Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 2 Oct, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Taking the Carbon Out of Chemicals

Just as the world is flush with atmospheric carbon — levels reached a record high in 2022, according to the US National Oceanic and Atmospheric Administration — so is it full of ambitious targets by companies aiming to decarbonize their activities.

Faced with financial and reputational risks, legislation and pressure from stakeholders, companies have made public commitments to reduce harmful greenhouse gas emissions. The industries they represent are increasingly diverse, going beyond the usual climate champions, such as consumer goods, and into more challenging areas, such as steel, cement and upstream oil and gas.

How will companies fare as these plans meet reality? Research from S&P Global Ratings, with data from S&P Global Commodity Insights, shows the potential impact of decarbonization strategies in the chemicals sector.

It’s an interesting case study. The industry is closely intertwined with fossil fuels, requiring large quantities of oil, gas and coal for heating, pressure and use as feedstocks. It consumes roughly 10% of all fossil fuels and emits 3 billion metric tons of CO2 equivalent each year, according to S&P Global Commodity Insights. The International Energy Agency considers it the world’s third-most-emissive industry after steel and cement, and the carbon intensity of some chemicals is even greater.

More than 70% of the largest chemicals producers have already committed to decarbonization. These commitments are the focus of the first of two reports by S&P Global Ratings, which considers the strategies and solutions companies could use to achieve their targets.

The research digs into a representative sample of 27 companies in the US and Europe, where about 80% of rated issuers are based. This includes names such as BASF, Dow Chemical Company and LyondellBasell, all of which are targeting carbon neutrality in terms of Scope 1 and Scope 2 emissions by 2050.

Reflecting the diversity of the sector, the possible routes to net-zero are varied. “The decarbonization of the chemical sector implies a combination of technologies and processes, and perhaps no consensus will be reached on the most appropriate path to net-zero,” the authors write.

Some solutions are easy to implement with low costs, relatively speaking. For example, improvements in energy efficiency “stand as low-hanging fruits for immediate action,” the report says. Many other possibilities are more costly, time consuming and difficult to deploy. These include electrifying key processes, adopting clean hydrogen as a feedstock, and the use of carbon capture and storage.

The second report by S&P Global Ratings looks at the risks that could arise from these decarbonization approaches, as well as the impact on companies’ credit quality.

Those risks won’t be constant; instead, they will evolve as decarbonization strategies unfold. In the short to medium term, for instance, there is uncertainty about the combination of solutions companies will decide to adopt. This “raises risks that companies might make suboptimal choices that slow their progress or raise [costs],” the authors warn. Longer term, companies face the risk of manufacturing disruptions as they reconfigure plants, as well as the risk of rising operating costs, with an uncertain impact on margins.

Amid these risks, there are potential mitigating factors. Some chemical production processes might be particularly suitable for electrification, and the sector’s familiarity with hydrogen could help propel its adoption. However, much will depend on the choices that individual companies make. Regulation remains a wildcard, with Europe and the US taking divergent regulatory approaches that could help or hinder companies depending on where they are based.

Today is Monday, October 2, 2023, and here is today’s essential intelligence.

Written by Mark Pengelly.

