Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 20 Feb, 2024 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Banks in South Africa, Nigeria Embrace New Technologies

Banks in Nigeria and South Africa, two of the main tech hubs in Africa, have embraced new technologies to meet rising demand for digital solutions and improve financial inclusion. However, they cannot rest on their laurels amid the rapid development of new technologies and the growing fintech sector.

In Nigeria — the first African country to establish an open banking regime — banks are "key enablers of digital solutions by developing and deploying apps on their platforms" through APIs, according to an S&P Global Ratings report. Enabled by strong earnings, despite volatile economic cycles, Nigerian banks have made strategic IT investments, including launching their own fintech businesses in the payment products sector, to compete and collaborate with fintech companies and telcos.

Still, the country's banking industry faces high tech disruption risk, particularly from technology and regulation, S&P Global Ratings' four-factor analysis of the banking system's technology, regulation, industry and preferences shows.

Nigeria's broadband infrastructure lags those of other emerging markets. However, there is widespread mobile access, and mobile data is cheaper compared with other African countries. These factors support the country's rapidly growing fintech sector, which generally operates on more agile cloud-based infrastructure versus the legacy IT infrastructures of the banking sector. Banks’ adoption of big data, AI and open banking is also at an early stage.

In terms of regulatory risks, the Central Bank of Nigeria has introduced regulation to foster competition between banks and fintech companies, including large telcos, to improve financial inclusion in the country. Nigeria's banks are competing with neobanks and payment processing companies, such as Flutterwave and Interswitch, for market share and technology experts.

Fintech startups and telcos are not expected to pose a significant challenge to the banking sector's top tier "because banks are not idle during technology shifts and there is a great interdependence between banks and fintechs," according to S&P Global Ratings. They do, however, challenge banks with weak digital capabilities, which should result in "a multi-tier financial sector and consolidation."

Nigeria's banks need to stay on top of technology trends, leveraging their deeper pockets and longer financial performance track records that foster client trust, to remain competitive. Demand for digital solutions is expected to rise as telcos roll out infrastructure technologies with optic fiber and 5G networks that will enable widespread and stable access to more advanced data-driven services and applications. An acceleration of fintech products also fits with Nigeria's demographics.

South Africa's banking sector, meanwhile, faces low tech disruption risk from technology and regulation, according to S&P Global Ratings' four-factor analysis of the banking system.

Broadband infrastructure and access to the internet in South Africa is comparable to that of Mexico, Brazil and several other emerging markets, but lags that of developed countries. South Africa ranks 64th among 157 countries in terms of access and use of new information and communications technology, S&P Global Ratings reported, citing the Global Enabling Sustainability Initiative Digital Access Index.

The country's technology-friendly environment enables banks to adopt fintech products while developing their own digital capabilities, typically by working with fintech startups and regulators through incubator programs and the sandbox environment. South Africa's banks have therefore been at the "forefront of system innovation" and were early adopters of technology such as online banking — even when internet and mobile penetration was low.

Banks in South Africa are well positioned to transition to the next stage in banking. Adoption of AI and big data is emerging and is expected to increase as banks complete the migration of their systems to the cloud, according to S&P Global Ratings.

The regulatory environment encourages the adoption of new technologies among banks. An "intensive and pioneering regulatory approach to fintech" also enables South Africa’s banking industry to manage disruption risks.

Disruption risk stemming from neobanks is limited because most of these fintech companies depend on banks or retail networks to operate. Fintechs are expected to continue challenging and emulating banks in the payments sector, however, and banks will have to adapt quickly and collaborate to remain competitive.

Today is Tuesday, February 20, 2024, and here is today's essential intelligence.

Written by Jasmine Castroverde.

