Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 27 Feb, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Pricing Carbon into Global Trade

On Feb. 9, the European Parliament's Committee on Environment, Public Health and Food Safety, or ENVI, passed the Carbon Border Adjustment Mechanism, or CBAM, by a margin of 63 votes to seven. While the news that ENVI passed CBAM may appear to be unimportant, acronym-heavy eurozone bureaucratese, this law could have sweeping implications for global trade in the era of climate change.

CBAM was created to prevent carbon leakage. Carbon leakage occurs when a company produces goods in a jurisdiction with weak carbon regulations and then sells those goods in a jurisdiction, such as the eurozone, that has stricter rules related to carbon emissions.

With the EU committed to tackling carbon emissions, carbon leakage could devastate heavy industry in Europe while incentivizing other regions to keep their carbon regulations lax. The European Commission originally proposed CBAM in July 2021 as part of a broad climate package designed to reduce carbon emissions by 55% by 2030. CBAM combats carbon leakage by placing a tariff on imports from countries where carbon prices are nonexistent or lower than those of the EU. Initially, CBAM will apply to imports of cement, iron, steel, aluminum, fertilizer and electricity, with tariffs phased in over a three-year transition period. But Brussels has not ruled out applying CBAM to other imports should the law prove effective in limiting carbon emissions.

“For some economies, such as the U.S., a smaller reliance on exports to the EU market might also enable ‘resource shuffling,’ directing the ‘cleanest’ products to reduce CBAM obligations,” said Michael Evans, analyst for Global Carbon Compliance Markets at S&P Global Commodity Insights. “We may also see a reorientation and shuffling of global trade, where the lowest emitting countries and producers shift a greater share of their exports to meet EU demand.”

The new carbon tariffs instituted by CBAM are proving controversial in other countries. Both advocates and critics of the law pointed out that the eurozone seems to be using its market size to institute a de facto global price on carbon.

“If a company from a country outside of the EU wants to export products into the European Union market, they will have to pay that CBAM at the border if they don't have a domestic carbon price that is high enough," said Sanjay Patnaik, director of the Center on Regulation and Markets at Washington, D.C.-based think tank the Brookings Institution. "That could really set incentives around the world.”

While an analysis by S&P Global Commodity Insights showed iron- and steel-exporting countries such as Canada, Brazil, South Africa and Turkey will pay the highest tariffs under CBAM, Asian countries are the least prepared for this global change. China has taken the lead in opposing CBAM, questioning whether the tariffs violate World Trade Organization rules. Others worry that CBAM, in seeking to lower emissions and protect European industry, could have the paradoxical effect of making it more difficult for developing economies to decarbonize.

"CBAM widens the gap between developed and developing countries in terms of [gross domestic product] and welfare, may worsen the unequal income and welfare distributions between rich and poor economies, and further erode the capacity of some low-income countries to decarbonize their economies," the Task Force on Climate, Development and the IMF of Boston University's Global Development Policy Center said in a March 2022 study.

Today is Monday, February 27, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

