Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 4 Mar, 2024 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Insurance Technology To Recover in 2024

Similar to fintech, insurtech, or insurance technology, has become a popular industry buzzword.

Combining insurance with technology and innovations such as advanced telemetry, machine learning and AI certainly holds plenty of promise.

For insurers, insurtech could make attracting and retaining customers easier by tracking client habits, suggesting relevant policies and automating the underwriting process. For customers, insurers’ use of real-time telemetry and internet of things may generate data that strengthens risk assessments and lowers premiums.

Insurtech is also used to describe the collection of upstart companies, such as Oscar Health, Lemonade and Root Insurance, that are pioneering improvements in technology to claim market share across the insurance industry.

Despite the encouraging story, insurtech had a bad year in 2022, following years of rapid growth. Like other tech startups, insurtech companies were forced to tighten their belts amid heightened concerns about profitability and declining equity valuations.

But there are signs of an emerging recovery. The valuations of insurtechs have improved, consolidation has taken place among industry players and the companies that remain have made progress in reducing costs. Analysts at S&P Global Market Intelligence expect the US insurtech sector to recover this year, although they noted that a return to the heady valuations seen in 2021 is unlikely.

If things hold up, the analysts also anticipate more IPO activity during 2024. For example, Slide Insurance Holdings, a Florida-based insurtech focused on homeowners insurance, is reportedly considering an IPO in the first half. The continued development of AI, as well as regulators’ approaches to how it is applied to insurance and other financial services, will be critical to the sector’s continued growth, according to S&P Global Market Intelligence.

In addition to improving the way insurers customize, sell and risk-manage insurance policies, technology has fostered the rise of new insurance categories. Cyber insurance, which protects organizations from potential losses related to cyberattacks, has proven an “exceptional source of premium growth” since the beginning of the COVID-19 pandemic, said Thomas Mason, senior research analyst at S&P Global Market Intelligence, speaking on the "Next in Tech” podcast.

The US accounts for 56% of premiums written on cyber insurance globally, according to the National Association of Insurance Commissioners. In 2022, the cyber insurance market — including US insurers and non-US insurers permitted to write in the US market — grew by 48% to reach $9.7 billion. This increase followed year-over-year growth of 61% in 2021, according to the insurance regulator.

Considering the impressive numbers, many insurance companies have been eager to enter the cyber insurance space, although this is challenging due to the lack of data on losses, Mason said. As the nature of cyberthreats facing companies becomes more existential, insurers are having to dig more deeply into organizations’ risk postures using technology such as real-time telemetry.

It’s not all rosy. The direct channel for autos, where some US insurtechs compete, has not been the source of growth it once was. For many years, growth in the direct channel, or policies sold over the phone or internet, outstripped the expansion of the broader market. However, this trend changed in 2022 and 2023, with direct channel growth lagging the rest of the industry. A significant part of this impact can be attributed to slowing growth at Geico, the Berkshire Hathaway-owned market leader, according to S&P Global Market Intelligence.

Normally, slowing growth at such a large, established insurer would represent a bounty for more agile insurtechs. This year, given the sharpened focus on profitability and expense management, it may be the more traditional insurers who reap the rewards.

Today is Monday, March 4, 2024, and here is today's essential intelligence.

Written by Mark Pengelly.

