Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 17 Nov, 2022

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Battery Metal Challenges Pose Rising Risks to EV Growth

Will potential battery metal supply deficits create a speed bump for electric vehicle growth down the road? In the medium term, very likely.

Trade frictions, logistical challenges and sustainability concerns are affecting raw material supply chains, pushing up the price of critical battery metals and, consequently, component and EV prices, according to S&P Global Mobility’s Auto Supply Chain & Technology Group.

In other words, supply will struggle to cope with demand.

Demand from makers of light passenger vehicles for lithium-ion batteries is estimated to accelerate to 3.4 terawatt-hours annually by 2030, according to S&P Global Mobility. In 2021, demand from the auto industry totaled 290 gigawatt-hours.

The development chains for critical battery metals such as lithium, nickel and cobalt are lengthy and complex, with China being the clear leader in materials refining as well as in packaging and assembling battery cells. Other battery elements, such as graphite — an essential ingredient in EV battery anodes — also mostly come from China.

However, logistical issues with Chinese suppliers and geopolitical concerns due to the Russia-Ukraine war have prompted battery producers to look at localizing supply chains.

Countries are making belated attempts to step in and fill the gap through subsidies and other incentives for local battery makers. In the U.S., the Biden administration awarded $2.8 billion in funding in October to 20 companies for domestic critical mining projects.

While such efforts are laudable, China is set to remain a dominant global supplier of battery materials for some time, according to Eric Desaulniers, president and CEO of Canada-based Nouveau Monde Graphite Inc., one of the few battery-grade graphite suppliers outside of China.

Another challenge suppliers face is responsible sourcing. Battery-grade cobalt for electrified light passenger vehicles, for instance, currently comes from just 18 mines, totaling 52,000 tonnes, of which 29,000 tonnes are forecast to be mined in the Democratic Republic of Congo in 2022.

But Congo’s cobalt industry is plagued by claims of child-labor practices, and many suppliers are rushing to find alternative sources and experiment with battery chemistry to reduce the cobalt content needed in batteries.

These shifts are occurring against a backdrop of more government policies encouraging the adoption of EVs. The U.S. administration recently said it wants half of all new car sales in the country to be EVs by 2030.

The European Parliament and European Council in October also provisionally agreed that all new vehicles registered in Europe must be zero-emission by 2035.

The supply of battery metals will undoubtedly drive those ambitions. As S&P Global Mobility noted, “The battery will be the defining technological and supply chain battleground for the industry in the next decade, and access to their constituent raw materials will be crucial.”

Today is Thursday, November 17, 2022, and here is today’s essential intelligence.

Written by Indira Vergis.

