Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 12 May, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Private Equity Rebound Not in Sight

Current and potential headwinds have left private equity firms uncertain about their future. Trends in the first quarter, however, indicate that 2023 will likely be a slow year (perhaps slower than 2022) in terms of dealmaking and fundraising.

A survey of private equity and venture capital executives conducted between Dec. 1, 2022, and Jan. 22, 2023, revealed varying outlooks for 2023, depending on firm size, location, investment focus and several other factors. Compared with 2022, more respondents have "pessimistic expectations" for deal activity, with 24% predicting a deterioration, compared with 7% last year, according to S&P Global Market Intelligence’s "2023 Private Equity Outlook" report.

The sentiment on fundraising conditions has also shifted "from cautious optimism to a more cautious outlook," with 45% of private equity respondents expecting the environment to be more challenging this year, compared with just 12% in 2022, according to the report. Among venture capital firms, 35% of respondents believe that conditions will deteriorate, compared with 15% last year.

A look at whole-company purchases, minority stake acquisitions and funding rounds in which the buyer or investor was a private equity or venture capital firm lends weight to expectations that 2023 will not be the year that deal activity rebounds to 2021's record highs. Private equity and venture capital entries in the first quarter were down over 40% year over year at 2,873 deals with a total value of $122.81 billion, according to S&P Global Market Intelligence data.

This slowdown follows double-digit declines in 2022 — a year marked by Russia's invasion of Ukraine, the lingering effects of the COVID-19 pandemic, record inflation and interest rate hikes. S&P Global Market Intelligence's “2023 Private Equity Outlook” report shows "market volatility and subsequent fluctuations in valuations" were the biggest obstacles to closing deals in 2022, followed by macroeconomic risk.

Investments in the banking sector by private equity and venture capital firms reflect the overall downturn in deal activity.

The industry's exposure to the banking sector seems on track to fall further in 2023 after declining more than 60% in 2022. Between Jan. 1 and March 22, private equity and venture capital firms announced or completed five investments in the banking sector totaling $110 million, a far cry from the 19 deals with a total value of $1.29 billion in the first quarter of 2022.

Increased bank regulation, a hot topic following the failures of Silicon Valley Bank and Signature Bank, could spark bank M&A activity as banks seek scale in response to new rules. However, private equity is more likely to seek opportunities elsewhere, according to S&P Global Market Intelligence.

Similar to dealmaking, private equity fundraising has also become significantly more difficult in 2023, as evidenced by global pension funds ending the first quarter "slightly underallocated to private equity” compared with their targets. Across 365 global pension funds, the median actual allocation was $276 million, and the median target allocation was $280 million. The numbers suggest that, in aggregate, pension funds had a $4 million net underallocation to private equity as of March 28, according to S&P Global Market Intelligence and Preqin.

One of the reasons cited for the aggregate underallocation was the sharp drop in private equity funds launched in the year to April 3. Another was investor hesitancy due to the uncertain direction of inflation and interest rates, as well as the “denominator effect” causing investors to become more exposed to private equity with declines in public markets.

Today is Friday, May 12, 2023, and here is today’s essential intelligence.

Written by Jasmine Castroverde.

Week Ahead Economic Preview: Week Of 15 May 2023

The week ahead sees a packed economic calendar with key releases due from the US to mainland China, notably for both including industrial production and retail sales figures. The eurozone also updates Q1 GDP alongside inflation and industrial production figures, while the labor market report is out from the UK. Central bankers in both the US and Europe will be watched for comments particularly with regards to the economic and monetary policy outlook.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Credit FAQ: The Renewables Race: How Quickly Can Asia-Pacific Shake Off Coal?

Total energy demand continues to outpace clean energy supply. This has prompted investor questions about the phasing-out of coal and whether renewables can fill the breach. Here S&P Global Ratings addresses questions that emerged from the its webinar, "Asia-Pacific Infrastructure Conference 2023: The Energy Transition and Infrastructure Investments In 2023: New Year, Same Obstacles?"

