Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 11 May, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Eurozone Economic Growth Edges Higher as Service Sector Bounces Back

After avoiding a recession over the unseasonably warm winter, Europe’s economy remains resilient as spring comes into full force. The eurozone started the second quarter on a strong footing, with the latest economic indicators flashing a sizable improvement in sentiment since the lows recorded in late 2022.

This improved sentiment can be attributed to energy market concerns waning, the odds of a recession receding, supply chain constraints easing and inflationary pressures peaking, according to S&P Global’s flash Purchasing Managers’ Index (PMI) survey.

The survey data shows business activity growth in the region has picked up, reaching an 11-month high in April. The HCOB Flash Eurozone Composite PMI Output Index, which is compiled by S&P Global, hit its highest level since May 2022, rising to 54.1 in April from 53.7 in March. GDP grew at a quarterly rate of 0.5% from 0.3% in the first quarter. This economic uptick in the eurozone reflects the growth seen in the UK, the US and Japan.

The upturn in April was driven by the increasing shift of consumer spending from goods toward services. New business in the service sector grew at its fastest pace since April 2022, largely because of the resurgence of client-facing services, tourism and travel. Demand and activity in financial services also bounced back from steep declines heading into the winter. Conversely, manufacturing output in April fell at its steepest rate since December 2022 as demand for goods continued to drop.

"The resulting outperformance of services relative to manufacturing was the widest seen since early 2009, and the survey has not yet previously recorded such a strong service sector expansion at a time of manufacturing decline," according to S&P Global Market Intelligence.

Business confidence in the eurozone has also proved resilient against the backdrop of persistent interest rate hikes and uncertainty stemming from the recent stress in the banking sector. This was evident in the region’s overall employment growth in April — its largest in 11 months. That growth was buoyed primarily by service-sector jobs, which increased at their fastest pace since July 2007.

For full year 2023 and into 2024, the outlook for economic growth in Europe remains tepid due to multiple headwinds. Investments are hindered by tightening financial conditions and household purchasing power remains low due to high inflation. Real GDP growth in the eurozone is projected to decelerate to 0.8% in 2023 from 3.6% in 2022. GDP growth is forecast to gradually tick up to 1.1% in 2024 and to 1.8% in 2025 as inflation and interest rates pull back.

The eurozone dodged a recession in the winter, thanks to unseasonably warm weather, a rollback in energy prices and China’s reopening after lifting COVID restrictions. However, European economies remain at risk of a recession if banking stresses intensify and core inflation — which excludes volatile food and fuel prices — lingers. An economic downturn is also possible if the war in Ukraine escalates or the housing market slump worsens and spreads.

"While recession appears to have been averted for now, there remains a strong possibility of substantially weaker economic growth later in the year as the lagged impact of higher interest rates feeds through to the economy, at the same time that the cost-of-living crisis has eroded real incomes," according to S&P Global Market Intelligence.

Today is Thursday, May 11, 2023, and here is today’s essential intelligence.

Written by Pam Rosacia.