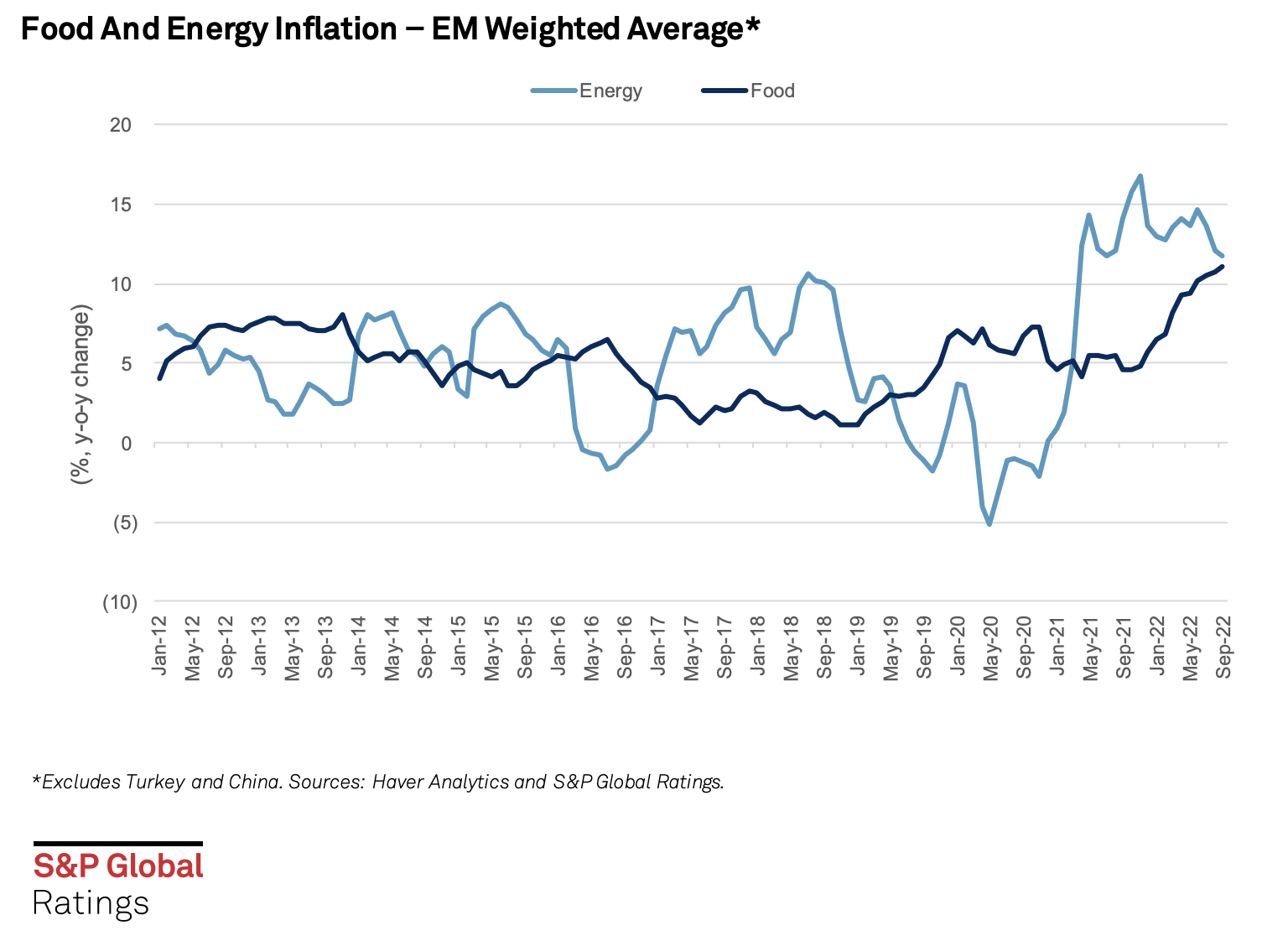

Emerging Markets Monthly Highlights: Approaching The Peak Of Tightening Cycle?

With a few exceptions, energy inflation decreased across most key emerging markets, in line with current global trends. Nevertheless, core and food inflation continues to increase outside of LatAm, suggesting a more persistent nature of inflationary pressures. Some economies in emerging markets in EMEA and LatAm have paused the tightening path, and S&P Global Ratings expects several central banks in LatAm to cut interest rates next year. Nevertheless, uncertainty over the food and energy prices outlook, as well as potential persistence of core inflation, suggest upside risks to current policy rates, especially among Central and Eastern European economies.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

Bank M&A 2022 Deal Tracker: 13 Deals Announced In October

Thirteen M&A deals were announced in the U.S. banking sector in October, bringing 2022's total deal count to 139, down from 176 over the same period in 2021. Aggregate deal value last month was $1.01 billion, down from September's $1.50 billion, according to S&P Global Market Intelligence data. Over the first 10 months of 2022, the median deal value-to-tangible common equity ratio for announced deals was 155.2%, higher than 2021's 152.5% and 2020's 135.3% but just below 2019's 156.5%.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

