Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 4 May, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Turkmenistan (Yes, Turkmenistan) Takes Center Stage

Turkmenistan is a sparsely populated country in Central Asia. It is a former Soviet Republic, mostly covered by the vast Karakum Desert, and ruled since 2022 by President Serdar Berdimuhamedov, son of former President Gurbanguly Berdimuhamedov. Turkmenistan is an unlikely object of financial and geopolitical interest, except for one fact — it is believed to possess the world’s fourth-largest reserves of natural gas. With Europe confronting natural gas shortages following the breakdown of trade relationships with Russia, Turkmenistan has a rare opportunity to play a growing role in global energy markets.

According to S&P Global Commodity Insights, Turkmenistan has about 50 trillion cubic meters of proven reserves of natural gas. This places Turkmenistan in rare company with Qatar, Iran and Russia. However, Turkmenistan is not subject to international trade sanctions, unlike many other top producers.

President Berdimuhamedov announced at a recent investor forum in Dubai, United Arab Emirates, that Turkmenistan is developing a pipeline to export natural gas to Europe. This East-West gas pipeline would supply gas through the Caspian Sea. However, the ultimate goal would be to supply gas to Europe through Turkey.

Direct trade of natural gas with Europe is something of a diplomatic departure for Turkmenistan. Historically, the country has depended on agreements with Russia’s Gazprom to bring its natural gas to market. Following 20 years of negotiation, a 2018 agreement between Turkmenistan, Russia, Azerbaijan, Iran and Kazakhstan setting out legal terms for energy projects in the resource-rich Caspian Sea was seen as a victory for Russian President Vladimir Putin. According to the Energy Information Administration, the Caspian basin contains an estimated 48 billion barrels of oil and 292 trillion cubic feet of natural gas in proven and probable reserves. Almost three-quarters of this crude is within 100 miles of the inland sea's coast.

Recently, Turkmenistan announced plans to offer two offshore blocks in the Caspian Sea for exploration of crude oil. The announcement, made at the same investment forum in Dubai, demonstrated President Berdimuhamedov’s desire to attract foreign investment. Despite significant probable oil reserves, Turkmenistan has been an observer at OPEC and OPEC+ meetings, without seeking permanent membership.

The policies of President Berdimuhamedov appear to indicate a desire for more direct trade with Europe without overtly alienating Russia. As the decoupling of energy markets in Europe and Russia grows increasingly permanent, this often-overlooked Central Asian country may become a major player in natural gas. But first it must thread the geopolitical needle between deep-pocketed customers and its large and more powerful neighbor.

