Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 13 Jul, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Still Not a Good Time for Borrowers

It remains a challenging time for borrowers as high interest rates, slowing economic growth and other downside risks keep credit conditions tight, according to a series of recent reports by S&P Global Ratings.

Lower-rated and highly leveraged borrowers are likely experiencing the most pain. Commercial real estate is among the sectors that could feel the bite due to significantly declining asset valuations amid tight financing conditions.

Interest rates are expected to stay higher for longer as many central banks continue to battle stubborn core inflation. While economies have generally been resilient in 2023 in the face of multiple stressors, several have yet to see the full impact of elevated interest rates. S&P Global Ratings analysts believe that once the full effects of the hikes manifest, weaker economic growth could follow.

In North America, the US Federal Reserve is poised to resume rate hikes after the hawkish pause in June, and no cuts are expected to be announced before mid-2024. In Canada, one of the economies where the full effect of rate hikes has yet to manifest, the central bank hiked the benchmark rate to 5% on July 12.

With corporate earnings already under pressure and debts coming due, borrowers at the lower end of the credit spectrum could suffer liquidity constraints and face debt-servicing issues, according to S&P Global Ratings. More stringent lending standards, as banks strive to bolster their balance sheets and preserve liquidity, will further restrict access to funding, especially for small and midsize businesses and households.

In Europe, the continued resilience of economies indicates that much of the real impact of interest rate hikes has yet to be seen, according to S&P Global Ratings analysts. Credit conditions will likely continue tightening as interest rates are expected to stay restrictive until central banks are close to restoring price stability — something the analysts do not see happening before 2025 in the eurozone. Real short-term interest rates could enter positive territory in 2024 for the first time since 2007-–2008.

Like in North America, higher funding costs, banks that are more risk averse and a heightened focus on credit quality will be key themes in Europe.

The credit outlook for Asia-Pacific, meanwhile, is complicated by desynchronized global economic growth, inflation and policy interest rate trends, according to S&P Global Ratings.

With several central banks continuing monetary tightening, export-centric economies will face weakening global demand and "souring" household sentiment, which will curtail export activities and consumption and put pressure on corporate revenues. High interest rates also mean costlier financing, resulting in lenders becoming risk averse.

Emerging markets in Asia-Pacific and elsewhere have seen credit conditions somewhat improve as inflationary pressures ease, but they will not be immune to the pressure of weakening global demand and high financing costs. Higher interest rates in the US, eurozone, UK and potentially Japan will make it challenging for central banks in emerging markets to ease monetary policy as they face the risk of capital outflows and weaker currencies.

Today is Thursday, July 13, 2023, and here is today’s essential intelligence.

Written by Jasmine Castroverde.