Week Ahead Economic Preview: Week of Feb. 27, 2023

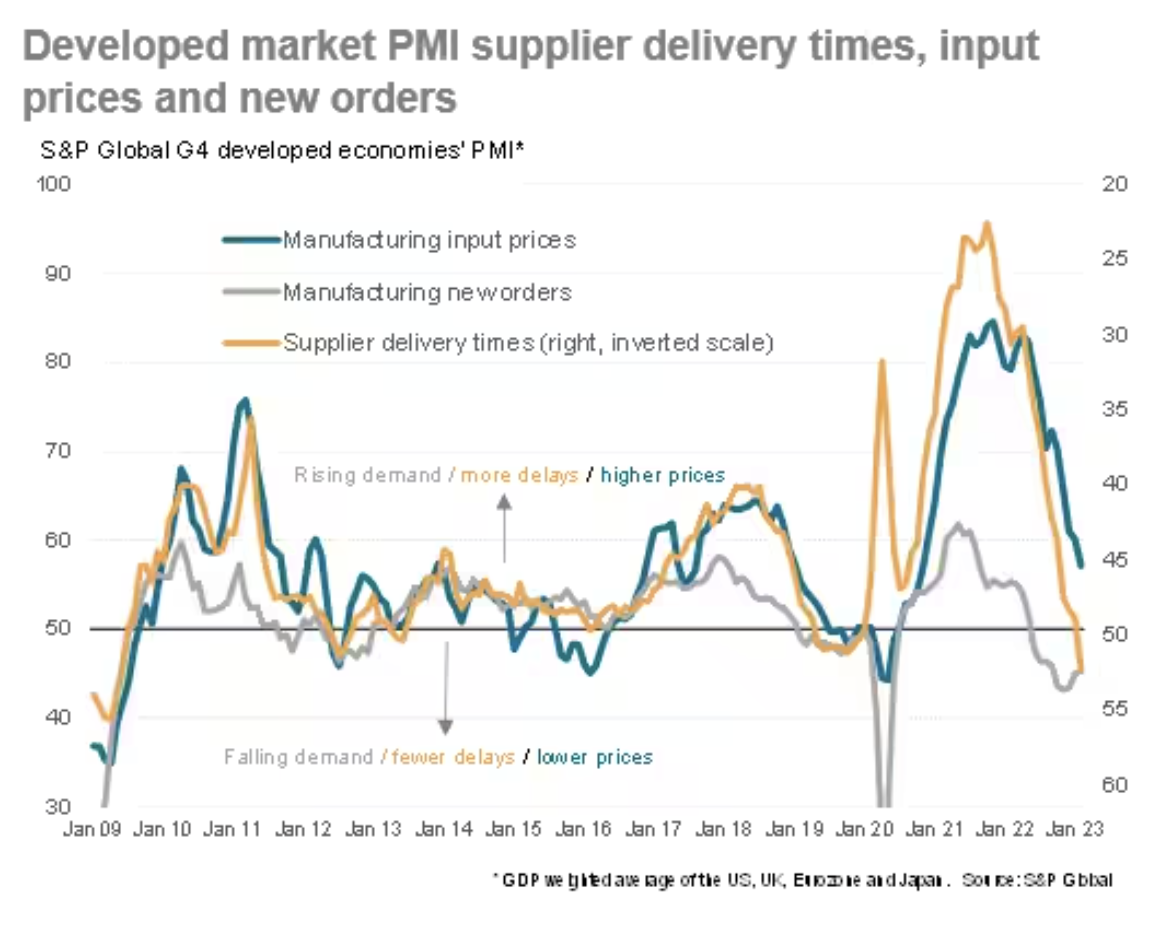

Global manufacturing and services PMI data will be released in the coming week, following the updates from the February flash figures. A series of GDP figures will also be due from Canada, Switzerland, Australia and India. Meanwhile inflation numbers from the eurozone, Germany and Indonesia will be closely watched amid ongoing scrutiny of the inflation trend. Finally, comments from various central bankers through the week, including Fed speakers, will be important to follow for further insights into likely interest rate trajectories.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

War Redirects Private Capital Flows In Russia; African Investment At 5-Year High

Waves of sanctions and a divestment campaign spearheaded by U.S. public employee pension funds throttled the flow of private capital into Russia following its February 2022 invasion of Ukraine. Yet private equity deal value soared to nearly $2.5 billion in Russia in 2022, a five-year high, driven by a flood of investments from Russia's domestic private equity and venture capital firms, according to S&P Global Market Intelligence data.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