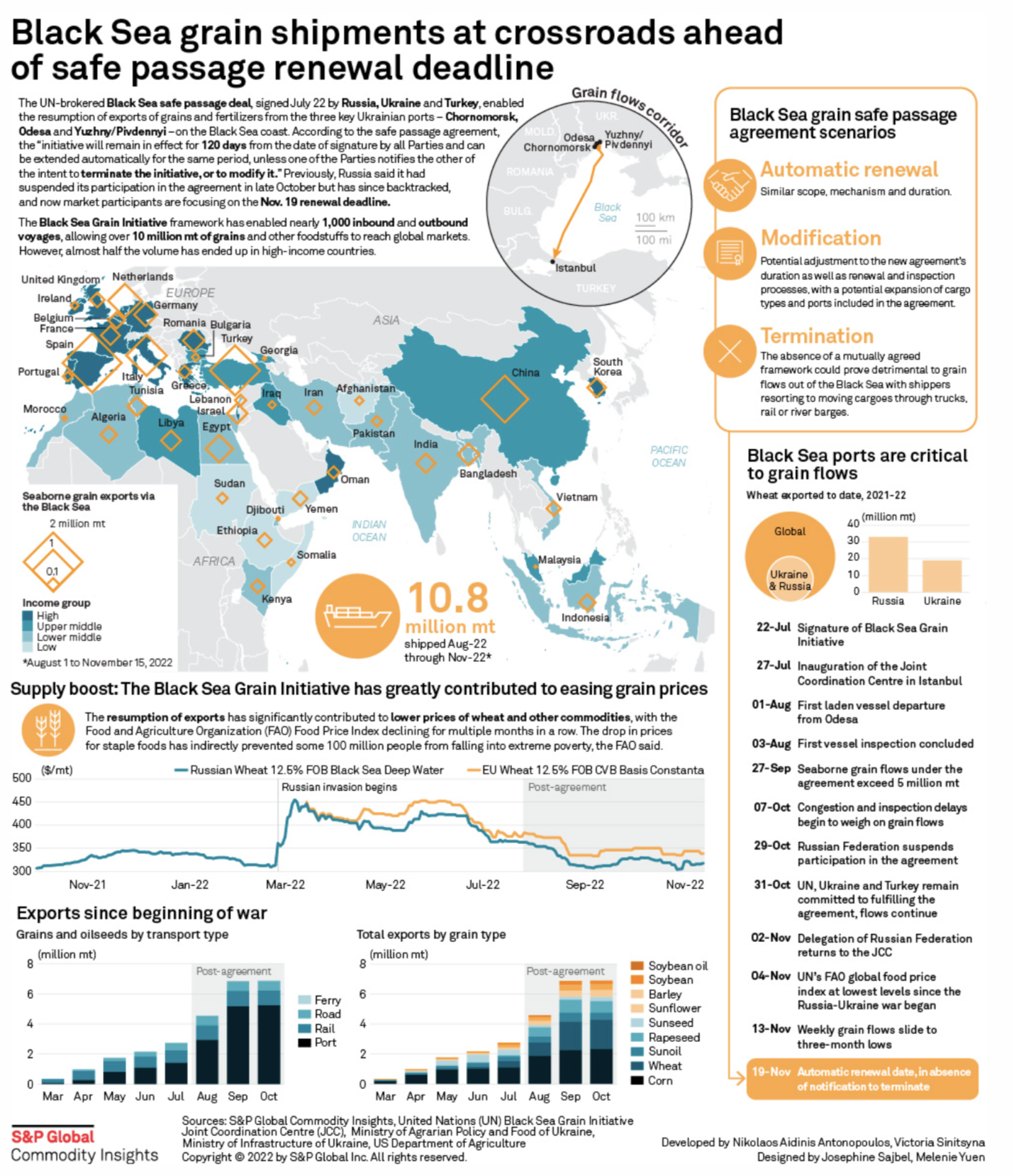

Infographic: Black Sea Grain Shipments At Crossroads Ahead Of Safe Passage Renewal Deadline

The UN-brokered Black Sea safe passage deal, signed July 22 by Russia, Ukraine and Turkey, enabled the resumption of exports of grains and fertilizers from the three key Ukrainian ports — Chornomorsk, Odesa and Yuzhny/Pivdennyi — on the Black Sea coast. According to the safe passage agreement, the "initiative will remain in effect for 120 days from the date of signature by all Parties and can be extended automatically for the same period, unless one of the Parties notifies the other of the intent to terminate the initiative, or to modify it."

