Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 10 May, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

An Uncertain Path Ahead for US Economic Growth

The US economy seems to be slowing down after a mixed picture over the past few months. Not much “hard” data, or data that can be measured, has been available recently, but several surveys offer a look at the state of the economy — though the results vary.

In the US Federal Reserve’s April Beige Book, nine of the 12 Federal Reserve Districts reported little or no change in economic activity since the last survey in March, while the remaining three reported modest improvement, according to S&P Global Market Intelligence’s April 25 commentary on the US economy. The Beige Book is published eight times per year and compiles anecdotal economic information from each District. Looking ahead, 11 Districts expect activity to remain stable, and two expect it to weaken.

Meanwhile, S&P Global “flash” Purchasing Managers’ Index data showed very strong growth last month. The Purchasing Managers’ Index (PMI) is a survey of private sector executives that provides insight into the health of economies worldwide. Flash PMI data is an early estimate of the final data.

According to US flash PMI data, economic growth hit an 11-month high in April. This growth was very uneven, however, with service sector activity reaching 12-month highs but manufacturing activity growing only modestly. The rise in the service sector “reflects a likely tailwind from the pandemic … as well as some easing of financial conditions after the tightness seen late last year. These factors are likely to act as diminishing drivers of growth as we head through the year, especially as higher interest rates take their toll,” said Chris Williamson, chief business economist at S&P Global Market Intelligence.

On May 3, the Federal Reserve increased interest rates by 25 basis points to the range of 5.00% to 5.25%, in line with S&P Global Market Intelligence’s forecast. According to Sara Johnson, an executive director at S&P Global Market Intelligence, US policy rates will likely remain around this level for the rest of 2023.

Johnson and Williamson expect growth to slow significantly as 2023 progresses and the increased interest rates hit the economy. Second-quarter GDP is forecast to rise just a little, said S&P Global Market Intelligence’s weekly US commentary published May 1, but a recession by midyear is still possible. There are other storm clouds on the horizon, too — lingering concerns that turmoil in the banking sector will return, commercial real estate prices may see sharp declines and the US might be unable to meet its financial obligations by early June. S&P Global Market Intelligence’s forecast assumes the debt limit will be raised in time, but political circumstances are less predictable now than in 2011, the last time we saw a similar situation.

Though recent growth has helped the US economy avoid a recession for now, it is still not out of the woods and is braced for a slowdown.

Today is Wednesday, May 10, 2023, and here is today’s essential intelligence.

Written by Claire Delano.

Philippines Corporate Primer: COVID Hits Aren't Slowing Growth Aspirations

The Philippines lost the equivalent of nearly three years of economic growth due to COVID-19. That makes it one of the hardest hit in the region. The pandemic also left its trace on corporate balance sheets with tumbling profits and more debt. The next challenge is inflation and higher rates. Rising funding costs will weigh on corporate profits, given higher legacy COVID debt. And operating performance is unlikely to be as solid as in rebound-year 2022, with GDP growth slowing to about 5.8% in 2023 and 2024.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

Inflation Trends Diverge As Service Sector Growth Spurt Drives Global Growth To 16-Month High

A further acceleration of services sector growth pushed the pace of global expansion to a 16-month high in April, according to the S&P Global PMI surveys based on data provided by over 27,000 companies. All major economies reported robust service sector growth, in all cases outperforming manufacturing which consequently remained broadly stalled on a global basis. Resurgent post-pandemic demand for services has diverted spending from manufacturing, meaning bottlenecks have eased in the goods-producing sector but increased among service providers.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