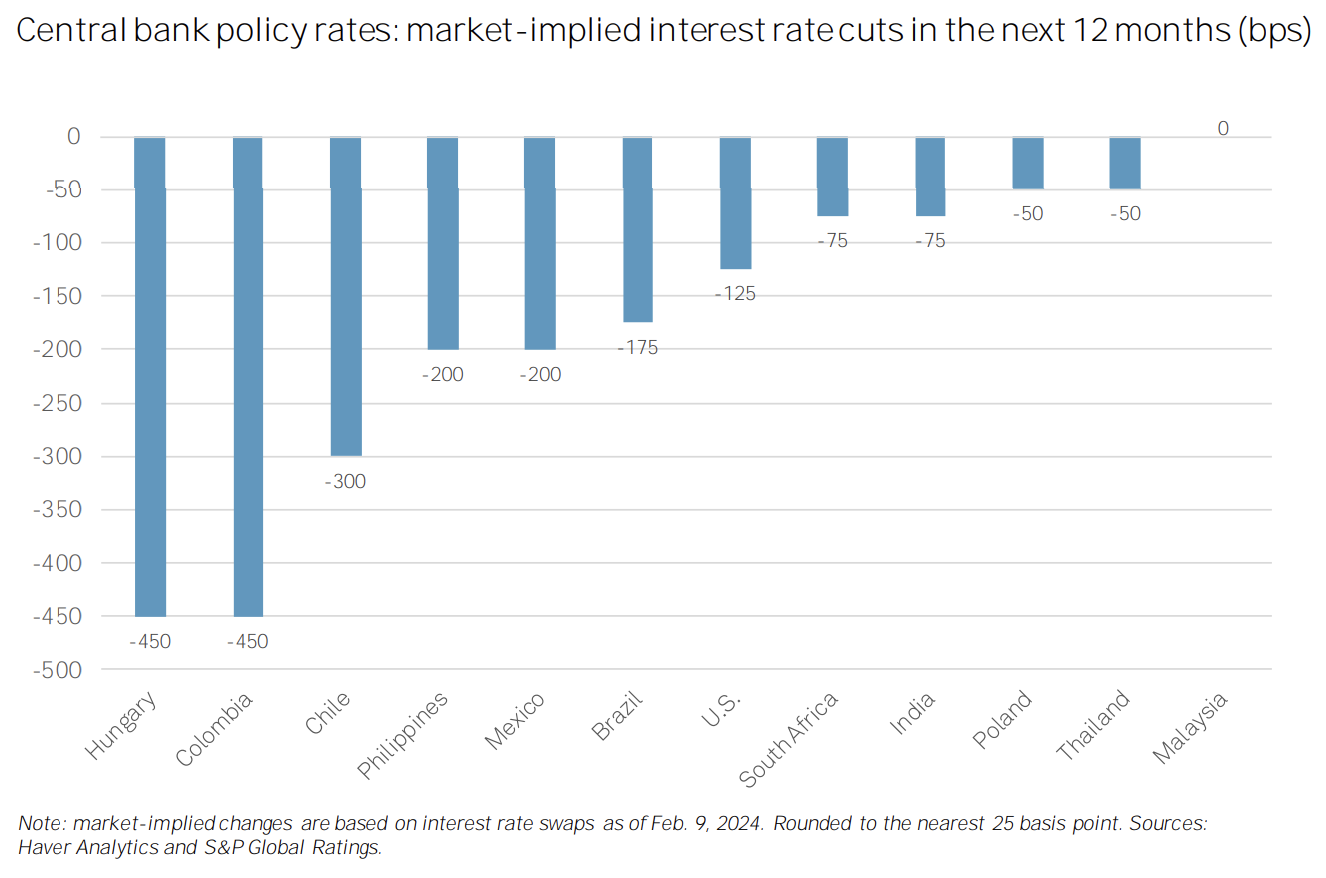

Emerging Markets Monthly Highlights: Improving Financing Conditions

Credit conditions in Emerging Markets (EMs) have improved. In Q4 2023, the pace of defaults in EMs was lower than in the US and Europe, following better economic and financing conditions, continued disinflation, positive growth surprises and a clearer path for Fed policy interest rate cuts. Issuances outside Greater China rose by more than 20% in January compared with December.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

CreditWeek: How Will Peak Interest Rates Affect Banks?

The expected eventual drop in rates should weigh moderately on bank profitability in developed economies like Europe and the US. A downside scenario, where this is coupled with a material deterioration in the economic backdrop, would leave banks scrambling to bolster both their profitability and asset quality — exacerbating the divergence in credit quality between the largest lenders and their less-diversified counterparts.