—Read the report from S&P Global Ratings

Access more insights on capital markets >

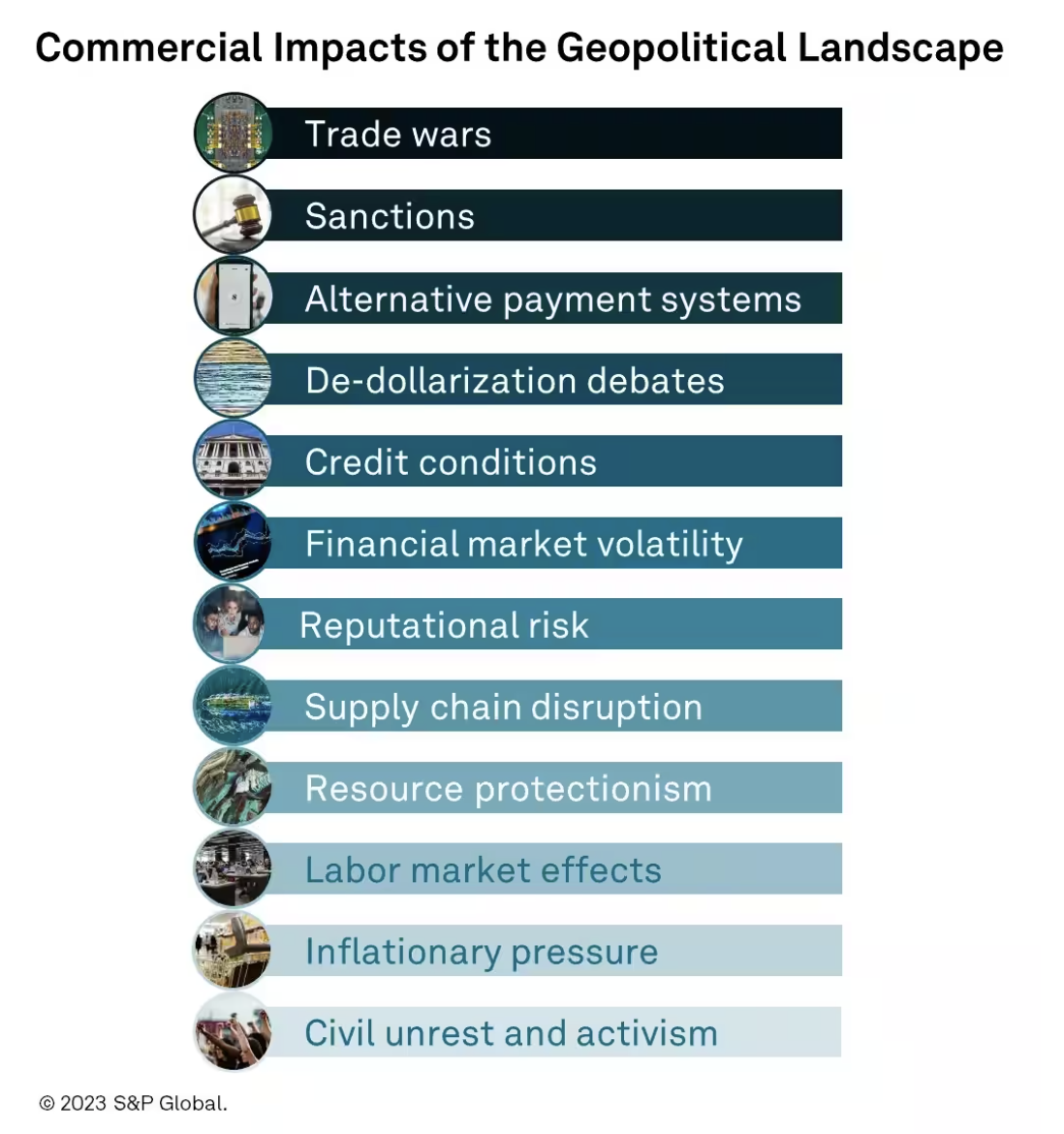

Navigating Geopolitical Headwinds

Geopolitics is no longer reserved for dinner-party conversation. We find ourselves simultaneously in a pandemic recovery, an ongoing conflict in Ukraine and a reorientation of global partnerships amidst strategic competition. A period out of equilibrium as the world rebalances. The contours of global risk today and in the years ahead are unlikely to be narrowly delineated by an arms race, space race or nuclear threat forcing countries to choose sides, as countries are instead pursuing pragmatism: collaborating across spheres of mutual interest while simultaneously competing elsewhere across spheres of national interest.

