Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 23 Feb, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

The Push for Low-Carbon Steel Investment in Europe

From towering skyscrapers to the hulls of supertankers, steel is central to the modern economy. But steel requires a huge amount of energy to produce, which creates a lot of carbon emissions. The steelmaking sector accounts for about 8% of final energy demand and 7% of energy sector carbon emissions globally, according to the International Energy Agency.

No wonder the sector is being targeted for reductions in many countries that have committed to reducing their overall emissions. This includes the U.S., where the Inflation Reduction Act was signed into law in August 2022, offering incentives for domestic low-carbon steel production and renewable energy.

More recently, European countries have been looking into what they can do to decarbonize steel production. In separate statements, the European Steel Association, or Eurofer, and the U.K. Energy Transitions Commission said Feb. 1 that more must be done to encourage investment in low-carbon steel projects, according to S&P Global Commodity Insights.

Eurofer’s statement came in response to the EU’s Green Deal Industrial Plan, announced by the European Commission earlier that day. The plan intends to support the scaling up of Europe’s manufacturing capacity for net-zero technologies and to increase the competitiveness of the region’s net-zero industry.

Eurofer noted that low-carbon steel plays an important role in the journey to climate neutrality, considering low-carbon steel’s use in wind turbines and electric vehicles. Eurofer Director General Axel Eggert called for “a reassessment of the EU policies, based on the principles of competitiveness and [a] level playing field, with an open and target-focused discussion between policymakers and the industry.” Eggert added that the policies “can be mainstreamed and actively promoted in all relevant policy areas for industry, as the U.S. has already done with the [Inflation Reduction Act].”

Eggert estimated that the Inflation Reduction Act, plus resources from the U.S. Energy Department, could provide at least $85 billion in funding for low-carbon steel production and upstream decarbonized energy. In particular, Eurofer cited the act’s impact on the cost of hydrogen, which, as a fuel, is seen as one of the key pathways for decarbonizing steel production.

Meanwhile, the U.K. Energy Transitions Commission said in a Feb. 1 report that “urgent action” was needed within two years for investors to have certainty to make final investment decisions in steel projects. According to the commission, the country will not meet its climate targets unless it lowers emissions from steelmaking.

Low-carbon iron- and steelmaking technologies are already available, the commission said, and the right conditions for final investment decisions and new project proposals can be reached with government and industry measures. “All these actions are feasible in the short term and could unlock a first wave of breakthrough steel investments in the U.K.," it said.

Today is Thursday, February 23, 2023, and here is today’s essential intelligence.

Written by Claire Delano.