Today is Thursday, May 4, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

S&P 500 Rises 1.5% In April As Financial Sector Stocks Regain Some Ground

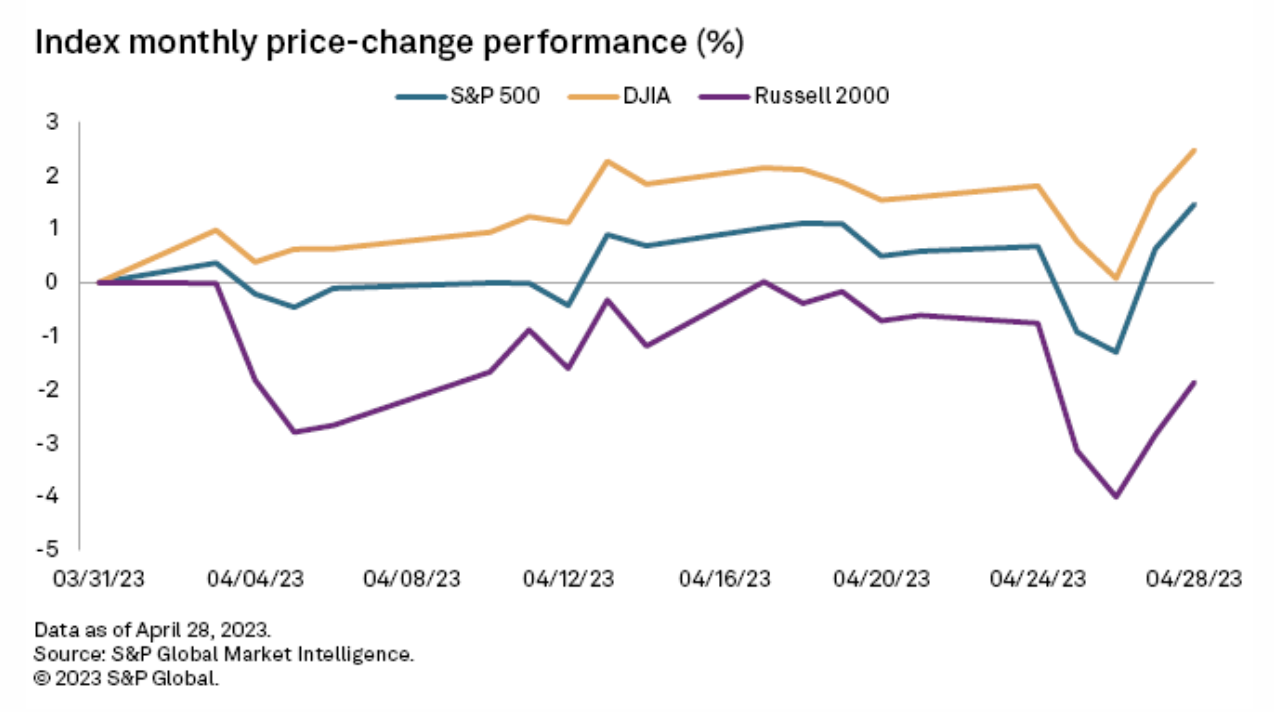

US stocks generally rose during April, as positive earnings drove several sectors higher and financial companies recovered somewhat from March's fall. The S&P 500 gained 1.5%, finishing the month at 4,169.48. The Dow Jones Industrial Average recorded a larger 2.5% rise. Smaller-cap stocks performed worse, with the Russell 2000 down 1.9% for the month.

— Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Sovereign Wealth Funds Lead Private Equity Co-Investment Activity

Sovereign wealth funds are taking the lead in co-investment activity as the slowdown in private equity fundraising and hurdles to dealmaking prompt both limited partners and fund managers to team up on more co-investment opportunities. The value of private equity co-investments involving sovereign wealth funds, pension managers, corporate investors and family offices increased nearly 39% year over year in the first quarter to $42.3 billion, according to an S&P Global Market Intelligence analysis of recent co-investment activity by those four main private equity limited partner groups.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

