Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 6 Feb, 2024 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Selling Picks and Shovels in the AI Goldrush

Nvidia gained prominence on the back of its high-performance graphics processors, which are beloved by video game enthusiasts for their ability to quickly render complex game graphics with minimum glitching. Nvidia graphics processors are able to render these images by handling huge numbers of simple calculations quickly and simultaneously. This ability also made Nvidia chips popular with cryptocurrency miners and for many AI applications. In a world where a gold rush is on for AI companies, Nvidia is succeeding by selling the processors on which all of these companies rely.

Nvidia President Jensen Huang has envisioned the potential of this business strategy for years. Back in September 2020, when Nvidia was trying to buy chip designer ARM from Softbank (a deal that fell through), Huang laid out a vision in which the market would become saturated with AI applications that run on Nvidia hardware in a wide range of devices, including phones, edge networks and cloud-based datacenters. Huang’s vision is now much closer to being realized.

Nvidia's chips have become indispensable for AI companies. Since the release of AI software ChatGPT, the demand for Nvidia’s chips has increased sharply, nearly tripling the company’s revenue and sending its stock up more than 200%. In recent months, Nvidia has significantly increased spending in its venture arm. Most of these venture investments are in startups in the AI sector. As a result of these investments, Nvidia became the fourth-largest corporate venture investor in 2023, behind Microsoft, Softbank and Alphabet. Through these investments, Nvidia appears to be incubating its next generation of multimillion-dollar customers.

In a recent blog post, Nvidia spokesperson Liz Archibald described these investments as "strategic partnerships" that can "stimulate joint innovation, enhance [the company's] platform and expand the ecosystem."

Some private equity firms are pursuing similar strategies by investing heavily in datacenters that will provide the computing power needed for widespread AI applications. Tens of billions of dollars are going to be required to build new facilities to meet this demand, and private equity has the dry powder to dedicate to large-scale projects. According to industry analysts, the demand for datacenter capacity for AI computing is additive to existing cloud computing demands. While investment by private equity funds in AI companies has also increased over the last 12 months, datacenters are perceived to be the best way to sell picks and shovels during the AI goldrush. Most of these datacenters will contain Nvidia processors.

Today is Tuesday, February 6, 2024, and here is today's essential intelligence.

Written by Nathan Hunt.