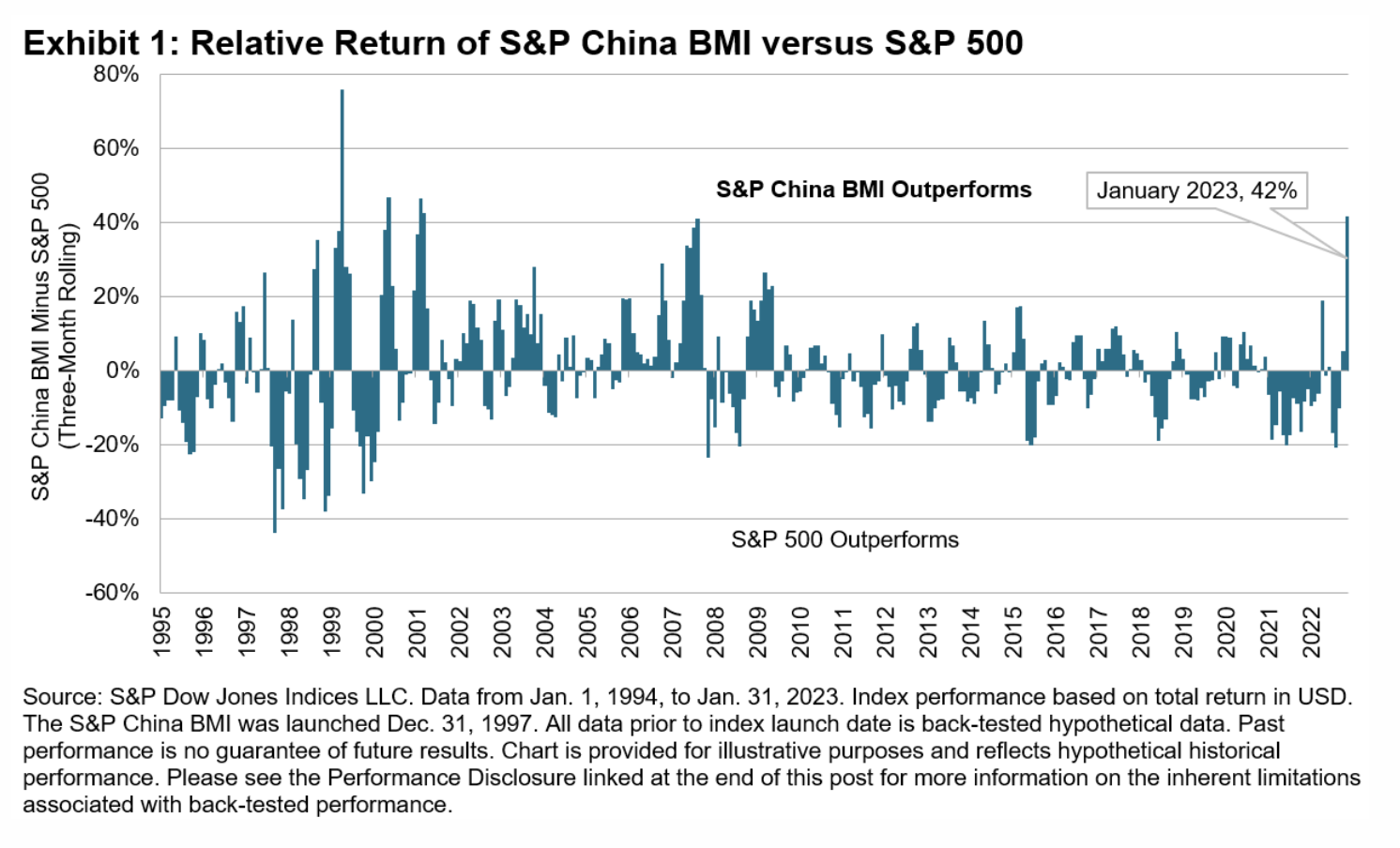

China Equities Diverge From Developed And Emerging Markets

China, the world’s second-largest market by both GDP and stock market capitalization, is showing itself to be a worthy diversifier, with low correlations to other equity markets. While many developed and emerging stock market indices have traded more in sync since the onset of the COVID-19 pandemic, China has performed differently, with both domestic China A-shares and offshore-listed China equities decoupling in comparison to developed and emerging markets.

—Read the article from S&P Dow Jones Indices

Access more insights on the global economy >

North Africa And Jordan Bank Outlook 2023: Uncertainty Will Test Resilience

Banks across Egypt, Morocco and Jordan face an uncertain 2023, marked by global economic instability and the accelerated tightening of monetary policy in the largest developed economies. S&P Global Ratings believes those factors could take a toll on the countries' banking sectors, though the recent decline in energy prices and the resilience of tourism may soften the financial and operational impact.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