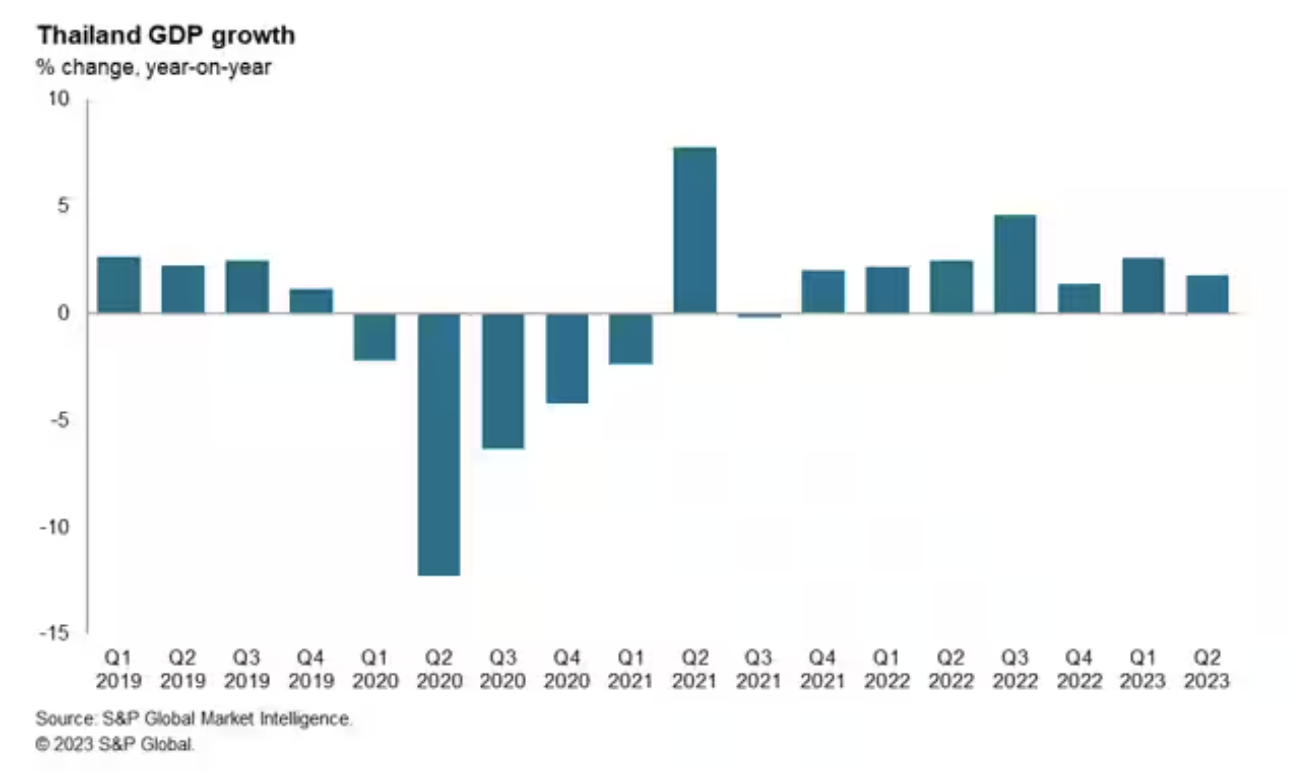

Thailand's Economy Faces Headwinds From Manufacturing Sector Downturn

Thailand showed a gradual economic recovery from the COVID-19 pandemic during 2022, with real GDP growth having risen from 1.5% in 2021 to 2.6% in 2022. However, the manufacturing sector has experienced weakening conditions due to declining exports. The S&P Global Thailand Manufacturing PMI survey results for August signaled the first contraction of the manufacturing sector in 20 months. The Bank of Thailand has also tightened monetary policy by a cumulative total of 200 basis points (bps) since August 2022, in order to constrain potential inflationary pressures.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Introducing The Dispersion Index (DSPX)

At 9:45 am Eastern Time on Sept. 27, 2023, a new index began publishing under the ticker DSPXSM, with an initial live value of 26.81. This index, the Cboe S&P 500® Dispersion Index (the Dispersion Index to its friends), might be loosely described as a “VIX® for dispersion.” But what is it? Why is it called that? And what is it good for? A short introduction is in order.

