Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 15 Mar, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

A Volatile New World

The past, present, and future are seemingly converging as unprecedented circumstances continue roiling markets again, and again, and again. The so-called new normal that market participants have been hopeful will emerge in a post-pandemic world appears to be shaping into one of near constant volatility. But this world redefined may, at the same time, also be more resilient to such shocks.

The events of the first quarter of this year show just how much faster disruptions are reshaping our globalized world, according to S&P Global Ratings.

“S&P Global Ratings sees 2022 as a year of divergence and accelerated disruption that will redefine the global economy and credit landscape,” S&P Global Ratings Global Head of Research, Sustainable Finance, and Innovation Alexandra Dimitrijevic and Global Head of Ratings Thought Leadership Ruth Yang said in a report today. “As the global economy continues to recover from the pandemic under newly uncertain and volatile conditions, it will be reshaped by changed consumer behavior, reshuffled global supply chains and capital flows, resurfacing credit headwinds, renewed urgency to combat climate change, and new and existing geopolitical shocks, as well as accelerated digitalization of markets and the broader economy.”

The omicron coronavirus variant came and went without much economic effect in the U.S. but is now spurring new lockdowns in China that pose risks to global activity. The S&P 500 benchmark index has showed volatility, dropping about 10% from its peak. Climate disasters are becoming more frequent, most recently with disastrous flooding in Australia. Russia's invasion of Ukraine has spurred stringent sanctions against the aggressor by a broad swath of the international community, shocked global markets, and created a supply and price shock across oil and gas, agricultural products, metals, and other commodities, according to S&P Global Commodity Insights.

Major central banks look set to confront this crisis within aggressive monetary policy normalization. As the U.S. Federal Reserve convenes today and tomorrow for its Federal Open Market Committee meeting—all but certain to announce at its conclusion the most powerful central bank’s first interest rate hike of this cycle—the market may be more focused on future rate hikes and inflation expectations, as well as plans to reduce a nearly $9 trillion balance sheet, according to S&P Global Market Intelligence.

“The CBOE Volatility Index (VIX), the so-called ‘fear gauge,’ has been hovering above 30, which is the 90th percentile of its historical value. Its level on March 10, 2022, was more than two standard deviations above its one-year average. Although it remains unclear how long these geopolitical tensions will last and how much it will affect the global economy, the U.S. equity market has managed to stay cool so far, compared with the VIX levels seen two years ago, which were triggered by pandemic-driven sell-offs,” Berlinda Liu, a global research and design director at S&P Dow Jones Indices, said in a commentary today. “More importantly, historical data show that the equity markets may be more robust than we expect and tend to bounce back quickly after elevated volatility … In the coming weeks, the swings in U.S. equities could continue and test investors’ sentiment. Big problems remain and big opportunities emerge. Fasten your seat belts and stay cool.”

Today is Tuesday, March 15, 2022, and here is today’s essential intelligence.

Written by Molly Mintz.