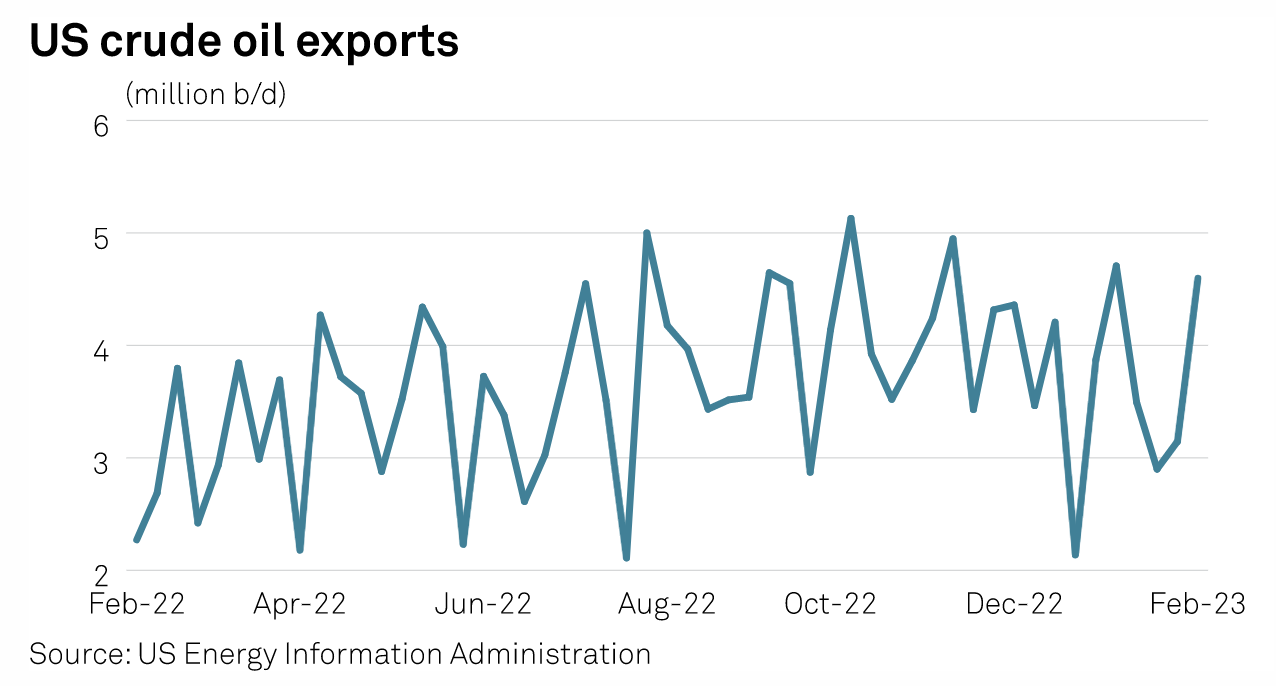

U.S. Crude Exports Continue To See Strong Volumes In Wake Of Russia-Ukraine War

A year removed from Russia's invasion of Ukraine, U.S. crude exports continue to see strong volumes, while new trends have begun to emerge in flows as the global oil landscape has shifted. U.S. crude export volumes saw a record year in 2022 as a combination of increased demand from Europe and added supply from increased U.S. production and a flood of crude from the U.S. Strategic Petroleum Reserve supported export volumes.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

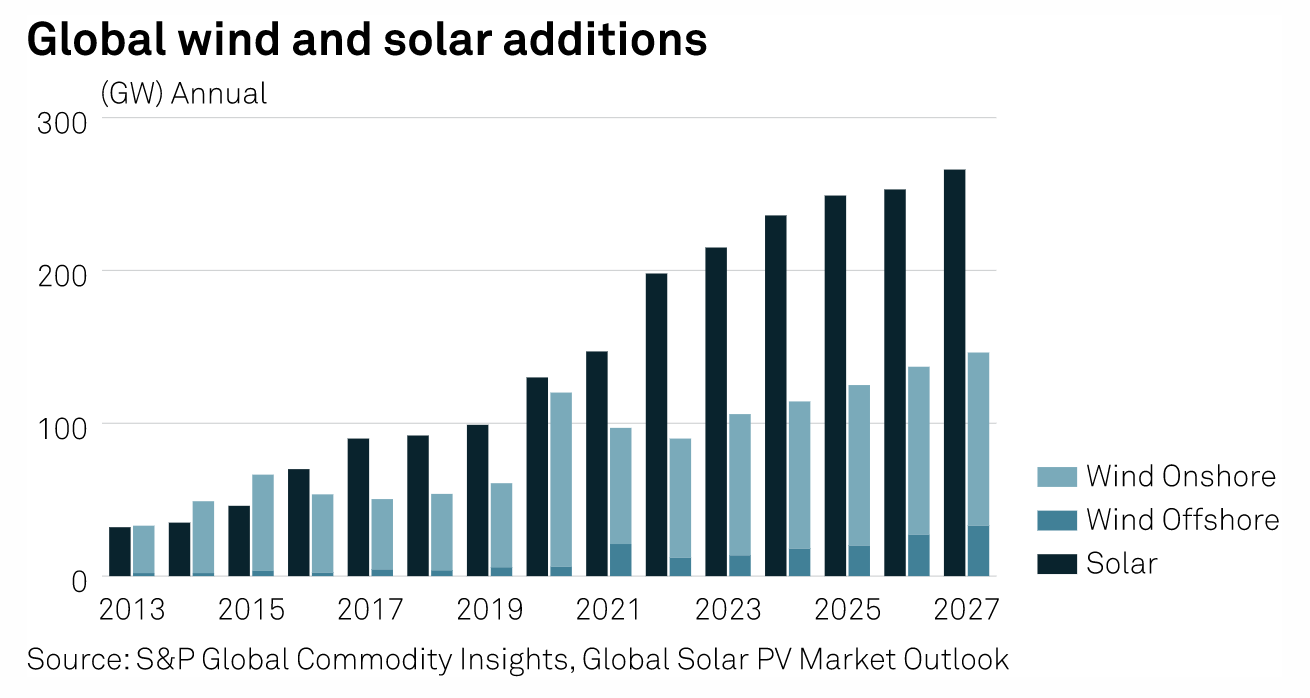

Renewable Energy Investment At Record $499 Bil In 2022 Not Enough For Climate Goals

