Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 13 May, 2024

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

To Meet Climate Goals, the Global South Must Take a Different Path

The world’s wealthiest countries all took a similar path to prosperity. Cheap energy derived from fossil fuels allowed them to build their cities and industries, heat their homes, light their offices, and achieve mobility of labor. Once these goals were accomplished and their wealth guaranteed, these countries could afford to question the wisdom of fossil fuels and gradually reduce emissions.

Europe and the US first tread this well-worn path. China has been following over the past few decades. Now the developing countries of the Global South, in Asia, Africa and South America, are eager for their own chance at rapid growth. They want the jobs, the healthcare, the schools and the opportunities that developed countries take for granted. But if they follow the same path, the damage to the planet will be incalculable.

Some political leaders in developing nations have protested the fairness of applying strict carbon targets. Why should India or sub-Saharan Africa pay a premium for renewable energy when coal is cheap and plentiful? Why should the Global South forgo inexpensive energy when the vast bulk of emissions still come from developed nations? Present energy consumption levels in sub-Saharan Africa are roughly equivalent to those in Western Europe in the 1860s.

A recent analysis by S&P Global titled “One planet, two realities: Realizing energy transition in the Global South” lays out the factors that constrain the ability of developing nations to jump straight to renewable energy. These factors include the affordability of energy, economic and political dependence on fossil fuels, infrastructure bottlenecks, access to technology, and the high cost of capital for developing nations.

However, the same article also illustrates why it is impractical for these countries to continue down a carbon-intensive path. If the developing world does not grow using low-carbon or no-carbon energy sources, there is almost no way to achieve the goal of limiting global temperature rise to 1.5 degrees C. As India, Africa and China build out infrastructure for fossil fuels, those newly constructed energy infrastructure assets will only serve as future arguments as to why an energy transition is economically impossible.

This appears to place the countries of the Global South in a no-win situation. If they grow their economies with cheaper energy, global temperatures will rise, and the economic impacts of higher temperatures disproportionately affect the developing world. If they forgo cheaper energy, they will struggle to grow their economies, with impacts on the health, wealth and happiness of their citizens.

The solution to this challenge will require the Global North to sacrifice for the good of the Global South. Multilateral development banks must be funded commensurate with the challenge of rapid decarbonization in developing countries. Wealthy countries must share knowledge, intellectual property, technology and capacity with their global neighbors. Developed nations must decarbonize rapidly to build out renewable energy capacity and drive down the cost of new technologies.

Today is Friday, March 15, 2024, and here is today's essential intelligence.

Written by Nathan Hunt.

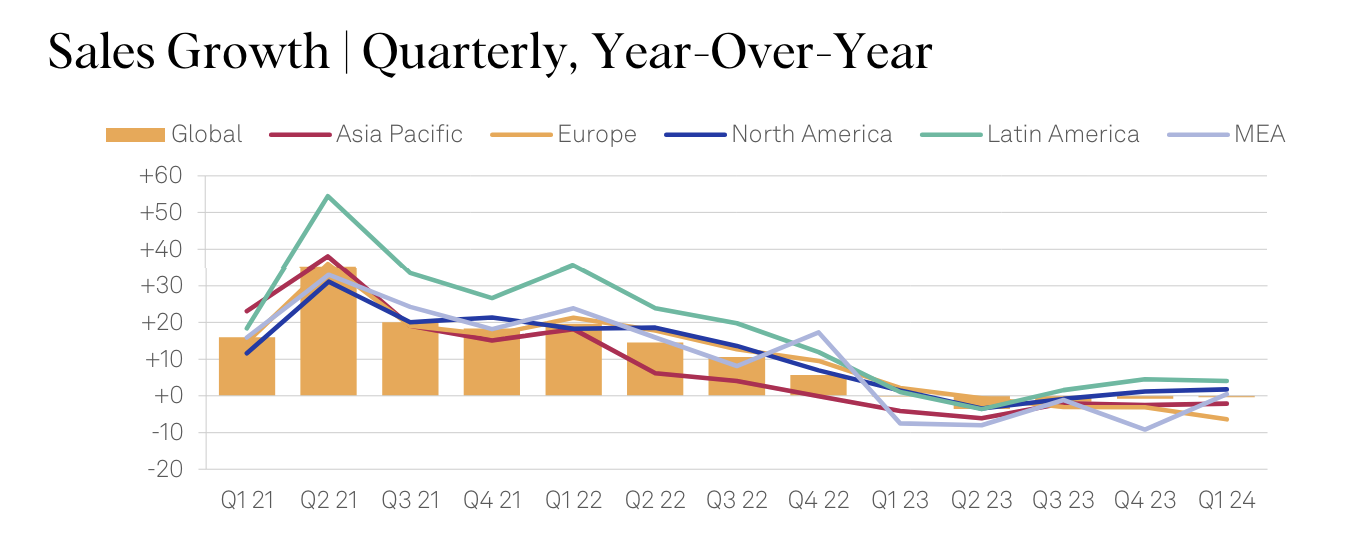

Corporate Results Roundup Q1 2024: Recovery Continues Excluding Commodity Sectors But Remains Fragile And Fragmented