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

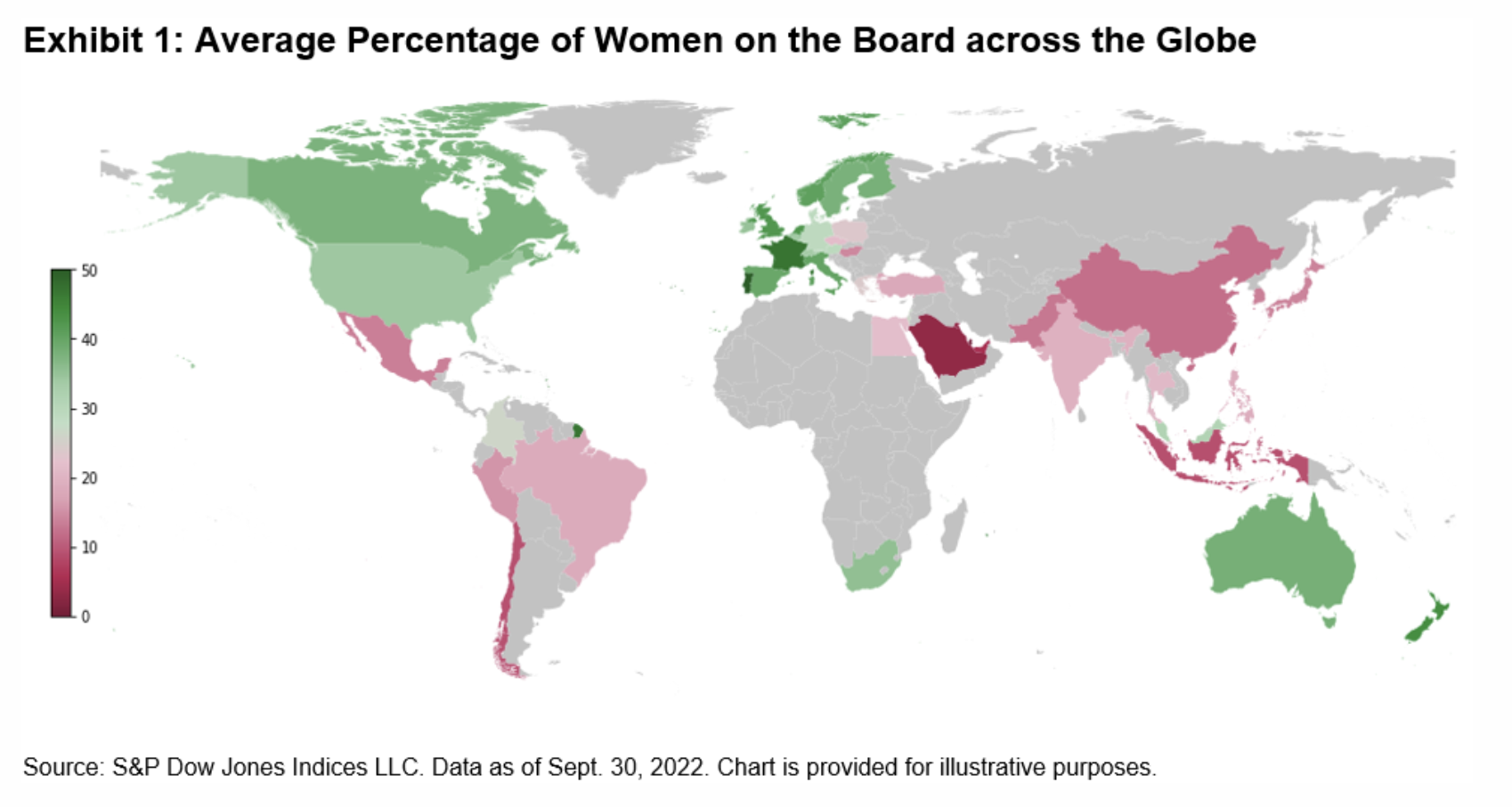

Measuring Board Gender Diversity Across S&P ESG Indices

According to numerous studies, having a gender-diverse board is a key indicator of good corporate governance. The gender diversity of a board of an investee company is also one of the mandatory sustainability indicators that financial market participants are required to assess and report on under the EU’s Sustainable Finance Disclosure Regulation. Using the S&P Global SFDR dataset, S&P Dow Jones Indices examines this metric in the context of the S&P ESG Indices.