—Read the article from S&P Global Market Intelligence

Access more insights on global trade >

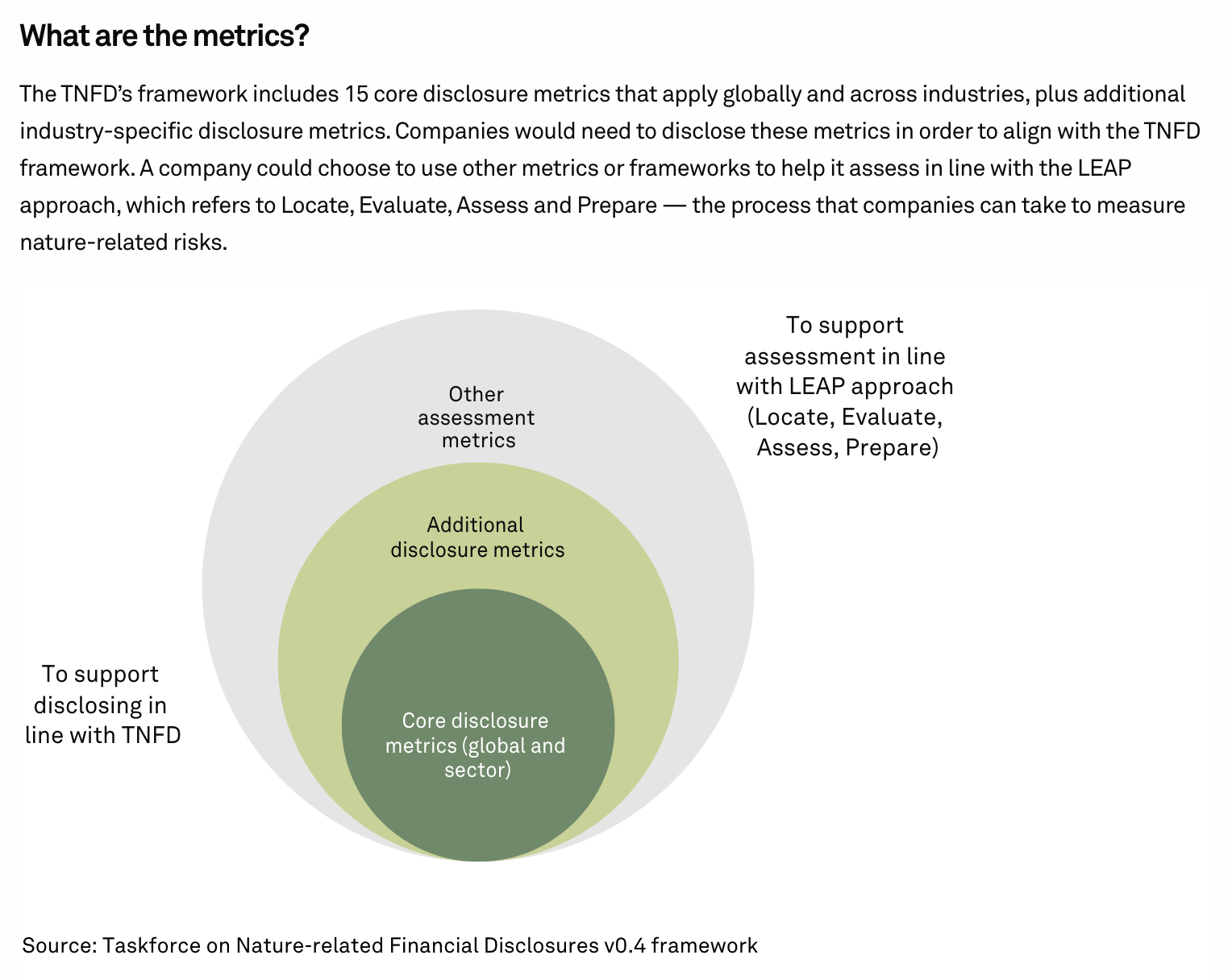

How TNFD’s New Core Metrics Can Help Corporations And Investors Measure Nature Impacts And Dependency