Week Ahead Economic Preview: Week of February 5, 2024

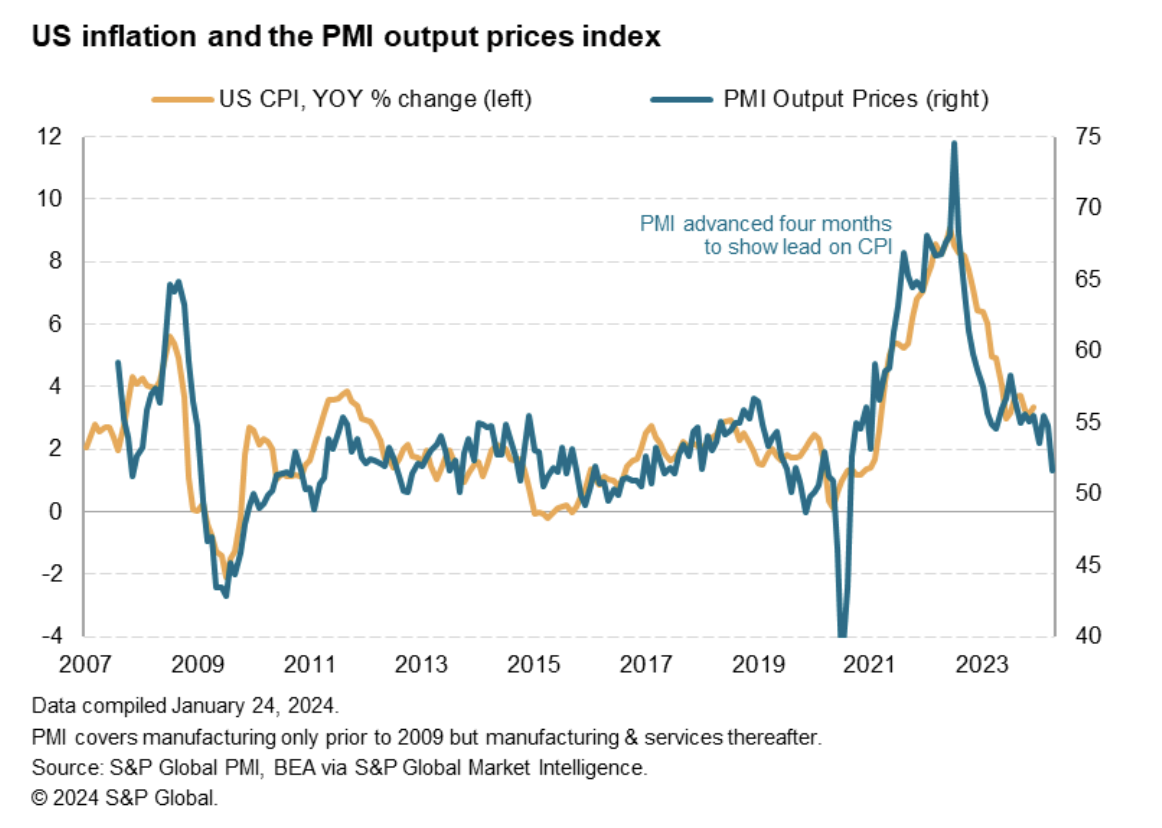

January's services PMI, plus detailed sector data, were expected to be unveiled at the start of the week to kickstart a busy data calendar. Notably, inflation figures were expected to be due across several economies including mainland China.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

2024 Outlook For US Public Finance: A Mixed Credit Picture

To start 2024, the US economy remains resilient and recession risks have moderated. Following recent economic growth adjustments, S&P Global Ratings lowered its probability of recession in 2024 to 26%. This compares with 34% last September. Inflation has receded but costs are generally higher across the board, which has pressured operating and capital budgets; effective budget management will be important to fiscal performance.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

