Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 31 Oct, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

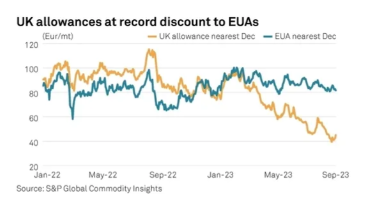

CBAM Confronts Steel, the Hard-To-Abate Poster Child

Most critics of net-zero targets are not opposed to decarbonization per se. Instead, they point to industries that are vital to the global economy but difficult to decarbonize. These hard-to-abate industries include cement, petrochemicals and steel. The steel industry consumes approximately 7% of global energy and is responsible for about 8% of global greenhouse gas emissions. About 70% of steel comes from new production, as opposed to recycled steel. Manufacturing steel from iron ore requires a high temperature, which is achieved mostly from coal that is transformed into coke, to extract oxygen from the ore. While there are multiple processes and technologies capable of producing green steel, steel plants have a long asset life, low profit margins and high capital intensity. Absent external pressures, most steel producers prefer sticking with their current setup.

There aren’t that many external pressures working to force the decarbonization of the steel industry. While there has been more demand for green steel, particularly from European car manufacturers, government regulations are the strongest force for change. Of all the government regulations affecting the steel industry, Europe’s Carbon Border Adjustment Mechanism (CBAM) is driving the most debate and concern.

While Europe is seeking to lead on decarbonization, European businesses protested that unilateral decarbonization would lead to European cement, petrochemicals and steel being undercut by cheaper and dirtier imports. CBAM protects Europe’s decarbonizing industries by requiring importers of power, iron and steel, cement, fertilizer, aluminum, hydrogen and some polymers to prove that carbon emissions from production have been reduced or offset in line with European standards. In simple terms, CBAM is an import tax on a product’s carbon content, and the biggest industry it affects, by volume, is steel.

Europe’s steel industry has been working to meet escalating emissions penalties under the EU's Emissions Trading System and CBAM. The expectation of CBAM’s architects is that other regions will implement similar emissions controls for their domestic steel industries. However, some industry observers believe that CBAM is likely to further fragment the global steel market.

Already, tensions between EU and Latin American steel producers are on the rise. Brazil’s steel industry has been a bright spot for the emerging market, but CBAM will erode the industry’s competitiveness. Brazil is setting up a regulated carbon market to establish a framework for measuring, recording and regulating emissions, but it will take time to establish, and CBAM is scheduled to be fully implemented by 2026.

Asian steel manufactures are also unprepared to meet the strictures of CBAM. According to S&P Global Commodity Insights, few countries in Asia have imposed any form of carbon tax; only China, South Korea and Australia have established nationwide emission trading schemes to price carbon. China has been vocal in opposing CBAM but has made efforts to accelerate its own emissions trading scheme to cover exports eligible for tariffs under the law.

While many non-European steel manufacturers are opposed to CBAM, the acceleration of net-zero initiatives in the global steel industry illustrates how interconnected carbon regulations are increasingly leading all regions to accelerate their decarbonization efforts.

Today is Tuesday, October 31, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

Australian Economic Growth Moderates Due To Tighter Monetary Policy

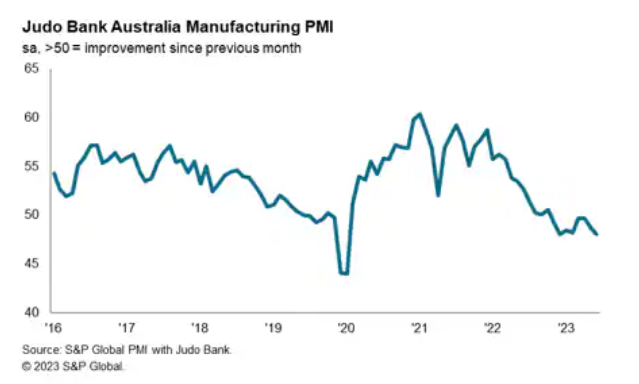

Australian economic growth momentum has softened during 2023 due to the cumulative impact of monetary policy tightening since May 2022. The Judo Bank Flash Australia Composite PMI Output Index for October 2023 posted below the 50.0 no-change mark for the third time in the past four months during October, reflecting weak domestic demand, continuing high inflation pressures and the impact of monetary policy tightening.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Credit Trends: Global Financing Conditions: Stubborn Rates Portend Slower Issuance Growth In 2023 And 2024

