Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 27 Jul, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Cyber Insurance in Demand

Cyber insurance prices are rising fast—as it is the fastest-growing subsector of the insurance market—due to a combination of limited supply, increasing ransomware attacks, geopolitical tensions, and new threats.

Price for cyber insurance in the London market increased sharply at the end of 2021 with average increases of 109% and some policyholders seeing increases in excess of 300%. While prices have continued to increase in 2022, there has been some flattening out after last year’s spike, according to S&P Global Market Intelligence. In the U.S., the increasing frequency of cyberattacks is also leading insurers to re-examine their prices and approach to the cyber insurance market.

While cyber insurance can mitigate the effects of a cyberattack, insurers typically conduct extensive technical review before accepting clients, according to S&P Global Ratings. The requirements for coverage can include multi-factor-authentication, encryption, and intrusion assessments. As a result of these requirements and high premiums, many companies or rated entities have no coverage or insufficient coverage against cyberattacks.

"If you haven't got the right controls in place and you go to market on a proposal form, you are just going to get a load of no-quotes—it is a pointless exercise," said Mark Rubidge, a director in the major risk practice at Arthur J. Gallagher & Co.'s U.K.-based international division, in an interview with S&P Global Market Intelligence.

The increased interest in cyber insurance is driving both new entrants in the market and an increase in cybersecurity M&A. Companies like Syndicate 1492, Resilience, and Coalition emerged to meet the increased demand while many traditional insurers hesitated to get into the cyber space. Opportunistic buyers have targeted cybersecurity firms during the technology sell-off and picked up strategic assets at lower prices.

Some of the increase in interest in cyber insurance this year was driven by an expectation of attacks from within Russia in support of the war in Ukraine. While there have been fewer cyberattacks than initially expected, there is general agreement that a prolonged war increases the risks. The energy infrastructure in Ukraine has already seen increases in cyberattacks, according to S&P Global Commodity Insights.

While prices remain high, cyber security experts believe that the risk of cyberattacks has increased. "The golden rule is, if you [believe you] haven't been compromised, then you just haven't worked out where you have been compromised," said Bob Schwarm, director of Information Systems withThe Metropolitan District, at a recent S&P Global Ratings seminar.

Today is Wednesday, July 27, 2022, and here is today’s essential intelligence.

Written by Nathan Hunt.

