Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 14 Feb, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Equity Investors in Search of a Silver Lining

Corporate bond investors tend to be pessimists, scouring companies’ balance sheets for the problems that could trigger a loss or default. Equity investors, meanwhile, tend to have a more cheerful disposition, searching for signs that a company might end up becoming the next runaway success.

But even the most optimistic of equity investors would have found it difficult to be cheerful last year.

Amid high inflation and concerns about a recession, 2022 was the worst year for U.S. stocks since 2008, when the global financial crisis was at its height and the federal government marshaled funds to bail out stricken banks. The S&P 500 index fell about 20% last year, with growth stocks in sectors such as Big Tech seeing outsized declines compared with value stocks, according to S&P Global Market Intelligence.

Growth stocks are issued by companies with revenues or earnings that are expected to grow more quickly, while value stocks are those seen as underpriced relative to their peers.

"Asset managers are still trying to figure out if this headwind is a gentle breeze or if it risks developing into a full-scale hurricane," said Paul Britton, CEO of Capstone Investment Advisors. "What is clear is that some strategies that worked for the last 10 years will not be effective in the near future."

The brunt of the fall in U.S. equities has been felt by companies that have been investor favorites in recent years, such as technology giants Apple, Microsoft and Amazon. The 10 largest constituents of the S&P 500 posted a decline of 37% in 2022, according to S&P Global Market Intelligence. Conversely, companies in the energy sector, such as Exxon Mobil and Chevron, climbed in value amid the fallout from the Russia-Ukraine conflict.

If U.S. equity markets in 2022 were dominated by fear, the early days of 2023 have offered hope. Amid improving economic expectations, the S&P 500 has so far retraced some of its 2022 losses. The sectors that led the rally were among those hardest-hit last year, including communication services, consumer discretionary and information technology, according to S&P Global Market Intelligence.

Looking beyond U.S. shores, 2022 was a lackluster year for international equities, but there were bright spots for investors prepared to go further in search of returns. On an aggregate basis, Latin American stock markets did well due to their high exposure to raw materials and currency strength versus the U.S. dollar. The S&P Latin America Broad Market Index, or BMI, was up 4.9% year over year, and it was the only major regional equity market to have gained during this period, according to S&P Dow Jones Indices.

Other international equity markets that previously sustained losses rebounded strongly in the fourth quarter of 2022. The S&P Hong Kong BMI, S&P Korea BMI and S&P Japan BMI returned 18.8%, 18.2% and 12.9%, respectively, according to S&P Dow Jones Indices. Significantly, the S&P China 500 gained 7.1% in the same period, paring back losses experienced earlier in 2022.

After a bruising year, there remain plenty of reasons for investors to worry in 2023, including high inflation, weaker consumer spending, the uncertain outlook for global growth and continued geopolitical tensions. So far, though, the picture has been more mixed. Recently, the U.S. Bureau of Economic Analysis estimated real gross domestic product to grow at an annual rate of 2.9% for the fourth quarter of 2022 — better than expected — while talk of a recession has become more focused on the idea of a shorter, milder retrenchment.

One thing you can count on: If there is a positive signal in there somewhere, equity investors will find it.

Today is Tuesday, February 14, 2023, and here is today’s essential intelligence.

Written by Mark Pengelly.