—Read the article from S&P Global Ratings

Access more insights on capital markets >

Listen: Supply Disruptions Drive Copper TC To Three-Year Low; Smelters May Cut Production

The Asian copper market saw CIF China copper concentrate TC/RC fall by 65% in just three months’ time, while smelters were still not able to find enough feedstocks to meet their production needs. As copper concentrate market changed from surplus to deficit and copper price is still hovering at $8100-$8500/mt level, our experts discuss what happened behind the price, share the outlook for copper concentrate and copper cathodes. S&P Global Commodity Insights senior Managing Editor Mok Cheng speaks with Han Lu, senior price editor and Wang Ruilin, senior copper analyst about the factors driving copper concentrate TC/RCs movement, implications for copper cathodes and copper price, and what we would expect in 2024.

—Listen and subscribe to Commodities Focus, a podcast from S&P Global Commodity Insights

Access more insights on global trade >

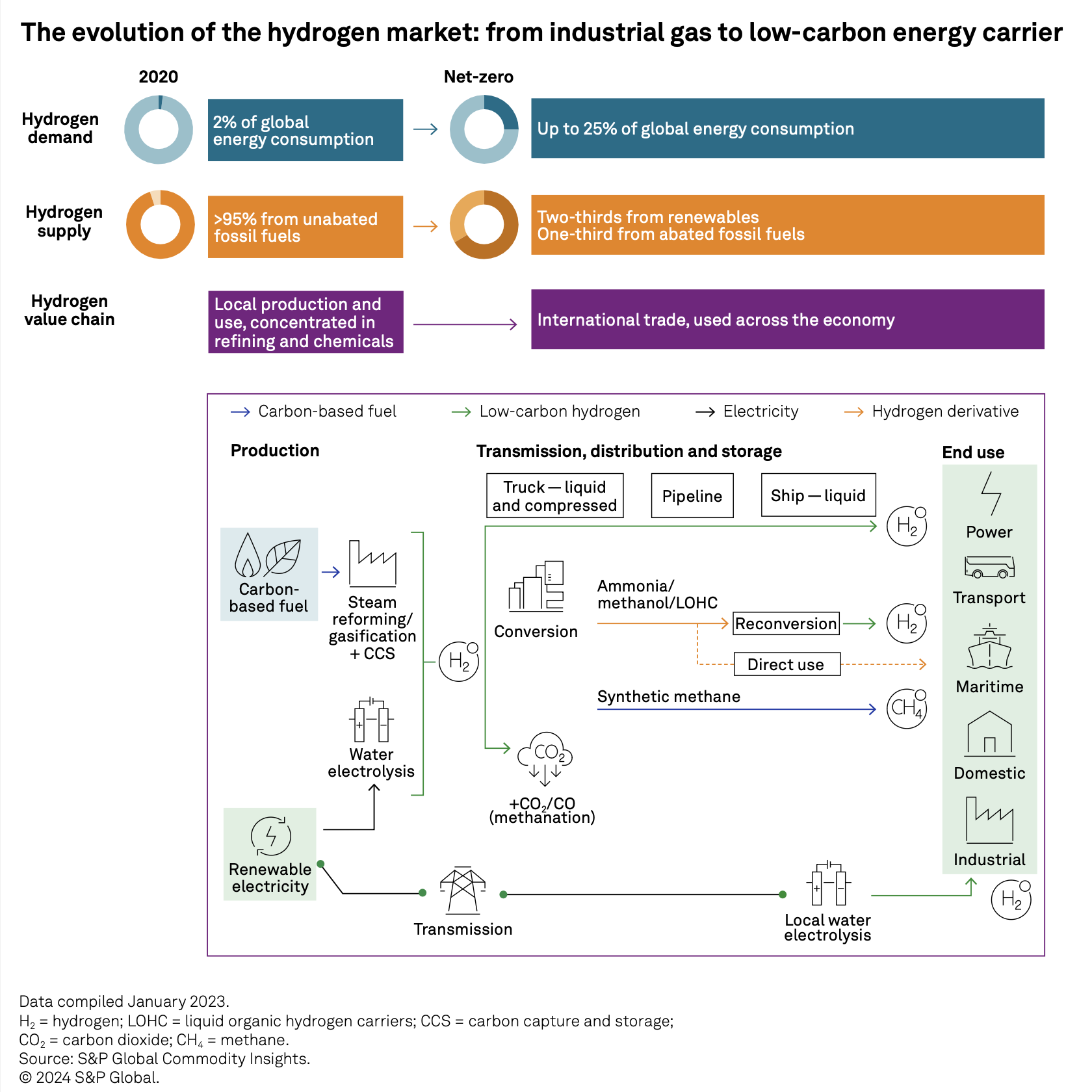

Hydrogen: New Ambitions and Challenges

In addition to its role in the oil refining and chemical industries, hydrogen is now emerging as a vector of clean energy delivery. There is genuine interest and investment worldwide as governments and businesses seek to develop this budding industry as part of their energy transition goals. Nevertheless, significant challenges lie ahead to bring this industry up to scale.

