Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 19 Jan, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Wind Power Surges Amid Energy Industry Disruption

Despite stubbornly high energy prices and a comeback for coal-fired power in some European countries, particularly Germany, wind-power developers and suppliers continue to see high demand and strong buildouts.

Taller and more powerful turbines, regulatory reforms and the opening of new areas for wind development, especially along the U.S. West Coast, underlie the industry’s recent advances.

In the U.K., the Conservative government has moved to lift a de facto ban on new onshore wind projects and said it will consult with businesses and environmental groups on wind-power planning policy, S&P Global Commodity Insights reported. The U.K. has 14.24 GW of operating onshore wind capacity, but new onshore plant additions have slowed to a near halt in recent years. Conservative lawmakers have exhorted their leaders to lift the prohibition in areas where local communities support new facilities.

The latest announcement marks a major shift by Prime Minister Rishi Sunak, but Labour Party leaders said it is not enough to help accelerate the country’s transition to clean energy.

"This will still leave onshore wind in a unique position in relation to planning, making it harder to build than incinerators or landfill sites," Shadow Climate Change Secretary Ed Miliband told BBC Radio.

The country’s influential Climate Change Committee recommends the U.K. double its onshore capacity to 29 GW by 2030.

The U.S. government, meanwhile, is moving forward with ambitious plans to build a new wind-power industry in a much more challenging environment: the deep Pacific Ocean off the coast of California and Oregon.

The first federal offshore wind energy lease auction in the Pacific drew competitive bids from five companies totaling $757.1 million, exceeding the figure for the first lease sales in the Atlantic region, the Interior Department said Dec. 7, 2022. Building wind farms in the deep water off the West Coast requires floating turbines, a technology that is still relatively young. The five initial lease areas off the Californian coast have the potential to produce more than 4.6 GW of offshore wind energy, marking “a historic step on California's march toward a future free of fossil fuels," California Gov. Gavin Newsom said in a statement.

That future includes taller and more powerful wind turbines as the ongoing race for greater scale in the offshore wind market continues, according to S&P Global Market Intelligence. Two Chinese manufacturers, CSSC Haizhuang Windpower and Ming Yang Smart Energy, recently unveiled plans for gigantic 18-MW offshore turbines, surpassing the previous record of 16 MW announced by Ming Yang in August 2021.

Those behemoths will tower above the 15-MW turbines made in recent years by Western manufacturers Vestas Wind Systems, Siemens Gamesa Renewable Energy and General Electric. Beset by rising costs and supply chain issues, these companies have struggled with profitability in recent years, and not everyone thinks the race to build ever-larger turbines is benefiting the industry.

"The expensive race for rapid and steep [levelized cost of electricity] improvements through bigger and bigger machines in which manufacturers are currently engaged is neither financially sustainable, nor necessary considering the higher cost of alternative power generation sources and the surging demand for clean energy," said former Siemens Gamesa onshore CEO Lars Bondo Krogsgaard.

Today is Thursday, January 19, 2023, and here is today’s essential intelligence.

Written by Richard Martin.

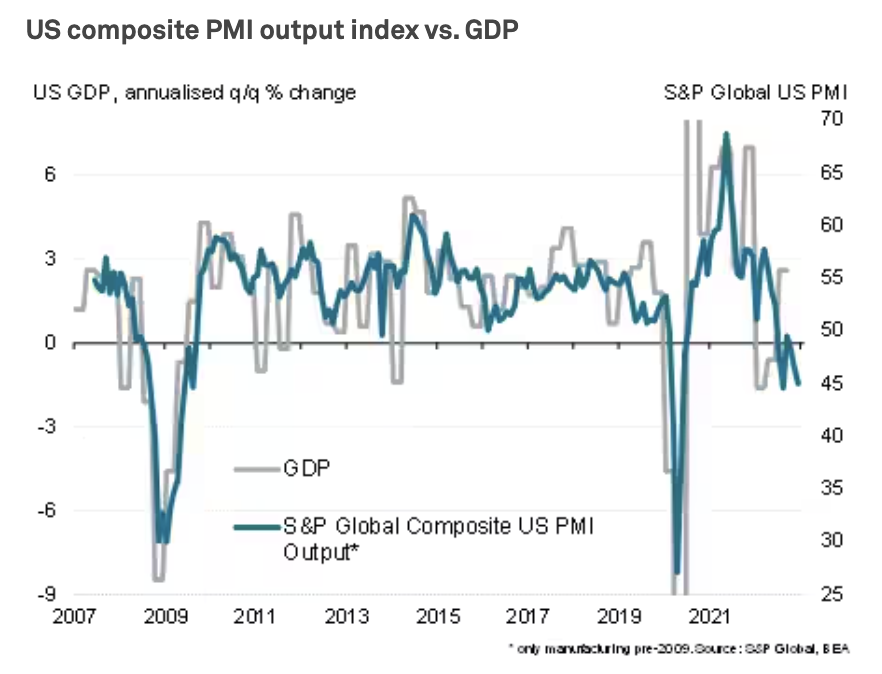

Recession Risks And Inflation Indicators: Previewing January's U.S. Flash PMI Data