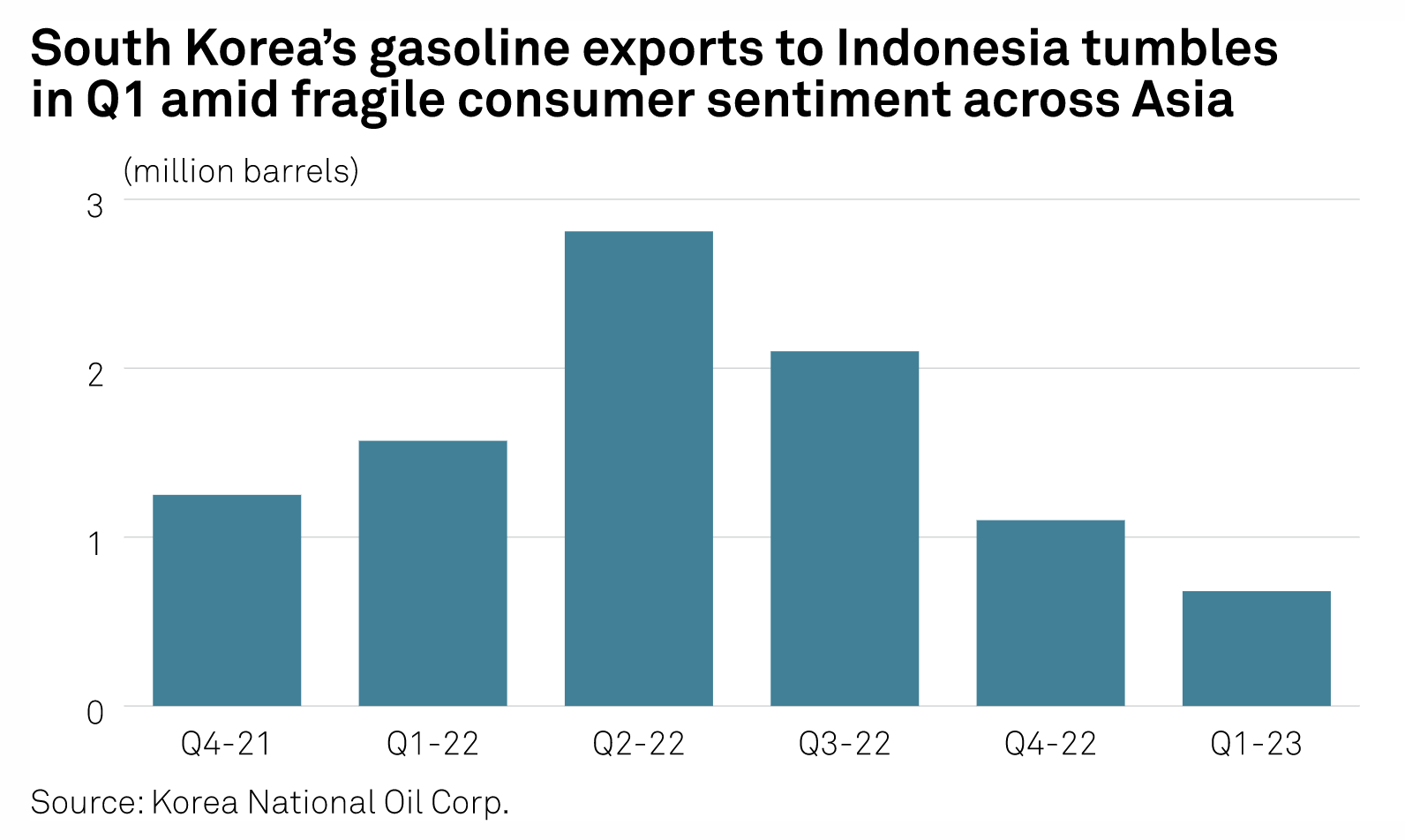

Indonesia's Pertamina Defers Gasoline Imports From May To June On Weak Demand: Traders

Indonesia's Pertamina has delayed the purchase of a few gasoline cargoes to June amid high inventories and slower-than-expected domestic demand, traders told S&P Global Commodity Insights May 3. The deferment is for one to two gasoline cargoes, said a source close to the matter, without sharing exact volumes. But a Singapore-based trader said the total volume was around 600,000 barrels. The company had previously deferred April-loading barrels to May, but the deferment volumes could not be confirmed.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