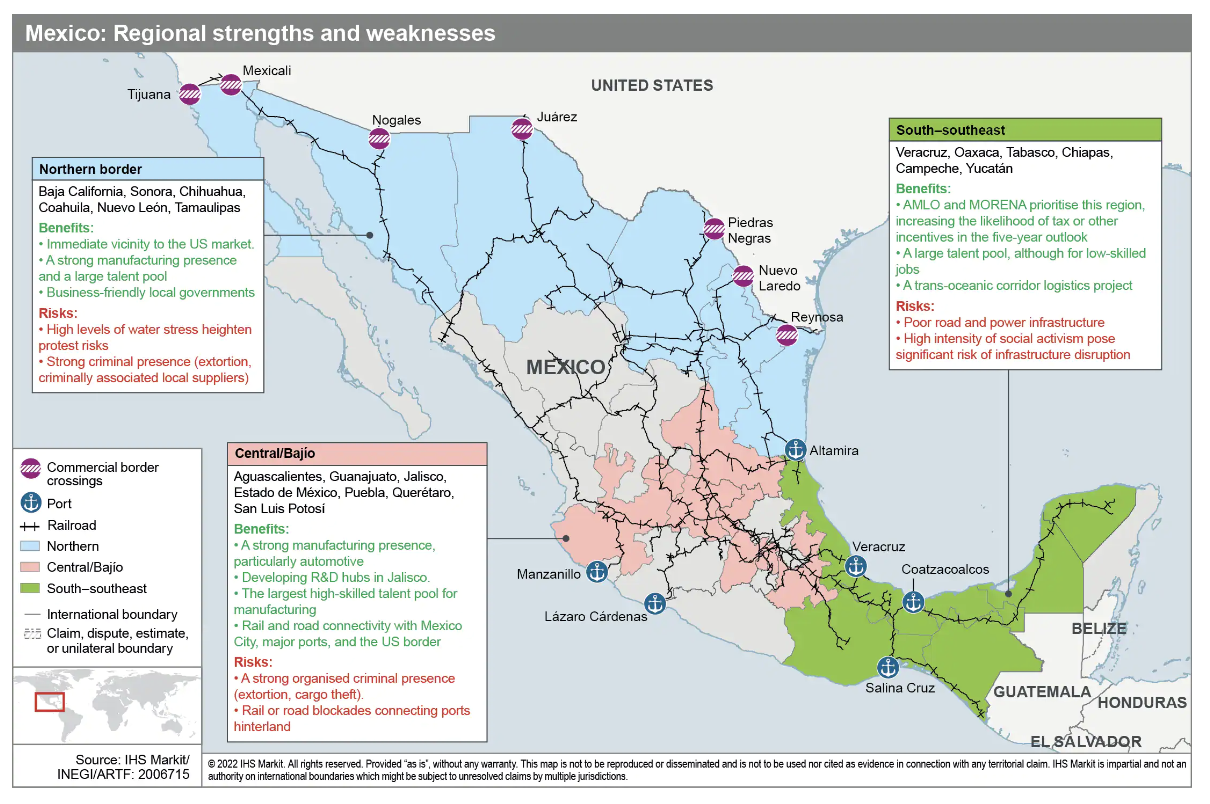

Mexico Nearshoring Potential For Critical Minerals

Mexico is particularly well placed to benefit from companies relocating their operations closer to their main destination markets (nearshoring), a response to recent supply chain shocks from the Russia-Ukraine conflict to China's dynamic COVID containment policy.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

UBS Bets On Rate Hikes, Diversification To Bolster Earnings After Tough Q2

UBS Group AG is counting on higher interest rates and its diversified business model to support earnings later this year amid the ongoing market uncertainties that weighed on second-quarter performance. "The second quarter was one of the most challenging periods for investors in the last 10 years," CEO Ralph Hamers said during an earnings presentation July 26. He cited rising inflation, tight labor markets, the Ukraine war, and COVID-19 restrictions in Asia-Pacific as the key drivers of lower client sentiment and activity.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