S&P Global Ratings Credit Research & Insights expects global bond issuance to rise 2.6% in 2023, to roughly $7.5 trillion, and to increase about 2.3% in 2024. As we close out 2023, some sectors saw fairly resilient issuance volumes considering higher interest rates, the lingering effects of pandemic-era factors and the increased volatility that developed market banking sectors faced in March. Looking ahead, the course of interest rates will dominate the macro-credit landscape, while rising refinancing obligations will need to be addressed amid likely slower growth.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

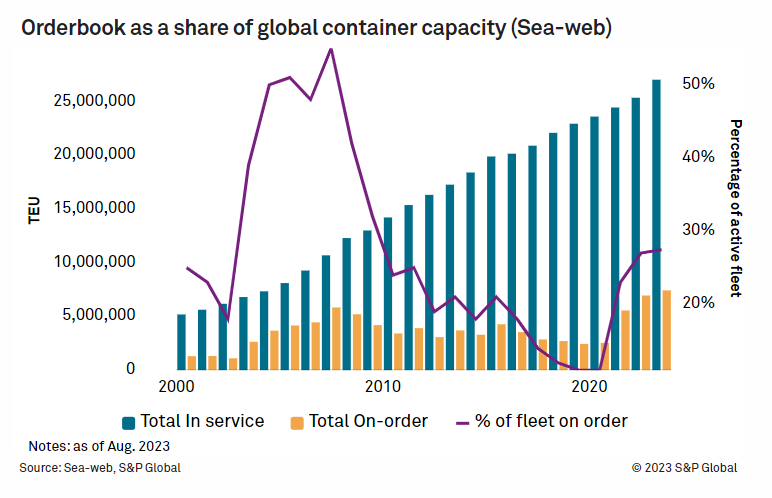

Feature: Average Containership Fleet Age Grows To 14.2 Years Amid Ongoing Replenishment

The containership fleet has notched a new record high for average age of 14.2 years — the highest average age of all three primary shipping sectors — with nearly 21% of the fleet over 20 years old, BIMCO said in an Oct. 26 report. The median age of the containership fleet has increased by some 4.3 years since 2010 to 14.2 years, with over 2,516 ships delivered in the intervening time.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Commodity Insights Magazine: Voluntary Carbon Markets: A Matter Of Trust

This edition focuses on key developments in carbon markets, as well as the challenges and opportunities in a space that is key to a sustainable low-carbon future.

—Read the magazine from S&P Global Commodity Insights

Access more insights on sustainability >

Listen: Geopolitical Turbulence Prompts Asia To Rethink Its Oil Strategy

Oil market volatility amid the conflict in the Middle East has started to ring alarm bells for Asian refiners. Hamas' surprise attack on Israel has fanned worries of a long-drawn period of geopolitical turbulence at a time when global oil markets are already been facing a squeeze in supplies, while demand continues to grow. This has rekindled the debate on oil crossing the $100/b threshold again. S&P Global Commodity Insights' Asia energy editor Sambit Mohanty speaks with Kang Wu, head of global demand and Asia analytics, and Daniel Colover, head of market engagement for the Middle East, on how some of the recent geopolitical developments, including the removal of sanctions on Venezuela, could potentially affect Asian oil markets.

—Listen and subscribe to Platts Oil Markets, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

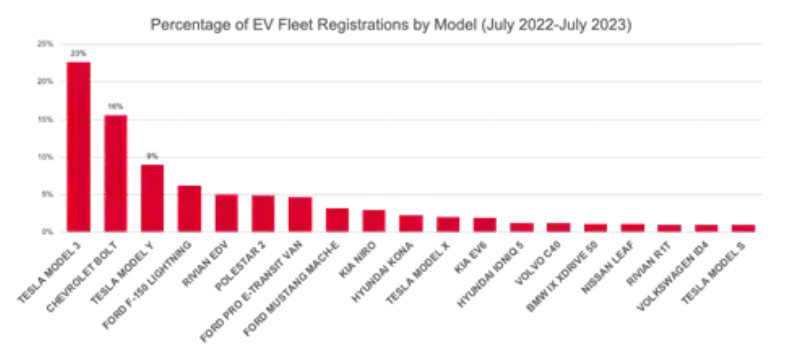

Tesla Is Most Popular EV Brand For US Fleet Companies

With consumer demand for electric vehicles appearing to reach a plateau for the moment, automakers are finding new customers for their EV stock: daily rental, corporate and government fleets. And the top seller into those fleets is Tesla — constituting nearly one-third of fleet purchases of EVs over the trailing 13 months.

—Read the article from S&P Global Mobility