—Read the article from S&P Dow Jones Indices

Access more insights on capital markets >

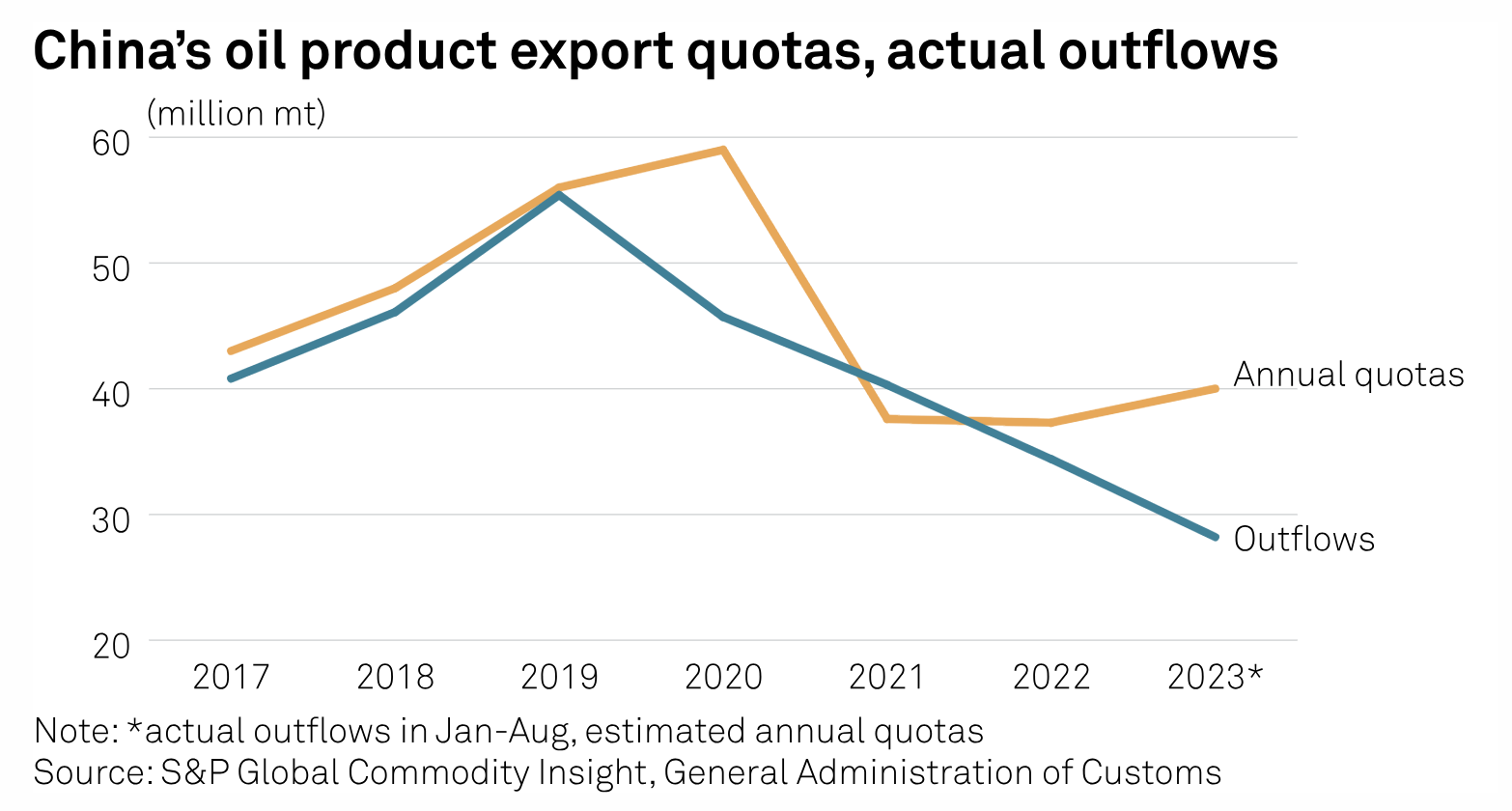

China Says No Extra Quotas For Clean Oil Product Exports, Crude Imports: Quota Holders

The Chinese government will not issue new quotas for clean oil product exports and additional allowances for crude oil imports this year, three Beijing-based trading officials with knowledge of the matter said late Sept. 27. According to the sources, a governor with the country's top planner, the National Development Reform Commission, had said this during a meeting with state-run companies Sept. 27, which will cap China's oil product exports and crude inflows at least in the coming months.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