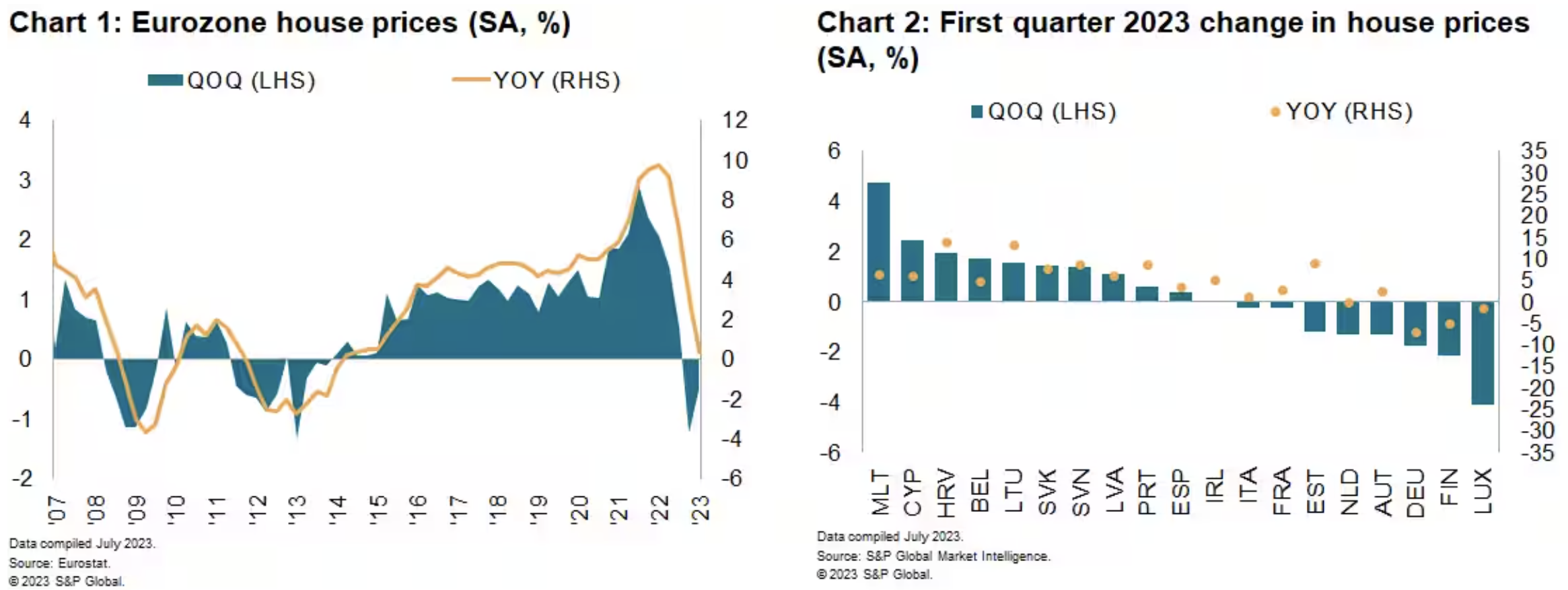

Eurozone House Prices Record Second Consecutive Quarterly Decline

The rapid tightening of financing conditions and continued feed-through of higher interest rates to consumers, plus an increase in inflation to levels last observed half a century ago, are weighing on the housing market.

—Read the full article from S&P Global Market Intelligence

Access more insights on the global economy >

Relentless Funding Costs Drive Expectations for Big Bank Earnings Declines

Banks are entering the second-quarter earnings season under unrelenting funding cost pressure, with analysts expecting broad declines in revenue and earnings and bracing for even greater downside.

—Read the full article from S&P Global Market Intelligence

Access more insights on capital markets >

Global Trade Falls at Fastest Rate for Five Months in June

The worldwide Purchasing Managers' Index (PMI) surveys compiled by S&P Global Market Intelligence indicated a sixteenth monthly fall in export orders for goods and services at the end of the second quarter. At a five-month low of 48.3, down from 48.8 in May, the seasonally adjusted PMI New Export Orders Index signalled a steepening downturn in global trade, as falling goods trade was accompanied by a softening expansion of services exports.