The global Q1 2024 results season for rated nonfinancial corporates is halfway through. Based on current results earnings are still declining, but the picture is more encouraging if volatile commodity components are excluded. The recovery can be characterized as fragile and fragmented, with marked regional and industry differences. Both North and Latin America have to-date reported positive sales and EBITDA growth versus the same quarter a year ago, while Europe and Asia-Pacific continue to report contraction. Industrial cyclicals continue to experience contraction, with positive global industry growth concentrated in leisure-related consumer sectors, technology, healthcare and aerospace and defense.

—Read the article from S&P Global Ratings

Access more insights on the global economy >

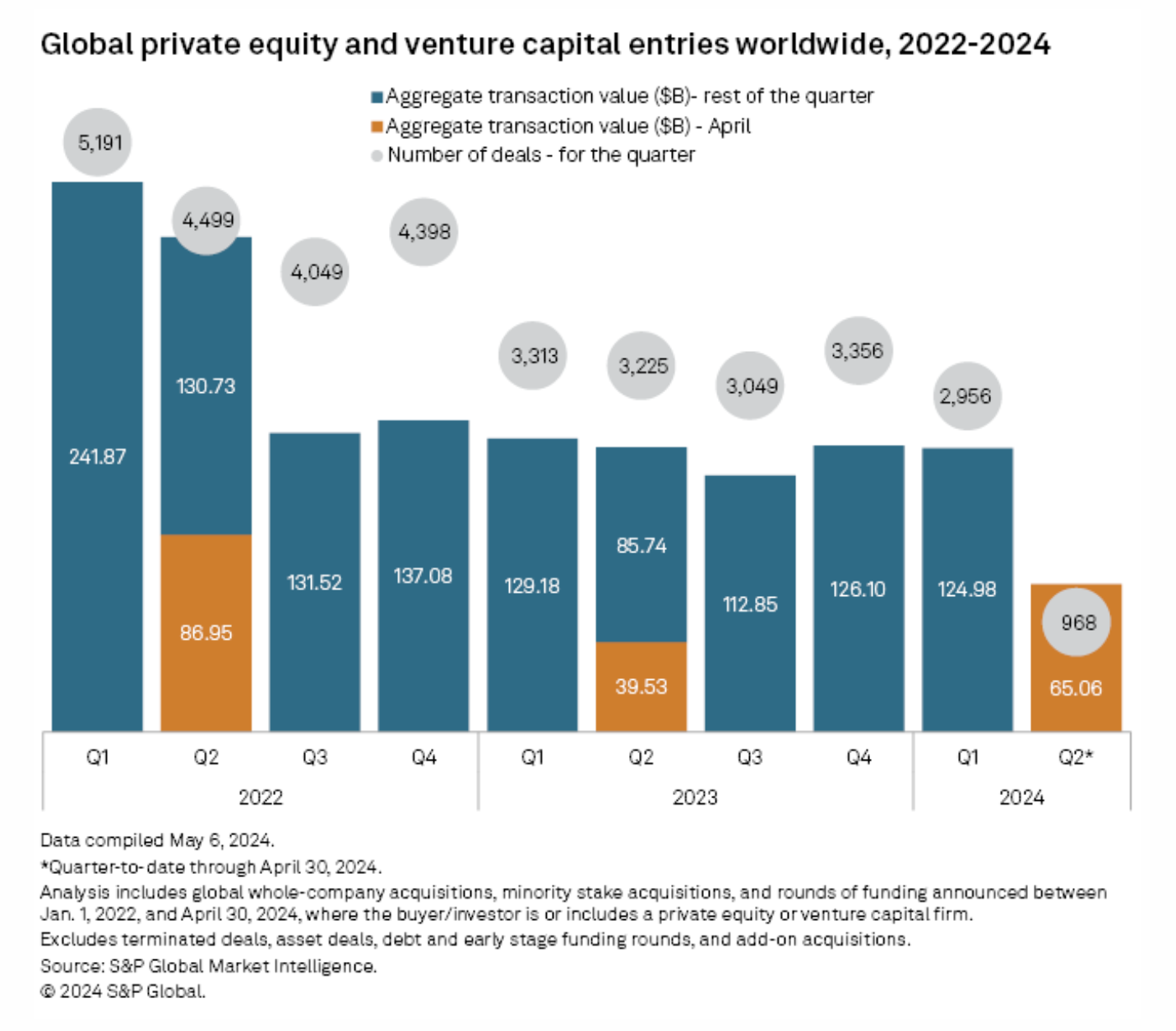

Private Equity Deal Value Jumps 65% YOY In April

Global private equity and venture capital deal value jumped 64.6% in April to $65.06 billion from $39.53 billion the same month a year earlier, according to S&P Global Market Intelligence data. The number of deals, meanwhile, went down to 968 from 1,025 deals in April 2023. Year to date, total deal value stood at $190.04 billion from $168.71 billion in the first four months of 2023.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