Renewable energy investments rose to a record $499 billion last year, but it still isn't enough to keep global temperatures from rising more than 1.5 C, according to a joint paper released Feb. 22 at the Spanish International Conference on Renewable Energy in Madrid. The total investments were up 16% from 2021, according to the report by the International Renewable Energy Agency and Climate Policy Initiative. But that's still less than 40% of the average investment needed each year through 2030 under IRENA's 1.5 C scenario which seeks to limit rising global temperatures to no more than 1.5 C.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

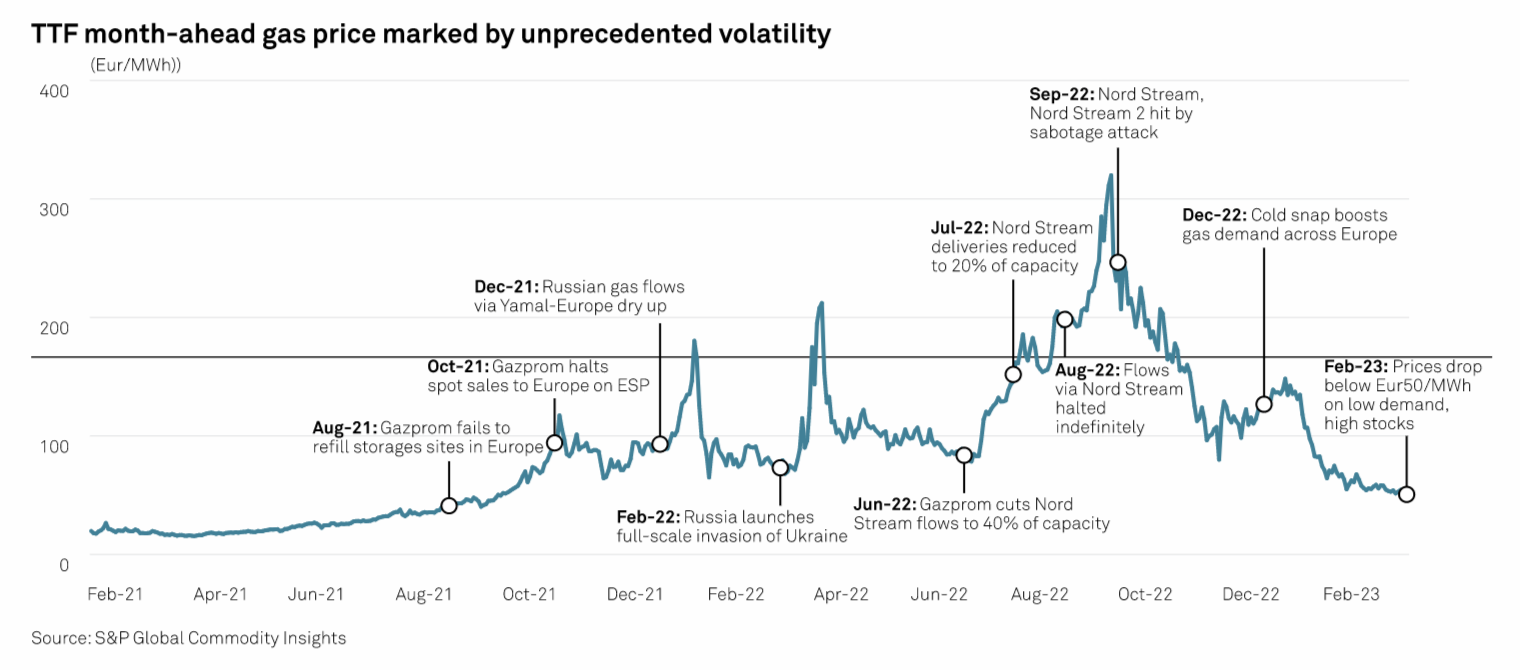

With Much Of The European Market Lost, Gazprom Looks Closer To Home

Russia's Gazprom — which until recently dominated the European gas market — reduced supplies to a minimum through 2022, losing most of its market share in the process and triggering a huge gas production decline. Gazprom has limited options for diverting gas that used to be piped to Europe to other markets, but that is not to say that it won't try. Russian President Vladimir Putin is keen on helping develop a gas hub in Turkey from where more Russian gas could find new homes in southeastern Europe, though most buyers would be unlikely to commit to new Russian volumes.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