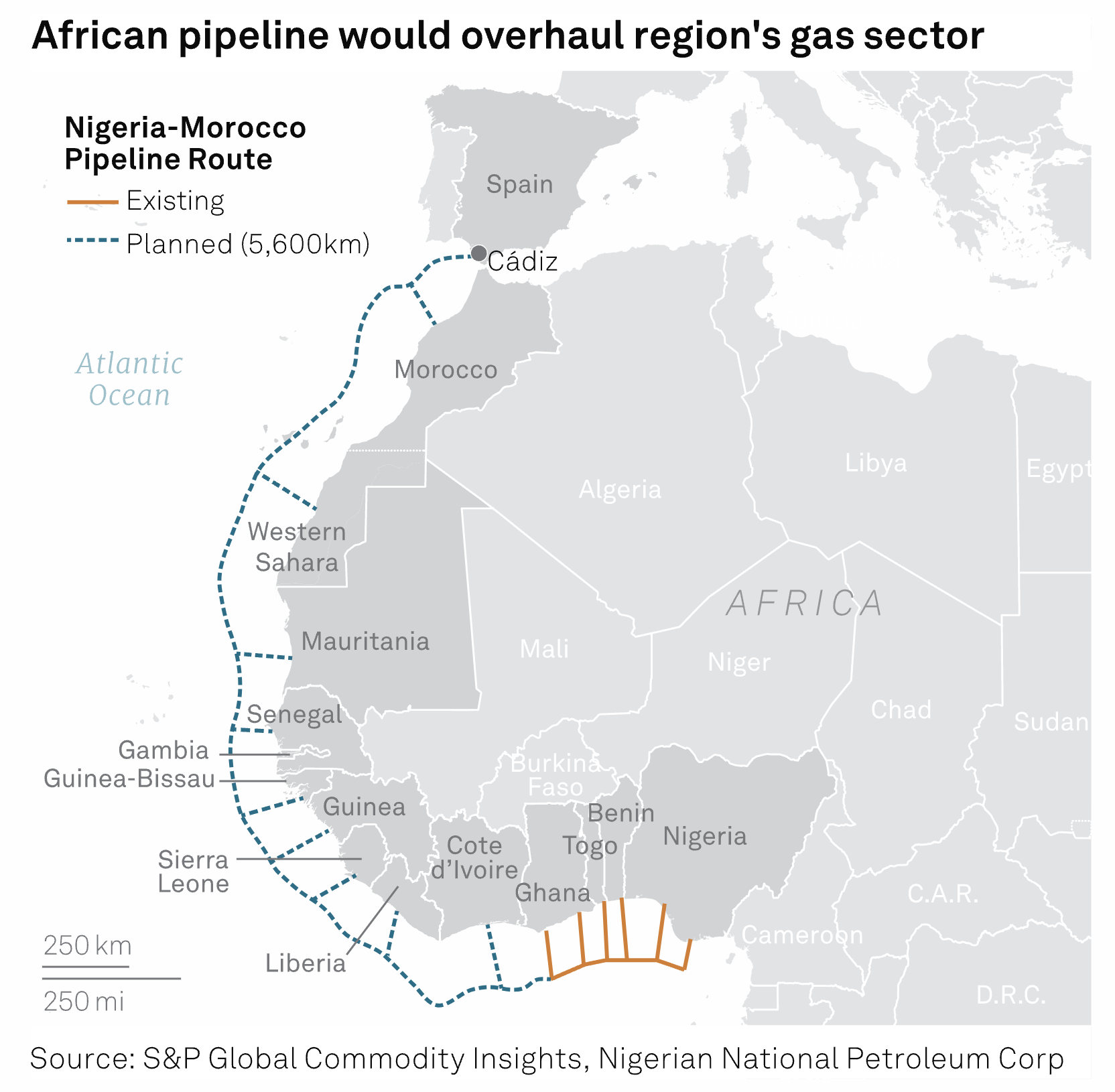

Nigeria Eyes 3 Bcf/d Gas Pipeline To Morocco After Relations Sour With Niger

Gas-rich Nigeria is looking to fast-track the construction of a 5,600-km gas pipeline to Morocco, capable of supplying Europe, after a total breakdown in diplomatic relations with Niger scuttled the Trans-Sahara pipeline to Algeria. Nigeria, Africa's biggest oil producer but a marginal gas player, has declared the 2020s a "decade of gas." The country, which is sitting on an estimated 203 Tcf of proven natural gas reserves, hopes to become a major supplier to Europe as the continent shifts away from Russian gas.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