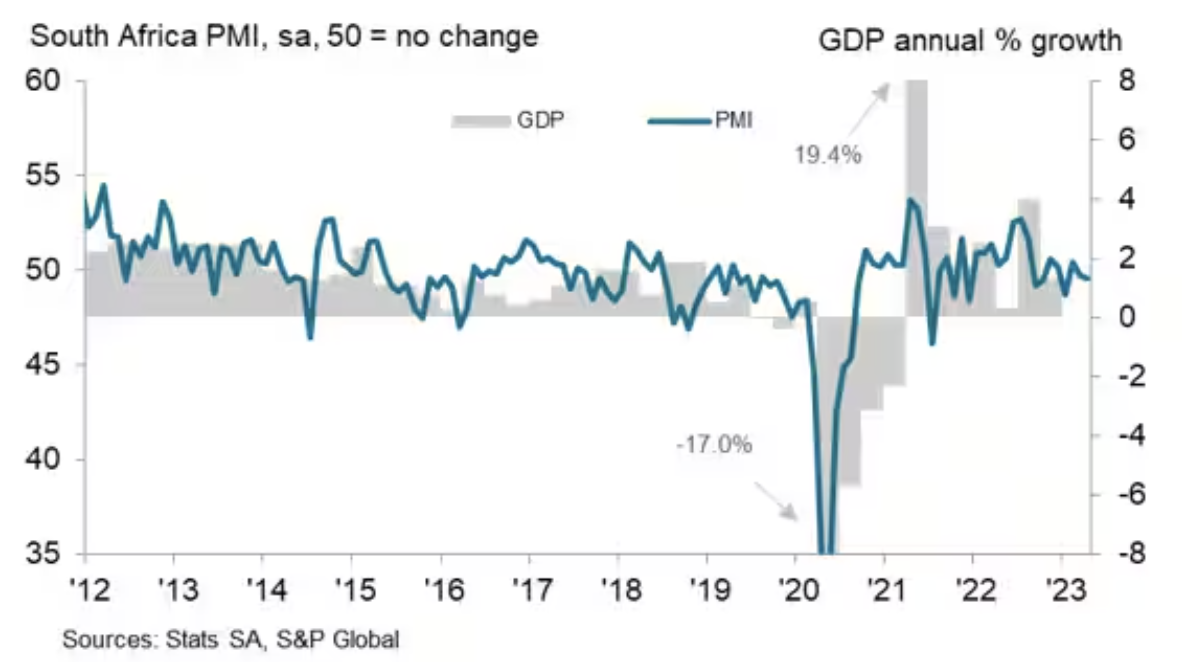

Load Shedding Program Weakens Business Capacity And Outlook In South Africa In April

South African companies struggled with multiple headwinds at the start of the second quarter. Load shedding in particular, related input shortages and longer lead times each acted to limit business capacity and drive another solid drop in output. Supply side challenges have also underlined rapid increases in input prices over recent months and meant that companies were unable to fully respond to an improved demand picture in April. A renewed rise in new business thus largely translated into a pile-up in backlogs of work that was the sharpest since last August.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Default, Transition, And Recovery: U.S. Public Finance Upgrades Continue To Surpass Downgrades In Early 2023

Credit quality for United States Public Finance (USPF) rose overall in the first quarter of 2023. USPF issuers rated by S&P Global had 186 upgrades (134 non-housing and 42 housing), down from 221 upgrades in the fourth quarter of 2022 (166 non-housing and 55 housing). Downgrades fell to 56 in the first quarter of 2023 (52 non-housing and four housing), from 67 in the fourth quarter of 2022 (64 non-housing and three housing).

—Read the report from S&P Global Ratings

Access more insights on capital markets >

Listen: Australian Wheat A Likely Beacon Of Hope Amid Black Sea Uncertainty

Australia, one of the world's leading wheat exporters, has produced three bumper wheat harvests in a row, and with the prospect of an extension of the Black Sea grain corridor deal fading by the day, the country is emerging as a reliable wheat supplier to Asian markets. In this episode of the Commodities Focus podcast, S&P Global Commodity Insights agriculture news senior editor Asim Anand discusses the outlook for Australian wheat with associate editor Vivien Tang, senior pricing specialist Nikolaos Aidinis Antonopoulos and editor Sampad Nandy.

—Listen and subscribe to Commodities Focus, a podcast from S&P Global Commodity Insights

