Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 13 Nov, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Storm Clouds Gather for Global Corporates

The large amount of fiscal stimulus injected into the global economy by governments around the world is starting to dry up. The post-pandemic surge in tourism and recreation has ended. Overstocking, which drove a manufacturing boom while supply chains sputtered, has stopped as companies look to sell down existing inventories. Finally, inflation remains stubbornly persistent, even though it is retreating in most regions. Looking at these factors in aggregate, it isn’t surprising that global corporates are confronting falling margins, demand and credit quality.

According to data collected by S&P Global Market Intelligence for over 27,000 companies in 40 countries, global business activity stalled in October. The headline Purchasing Managers’ Index fell to its lowest level since February. Global manufacturing output dropped for a fifth successive month in October, while service sector growth stalled. Demand for consumer services, which were a source of growth and expansion in the first four months of the year experienced the steepest decline. Some consumer sectors continue to grow, notably media, leisure and retail. The heavy industries, resources and technology sectors saw the steepest declines. The lower demand has had the positive impact of moderating inflation. In October, global average prices continued to rise, but at the slowest rate in nearly three years.

According to an analysis by S&P Global Ratings, revenues for global corporates are flat and EBITDA is down 4.4% year over year. If resource companies such as those in the oil and gas and metals and mining industries are excluded, revenues are still growing, but at a lower rate. Margins are declining for two-thirds of industries, and companies have reacted to these conditions by reducing share buybacks and curtailing annual dividend growth.

Europe remains the poster child for the worsening global economic climate, but Canada is also entering a downturn, and growth in China has stalled. Growth in the US has been surprisingly persistent in 2023, but it is increasingly subdued. On the bright side, global employment continues to grow, albeit at lower rates than in January.

Naturally, the decline in corporate margins combined with higher interest rates has affected corporate credit downgrades. According to S&P Global Ratings, the global downgrade ratio increased to 54% in the third quarter from 52% in the second quarter. In early 2023, downgrades were concentrated in the US and Asia-Pacific, but the downgrade ratio increase has recently shifted to Europe and emerging markets. As often happens amid slowing economic conditions, it is the lower-rated issuers who face more immediate challenges. The challenging credit environment appears to be affecting the metals, mining and steel sectors, as well as the healthcare sector.

Today is Monday, November 13, 2023, and here is today's essential intelligence.

Written by Nathan Hunt.

Global PMI Data Show Prices Rising At Slowest Rate Since December 2020

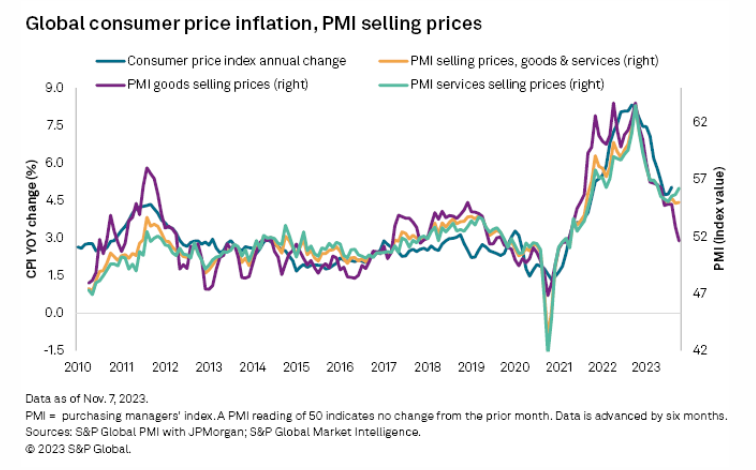

Global inflationary pressures moderated in October to their lowest level since late 2020, according to Purchasing Managers' Index (PMI) data compiled by S&P Global across over 40 economies and sponsored by JPMorgan. Although the overall rate of inflation of selling prices for goods and services remains above its pre-pandemic average amid some stickiness of services inflation and a modest upturn in goods prices, there is encouraging news on underlying price pressures cooling further in the coming months. In particular, wage pressures have moderated markedly in recent months, and companies' pricing power has been hit by reduced demand.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Measuring Fixed Income Opportunities In Asia With Indices

How are indices helping investors track the continued development of Asian Bond markets? S&P DJI’s Randolf Tantzscher and SSGA’s Kheng Siang Ng discuss how indexing is helping market participants track the evolving fixed income opportunity set across currencies in Asia.

—Watch the video from S&P Dow Jones Indices

Access more insights on capital markets >

Listen: With Venezuela Sanctions Lifting, What's In Store For Mexican And Canadian Crudes?

The lifting of Venezuelan oil sanctions by the US has sparked a series of reactions in the upstream market. S&P Global expects an increase of roughly 100,000 b/d in crude exports from Venezuela to 850,000 b/d. Jeff Mower, director of Americas oil news, sits down with Americas crude markets editor Patrick Harrington and Mexico energy editor Sheky Espejo to discuss the sanctions and the impact their lifting will have on competing Mexican and Canadian crude grades.

—Listen and subscribe to Platts Oil Markets, a podcast from S&P Global Commodity Insights

Access more insights on global trade >

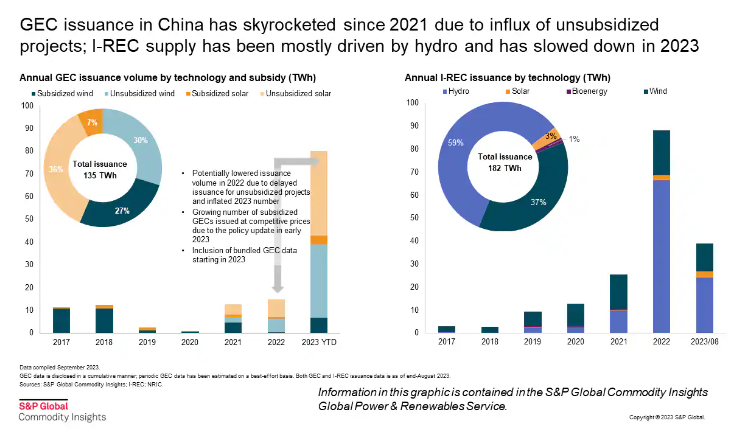

Recent Global Power And Renewables Research Highlights: Renewable Procurement Growth, Offshore Wind Challenges And Short-Term Transition Hurdles

There has been net growth recently in the global move toward renewables, but this has not come without hurdles. Corporate renewable contracts and clean energy certificates have demonstrated considerable uptake. At the same time, some regions have increased their reliance on gas, at least for the short term, and power companies have divested out of some renewable assets.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

Most Likely No Russian Gas Transit Via Ukraine From 2025: Industry Chief

There will most likely be no Russian gas transit via Ukraine from 2025, which means it is "critically" important for work to be carried out to optimize the Ukrainian grid, the head of gas industry group AGPU said Nov. 8. Russian gas transit via Ukraine has dropped sharply, with just 12.1 Bcm of gas delivered to Europe in the first 10 months of this year.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Credit FAQ: More Risks Ahead For Global Technology Companies As US Restrictions Tighten

The US has made its objective clear in the latest restrictions on chip sales to China. It aims to limit China's high-performance computing capabilities, particularly for artificial intelligence (AI). Moreover, S&P Global Ratings believes supply-chain bifurcation and tit-for-tat measures could continue for the foreseeable future. While the understanding and interpretation of the new ruling is still very fluid, S&P Global Ratings’ initial assessment is that the updated restrictions could have meaningful implications for the global technology companies it rates.

—Read the report from S&P Global Ratings