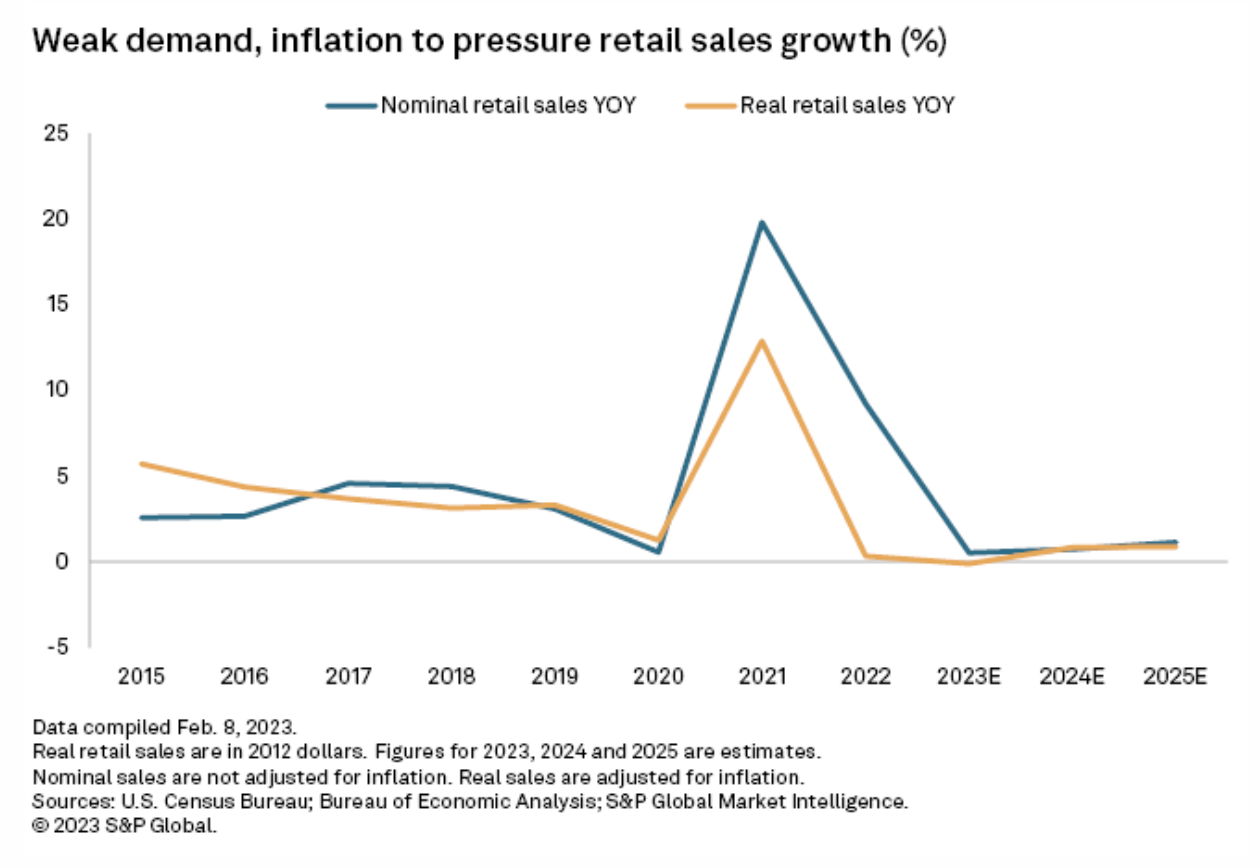

Inflation, Weak Demand To Weigh On U.S. Retail Sales In 2023

Persistently high inflation and weakening consumer demand are eating into U.S. retail sales expectations this year. S&P Global Market Intelligence economists predict retail sales growth of 0.5% in 2023, or a 0.1% decline when accounting for inflation, before returning to slower growth than pre-pandemic levels afterward. Price growth, meanwhile, will shrink to 0.6% in 2023 from 8.9% in 2022. Belt-tightening consumers will hinder sales in 2023 compared with previous years that benefited from post-lockdown spikes in demand and strong household balance sheets.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

This Week In Credit: Market Optimism Under Pressure

The threat of persistent inflation is not going away despite market aspirations. Last week’s U.S. CPI revisions — plus Russia’s announcement it will cut oil production in March and the Chinese economy's brighter growth outlook — all point to ongoing inflationary pressures. The U.S. CPI numbers (out Tuesday) are probably the key release to watch out for this week, as are the U.S. and U.K. retail sales and European fourth-quarter GDP updates. Markets expect interest rates to rise again in the U.S. and Europe, while credit pricing optimism seems to be stalling, at least for now.