—Read the article from S&P Dow Jones Indices

Access more insights on sustainability >

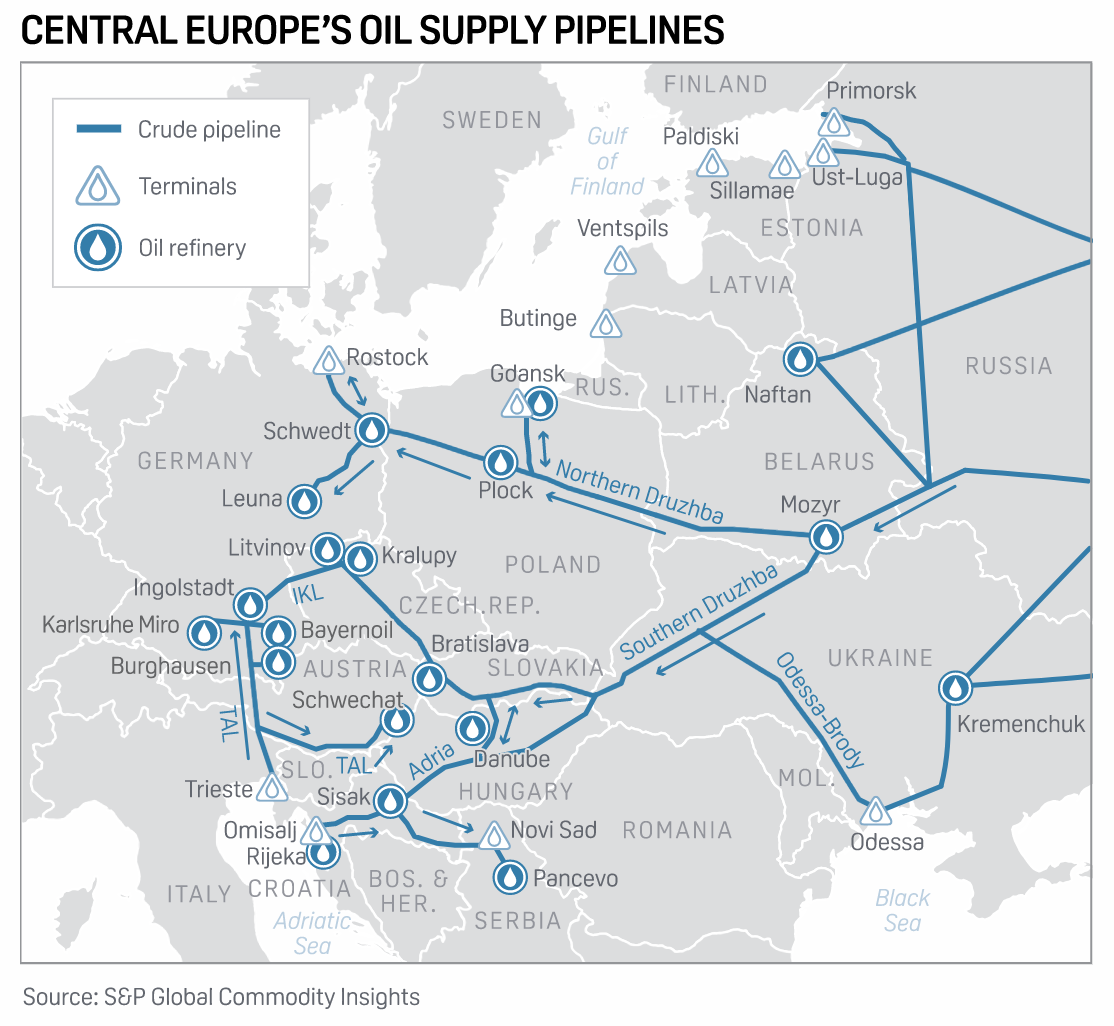

Russian Crude Exports Resume Via Druzhba Pipeline After Rocket Briefly Halts Flows

Russian crude flows have restarted on the southern branch of the Druzhba pipeline at below normal levels, Hungary's foreign minster said Nov. 16, following initial repairs to power supplies damaged by Russian rockets that had briefly halted pumping on the export route. Russian crude supplies via the southern branch of the pipeline were suspended late Nov. 15, halting flows to refineries in Hungary, Slovakia and the Czech Republic, following a barrage of Russian missile attacks targeting Ukrainian energy infrastructure.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

