Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

16 Nov, 2022

By Brian Scheid and Chris Hudgins

The stock market's Big Tech party came to a screeching halt earlier in 2022. With the Federal Reserve's still-hawkish plans and threat of the next recession looming over the market, the hangover could continue well into 2023.

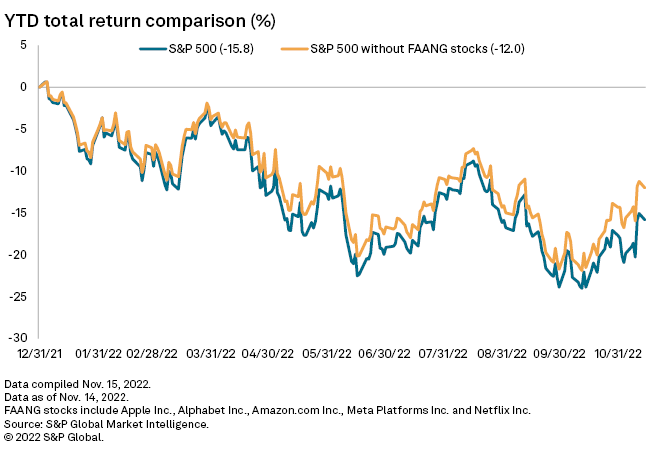

Since the start of the year, the S&P 500 is down 15.8% on a total return basis. If you remove five technology stocks that saw some of the biggest gains during the market's bull run — Meta Platforms Inc., Apple Inc., Amazon.com Inc., Netflix Inc. and Alphabet Inc. — the S&P 500 lost only 12%. On a strictly index-level basis without dividends added, the S&P 500 has fallen about 17% since the start of the year, or just 13.5% when removing the five companies, collectively known as the FAANG stocks.

After rallying throughout much of the pandemic, large technology companies saw their valuations reach record highs at the end of 2021 but have since been hit with interest rates rising at the fastest pace in decades, a persistently strong U.S. dollar and inflation soaring to levels not seen since the early 1980s. These biggest technology companies, the so-called mega-cap tech stocks, continue to underperform their larger indexes, offering little indication of a near-term turnaround.

"We have really had the perfect storm of headwinds for mega-cap tech stocks," said Paul Schatz, president of Heritage Capital.

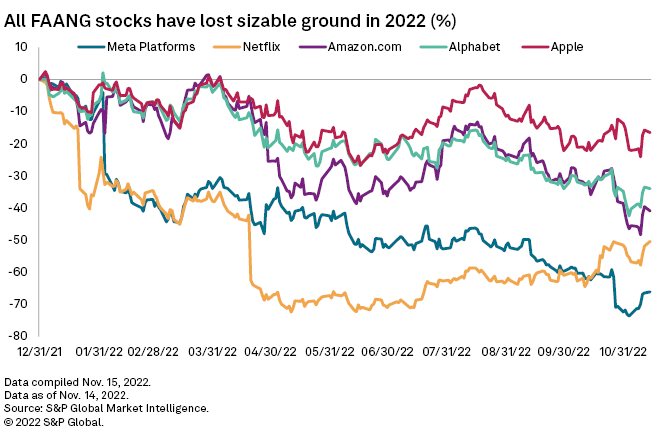

The FAANG stocks have lost an average of nearly 42% since the start of the year, with Meta Platforms dropping more than 66%. Netflix, which had fallen by more than 72% on the year in June, was down just over 50% as of Nov. 14.

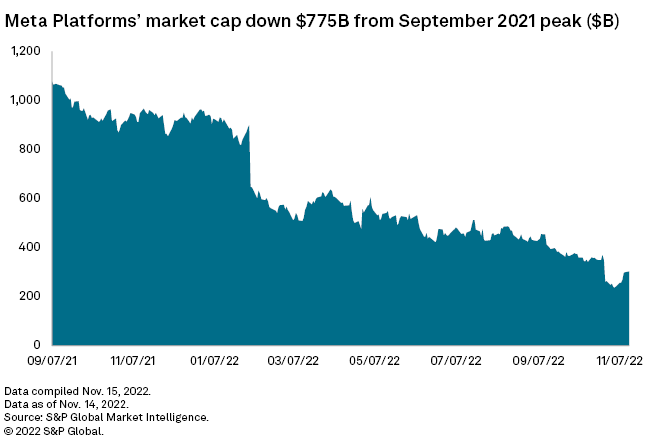

Meta's decline has caused its market cap to fall nearly 80% from its 2021 peak. It is no longer one of the 20 biggest companies in the S&P 500. Meta announced Nov. 9 that it was laying off more than 11,000 workers, about 13% of its workforce, amid steep declines in digital advertising and challenges with its new metaverse business.

Higher rates, and the higher borrowing costs that follow, tend to hit Big Tech companies disproportionately, said Callie Cox, a U.S. investment analyst at eToro. Until the Fed pivots, or at least pauses its rate hikes, mega-cap tech stocks are unlikely to rally much.

The Fed has raised rates 375 basis points since March, with expectations of additional increases in December and into 2023.

"The Fed has pulled the societal lever from innovation to conservation," Cox said. "Until they pull the lever back to innovation via rate cuts, we're stuck in a persistently high-rate environment that could reward prudence and stability over growth."

For the year, the communication services sector has fared the worst, falling nearly 38%. The sector includes Meta and Google parent Alphabet.

"Wall Street is turning defensive and they are gravitating towards industrials, healthcare and more utilities," said Edward Moya, a senior market analyst with OANDA. "Big Tech is still vulnerable to pain here as high borrowing costs are not going away anytime soon and many companies grew too quickly."

The fourth quarter will be the 11th quarter in the past 10 years that the four mega-cap stocks — Apple, Alphabet, Amazon and Microsoft Corp. — will have collectively underperformed the S&P 500, according to a Nov. 11 note from David Kostin, chief equity strategist with Goldman Sachs.

"The one characteristic most associated with large-cap tech stocks — superior sales growth — has vanished, at least for this year," Kostin wrote.

The four mega-cap companies recorded average annual sales growth of 18% during the past decade, compared to the 5% annualized growth the broader market averaged. In 2022, however, aggregate sales growth for the group is forecast to rise by 8% compared to 13% for the overall S&P 500 index, Kostin said.