—Read the research from S&P Global

Access more insights on sustainability >

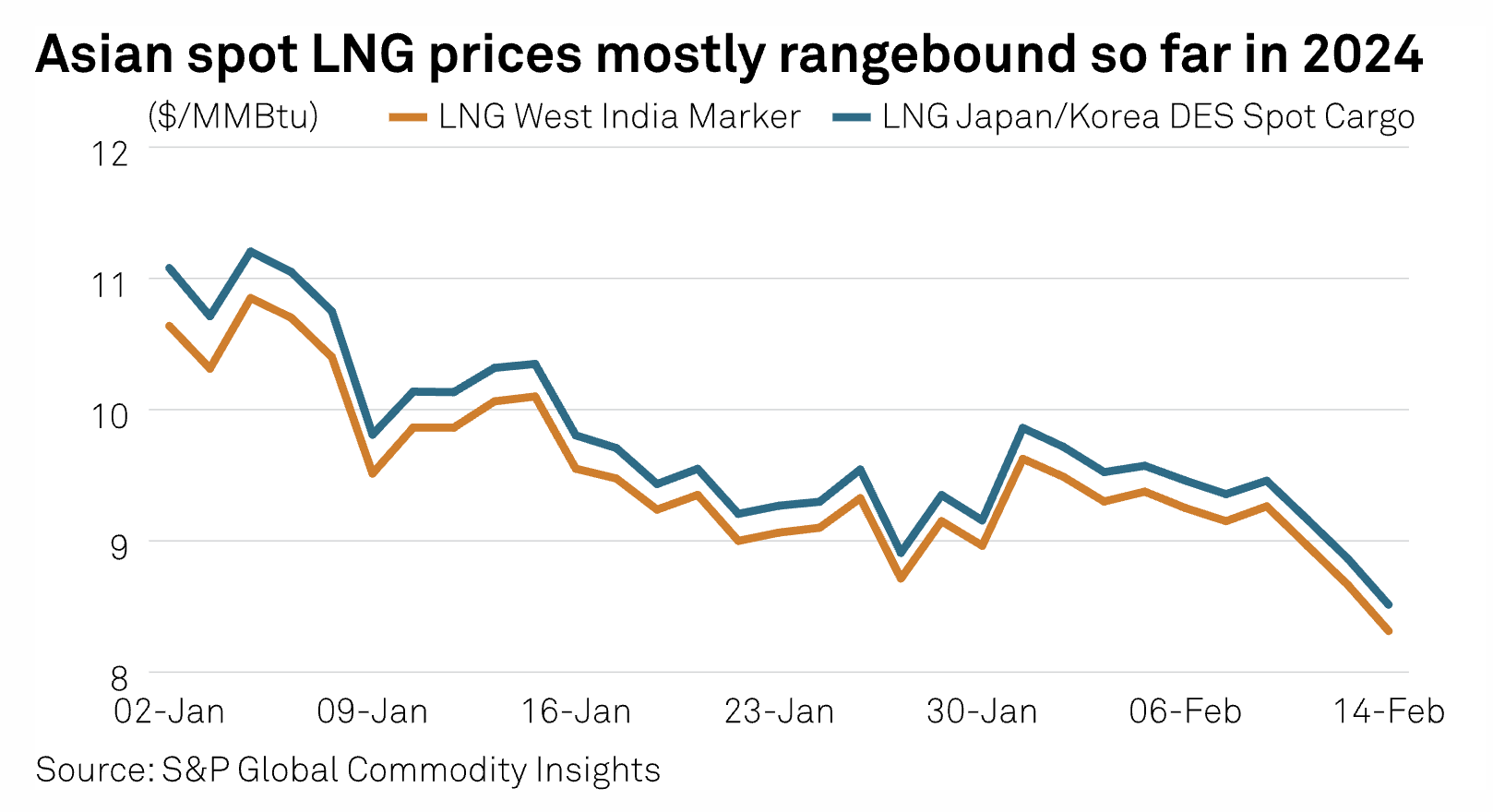

India's 2024 Gas Consumption To Rise 5%-6%, Says Adani Total Gas CEO

India's natural gas consumption in 2024 will likely grow 5%-6% corresponding to an estimated economic growth of 6%-7%, with its share boosted in future if the country taps two "hidden jewels" — Micro, Small and Medium Enterprises (MSMEs) and LNG for transport and mining (LTM), Adani Total Gas Executive Director & CEO Suresh P Manglani said.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

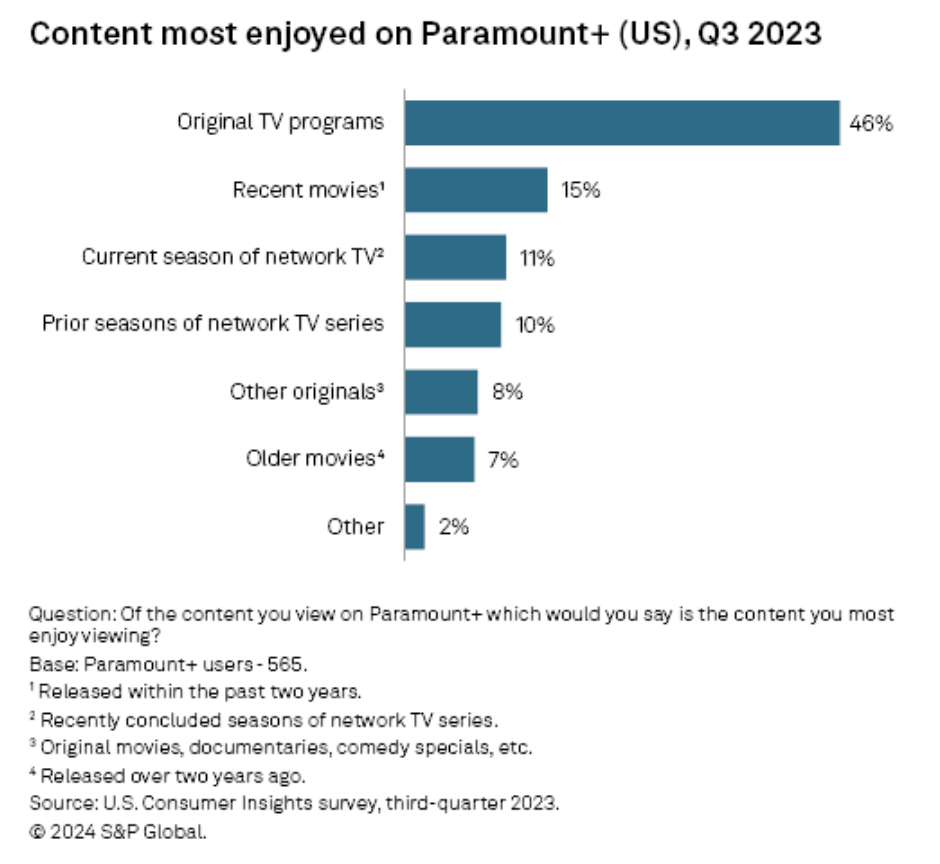

Content Most Enjoyed On Paramount+, (US) 2023

Original TV programs dominated the content most enjoyed across a range of streaming services in 2023, including Paramount+. Nearly half (46%) of Paramount+ users in S&P Global Market Intelligence Kagan's US Online Consumer survey selected original TV programs as the content they most enjoyed on the Paramount Global streaming service, extending a recurring theme seen among users of several other services, including Peacock Premium, Disney+ and Max. All users were surveyed in the third quarter of 2023.

—Read the article from S&P Global Market Intelligence

Content Type

Location

Language