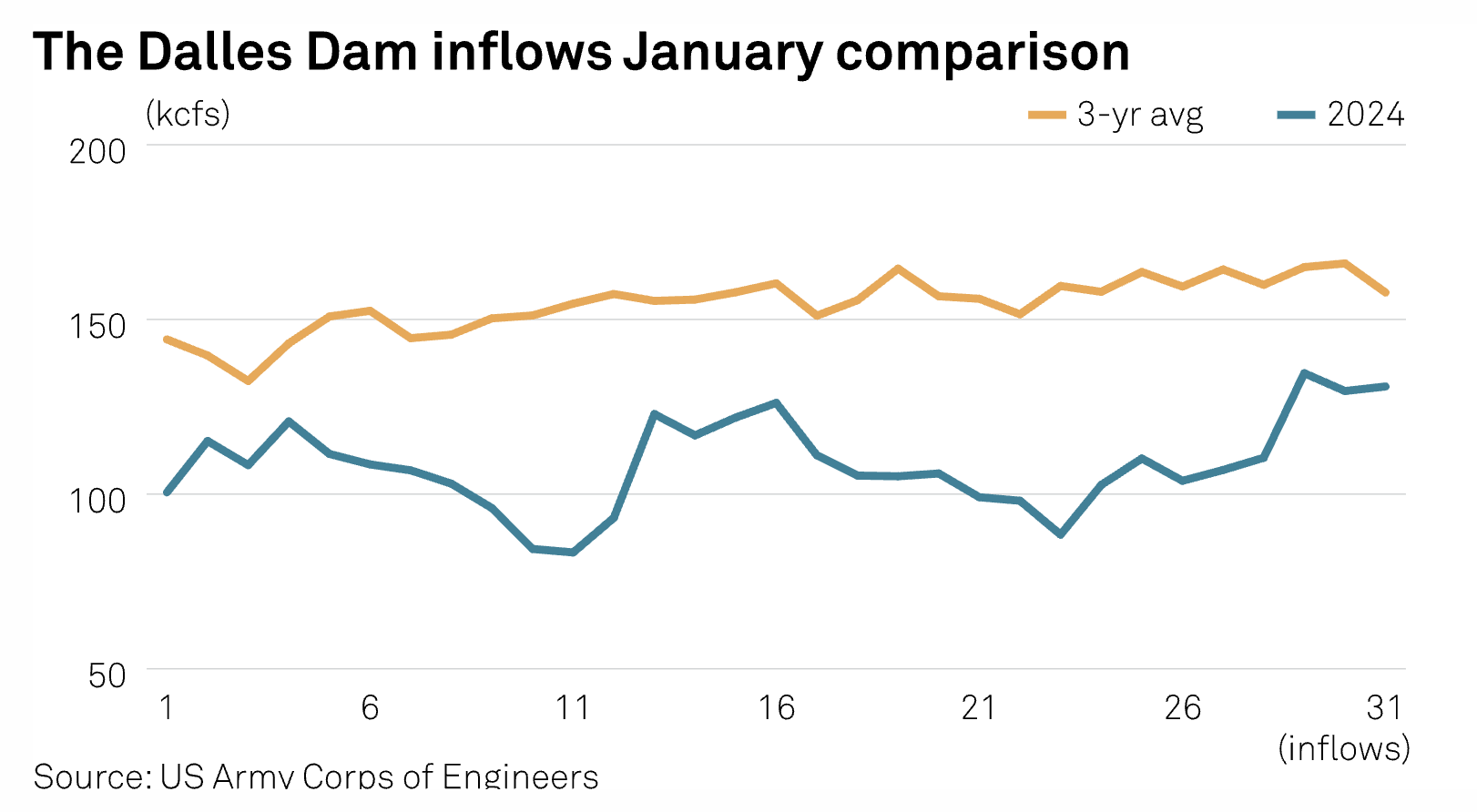

US Pacific Northwest Hydropower Trend Below Normal On Weak Snowpack

The hydropower generation outlook across the US Pacific Northwest remains below normal despite an early January cold snap and December precipitation 113% above normal. "This water year has been mostly drier and warmer than normal," Amy Burke, a hydrologist with the Northwest River Forecast Center, said during the Feb. 1 NWRFC water supply briefing. "Snowpack has been lower than normal, scraping record levels."