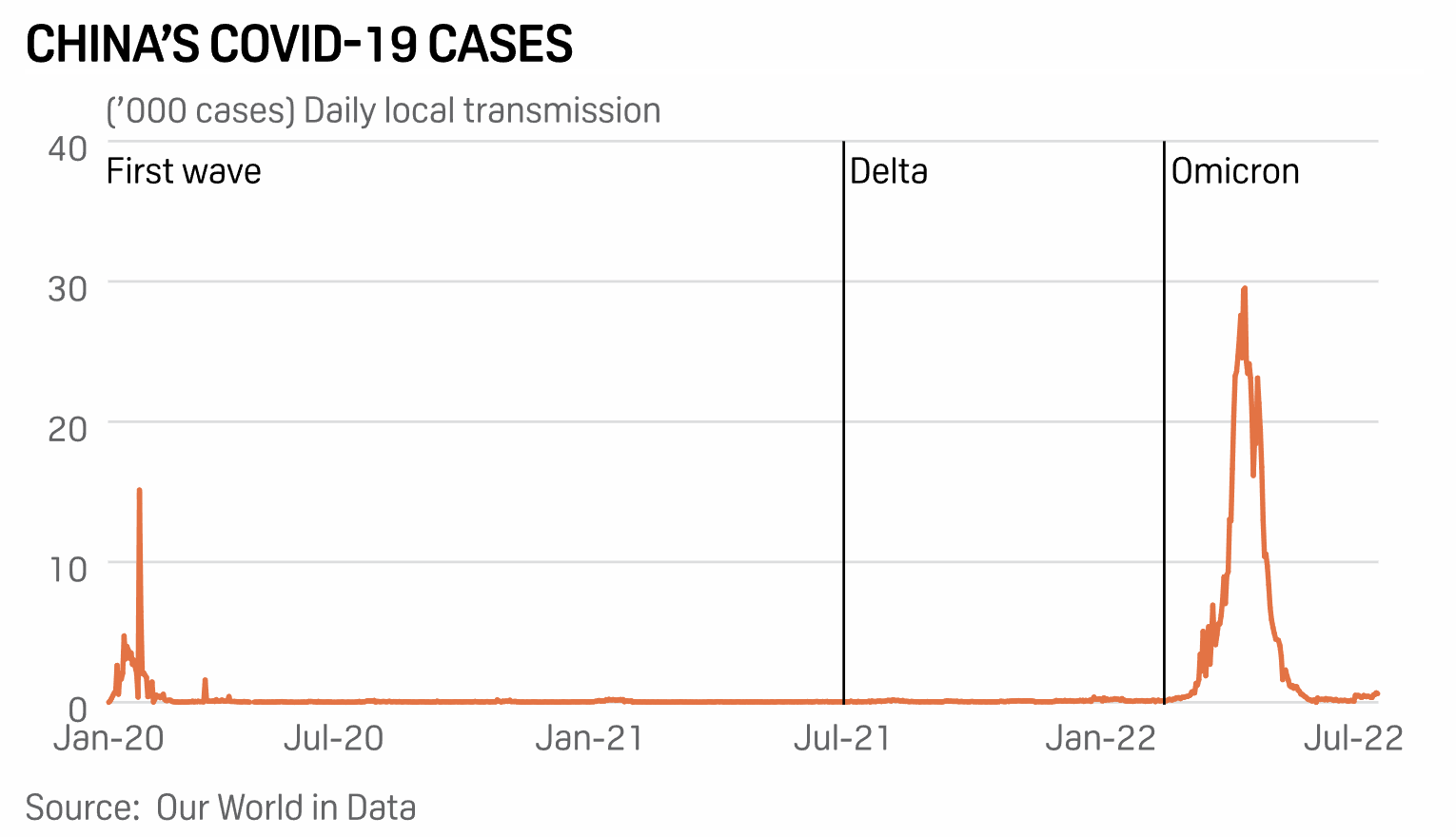

Why China’s Economic Measures May Not Be Enough To Drive Up Consumer Demand

China's economic activity has started to recover from the late-May COVID-19 resurgence, while the government has also been stepping up fiscal and monetary stimuli to support the recovery. However, recovery this year is likely to face a bumpy ride and remain relatively weak compared to the waves in 2020 and 2021, with the spread of the omicron variant proving more difficult to contain.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

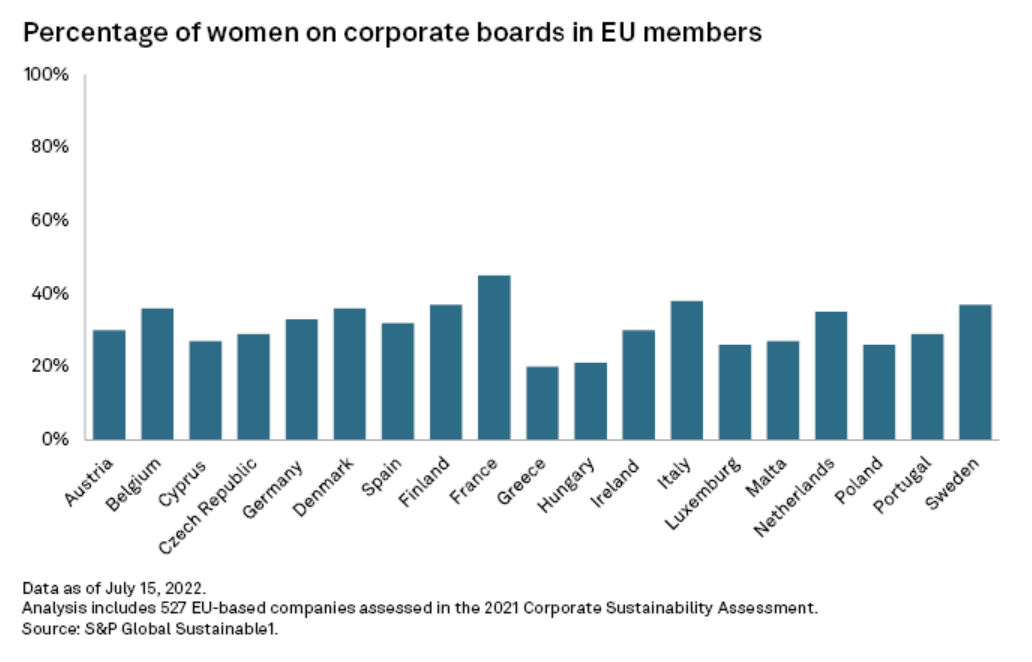

ESG Regulatory Tracker – June 2022

Regulation is shaping the sustainability agenda and changing the way companies do business in different jurisdictions but keeping pace with constant regulatory updates has become a mammoth task for businesses and investors. In this recurring series, S&P Global Sustainable1 presents key environmental, social, and governance regulatory developments and disclosure standards from around the world. This month’s update looks at an agreement between the European Parliament and EU governments on gender quotas on boards, new green finance guidelines in China for financial institutions, and Canada’s new carbon emissions offset credit system.