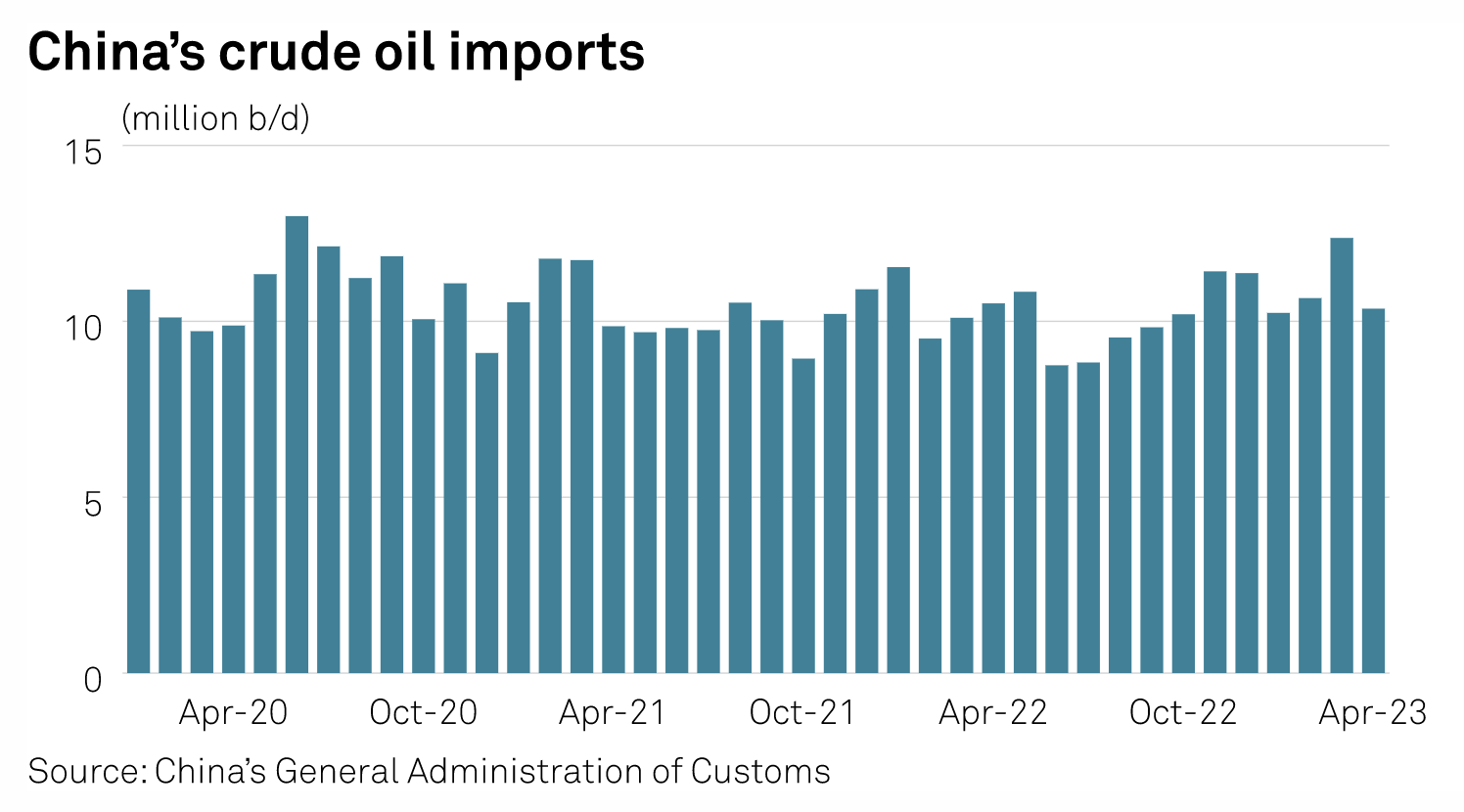

China Data: April Crude Imports Drop 16% To 10.4 Mil B/D

China's crude imports fell 16% to 10.36 million b/d in April, dropping from a 33-month high of 12.37 million b/d in March, while oil product exports hit a nine-month low, General Administration of Customs data released May 9 showed. However, analysts expect crude inflows to rebound strongly in May, which may even be higher than the level in March, due to a hefty stream from the US. But tightened specification testing on hazardous chemical imports conducted by customs could slow logistics and cap crude imports in the month.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: How Companies, Countries Are Beginning To Put A Value On Nature

We’re seeing more companies and countries start to account for the value of nature. In this episode of ESG Insider, hosts Lindsey Hall and Esther Whieldon hear from two people well-placed to explain how the world has historically done little to understand the way nature benefits the economy — and how that is now evolving.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Sustainable1