Access more insights on global trade >

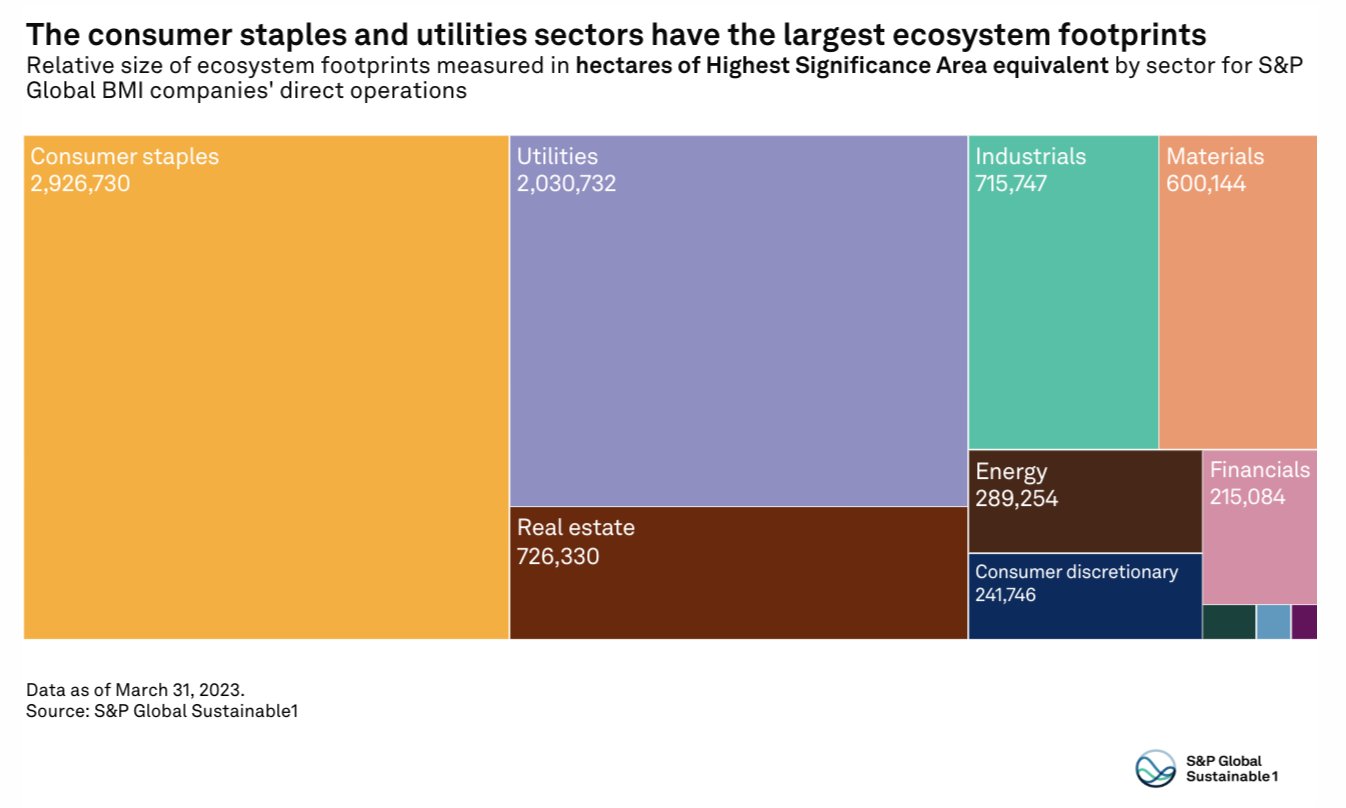

How The World’s Largest Companies Depend On Nature And Biodiversity

Most of the world's largest companies are significantly dependent on nature in their operations even as the biodiversity and ecosystems underpinning those resources are declining due to overexploitation and climate change. S&P Global Sustainable1 data shows that 85% of companies in the S&P Global 1200 — an index that covers the 1,200 largest companies across North America, Europe, Asia, Australia and Latin America — have a significant dependency on nature across their direct operations.

