Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 29 Jan, 2024 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Japan Takes Tentative Steps Away from ‘Lower for Longer’

In the late 1990s, Japan’s central bank attempted to overcome economic stagnation by lowering interest rates. Rates in Japan have hovered near 0% for over a quarter of a century. There is no modern historical precedent for a major economy maintaining such low interest rates for so long. Now, the Bank of Japan (BOJ) has begun taking steps to raise interest rates in response to persistent inflation. However, it has been more than a generation since the banking, equity, real estate and loan markets in Japan have confronted even modestly higher rates, so the impact of these changes will be difficult to predict.

In 2016, the BOJ strengthened its existing policy of monetary easing by applying negative interest rates. In practical terms, this means that borrowers earn a profit on money borrowed from the central bank. Confronting persistent inflation of about 3.3%, the BOJ began taking steps to reverse these negative rates in 2023. According to S&P Global Ratings, the short-term policy interest rate in Japan is projected to remain at 0% in 2024, before climbing to 0.25% next year and to 0.50% in 2026. These modest interest rate rises are not anticipated to have a major influence on Japan’s GDP or unemployment rate, which stands at about 2.6%.

Many US banks recorded high profits in 2023 due to increased income from interest rates. The same may be true of some Japanese banks in 2024. For the three major banking groups in Japan, S&P Global Ratings anticipates a 3% rise in net operative profit, thanks mostly to a 12% rise in income from loans due to higher interest rates. However, not all Japanese banks have the loan portfolios to take advantage of higher rates. Many Japanese banks invest in securities rather than loans. In these cases, higher unrealized losses on bond holdings resulting from higher interest rates may negatively affect some Japanese banks. Outcomes for Japanese banks will grow increasingly polarized due to interest rate changes.

Japan’s private sector is expected to return to growth in early 2024, largely on the strength of a resurgent service sector. With inflation cooling from a high of about 4% in 2022 and expectations that it will decrease to the BOJ’s target rate of 2% early this year, price pressures are easing in the Japanese economy. Economic optimism is translating into positive performance in Japanese equities.

Japan’s real estate prices continue an upward trajectory that began during the COVID-19 pandemic, with condominiums and detached homes increasing in value. According to S&P Global Ratings, these prices are probably due to a downward trend in supply resulting from few housing starts. Supply has taken a hit, but demand remains high because of very low unemployment. The modest interest rate rises undertaken by the BOJ are unlikely to impact housing prices if supply remains low and demand stays high. Most homes in Japan are purchased by borrowers in their 30s, whose housing needs are unlikely to be affected by 25-basis-point changes in the policy rate.

Today is Monday, January 29, 2024, and here is today's essential intelligence.

Written by Nathan Hunt.

Economic Research: European Housing Markets: Forecast Brightens Amid Ongoing Correction

European house prices proved more resilient than expected in 2023, leading S&P Global Ratings to change its forecasts for the housing market. The extent of our upward revisions varies greatly from country to country, and is most pronounced for the UK, Ireland, and countries in southwest Europe such as Spain and Portugal. Meanwhile, only Germany and Sweden depart from the general trend toward greater housing price resiliency in 2023.

—Read the article from S&P Global Ratings

Access more insights on the global economy >

US Equity REIT Capital Offerings Up 13.5% In 2023

US equity real estate investment trust capital market activity grew in 2023, with the industry raising a total of $58.27 billion. The total was a 13.5% increase from the $51.36 billion raised by the industry in 2022, according to S&P Global Market Intelligence data. The majority of the capital raised in 2023 came through debt offerings, which brought in $44.87 billion for REITs. Common equity offerings accounted for $12.66 billion, while the remaining $748.5 million was obtained through preferred equity offerings.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