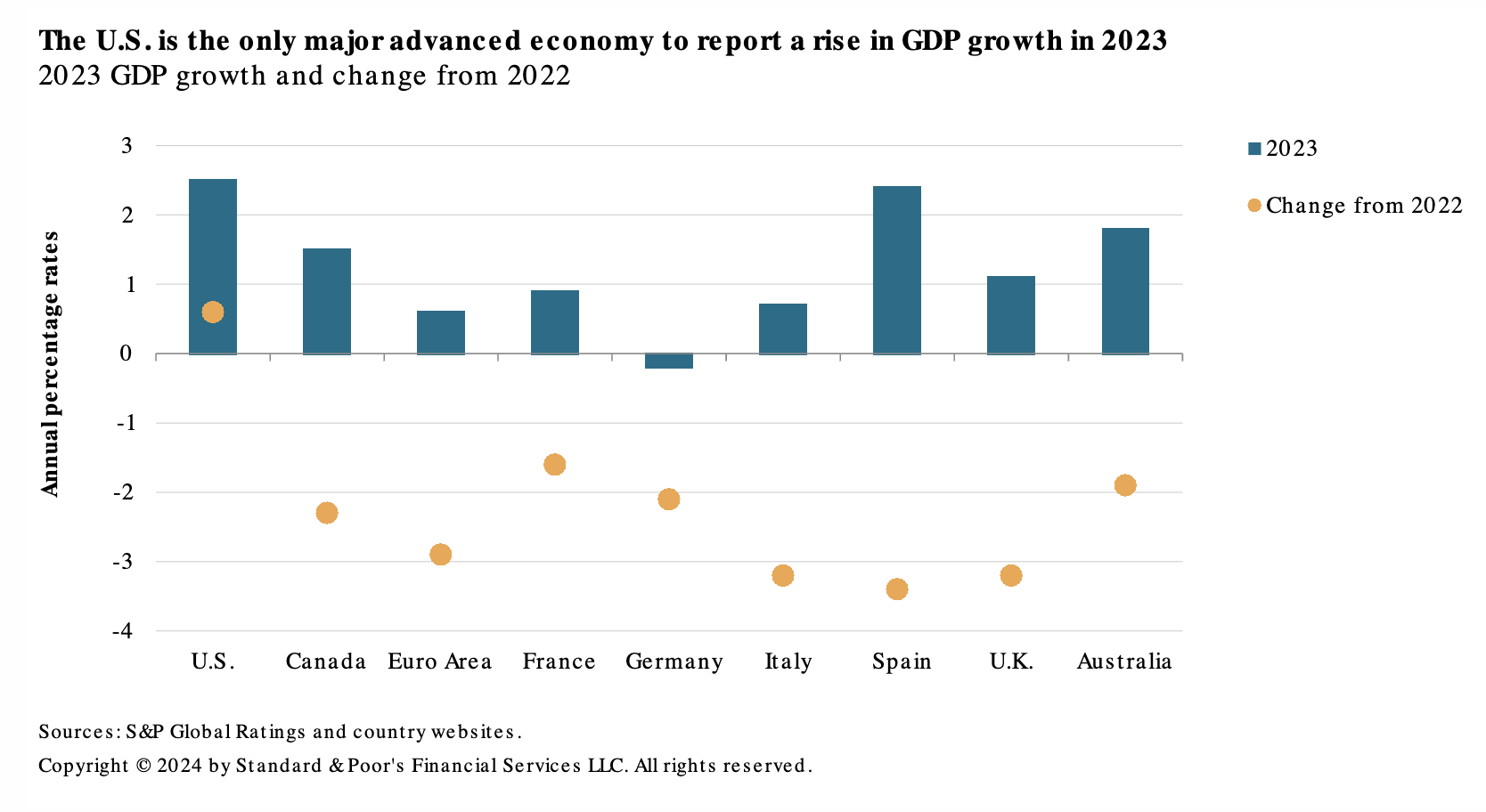

Economic Research: The US Economy Bucks The Global Trend

The US appears to have emerged virtually unscathed from a round of steep policy rate hikes. GDP growth in 2023 rose by 0.6 percentage points from 2022, making the US an outlier among major advanced economies. Indeed, for the countries in S&P Global Ratings’ sample, real GDP growth rates declined by over 2.5 percentage points last year.

—Read the article from S&P Global Ratings

Access more insights on the global economy >

Asia-Pacific Banking Country Snapshots: Property Exposures Will Test Ratings In 2024

S&P Global Ratings continues to monitor downside risks, particularly property-related, arising from China and Vietnam. Nonbanks in Korea could also face challenges from real estate project financing. Its outlook for the Asia-Pacific banking sector remains steady with 83% of banks on stable outlook as of Jan. 24, 2024.