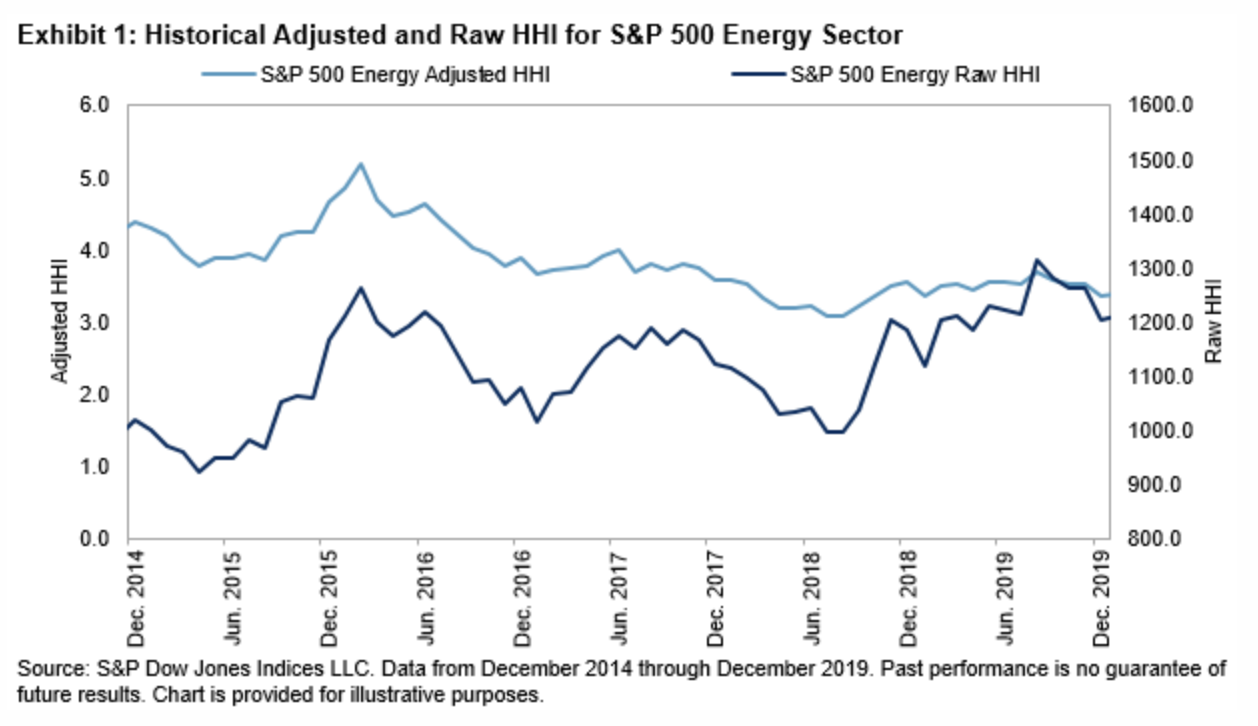

Contemplating Concentration

After the exceptional performance of large-cap stocks in recent years, concentration concerns naturally come to mind. There are many ways to measure concentration. A simple method is to add up the weight of the top names, but the drawback with this approach is it doesn’t incorporate all the constituents in an index. The Herfindahl-Hirschman Index, defined as the sum of the squared index constituents’ percentage weights, is more favorable from this aspect and is widely used.

—Read the full article from S&P Dow Jones Indices

Access more insights on the global economy >

China's Housing, Monetary Policy Restraint To Keep Banking Risks In Check

China's policy support for homebuyers and restrained approach to monetary easing will likely help banks keep credit and earnings risks under control as the country grapples with an economic slowdown. The world's second-largest economy is likely to further ease restrictions and lower borrowing costs on home purchases to support the property market, which will be crucial to meet its 2022 GDP growth target of around 5.5%, outlined at China's annual political meetings last week, analysts said. Instead of direct lending or other forms of bailouts, policies aimed at boosting housing demand will help restore cash flow and thus the repayment ability of debt-ridden developers, which have been a major source of credit risk for banks since the second half of 2021.

—Read the full article from S&P Global Market Intelligence

Access more insights on capital markets >

Listen: Sanctions On Russia Create High Stakes For Global Economy, Fuel Prices

The oil markets' reaction to Russia's invasion of Ukraine has been dramatic to say the least as global oil and gas supplies, already struggling to keep up with the strong post-pandemic recovery in fuel demand, were further tightened as countries pulled away from Russian resources. The analytics team at S&P Global Commodity Insights has said "there are not sufficient sources of incremental supply to cover a substantial prolonged loss of Russian oil." Senior editor Jasmin Melvin spoke with foreign policy and international energy specialist Brenda Shaffer about what's needed to shore up global energy supplies and bring down prices, as well as whether sanctions remain the right tool for dealing with geopolitical conflicts.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Commodity Insights