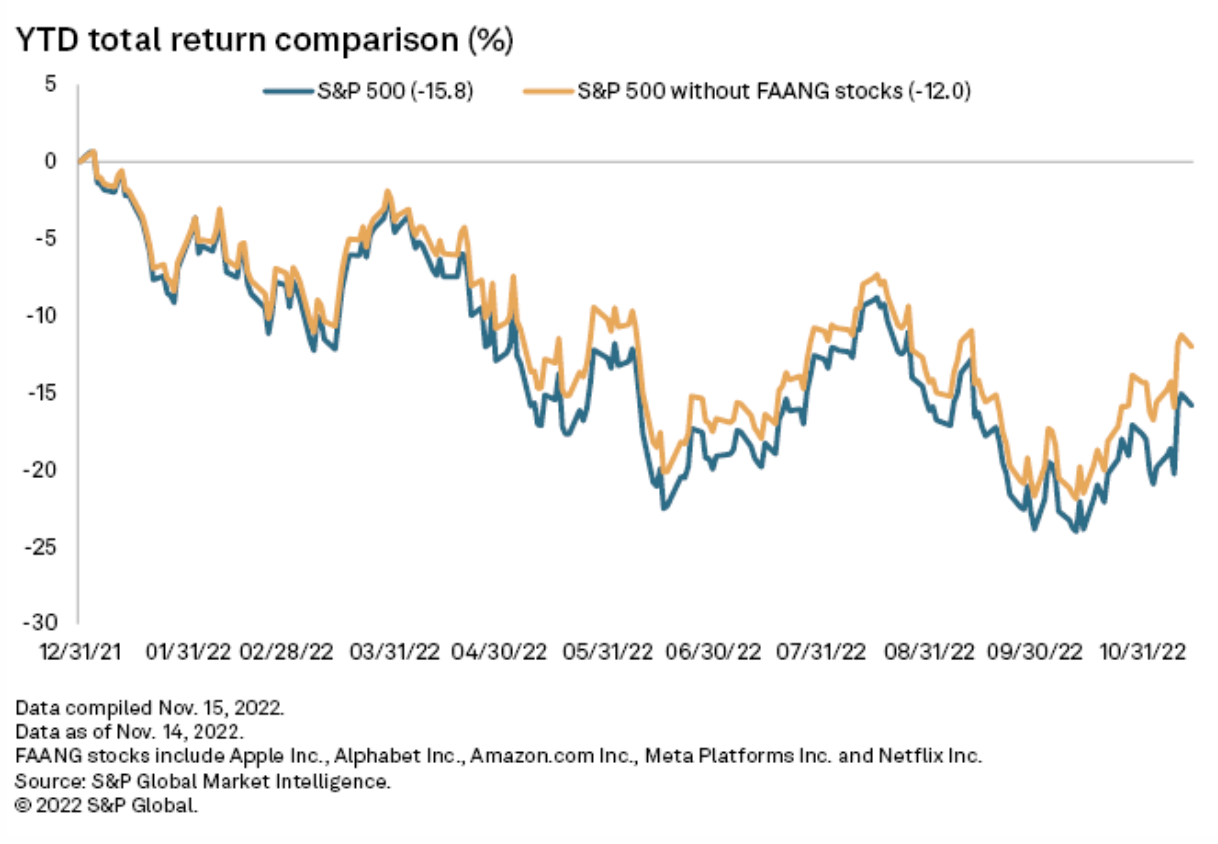

Mega-Cap Tech Stocks Underperform Broader Market As Fed Hikes Persist

The stock market's Big Tech party came to a screeching halt earlier in 2022. With the Federal Reserve's still-hawkish plans and threat of the next recession looming over the market, the hangover could continue well into 2023. Since the start of the year, the S&P 500 is down 15.8% on a total return basis. If you remove five technology stocks that saw some of the biggest gains during the market's bull run — Meta Platforms Inc., Apple Inc., Amazon.com Inc., Netflix Inc. and Alphabet Inc. — the S&P 500 lost only 12%.

—Read the article from S&P Global Market Intelligence