—Read the article from S&P Global Ratings

Access more insights on capital markets >

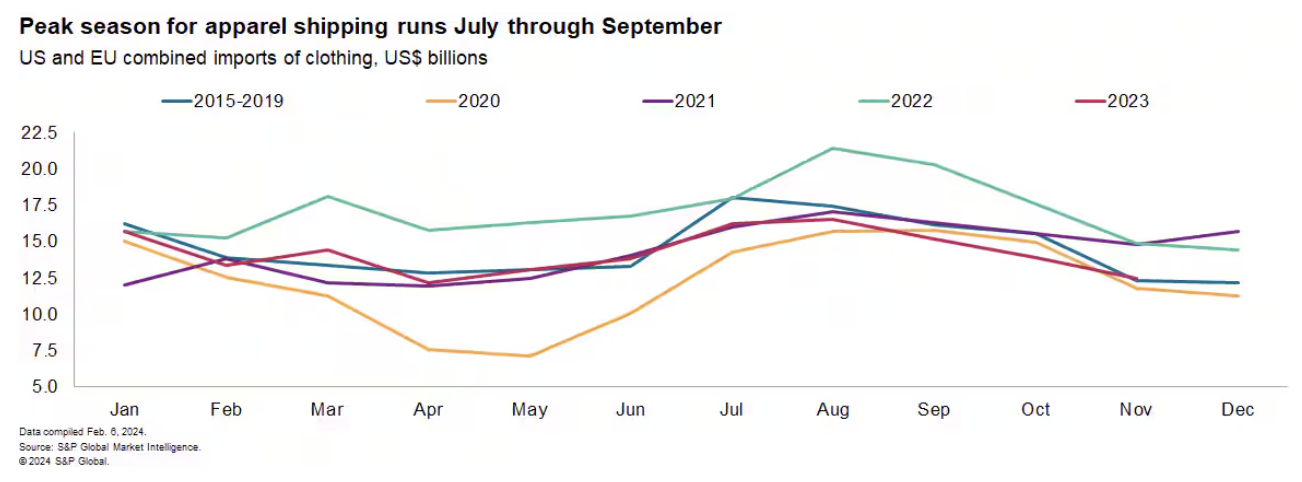

Logistics Disruptions’ Impact On Apparel Supply Chains

The sourcing patterns and seasonality of the apparel industry have left firms exposed to the shipping disruptions caused by violence in the Red Sea. Shipments from Asia by sea that may need to use the Suez or Panama Canals accounted for 51.0% of EU imports of apparel and footwear in the 12-months to Nov. 30, 2023. In the case of the US, the ratio is lower at 30.7% as only shipments to US east coast counted.