Access more insights on global trade >

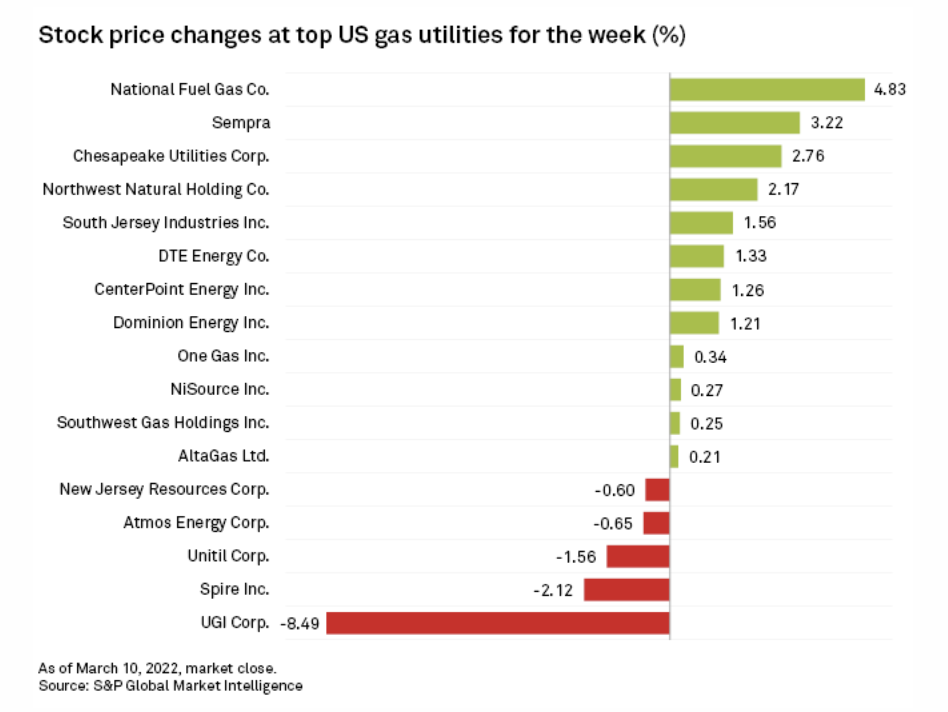

Green Energy Shift Shakes Gas Industry, Investors

The world's evolving transition to low-carbon energy has challenged the global market, the U.S. natural gas industry, and investors. Gas utility operators are poised to become bigger players in the renewable natural gas market in 2022 as customers expand commitments to procure low-carbon fuels. Utility executives touted the volumes of renewable natural gas, or RNG, flowing through their distribution networks and promoted project portfolios during quarterly earnings conference calls. For some gas distributors, new state policies promoting low-carbon fuel use presented opportunities to start or increase RNG purchases, executives said.