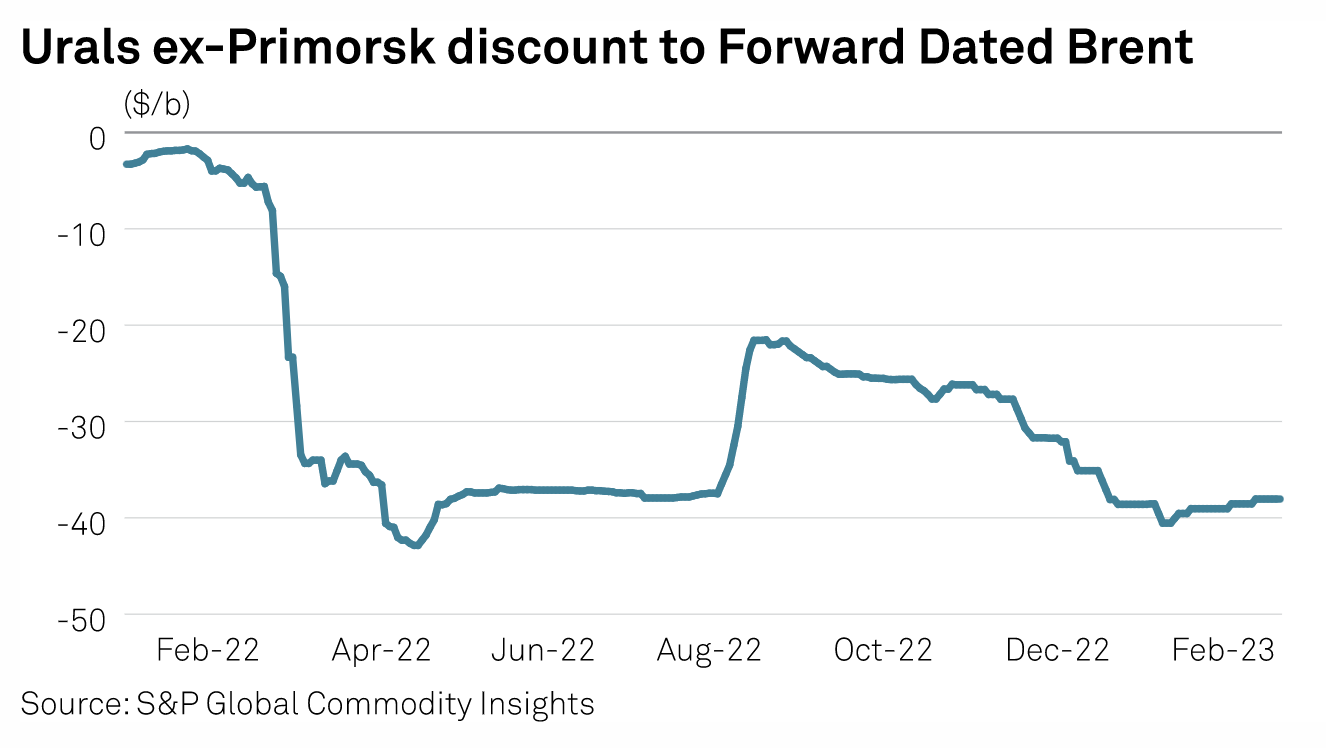

Supply And Price Risks High As Russia Escalates Ukraine War

International energy and commodity markets face more uncertainty as Russia escalates its war in Ukraine, raising concerns of ongoing supply risks, sanctions and another year of volatile prices. Analysts expect significant discounts on Russian oil to continue and the country's crude production to fall, as the latest restrictions on some oil imports to the EU and price caps hit the sector. "Ultimately I think the biggest risk, the most identifiable risk, is that an escalation in Ukraine causes the West to get a tougher sanctions posture," said Paul Sheldon, analyst at S&P Global Commodity Insights.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