To address the risk of nature and biodiversity loss to long-term economic growth, companies and investors are seeking guidance on how to distill broad concepts into discrete points to focus on. The recent framework update from the Taskforce on Nature-related Financial Disclosures (TNFD) can help market participants home in on relevant nature-related factors by setting out core metrics related to both impacts and dependencies and to risks and opportunities.

—Read the article from S&P Global Sustainable1

Access more insights on sustainability >

Listen: Diesel In The Western Hemisphere Faces A Shifting Landscape

This year, the US, alongside G7 countries, placed a price cap on Russian-grade refined product at $100/b. This marked another set of sanctions designed to shrink Russia's influence on global oil markets. Following the Feb. 5 price cap, disruptions have been seen in both the clean tanker market and the Americas diesel market. In this Oil Markets episode, S&P Global Commodity Insights' shipping, diesel and Latin America refined products experts Eugenia Romero, Jordan Daniel and Maria Jimenez Moya sit down to discuss the current landscape and recent changes to these trade flows.

—Listen and subscribe to Platts Oil Markets, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

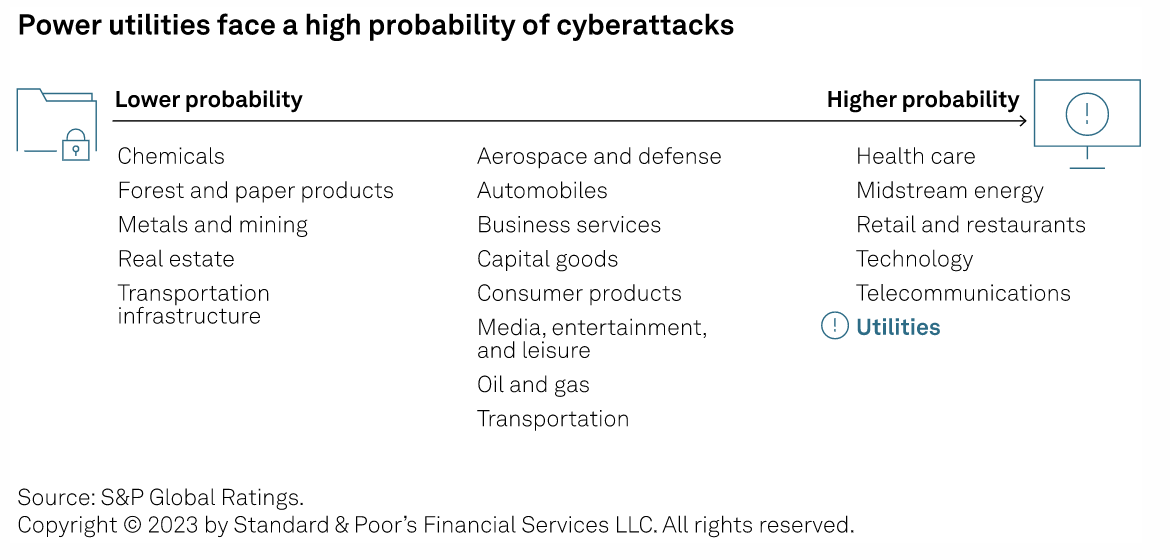

Cyber Risk Insights: Ongoing Preparedness Is Key To U.S. Power Utilities Keeping Attackers In The Dark

Given the critical infrastructure it oversees, the power utility sector — including investor-owned utilities (IOUs), municipal owned utilities, rural electric cooperatives and merchant generators — faces a high probability of cyberattacks. A successful cyber or physical attack can cause blackouts and other operational fallouts that herald wide-ranging economic and social ripple effects.

—Read the report from S&P Global Ratings