—Read the article from S&P Global Market Intelligence

Access more insights on global trade >

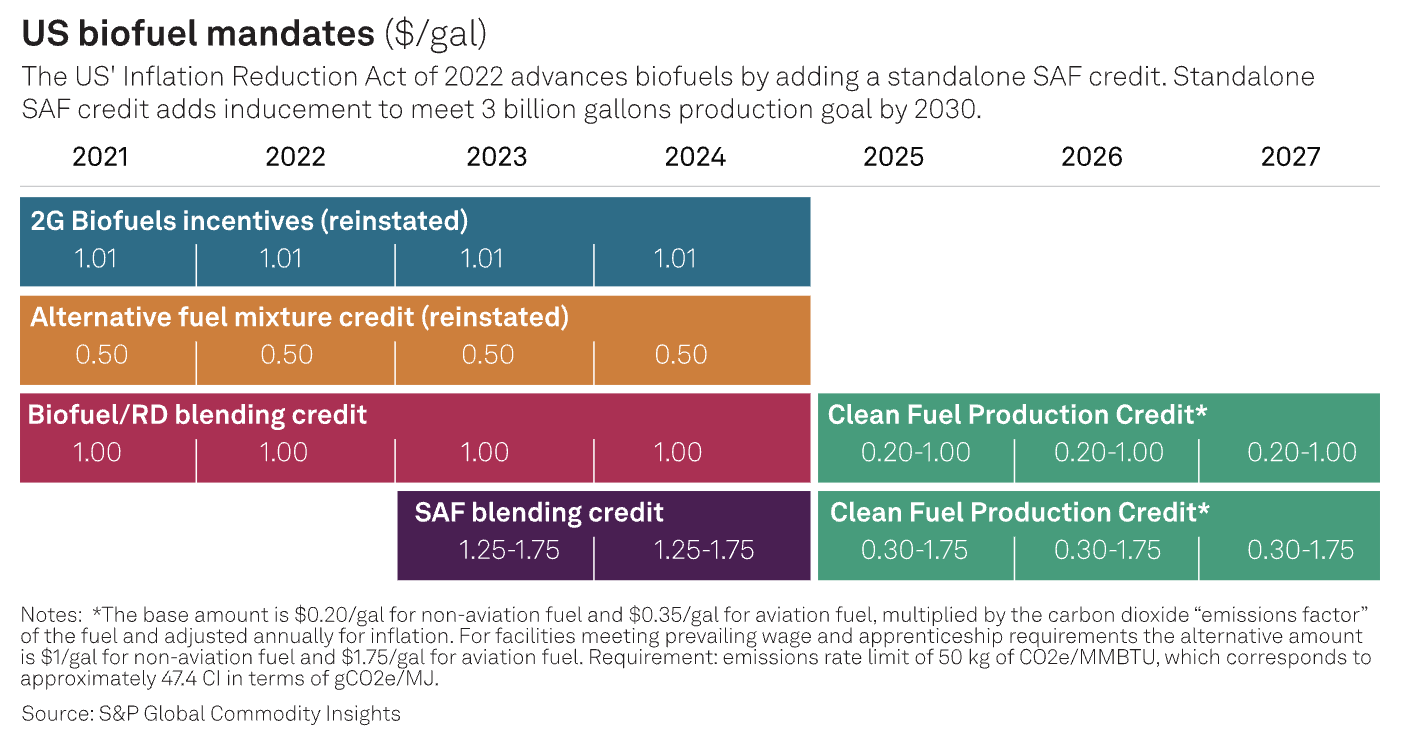

Fueling The Future: Biofuels Driving Progress On Net Zero

The role of biofuels in energy transition is growing, as they can help decarbonize hard-to-abate transport sectors, but more supply is needed to keep the world on track with net-zero goals. S&P Global Commodity Insights explores how regional policies are driving adoption and evolving technology is widening the feedstock pool, as well as supply and demand outlooks across transport sectors.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

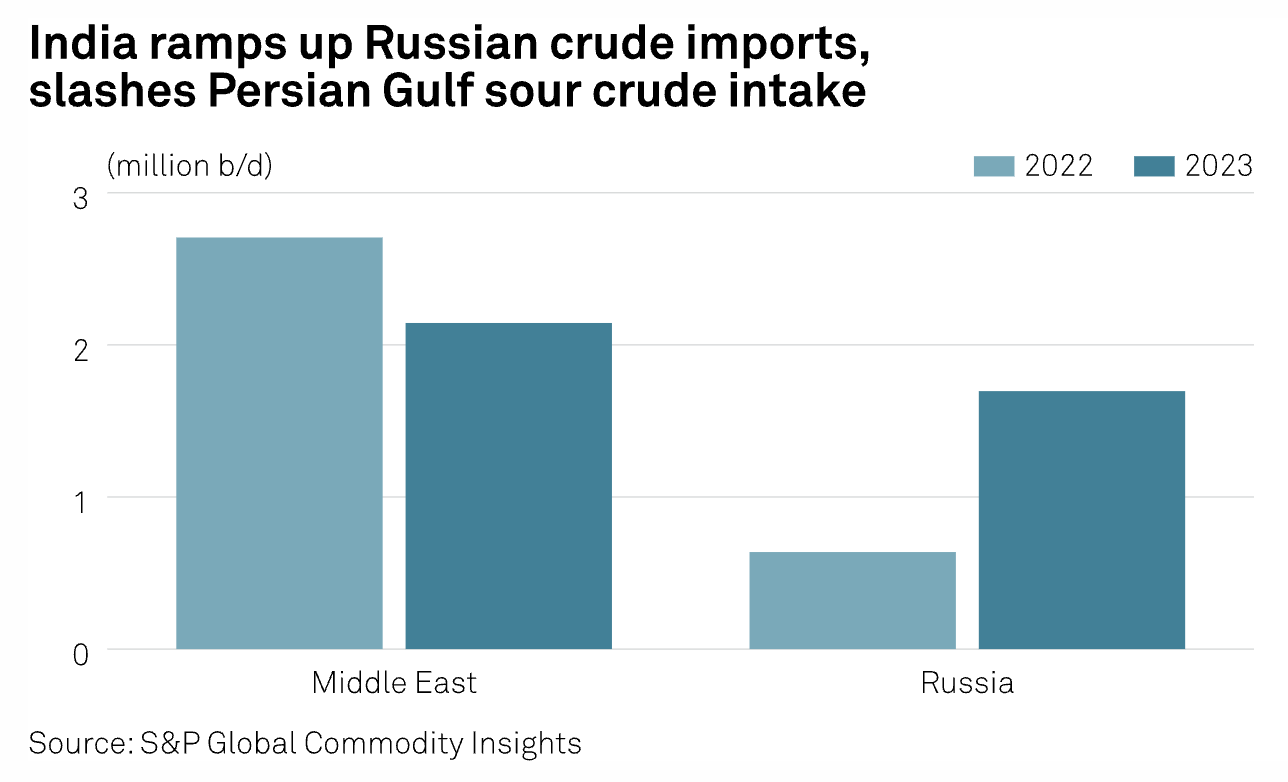

South Korea, Japan Trade Sources See OPEC+ More Likely To Extend Crude Production Cuts