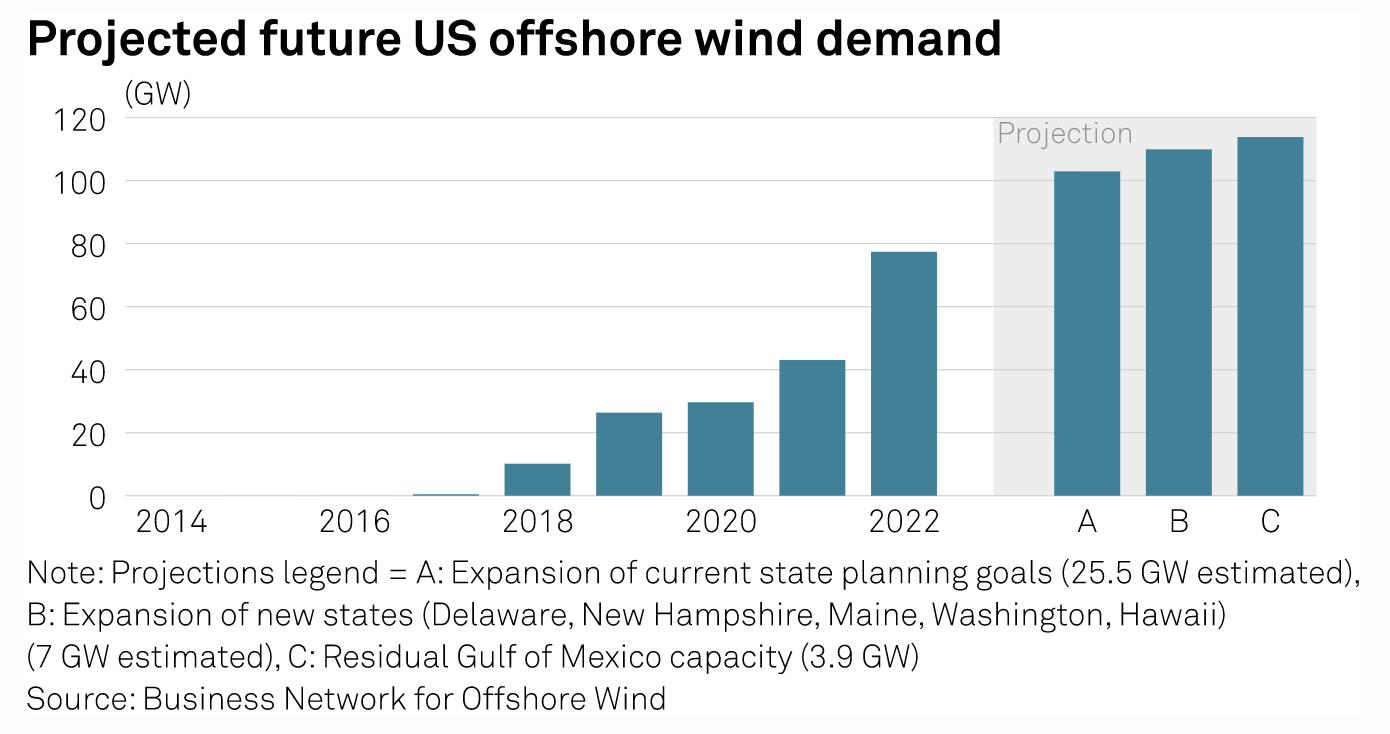

U.S. Offshore Wind Investments More Than Triple In 2022, IRA To Boost Alternative Uses

New investments in the U.S. offshore wind market more than tripled year on year to $9.8 billion in 2022 and going forward the Inflation Reduction Act will drive alternative uses of offshore wind power, according to the Business Network for Offshore Wind's annual U.S. Offshore Wind Market Report released Feb. 21.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

