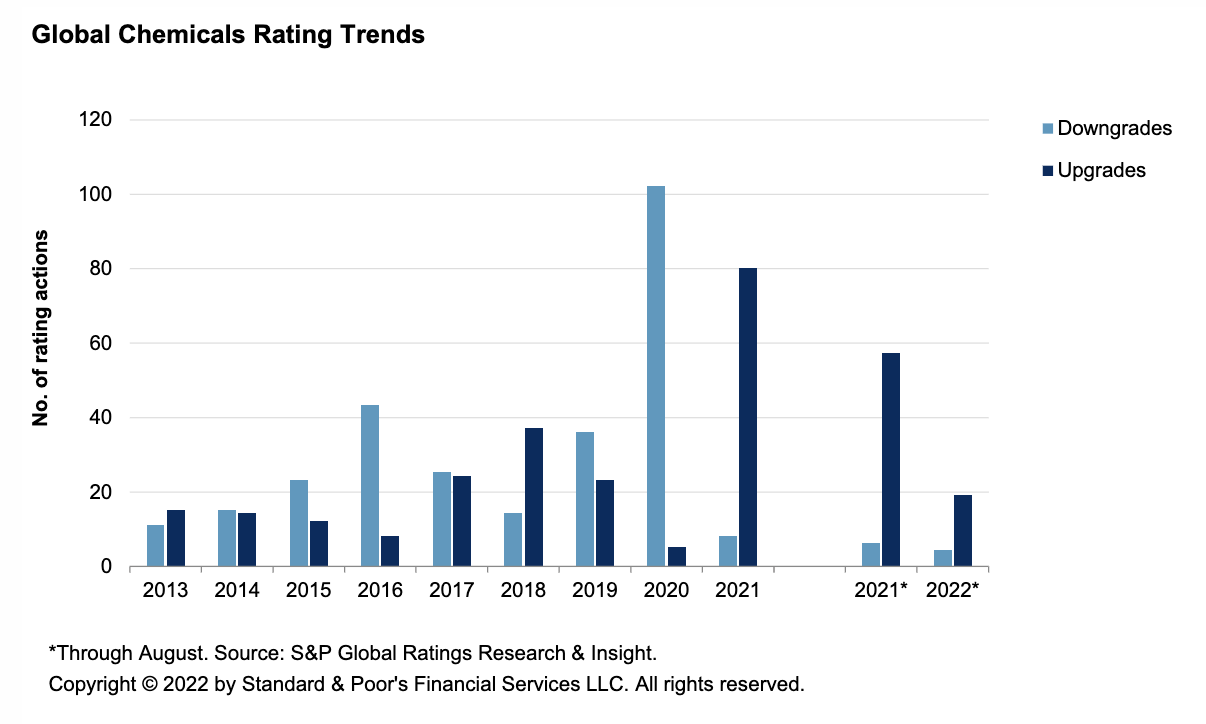

Inflationary And Natural Gas Supply Headwinds Challenge Global Chemicals Sector Stability

Following the weak operating environment in 2020 due to the COVID-19 pandemic, which resulted in negative rating actions, S&P Global Ratings upgraded several chemical companies in 2021 amid faster-than-expected commodity price recovery, supported by strong global demand and supply disruptions. This positive momentum continued into early 2022, with most companies reporting strong first-quarter, and in some instances strong second-quarter results.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