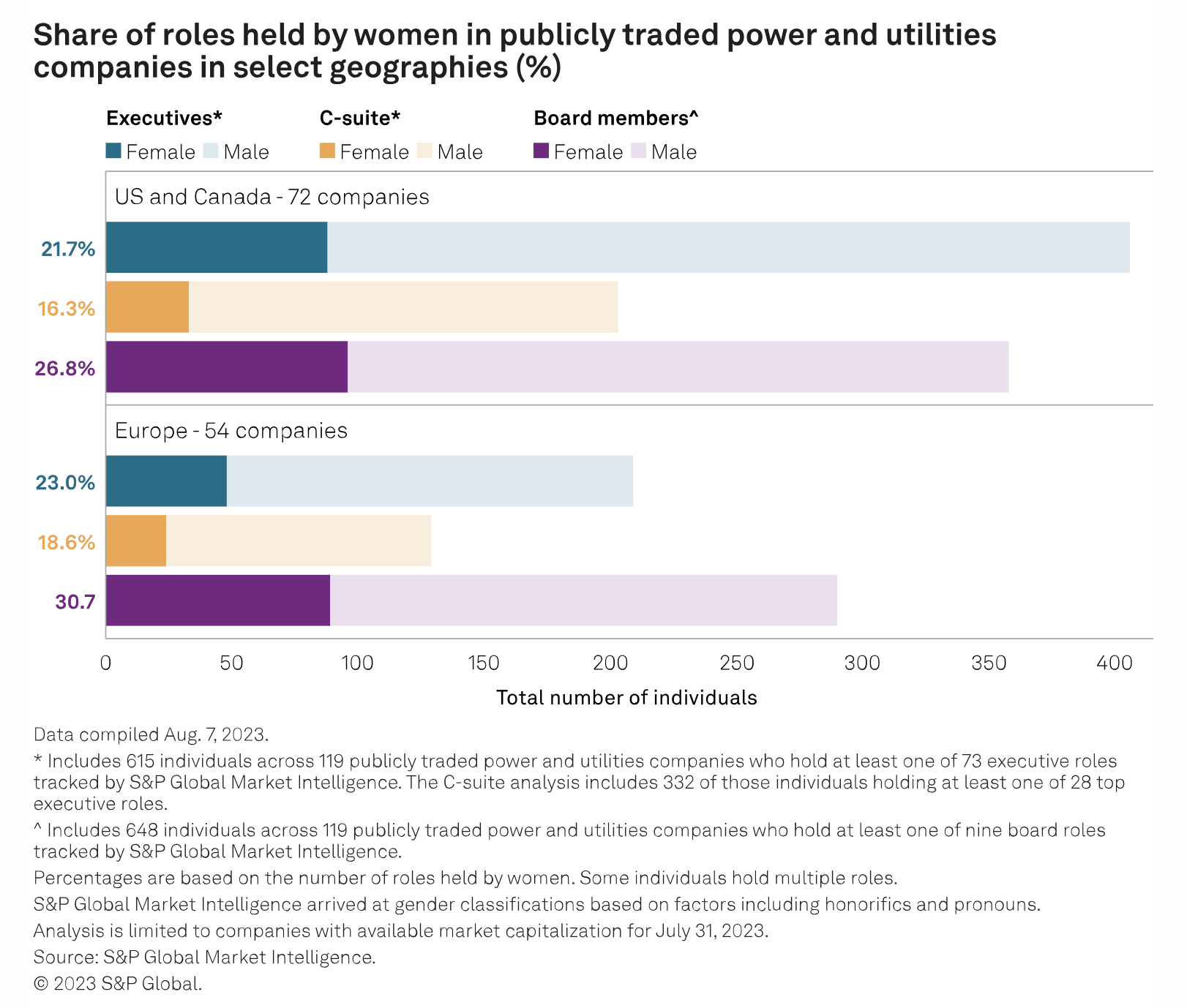

Women In Energy: More Utility Leadership Roles, But Parity Remains Far Off

Women are playing a more pivotal role in the power and utilities sector than ever, a shift that comes at what some call an opportune time as the industry evolves to meet the challenges of increasing electrification and climate change. "We are going through a massive, massive change and having different voices in the room to solve those problems is imperative," Exelon Corp. Executive Vice President and CFO Jeanne Jones said in an interview. "If we don't have the best, the brightest, the most diverse perspectives solving those problems, we're not going to get there in the most efficient way."