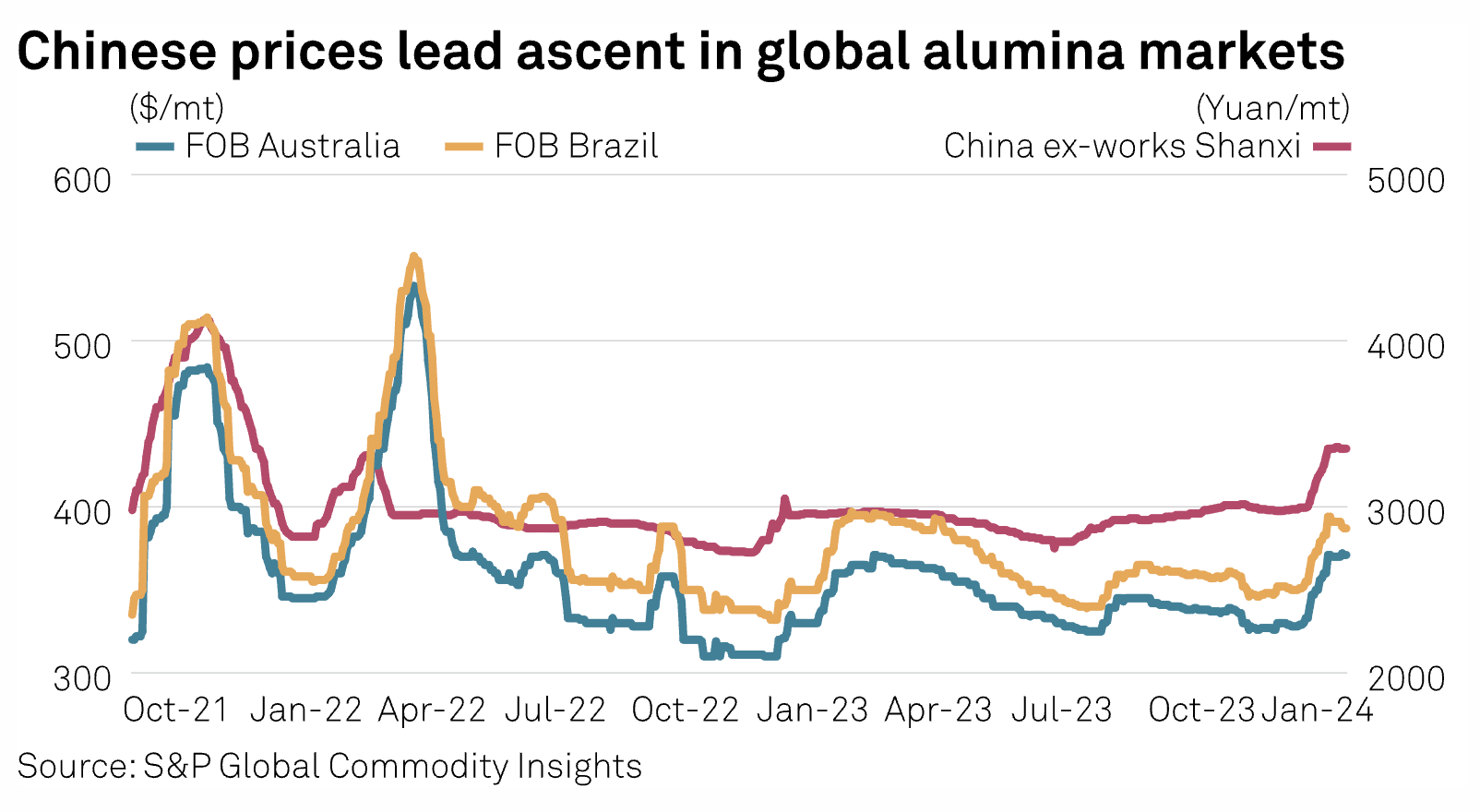

Global Alumina Markets To Inch Higher In Q1 On Refinery Cuts, Bauxite Supply Concerns

Global alumina markets kicked off the first quarter of 2024 with support seen on the back of upcoming and ongoing refinery cuts and elevated Chinese domestic prices on bauxite supply concerns, although downstream aluminum demand fundamentals remain largely unchanged amid minimal additional smelter restarts and expansions.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: Recycled Polymers Outlook

In the first episode of an occasional series on recycling and sustainability, S&P Global Commodity Insights Global Sustainable Senior Editor Heng Hui and European Chemicals Analyst Iris Poon join host Abdulaziz Ehtaiba to discuss the outlook for recycled polymer markets, with a particular focus on geographic differences, regulation and price dynamics.