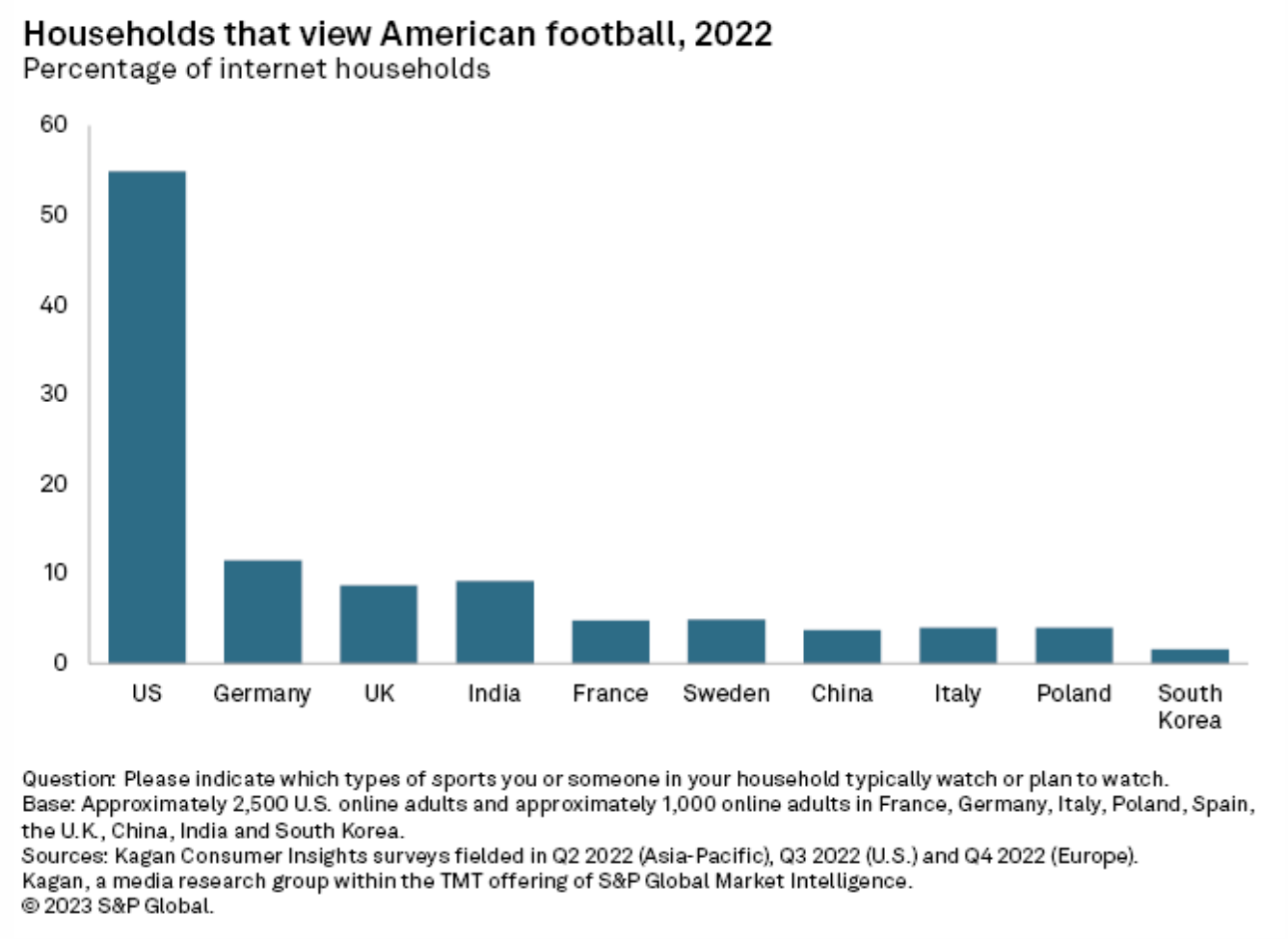

Who Watches American Football Around The World?

With more than 100 million U.S. viewers expected to have tuned in to Super Bowl LVII on Feb. 12 to watch the Kansas City Chiefs defeat the Philadelphia Eagles, the Super Bowl remains one of the few TV events that can draw such a massive crowd. Unlike the 2022 World Cup final, which FIFA claimed was watched by about 1.5 billion viewers globally, watching the U.S. version of football is still primarily an American pastime.

—Read the article from S&P Global Market Intelligence

Access more insights on technology and media >

CERAWeek by S&P Global — Navigating A Turbulent World: Energy, Climate and Security

Join global leaders, policymakers and executives from across energy, climate, finance, technology and industry at CERAWeek 2023 for timely dialogue, shared learning and connection.

—Register for CERAWeek