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

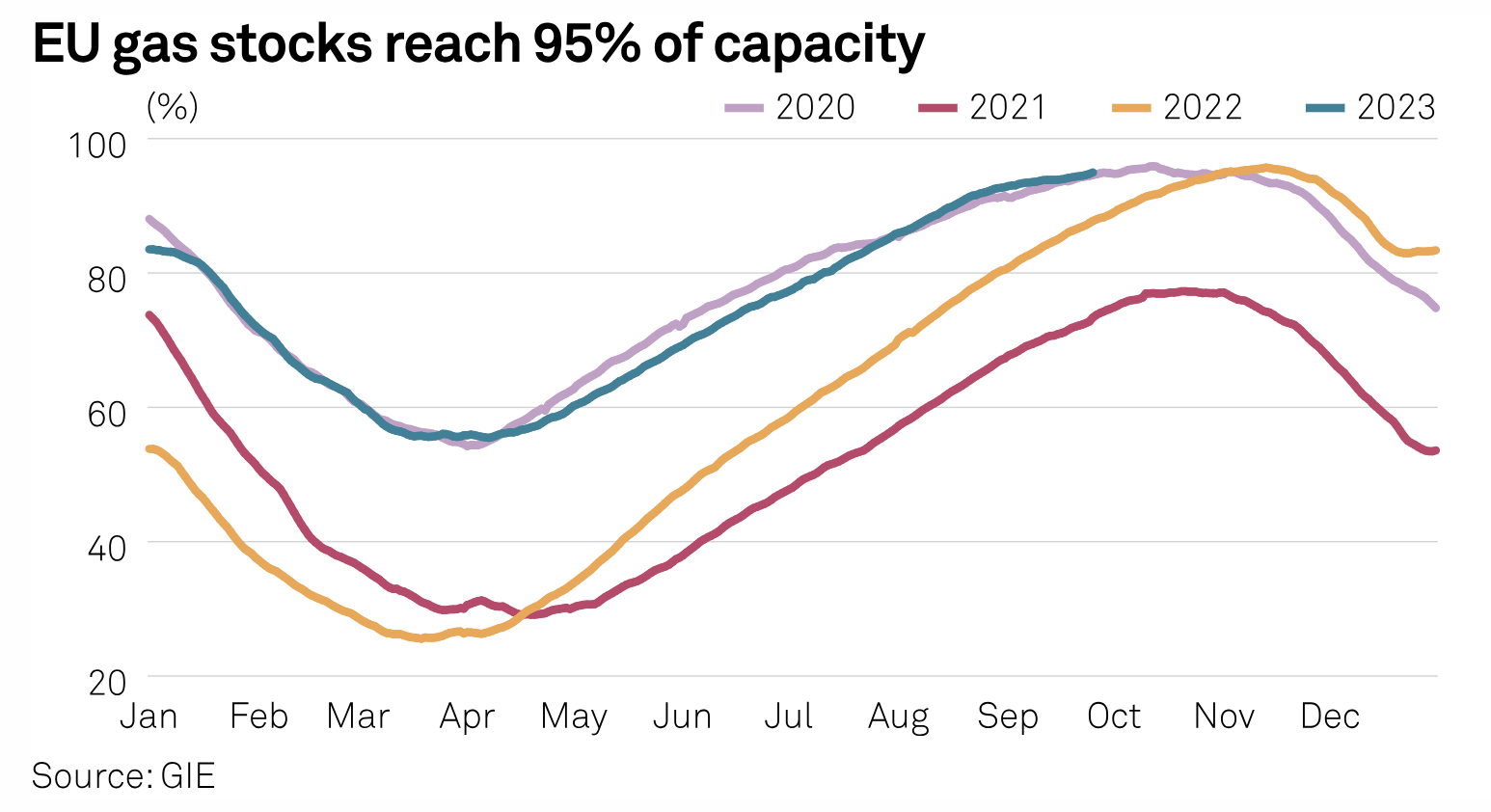

Europe's Gas, Power Markets Remain Vigilant Into Q4 2023

As Europe enters the fourth quarter of 2023, and the official start of the gas winter, markets remain on edge with repeated calls for consumers to continue to exercise responsible gas use despite robust storage levels. Gas demand is still well down on pre-crisis levels but any new supply disruption or a very cold winter could still trigger the threat of gas shortages. Market reaction this summer to the threat of strike action in the Australian LNG sector and extended maintenance on Norwegian assets was a signal of continued supply concerns.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

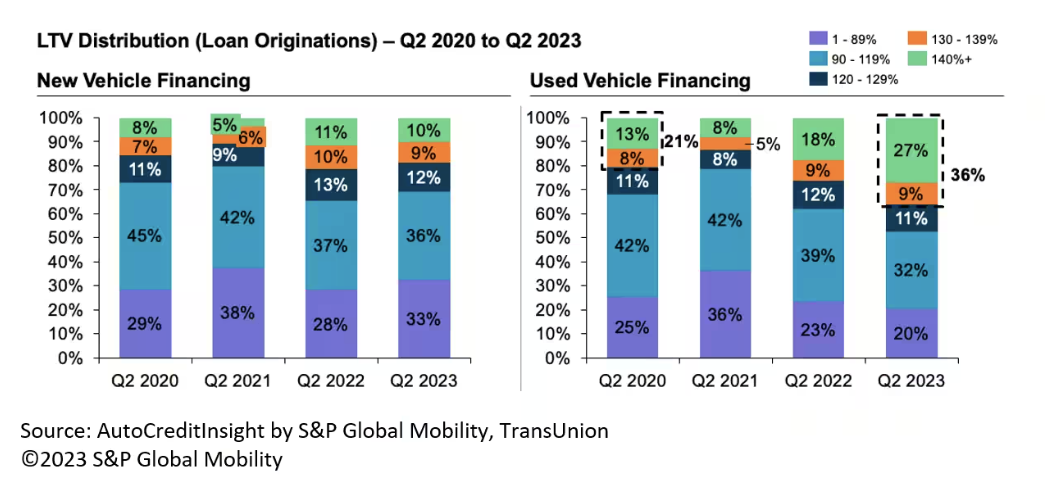

Have Lenders And Consumers Taken On Too Much Risk In The Used Vehicle Portfolio?

As the transaction prices of used vehicles steadily rose through the pandemic, the corresponding funding needs of consumers who purchase those vehicles also have increased. But so has the risk that lenders must consider when deciding to finance their customers' vehicle purchases, according to analysis of data from AutoCreditInsight by TransUnion and S&P Global Mobility.

—Read the article from S&P Global Mobility

Content Type

Location

Language