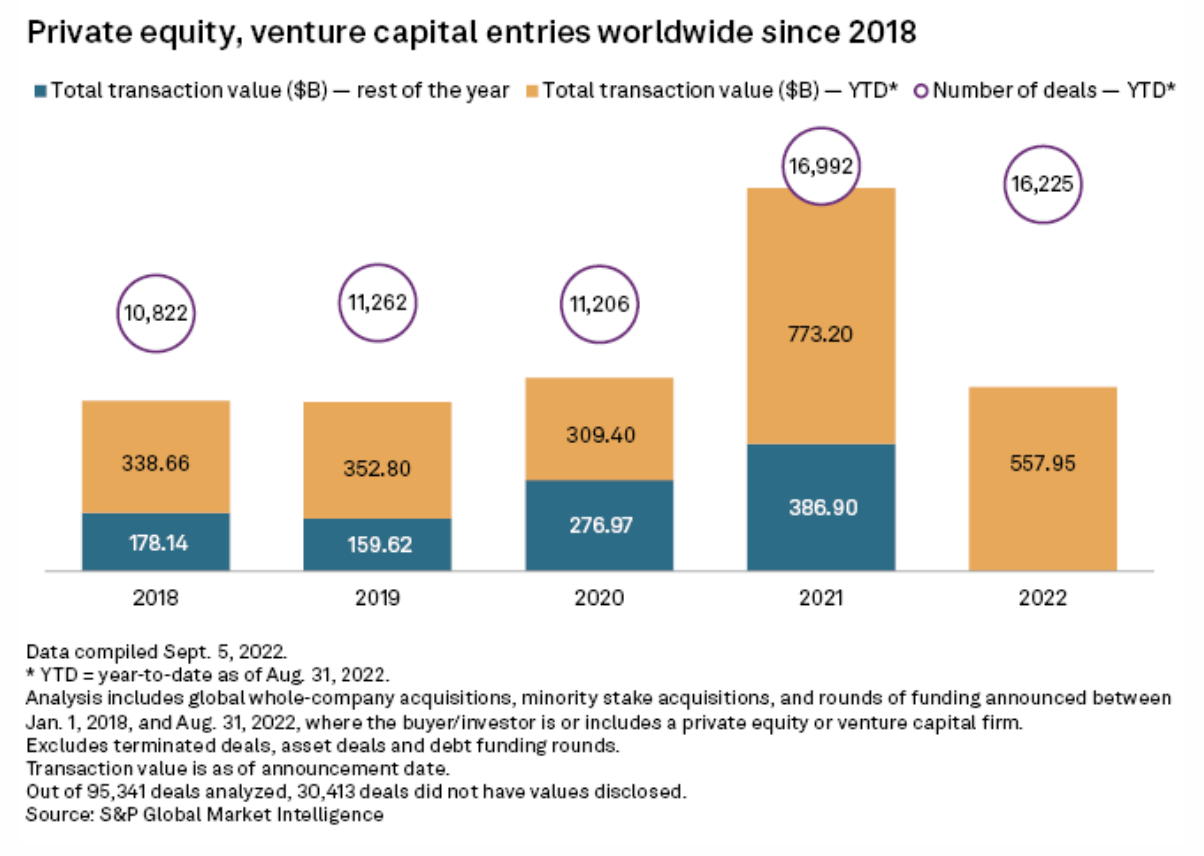

Global Private Equity Entries Slip In August Amid Inflation, Valuation Concerns

Private equity and venture capital deal value worldwide dropped in August as investors remained cautious about inflation and asset valuations. Global private equity entries in August dipped 45.8% to $42.23 billion from $77.95 billion in the same month a year ago, S&P Global Market Intelligence shows. Announced deals during the month declined 28.5% to 1,441 from 2,015 transactions a year ago.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