—Listen and subscribe to Chemical Week, a podcast from S&P Global Commodity Insights

Access more insights on sustainability >

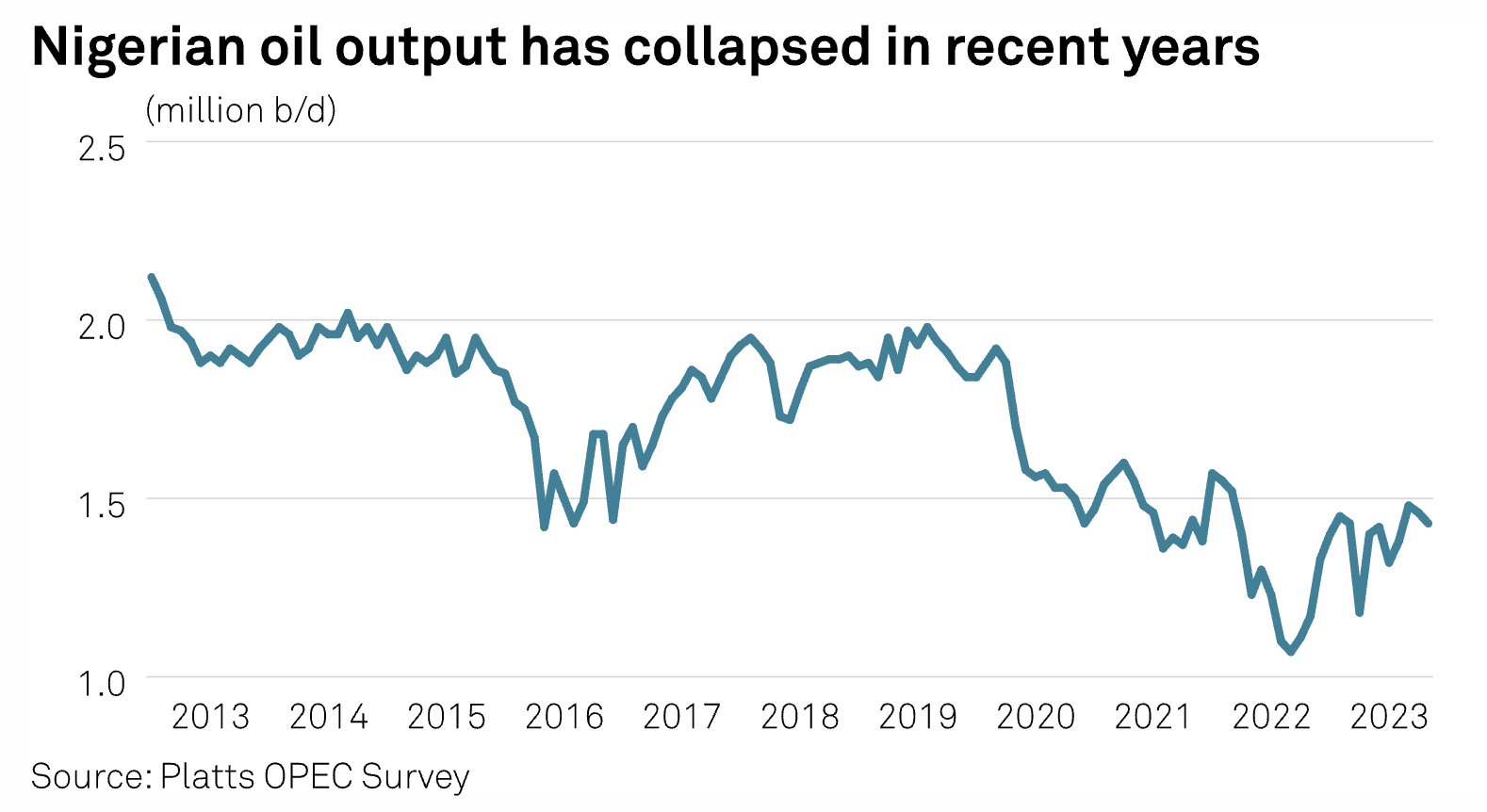

Chevron Lays Out Nigeria Investment, Drilling Plans Amid IOC Exodus

Chevron is scaling up investments in Nigerian deepwater and has acquired a stake in juicy oil block OPL 215, Nigerian officials said Jan. 25, amid struggles by the OPEC member to retain IOCs like the US major. Clay Neff, president of Chevron International Exploration and Production, who unveiled the company's investment plans during a meeting with President Bola Tinubu in Abuja, said the company was entering a new phase of development of deepwater leases in Nigeria.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