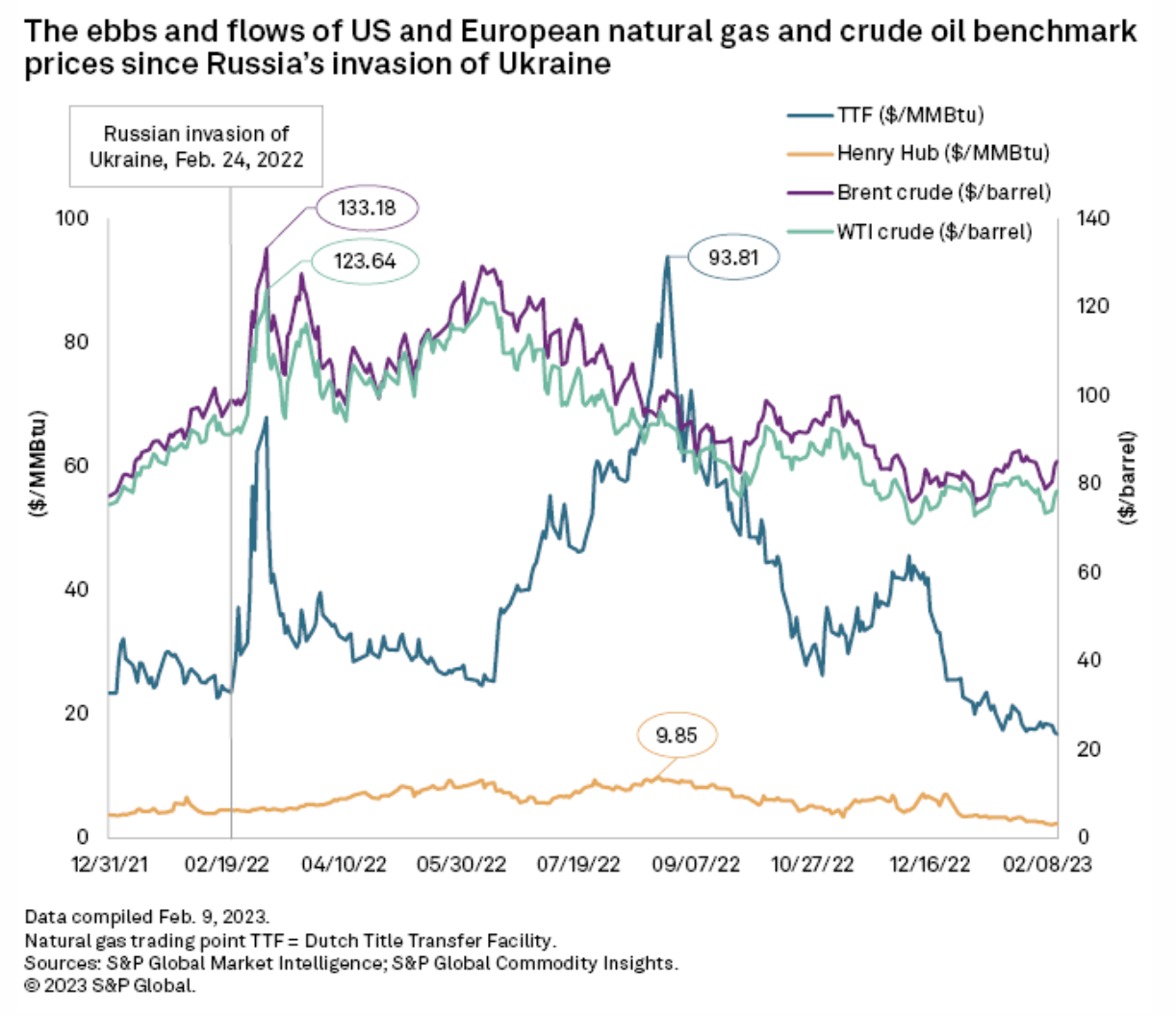

Europe Needs US LNG For Now, But War Has Pushed Continent Toward Renewables

Russia's 2022 invasion of Ukraine created an immediate need for U.S. oil and natural gas in Europe, but the loss of access to much of Russia's fossil fuels strengthened the development of renewable energy across the continent. "Europe has succeeded in disentangling itself — more rapidly than just about anyone could have anticipated — from what in retrospect had been dangerously excessive dependence on Russian natural gas," Raymond James & Associates Inc. energy analyst Pavel Molchanov said in an email.