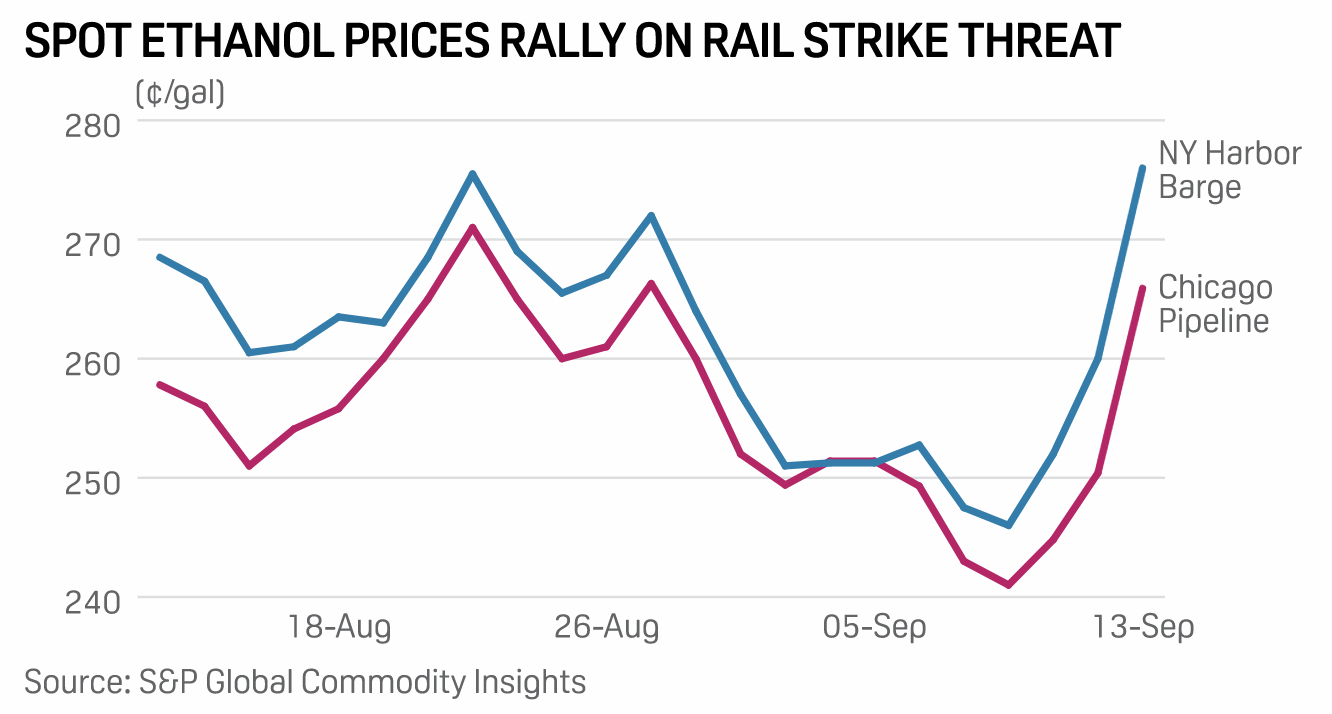

Looming U.S. Rail Strike Could Disrupt Commodity Markets

Commodity markets were closely watching negotiations between U.S. railroads and unions Sept. 13 as a deadline nears for a strike that would curtail shipments of agricultural and energy products, leading to price spikes. Ten of the 12 major unions have reached agreements, leaving just the Brotherhood of Locomotive Engineers and Trainmen and SMART Transportation Division.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Video: Latin America — Renewables Keep Up The Pace Amid Growing Economic Uncertainties

Renewables will sustain the fast pace of growth in Latin America, despite the economic and political uncertainties. In this video, a dynamic chart shows the S&P Global Commodity Insights power outlook for the region. It includes historical figures and country-level outlooks through 2035 for Brazil, Mexico, Chile, Argentina, Colombia and Peru, with highlights about the most important drivers of growth.

—Watch the video from S&P Global Commodity Insights

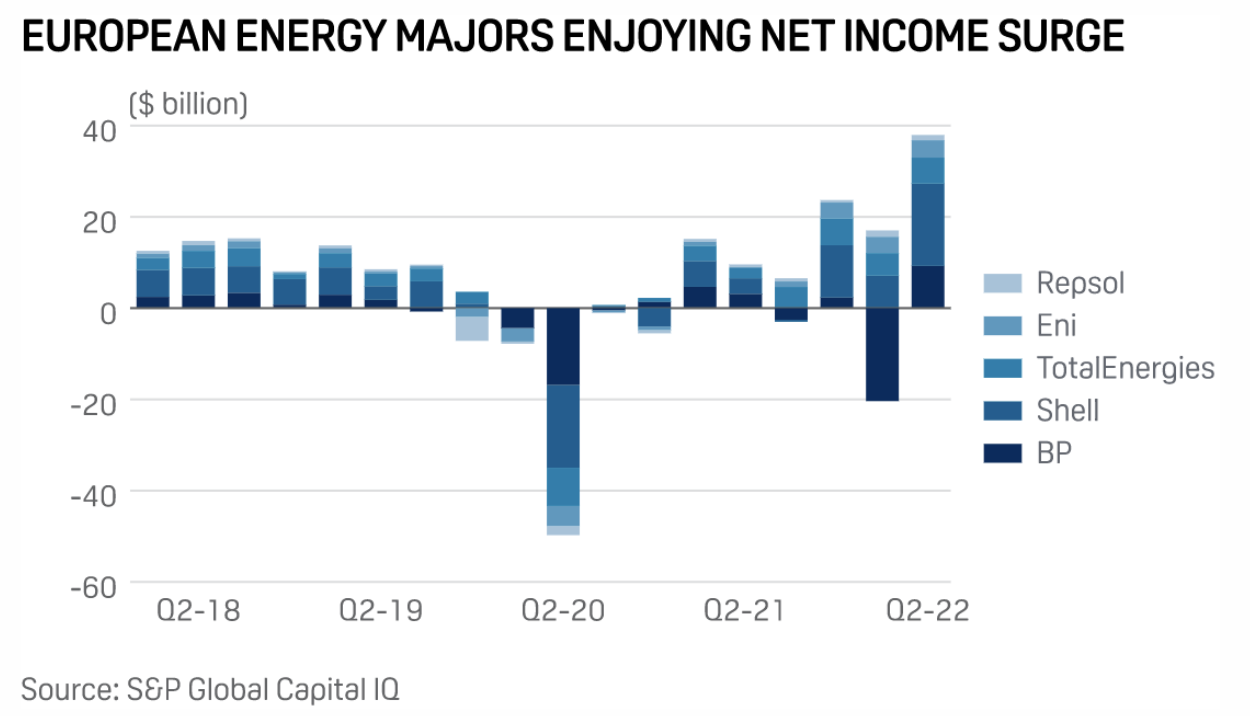

EU Proposes $25 Billion Windfall Tax On Fossil Fuel Producers To Help Offset Energy Crisis