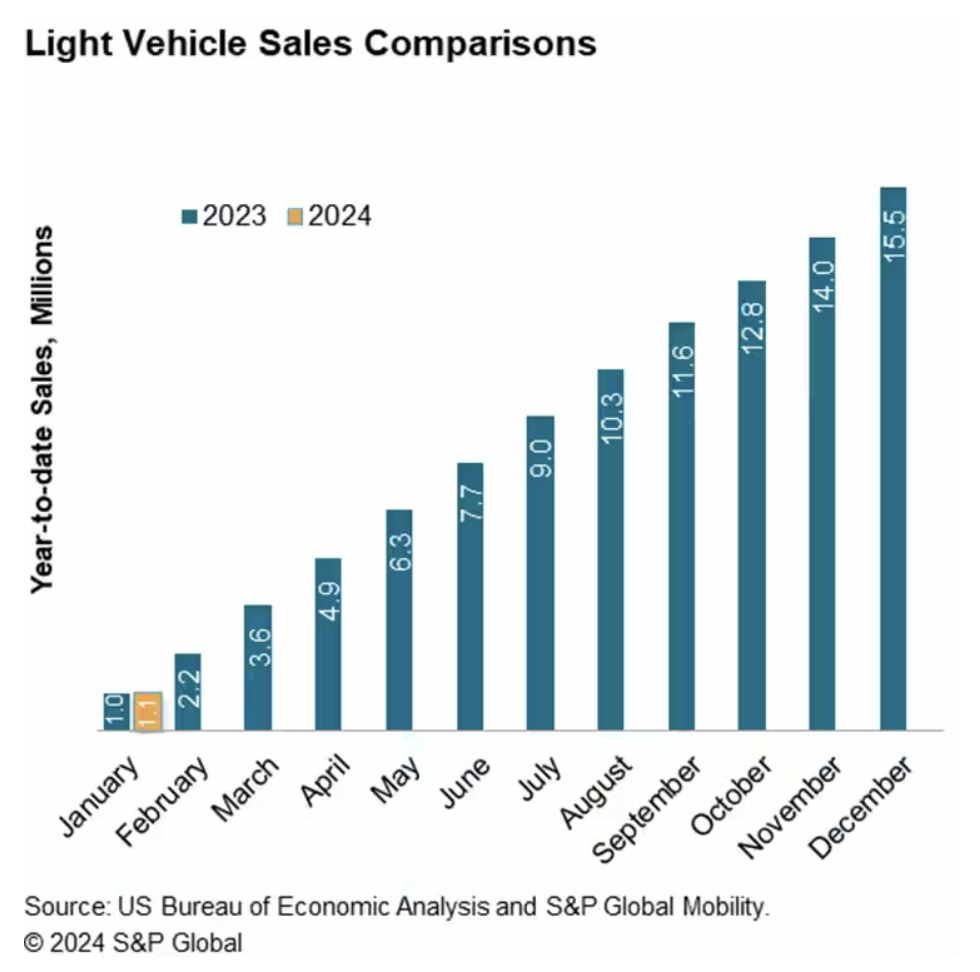

January 2024 US Auto Sales Feel The Chill

With volume for the month projected at 1.09 million units, January 2024 U.S. auto sales are estimated to translate to a sales pace of 15.2 million units (seasonally adjusted annual rate: SAAR). While this would be an improvement from the year-ago level, the result reflects a potential preview to the upcoming calendar year whereby month-to-month volatility is expected to remain in the market. Contributors to the chill in the January sales pace include an expected hangover from the solid closeout to sales in December 2023, combined with some inclement weather effects.

—Read the article from S&P Global Mobility