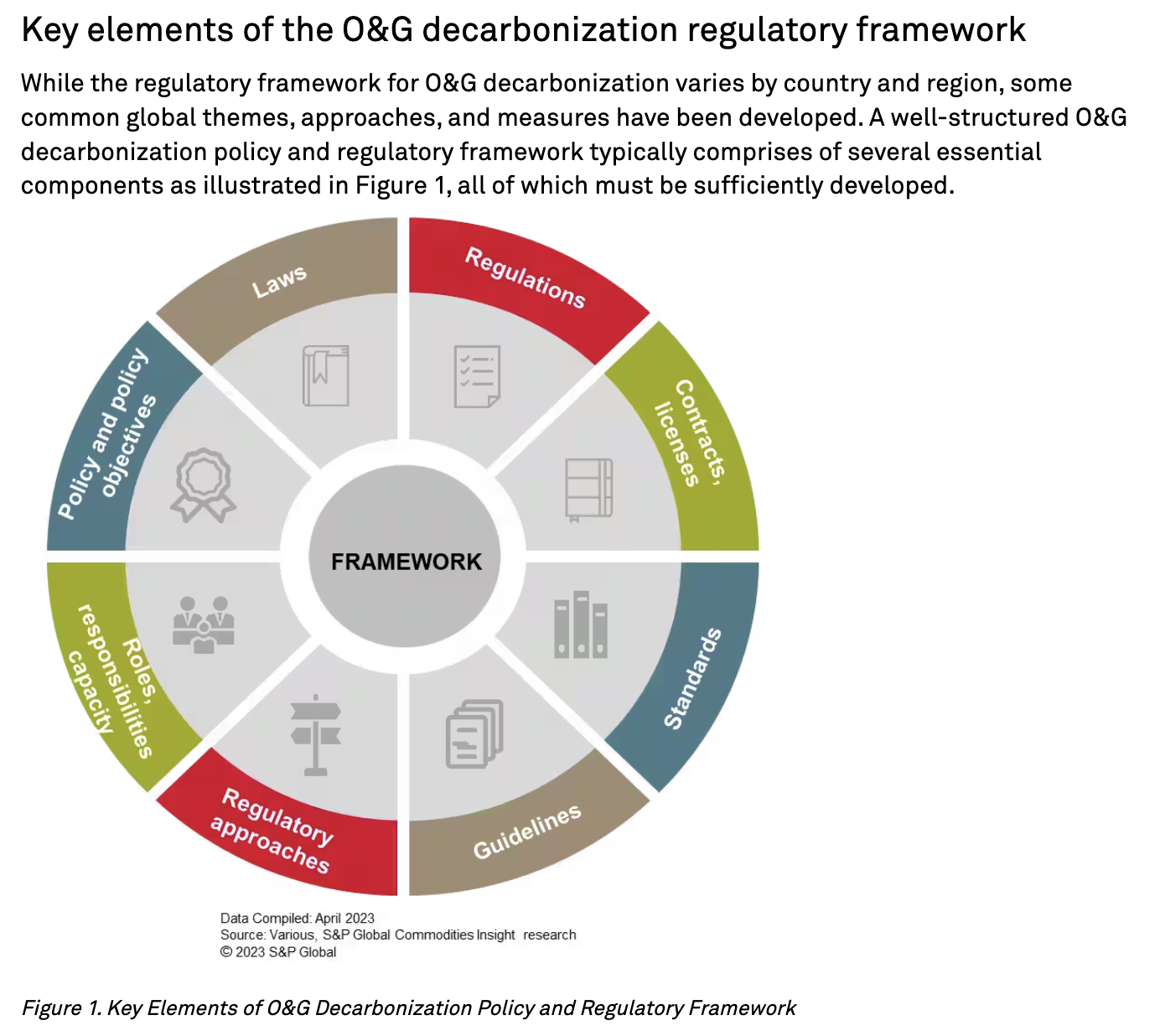

Considerations In Developing O&G Decarbonization Regulatory Framework

Well-thought-out governmental policies and an effective supporting regulatory framework are critical factors in reduction of greenhouse gas (GHG) emissions derived from oil and gas (O&G) operations. Globally, the regulatory framework for O&G decarbonization is evolving rapidly as countries seek to either meet national- or industry-specific climate targets deriving from international and national commitments.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