—Read the article from S&P Global Ratings

Access more insights on capital markets >

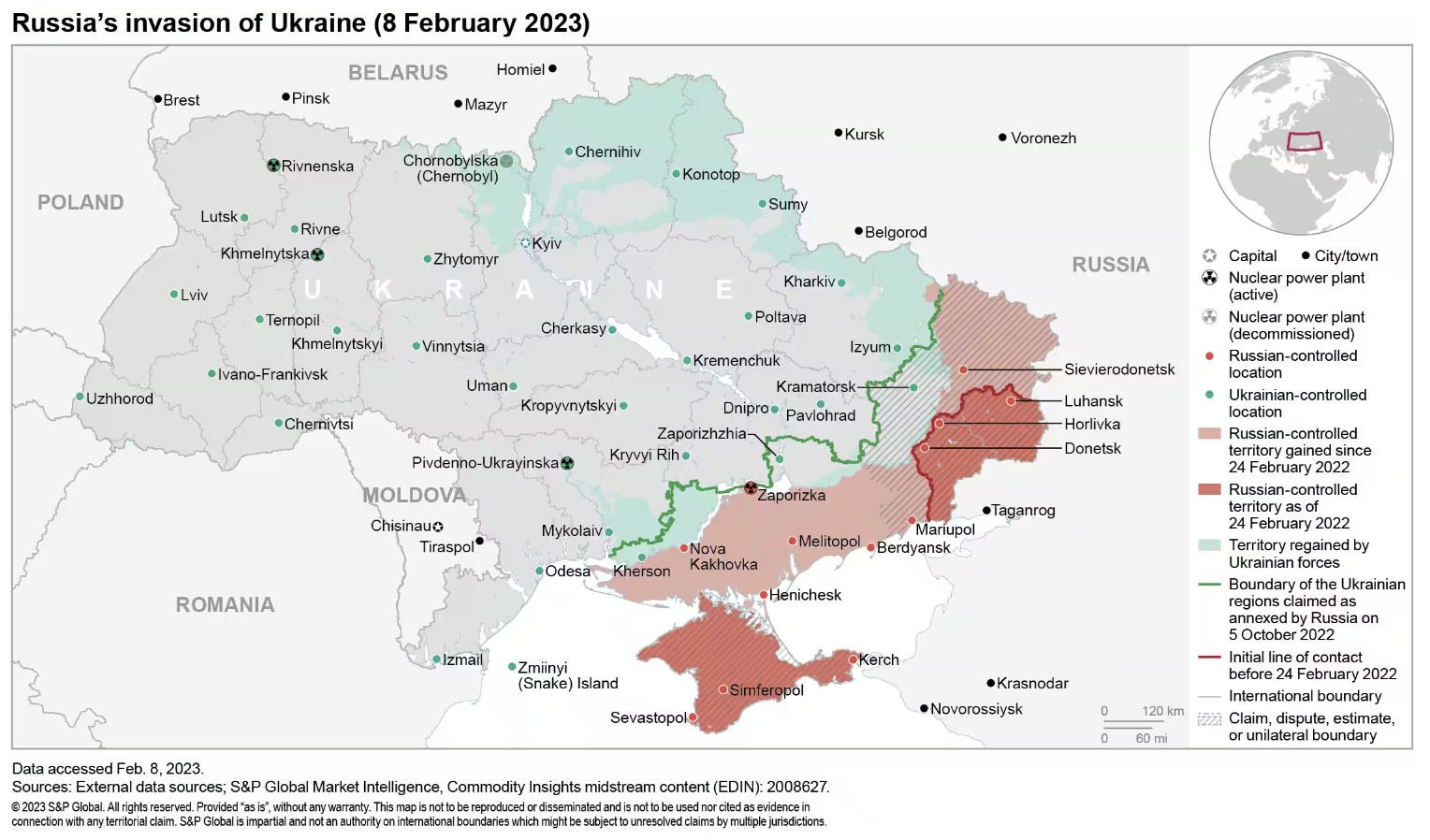

Russia-Ukraine War: One Year On

Russia is continuing its bombardment of Ukraine, with the conflict now nearly a year on, to wear down the Ukrainian population's support for the war and initiate ceasefire negotiations that would freeze the 1,000-km line of contact. Russia has increased the intensity of missile and unmanned aerial vehicle (UAV) strikes on cities across Ukraine since early October, launching approximately 1,000 missiles in 14 swarm missile attacks and focusing on critical national infrastructure. Ukraine claims that approximately 80% of missiles and UAVs have been intercepted by its air defenses. Still, the attacks have caused significant damage, including reducing up to 50% of power generation capacity, according to the Ukrainian government, and causing large-scale blackouts.

—Read the article from S&P Global Market Intelligence

Access more insights on global trade >

Listen: How Sustainable Taxonomies Are Going Global

Taxonomies: This is a topic that has dominated many conversations in the sustainability world in recent years. In this episode of the ESG Insider podcast, hosts Lindsey Hall and Esther Whieldon explore the growing number of taxonomies around the world. In simple terms, a taxonomy is a kind of dictionary of sustainable activities designed to provide clarity on which economic activities are sustainable and to support investment flows into those activities. A recently released report from international conservation organization WWF and German sustainable finance think tank Climate & Co. finds dozens of sustainable finance taxonomies have been introduced or are being developed across the globe.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Sustainable1