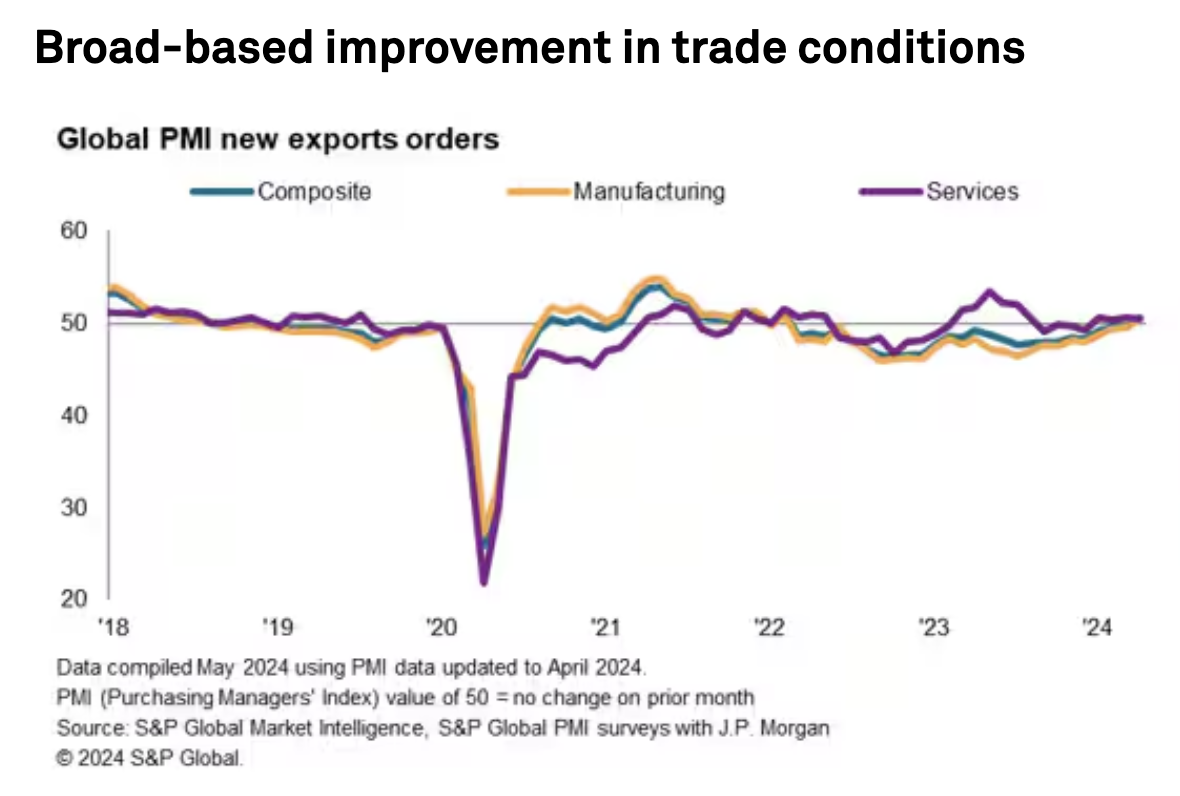

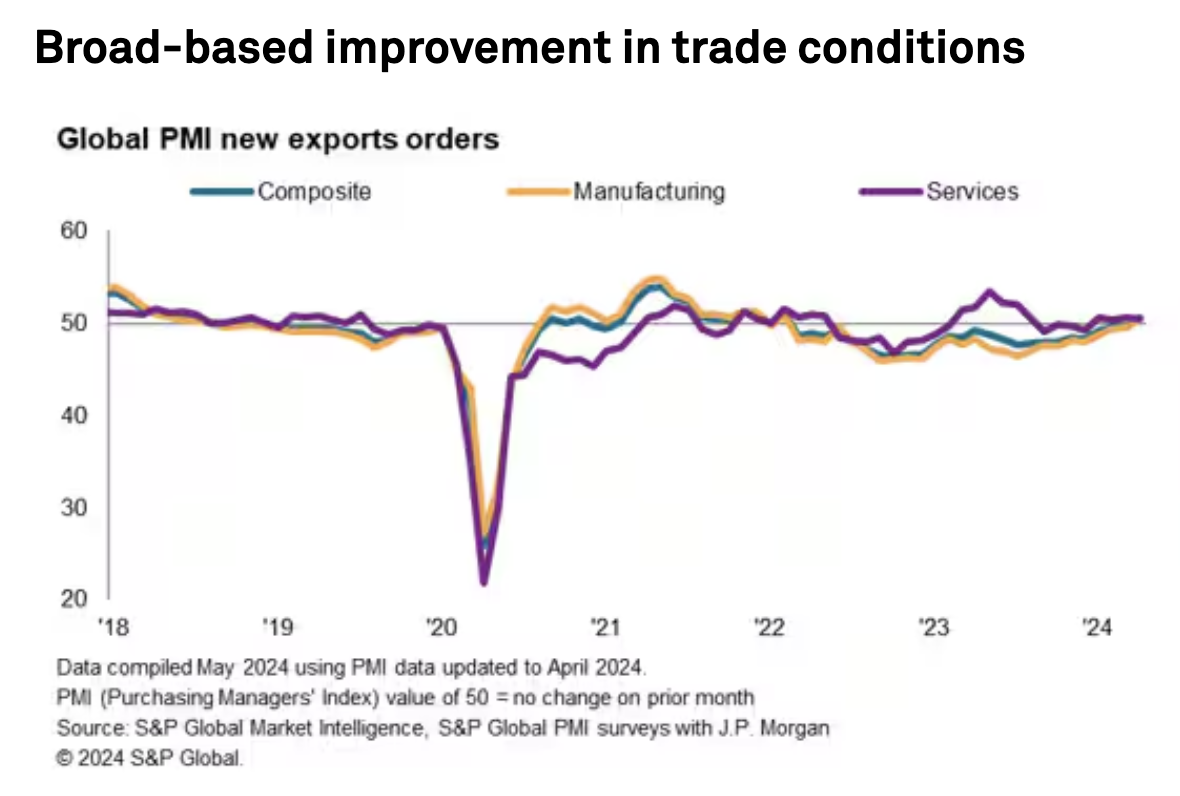

Global Trade Revives Amid Renewal Of Worldwide Goods Exports

The worldwide Purchasing Managers' Index (PMI) surveys compiled by S&P Global Market Intelligence indicated that global trade expanded at the start of the second quarter of 2024, thereby concluding the contraction streak of just over two years. The seasonally adjusted Global PMI New Export Orders Index posted 50.6 in April, up from 49.8 in March. Although marginal, the latest rise in global trade conditions signalled the first improvement since February 2022. Moreover, the latest uptick in trade conditions was broad-based with both manufacturing and services export business rising in April.