—Read the article from S&P Global Sustainable1

Access more insights on sustainability >

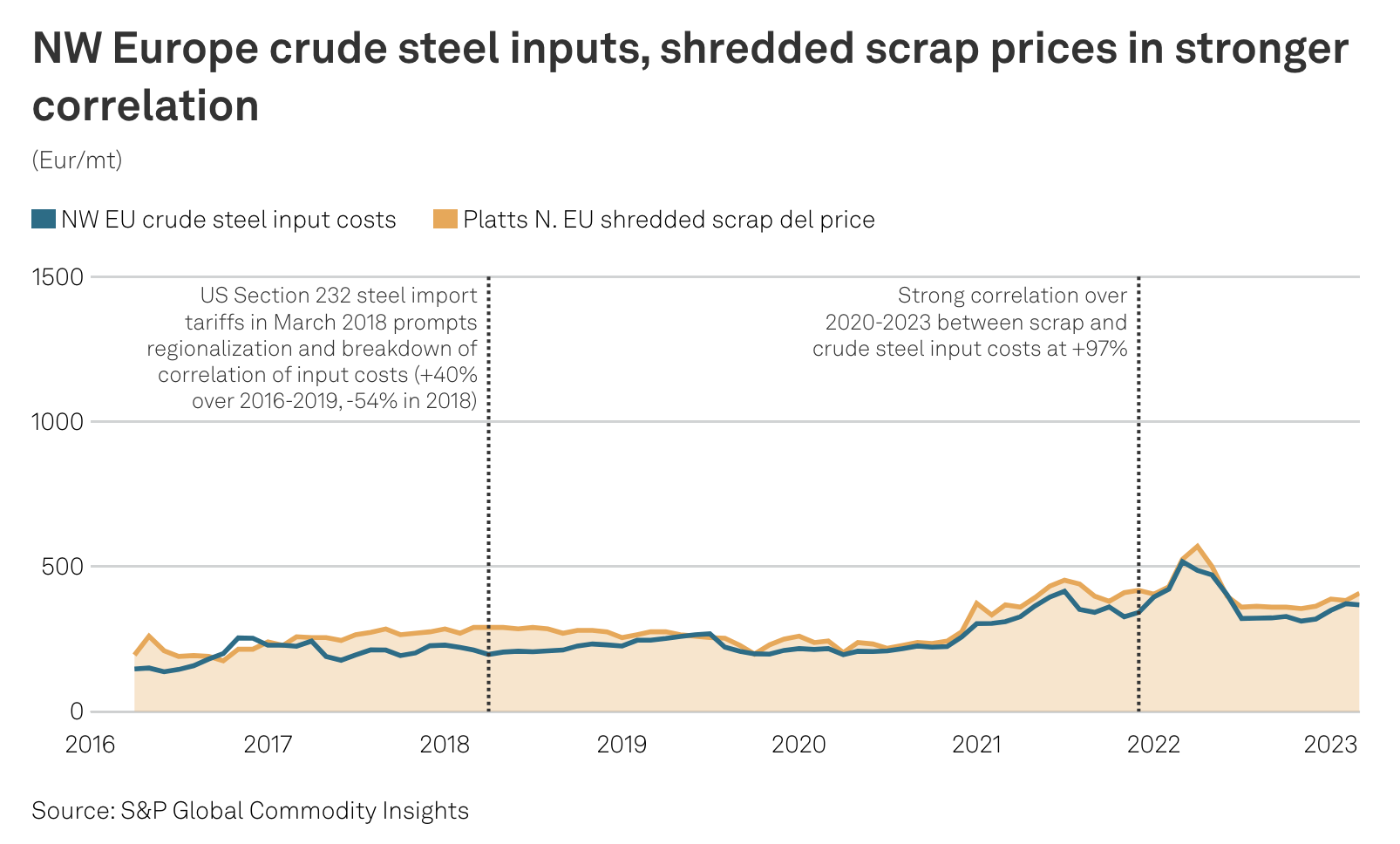

Recycling In Focus: Navigating Plastics And Metals Circularity In 2023

The focus on price transparency in circular economy-based commodity products has been growing sharply in recent years, due to the stronger influence of environmental, social and governance (ESG) criteria, along with national and transnational legislation to promote the circular economy and reduce carbon emissions. The growing importance of price transparency can be seen from well-developed commodity supply chains, such as steel and scrap markets, to more nascent ones in the recycled plastics market, both of which we will explore in this special report.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