Amid speculation that the U.S. could be slipping into a recession, upcoming flash PMI data will be eagerly assessed to gauge the business climate in the opening month of the year. The surveys from S&P Global have been sending especially weak signals for output and demand growth, albeit with labor markets remaining relatively resilient, which has in turn led to a marked cooling of inflationary pressures. Putting all of the signals together will provide insights into the potential future path of monetary policy.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

The Key To The S&P 500 ESG Index’s Outperformance: Avoiding The “Worst”

Now approaching its fourth anniversary since launch, the S&P 500 ESG Index seeks to reflect many of the attributes of the S&P 500 itself, while providing an improved sustainability profile as a result of an updated ESG score. With live performance data covering an extraordinary period — including two bear markets on either side of a growth boom — we are presented with a real-world performance test for the index’s improved sustainability profile.

—Read the article from S&P Dow Jones Indices

Access more insights on capital markets >

Listen: China's Oil Product Export Quota: What It Means For Asia's Supply And Demand In The New Year

China has already hinted at its first batch of oil product export quota for 2023, which has left some market watchers nervous amid the current economic headwinds at the start of this year. This episode looks deeper at the implications of the oil product export quota from China, how it could impact the oil product supply-demand fundamentals in Asia and what the rest of Asia can expect.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

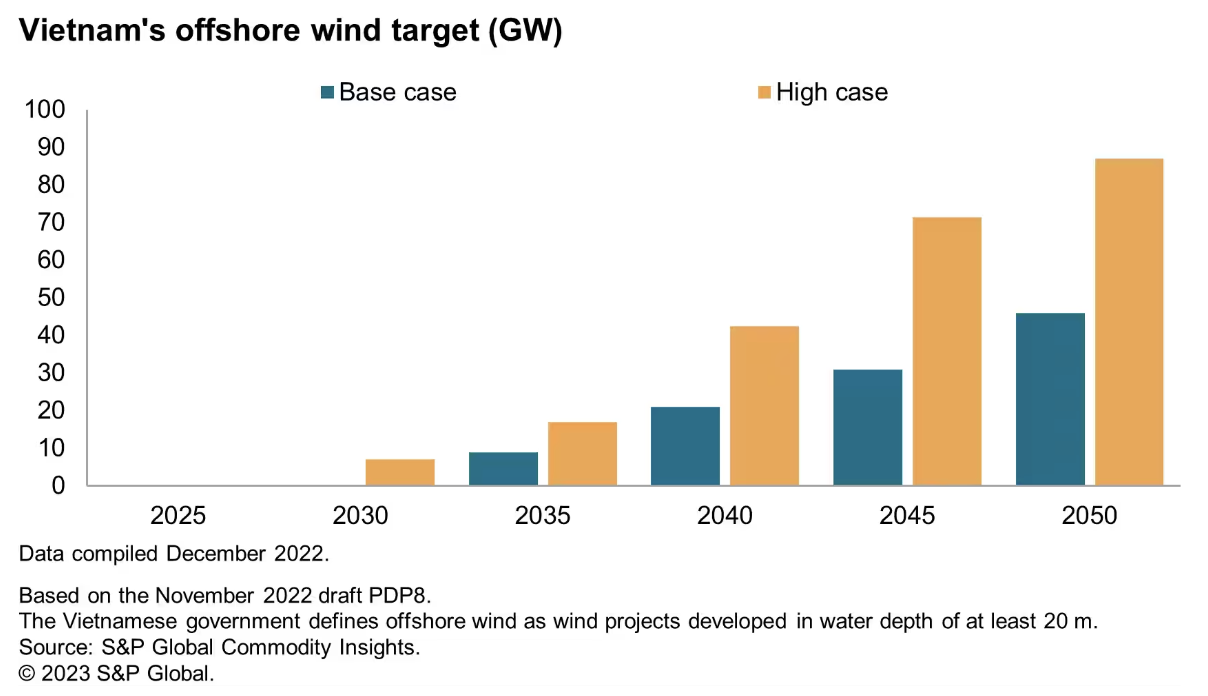

Seizing Offshore Wind Investment Potential In Southeast Asia

Vietnam and the Philippines have been gaining traction among offshore wind developers and investors. About half of electricity generation in these economies still comes from coal, while growth in electricity demand is among the highest in the region. Offshore wind is well positioned to cater to the rising demand or displace old coal-fired power plants owing to their large capacity and high-capacity factor relative to solar or onshore wind.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability

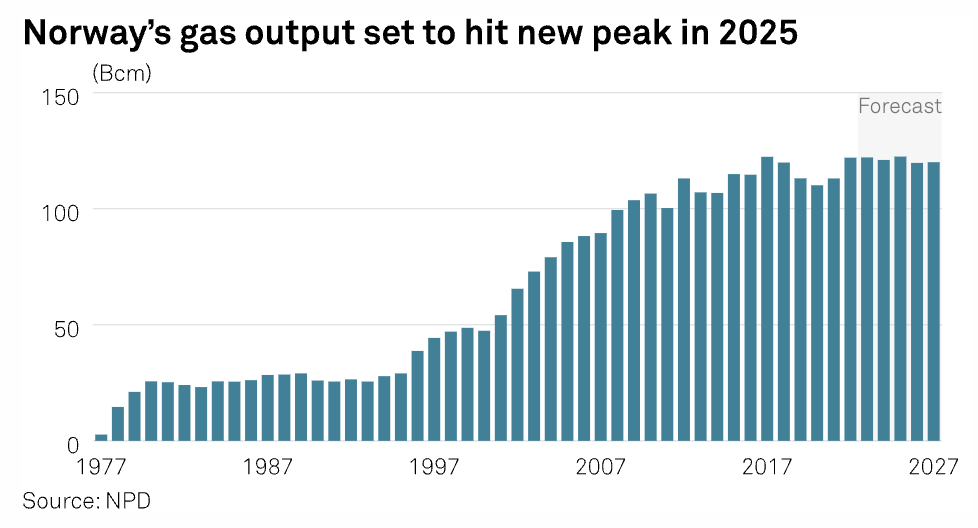

Norway's Equinor Makes Gas Discovery Near Irpa Field In Norwegian Sea

Norway's state controlled Equinor has made a commercial gas discovery in the Norwegian Sea close to the Irpa field, it said Jan. 18, the first find on the Norwegian Continental Shelf in 2023. Recoverable gas reserves at the Obelix Upflank find in license area 1128 are estimated at 2-11 Bcm of gas, Equinor said in a statement. Equinor — together with partners Wintershall Dea and Petoro — drilled exploration wells 6605/1-2 S&A in the Norwegian Sea that led to the discovery.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

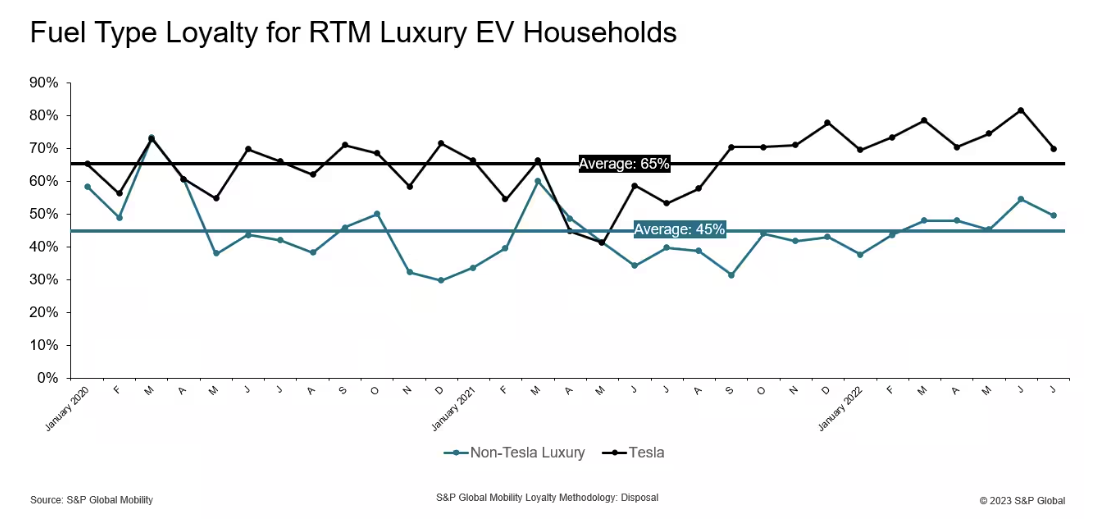

Yet Another Tesla Advantage

Auto industry observers more than once have commented that the U.S. luxury market really is two different markets, with Tesla in one and the nineteen other luxury marques in the other. Here's another finding supporting that observation: Tesla owners who return to market are much more likely to acquire another electric vehicle than owners of non-Tesla luxury EVs.

—Read the article from S&P Global Mobility

Access more insights on technology and media >

CERAWeek by S&P Global — Navigating A Turbulent World: Energy , Climate and Security

Join global leaders, policymakers and executives from across energy, climate, finance, technology and industry at CERAWeek 2023 for timely dialogue, shared learning and connection.

—Register for CERAWeek