The European Commission proposed Sept. 14 a temporary tax on the 'surplus profits' of the trade bloc's fossil fuel producers to help offset soaring power and gas bills in the region in the wake of Russia's war on Ukraine. Under the proposal, a "solidarity contribution" on excess profits generated from activities in the oil, gas, coal and refinery sectors will be applied for one year after entering into force with a review by Oct. 15, 2023, the commission said.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

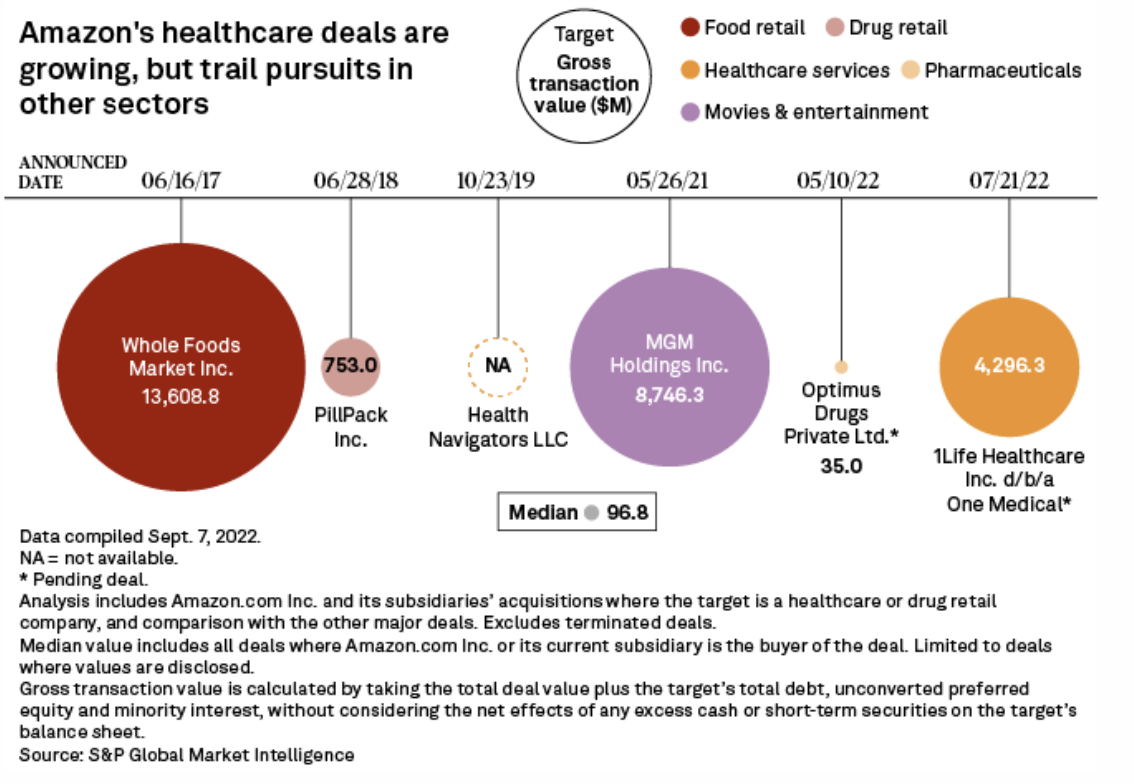

Amazon's Healthcare Ambitions Hinge On Smaller Deals That Survive FTC Scrutiny

If Amazon.com Inc. hopes to become a big player in the multitrillion-dollar healthcare industry, the e-commerce company will have to buy its way in, one midsize deal at a time. The Federal Trade Commission is reviewing Amazon's plans to purchase 1Life Healthcare Inc., the parent company of One Medical. Approval of the One Medical deal would give Amazon control of a national primary healthcare organization with more than 180 clinics providing in-person care, as well as digital health and virtual care services.

—Read the article from S&P Global Market Intelligence

Access more insights on technology and media >