—Read the article from S&P Global Sustainable1

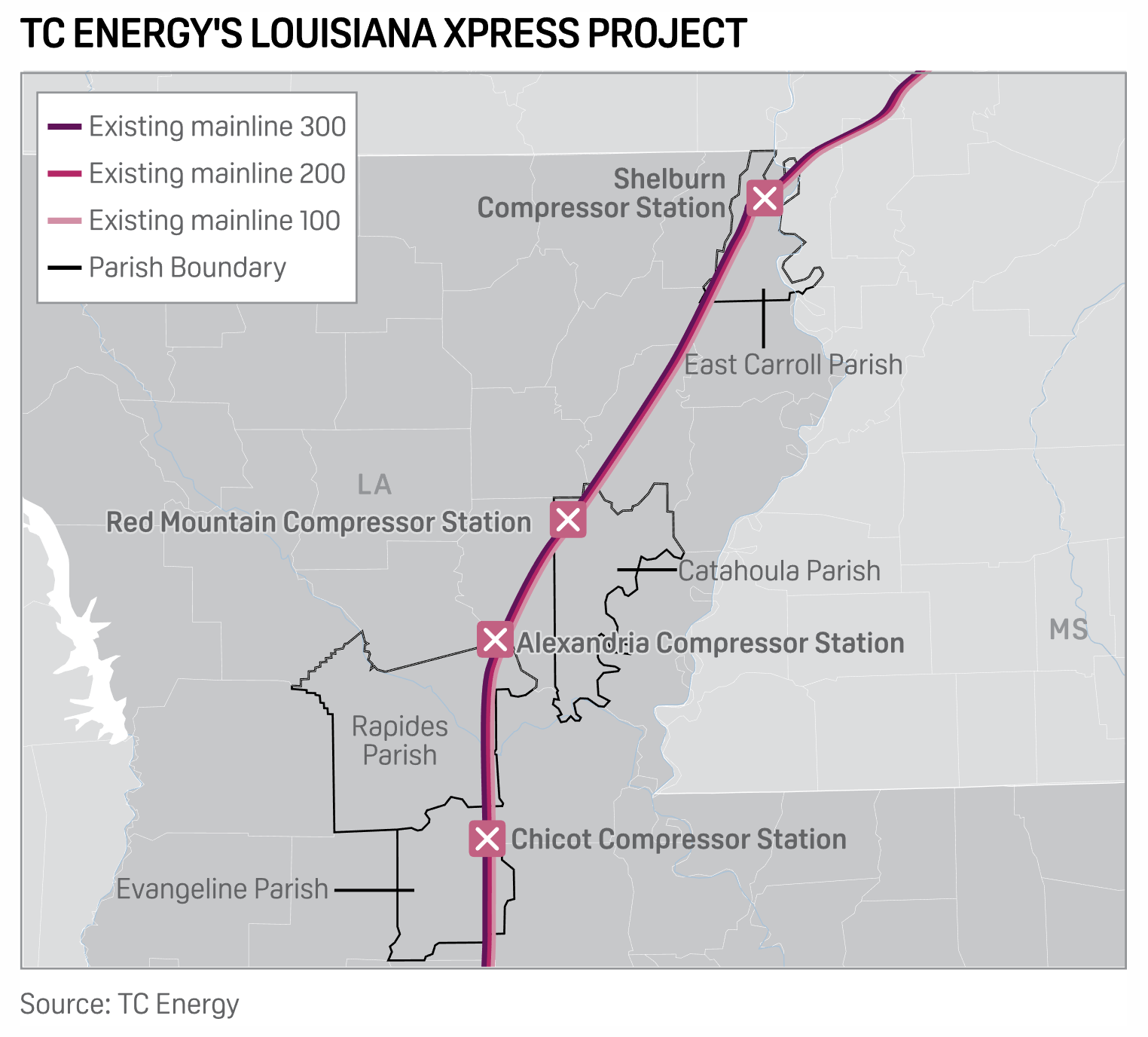

TC Energy Seeks 3 More Months To Finish Louisiana XPress Gas Pipeline Project

TC Energy asked the U.S. Federal Energy Regulatory Commission for three more months to finish construction and fully place into service Louisiana XPress natural gas pipeline project, citing ground settlement issues that have delayed completion of a final compressor station. The expansion on Columbia Gulf Transmission will help to supply Cheniere's Sabine Pass Train 6 LNG export facility by delivering gas into Kinder Morgan's Acadiana Expansion, which is already online and delivers into Sabine Pass.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