—Read the full article from S&P Global Market Intelligence

Access more insights on global trade >

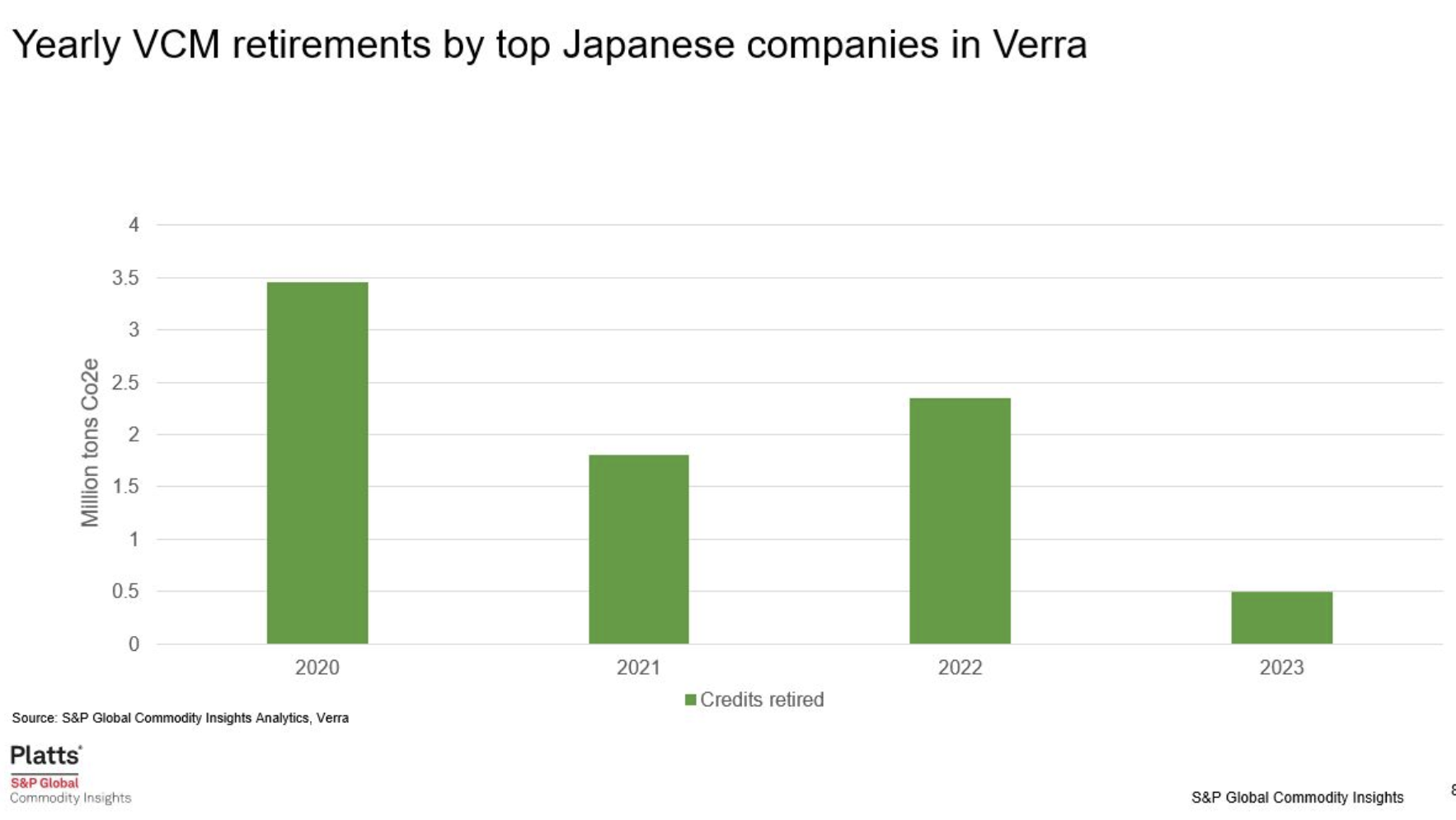

Japan Eyes Voluntary Carbon Market Amid Low J-Credit Liquidity

Given the lack of clarity on the rules and regulations around Japan's GX-ETS, the country's planned emissions trading scheme to help meet national climate targets, carbon market participants have shifted their focus to the voluntary carbon market.

—Read the full article from S&P Global Commodity Insights

Access more insights on sustainability >

Listen: Dan Yergin on Energy Security, Being An Entrepreneur, Advising U.S Presidents & His New Book

Daniel Yergin, Vice Chairman at S&P Global, Pulitzer-Prize winning author and founder of CERA, joins host Joe Cass on this special 1-on-1 episode of Fixed Income in 15. Topics included Dan’s newest book ‘The New Map’, challenges of the energy transition, founding Cambridge Energy Research Associates in 1983 and his experiences advising multiple U.S Presidents.