Access more insights on sustainability >

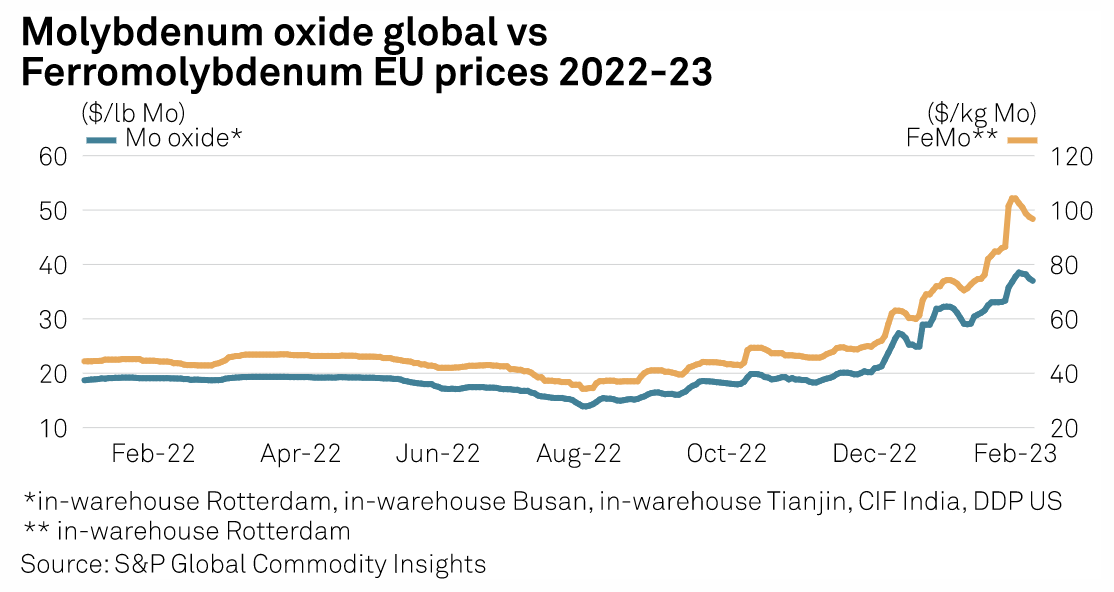

4 Key Factors Driving The ‘Perfect Storm’ In Molybdenum Markets

Recent volatility has generated record highs in global molybdenum markets, with both acute and fundamental factors operating to drive prices beyond the expectations of market participants. Ferromolybdenum prices surged 18% Jan. 30, up $15/kg on the day, a record high since Platts started publishing the price in February 1987 — 36 years ago. The Platts Ferromolybdenum 65% European in-warehouse Rotterdam price moved up to $99/kg-$104/kg Jan. 30, from $85/kg-$88/kg the previous day. Platts is part of S&P Global Commodity Insights.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

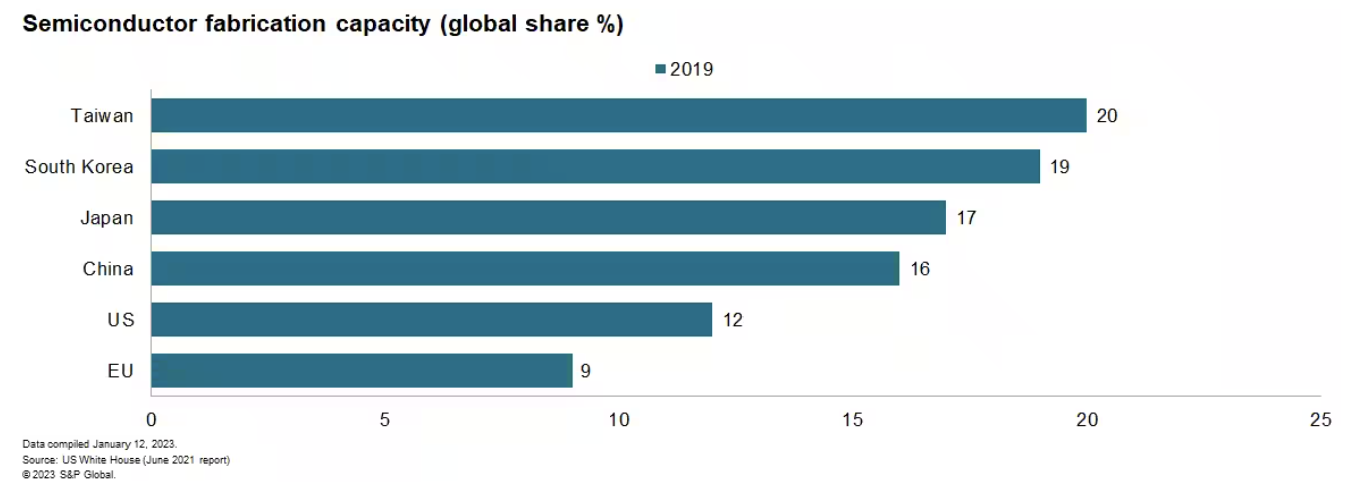

The Shifting Global Semiconductor Landscape In Asia-Pacific

Rapid and far-reaching changes in the public policy landscape for semiconductors manufacturing in the U.S. and European Union during 2022 will have important direct implications for the semiconductors industry in Asia Pacific economies. Legislation in the U.S. and EU aims to boost domestic and regional semiconductors manufacturing significantly, threatening to rebalance global semiconductors manufacturing away from Asia Pacific economies. Taiwan, South Korea, Japan and mainland China accounted for 72% of global semi-conductor production in 2020, with prior production locations such as the U.S. and Japan focused on the more profitable design segment.

—Read the article from S&P Global Market Intelligence

Access more insights on technology and media >

CERAWeek by S&P Global — Navigating A Turbulent World: Energy, Climate and Security

Join global leaders, policymakers and executives from across energy, climate, finance, technology and industry at CERAWeek 2023 for timely dialogue, shared learning and connection.

—Register for CERAWeek