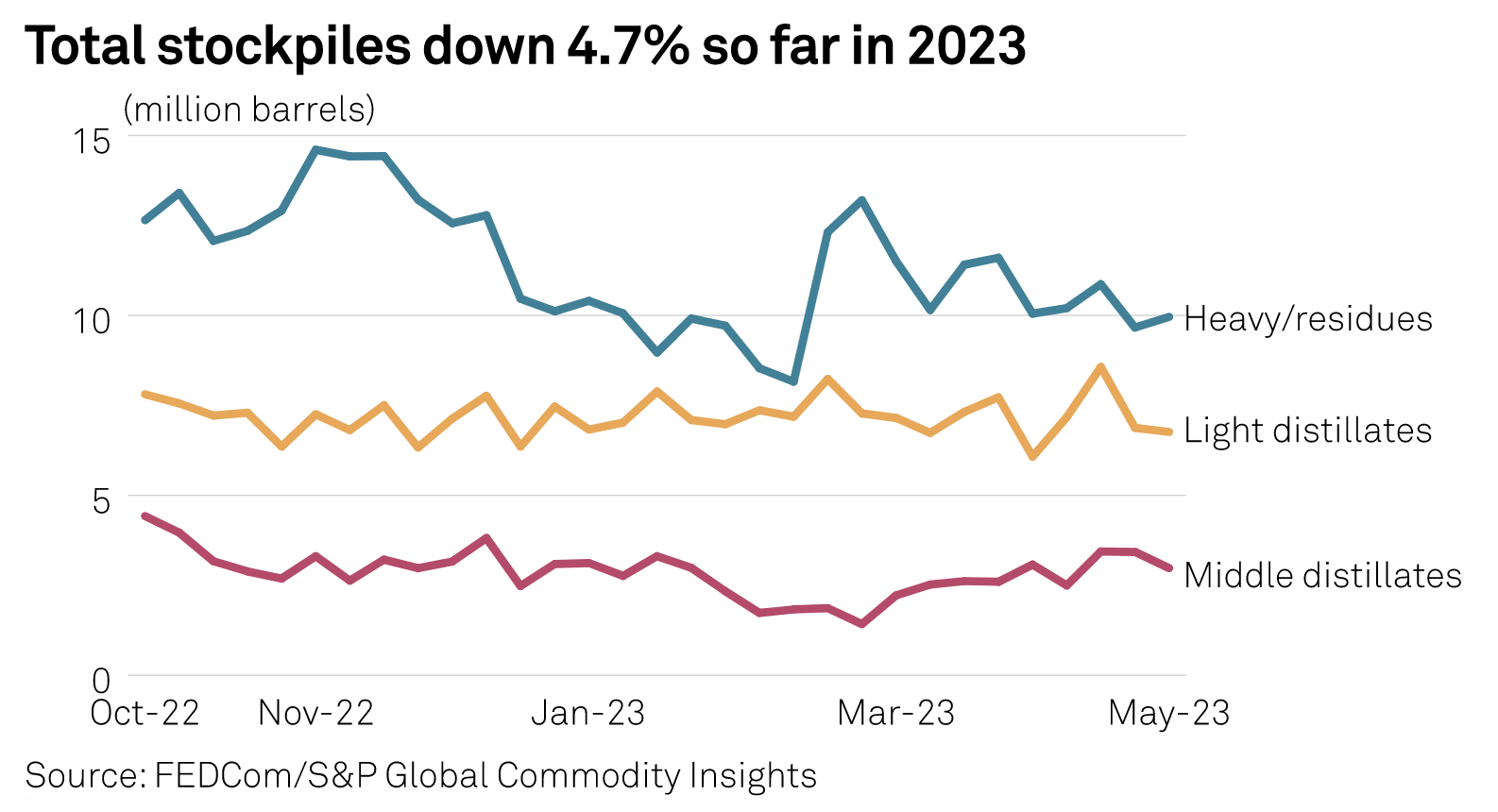

Oil Product Stocks Hit Four-Week Low, Middle Distillates Decline Most

Stockpiles of oil products at the UAE's Port of Fujairah dropped 1.3% in the week ended May 1, with all categories showing declines except for heavy distillates, according to data published May 3 by the Fujairah Oil Industry Zone. Total inventories fell to a four-week low of 19.693 million barrels as of May 1, the FOIZ data provided exclusively to S&P Global Commodity Insights showed. The decline followed a 13% slide in week ended April 24, the biggest drop in 2023. The total is now down 4.7% since the end of 2022.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: Next In Tech | Episode 114: Metaverse Research And Outcomes

With the attention given to the metaverse, it’s worth digging into the more practical details of how it’s impacting the need for infrastructure, and what the market impacts can be. Ian Hughes and Neil Barbour return to look at recent research, market forecasts and the evolution of advertising in this new realm with host Eric Hanselman. As practical applications extend from gaming to the industrial metaverse and investment strategies change, branding and advertising are changing along with them.

—Listen and subscribe to Next in Tech, a podcast from S&P Global Market Intelligence