—Listen and Subscribe to Fixed Income in 15, a podcast from S&P Global Ratings

Access more insights on energy and commodities >

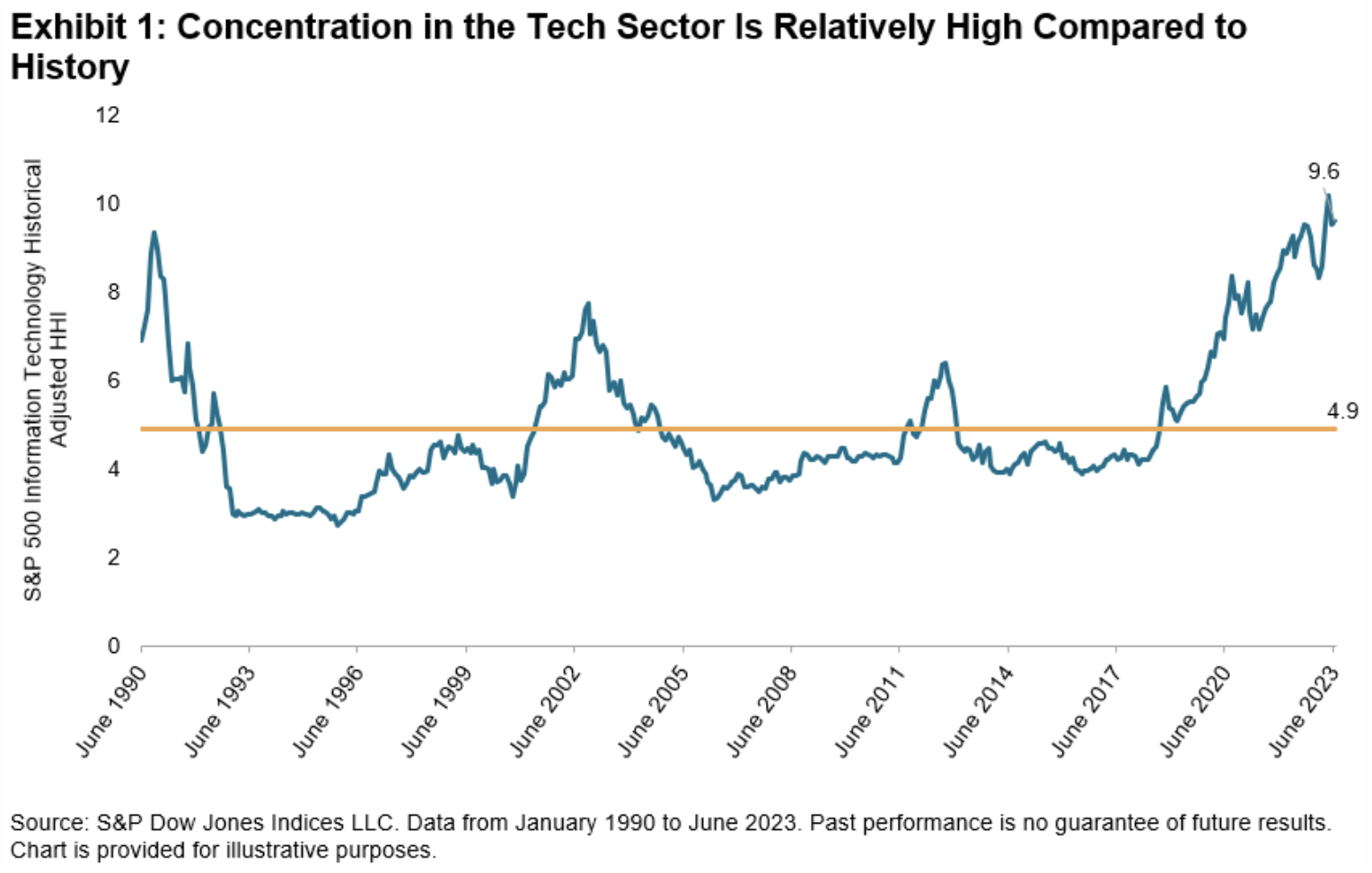

Towering Tech

The performance of large-cap Technology stocks so far this year has been exceptional, with the S&P 500® Information Technology sector outperforming the S&P 500 by 26% over the six-month period ending June 30, 2023—the 97th percentile of all observations in our database. Tech’s outperformance, driven by mega-cap strength, has been especially notable because of its narrow breadth.

—Read the full article from S&P Dow Jones Indices

Content Type

Location

Segment

Language