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

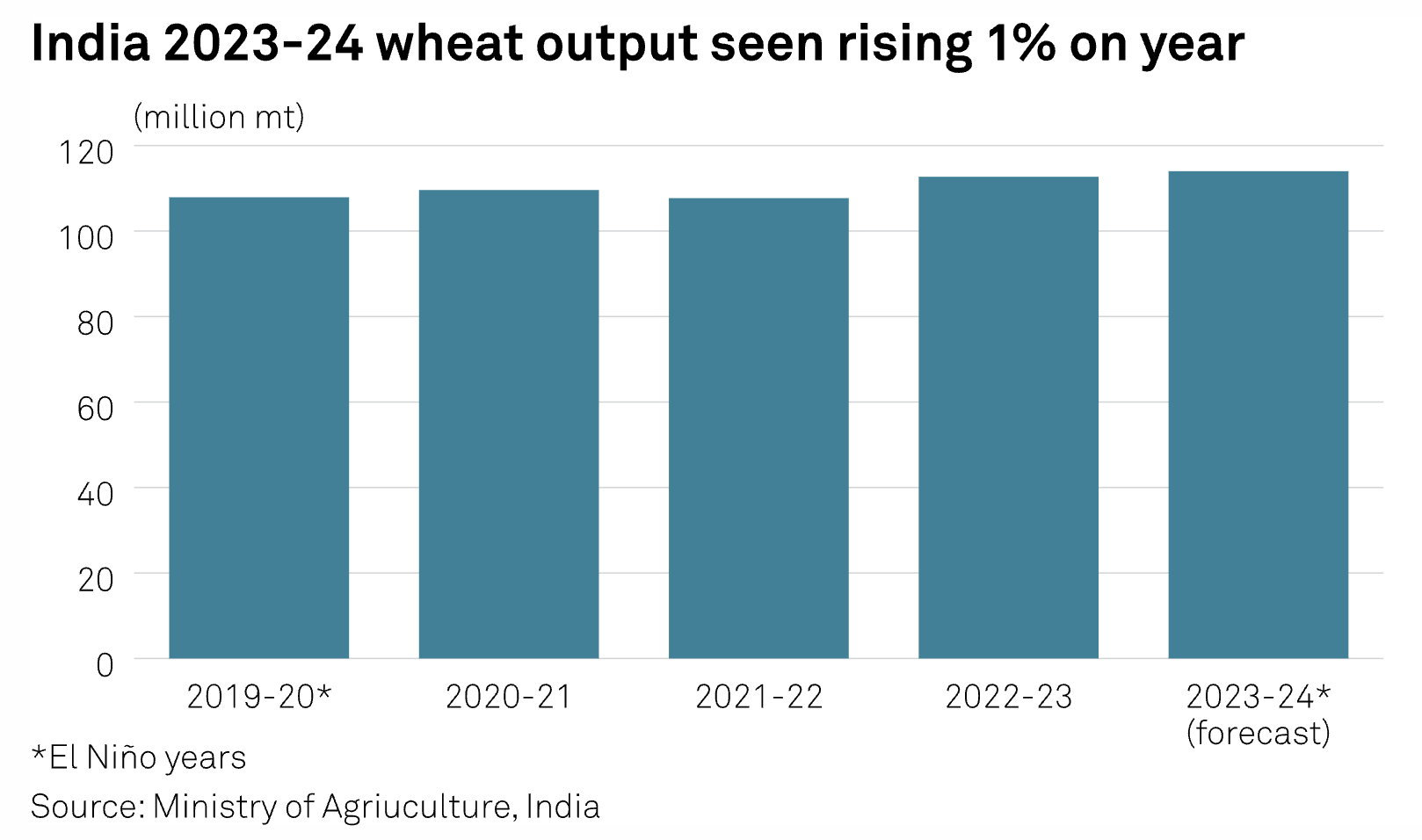

Wheat Markets In India, Indonesia Face Uncertainty Ahead Of 2024 Elections

Key players in the wheat trade, India and Indonesia are headed to the polls this year, and market sources believe that the role of agricultural policies is increasingly taking center stage, especially amid a backdrop of food security concerns and inflationary pressures. Recent elections in other countries that are also heavily involved in global grain production and trade have demonstrated the rising importance of agriculture in the political sphere.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Macao Gaming 2024 Outlook: Odds Favor Further Recovery

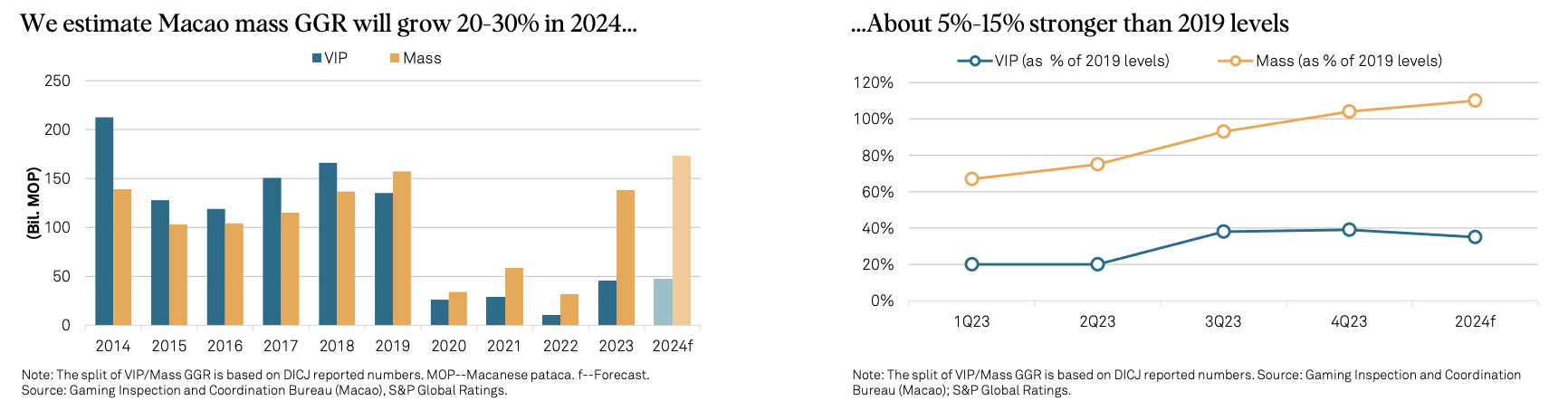

S&P Global Ratings expects Macao mass gross gaming revenue (GGR) in 2024 to be 5%-15% stronger than in the pre-COVID year of 2019. Its 2024 mass forecast implies a year-over-year increase of about 20%-30%, led by higher visitor numbers and expanded hotel capacity. Volumes for junket (also known as VIP) will likely stay near current low levels. Operators are unlikely to significantly expand junket VIP operations amid tightened regulations, in S&P Global Ratings’ view.

—Read the report from S&P Global Ratings