—Read the full article from S&P Global Market Intelligence

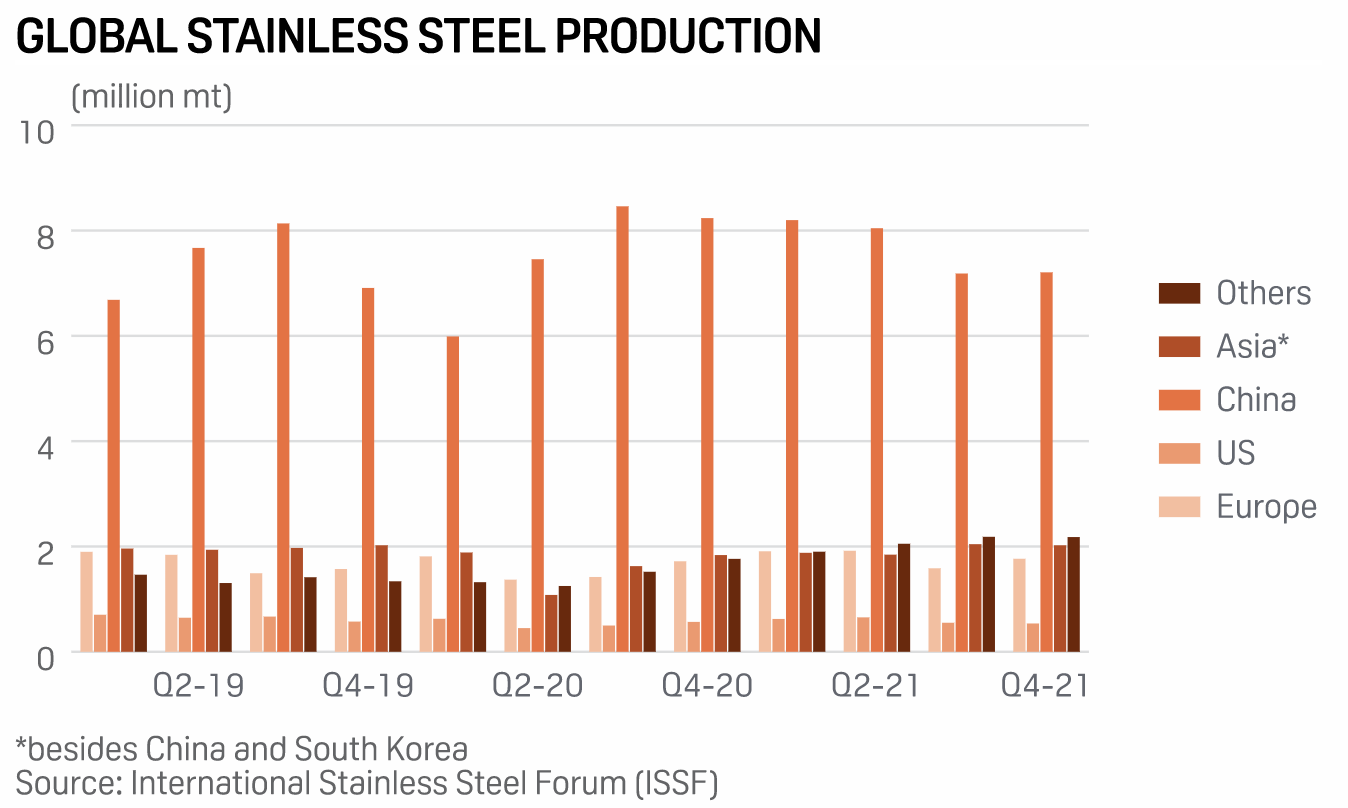

Global Stainless Steel Production Up 10.6% On Year In 2021: ISSF

World stainless steel melt shop production rose 10.6% year on year in 2021 to 56.3 million mt, according to figures released March 14 by International Stainless Steel Forum. Output was up in all regions monitored by the ISSF, with Asia, outside of China and South Korea, showing the largest climb of 21.2% year on year to 7.8 million mt. However, this made up just 13.8% of the overall total. Production in China rose 1.6% year on year to 30.6 million mt in 2021, 54.4% of the total global output.

—Read the full article from S&P Global Commodity Insights

Access more insights on energy and commodities >

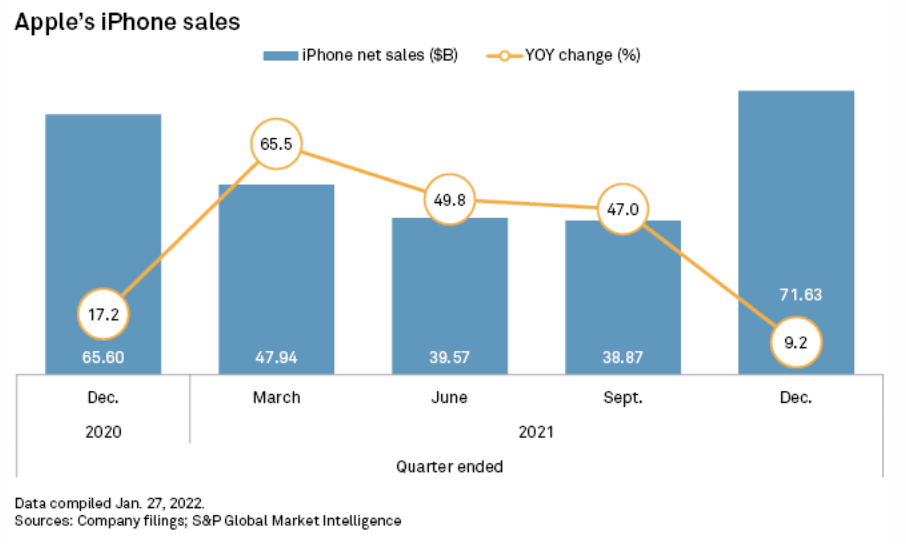

Apple Aims More Expensive 'Budget' iPhone At Eco-Conscious, 5G Shopper

The record-high inflation seen in the broader economy is hitting Apple Inc.'s new budget-tier iPhone. With prices starting at $429, the new iPhone SE costs 7.5% more than its 2020 predecessor. Apple attributed the higher price point to the cost of adding 5G components and a faster processor. The company previously offered 5G network compatibility only on its higher-end iPhones. The iPhone SE is available for preorder March 11 and will reach consumers March 18.

—Read the full article from S&P Global Market Intelligence