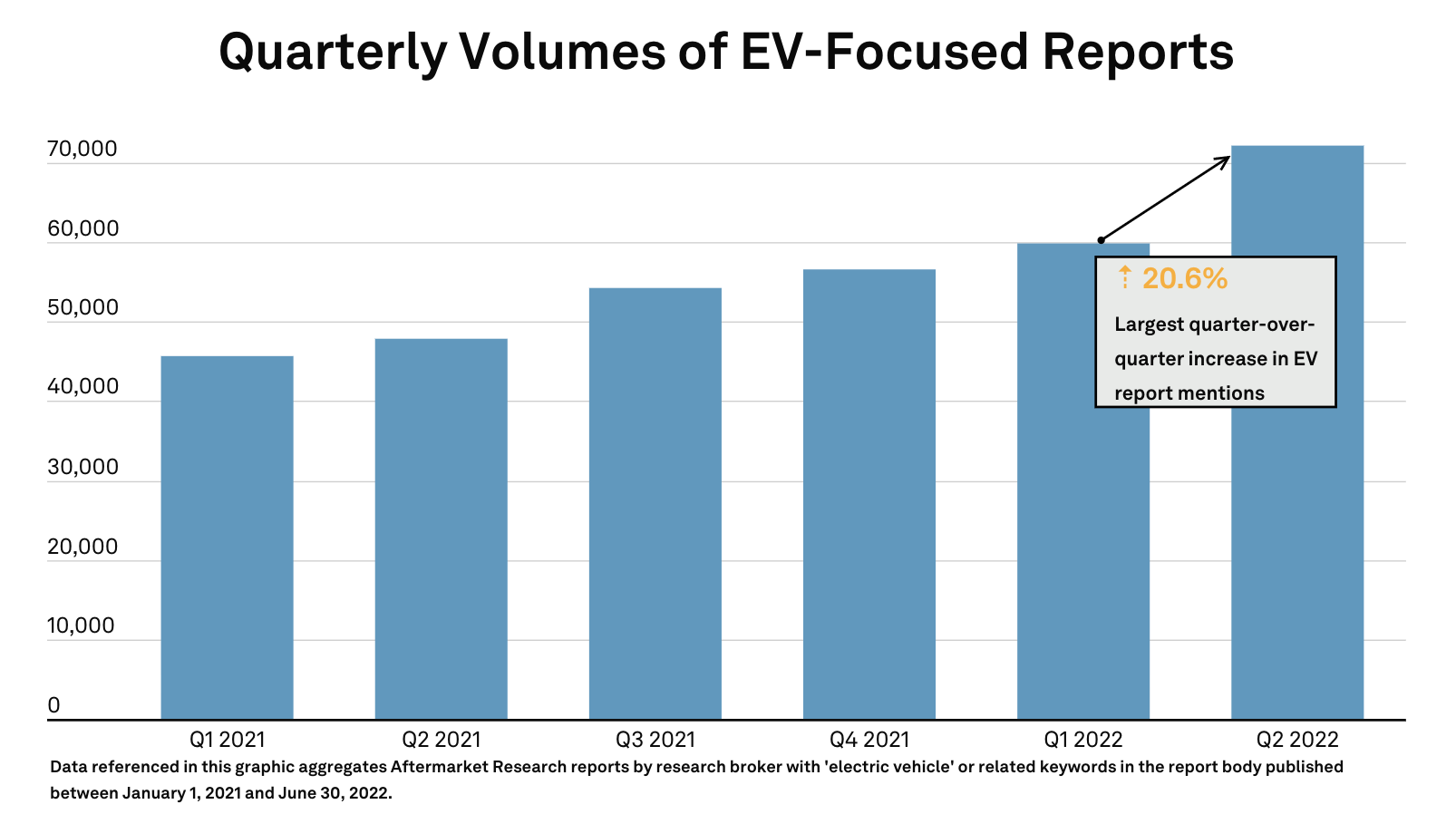

Research Brokers Accelerate Their Coverage Of Electric Vehicles

According to Edouard Tavernier, President of S&P Global Mobility, hybrid and electric vehicles have helped push the automotive industry into "a fundamental business model and technology transformation—arguably the biggest revolution since mass production." To keep up with this upheaval, the world's top investment research brokers have devoted more coverage to the electric vehicle space.

—Read the article from S&P Global Market Intelligence