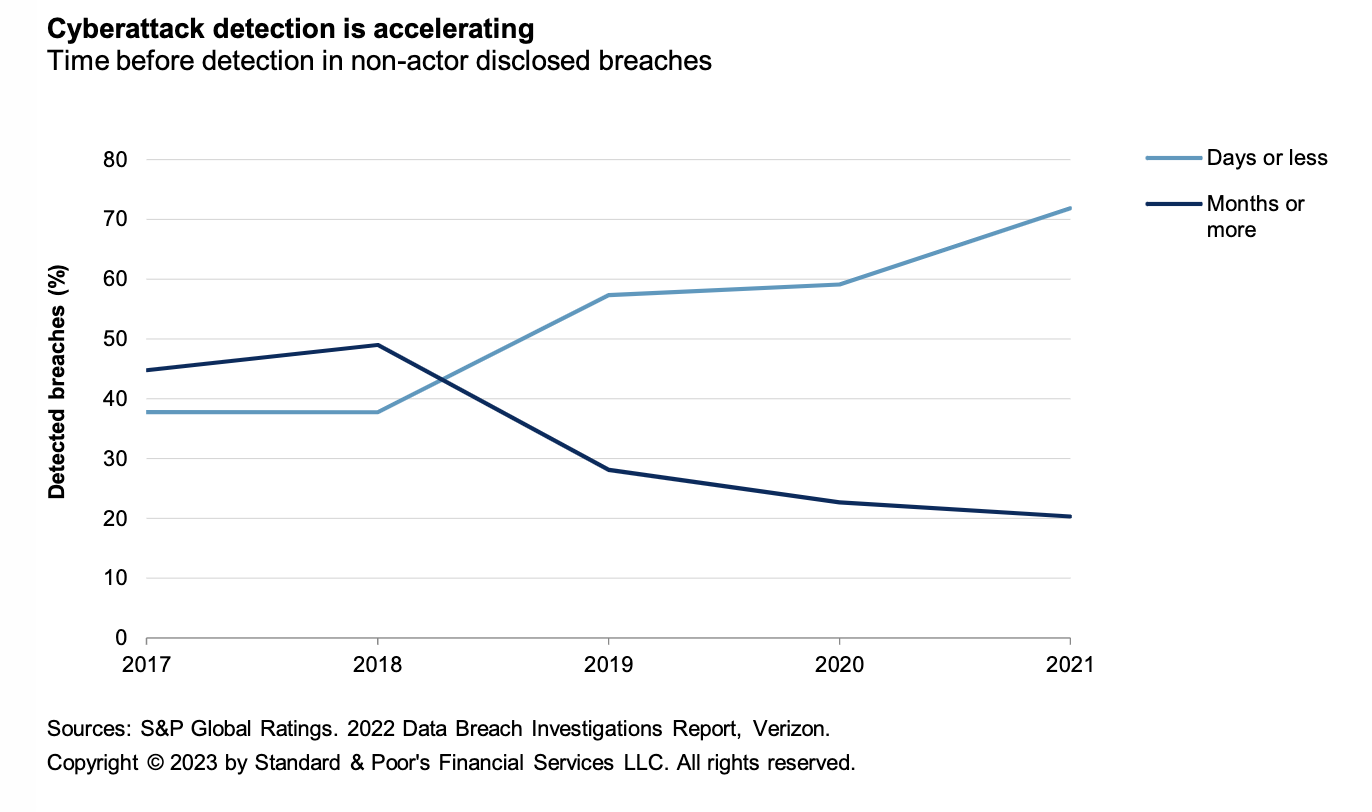

Cyber Risk Insights: Detection Is Key To Defense

Organizations are coming to accept that it is a matter of when, not if, they will be targeted by cybercriminals. That realization is changing the dynamic of cyber risk management, pushing damage limitation to the forefront and, as a result, turning the spotlight on attack detection. Detecting (preferably rapidly) when a malicious actor has access, or is attempting to gain access, to an organization's systems is the foundation on which response and recovery are built. And it is an element whose benefit can be measured in cash.

—Read the report from S&P Global Ratings