—Read the article from S&P Global Market Intelligence

Access more insights on global trade >

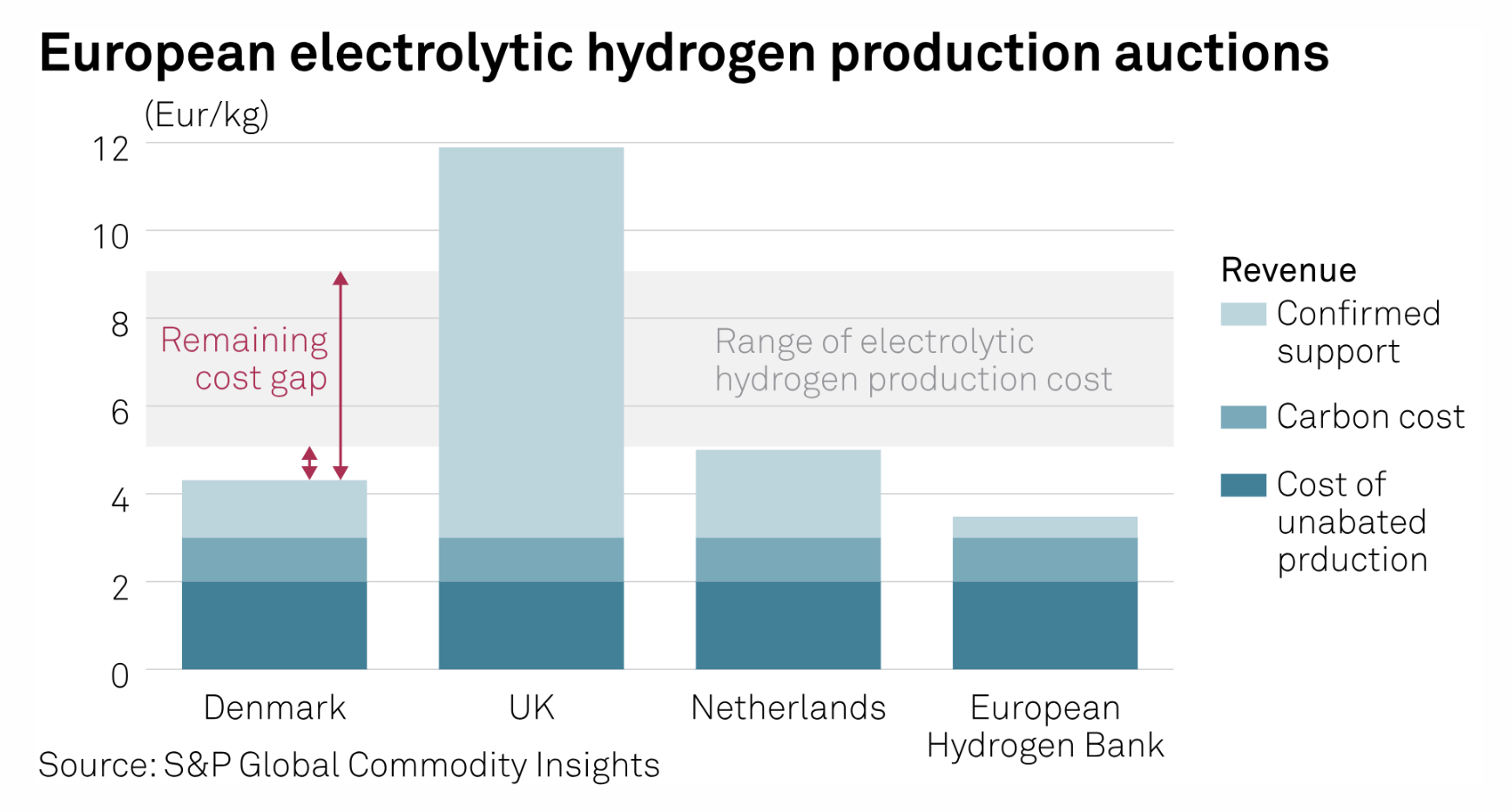

EU’s Hydrogen Bank Auction Clears Below 50 Euro Cent/Kg, Funding 1.5 GW

The first auction under the European Hydrogen Bank mechanism has cleared well below expectations, with the seven winning projects bidding at 37-48 euro cent/kg (40-51 cents/kg) for a total 1.5 GW of electrolysis. The EU will provide Eur720 million to the projects, which will produce 1.58 million mt of green hydrogen over 10 years, the European Commission said.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

Higher And More Stable Oil Prices Are Pushing Oil Sands Growth Higher … Again

S&P Global Commodity Insights expects Canadian oil sands production to approach 3.8 million b/d by the end of the decade. This is 90,000 b/d, or 3%, higher than the prior outlook and marks the second upward revision in recent years. This also marks the first time S&P Global Commodity Insights has published its outlook to 2035 where a modest decline begins to emerge from older operations.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: MediaTalk | Season 2 Ep. 12: Broadband's Growth Outlook as Subsidy Program Ends and Fiber Expands

In this episode, MediaTalk host Mike Reynolds sits down again with S&P Global Market Intelligence Kagan analyst John Fletcher, who specializes in multichannel and broadband. John shares his outlook on how the broadband industry is set to grow in both the near and distant future. On one hand, funding for a key federal subsidy is set to end this month and legislators have yet to agree on a plan to extend it. As a result, tens of millions of low-income households could once again be priced out of broadband. On the other hand, fixed wireless is continuing to roll out across the country, driving subscriber growth for the broadband industry as a whole. What do both of these things mean for the cable industry? And what do they mean for efforts to close the digital divide? And where do low-earth orbiting satellites fit into all of this? Mike and John dig into these questions and more.

—Listen and subscribe to the podcast from S&P Global Market Intelligence