Access more insights on sustainability >

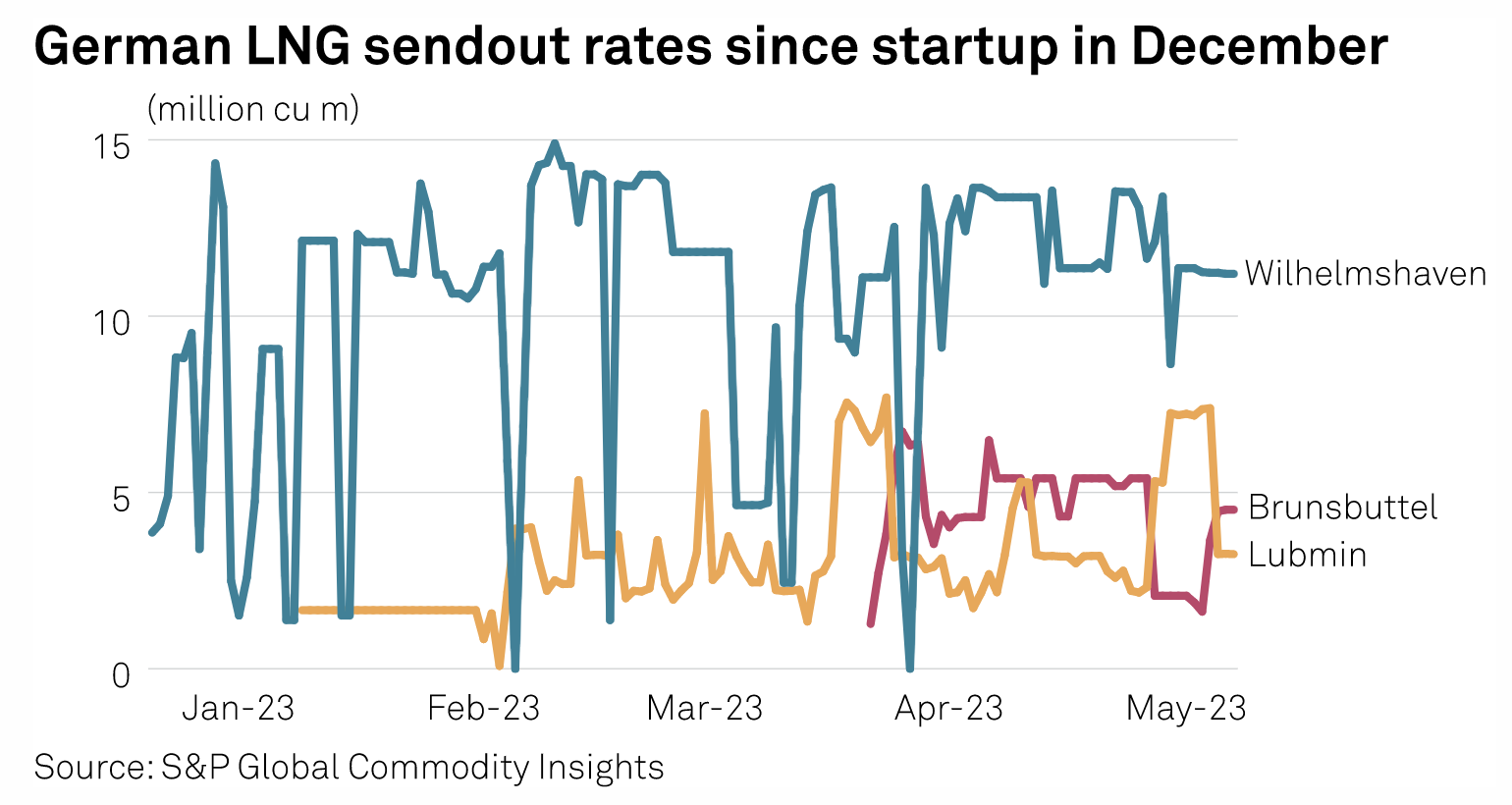

German LNG Sendout Passes 2 Bcm Mark With More Terminals Lined Up

Once the biggest buyer of Russian pipeline gas, Germany has moved quickly to build out a significant volume of floating LNG import capacity as part of efforts to compensate for the lost Russian deliveries. It already has three operational FSRUs across its northern coast, with more to come by the end of 2023 and several permanent sites also under development. The first floating import terminal, developed on behalf of the German state by utility Uniper at Wilhelmshaven, began sending out gas into the national grid last December.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: If You Build It, They Will Come: EV Momentum ‘Not Going Away’

Momentum for electric vehicles is on the rise as policy, industry investment and market perspectives are aligning for a potential EV revolution. But challenges also remain plentiful. Darcy Bisset, a partner at Hogan Lovells specializing in renewable energy and energy transition transactions, joined the podcast to discuss what's needed to meet ambitious policy goals for EV adoption. She touched on the regulatory uncertainty facing the EV industry, as well as her expectations for a very bright future once certain hurdles are cleared. She also shared why she thinks this bright future for EVs does not mean dark days ahead for the oil sector.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Commodity Insights