More than half of the refining industry participants in South Korea and Japan surveyed by S&P Global Commodity Insights over Feb. 22-28 said they expect OPEC and its alliance members to extend crude production cuts beyond April, but supply security remains firmly intact for Asia's third and fourth biggest crude importing nations. With just little over a month left on scheduled OPEC+ voluntary production cuts of 2.2 million b/d, the Joint Ministerial Monitoring Committee, co-chaired by Saudi Arabia and Russia, has yet to confirm whether the group will extend the supply reduction stance beyond April.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

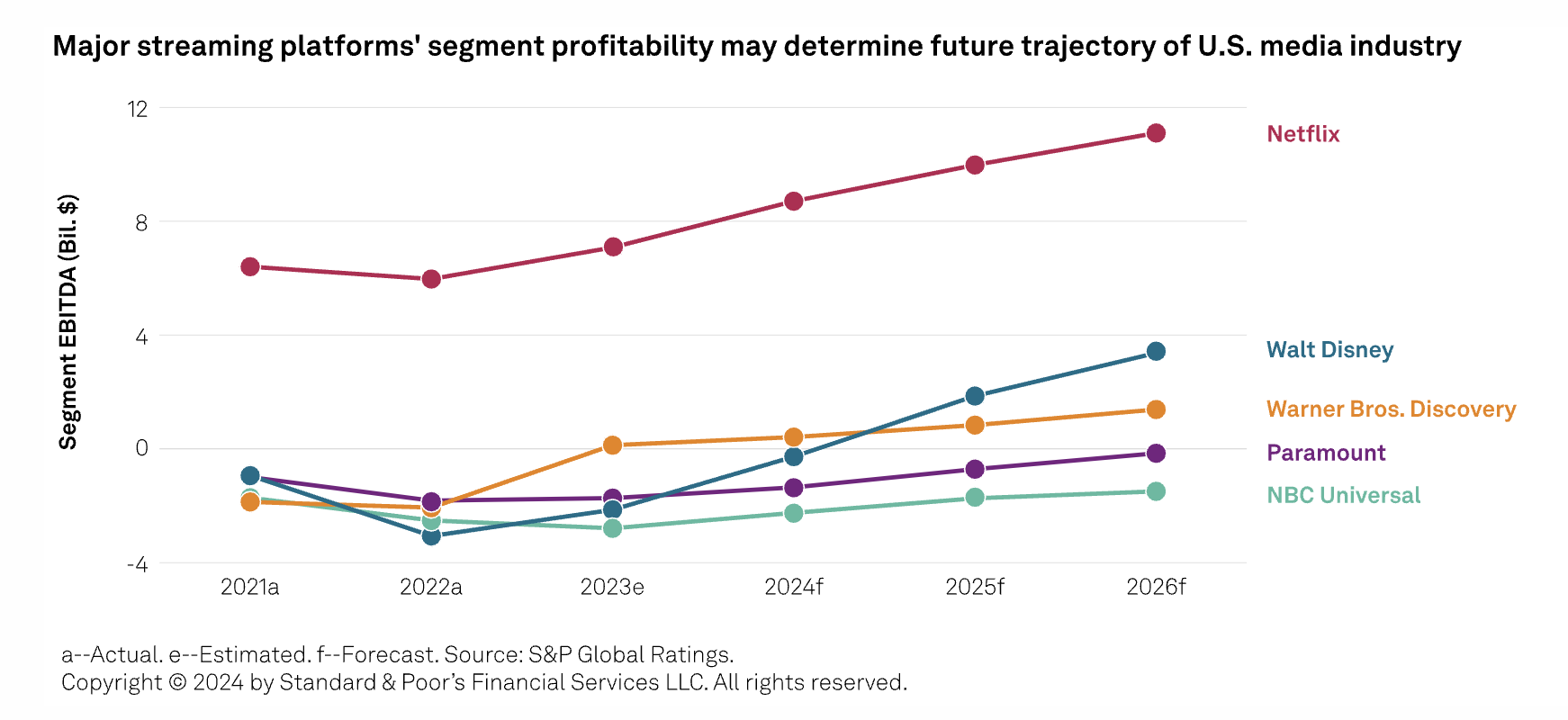

CreditWeek: Does Our CreditWatch Negative On Paramount Mean More Pain Ahead For The US Media Sector?

The US media and entertainment sector's shift toward a streaming-centric ecosystem represents an existential transition akin to the print media's move to digital platforms. S&P Global Ratings expects 2024 will be a pivotal year in determining the winners and losers — with the latter likely to outnumber the former.

—Read the newsletter from S&P Global Ratings