—Read the article from S&P Global Market Intelligence

Access more insights on energy and commodities >

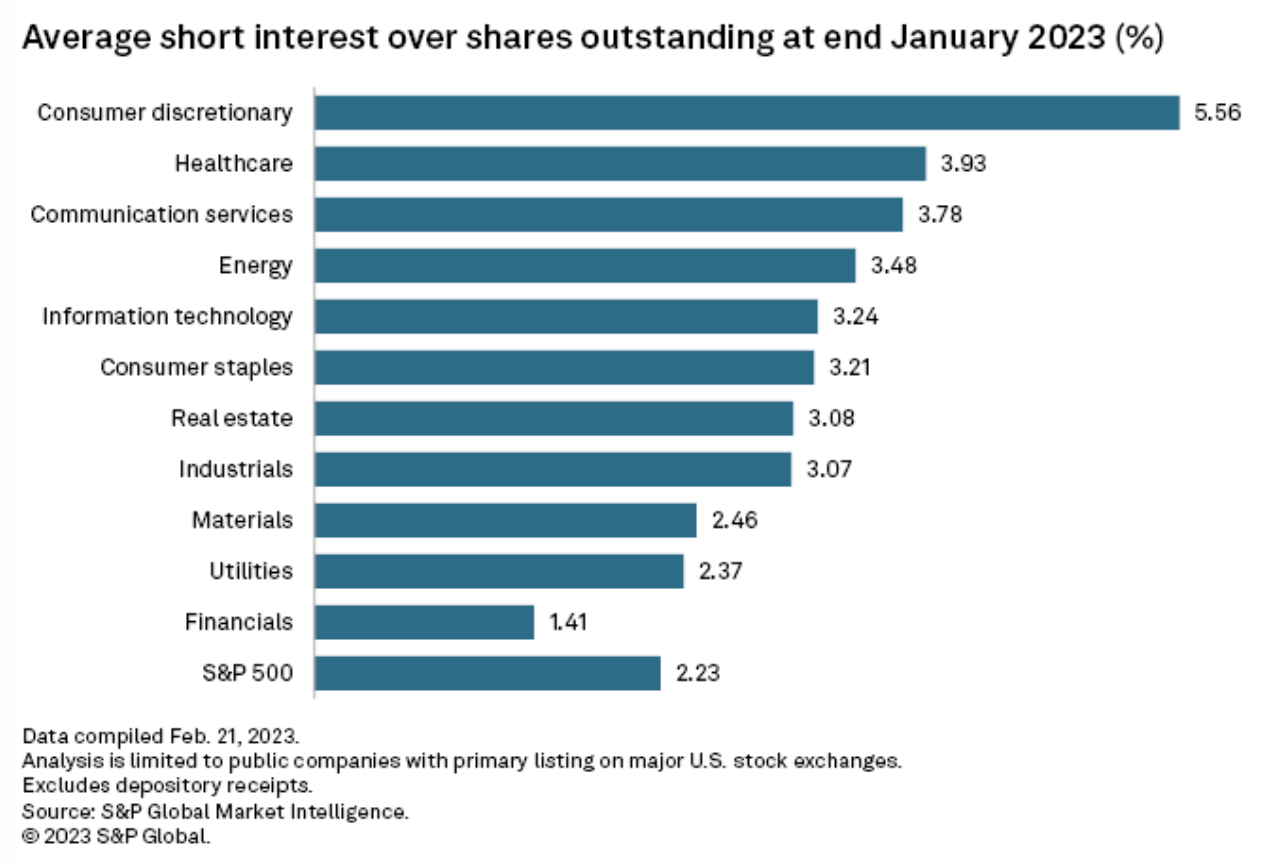

Short Sellers Boost Bets Against Communication Services Stocks In January

Short sellers boosted their positions against communication services stocks through late January amid a broader pullback as equities rallied. Short interest in communication services stocks was at 3.78% at the end of January, up from 3.67% in mid-January and a recent low of 3.55% at the end of November 2022, according to the latest S&P Global Market Intelligence data.

—Read the article from S&P Global Market Intelligence

Access more insights on technology and media >

CERAWeek by S&P Global — Navigating A Turbulent World: Energy, Climate and Security

Join global leaders, policymakers and executives from across energy, climate, finance, technology and industry at CERAWeek 2023 for timely dialogue, shared learning and connection.

—Register for CERAWeek