Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 20 Dec, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Saudi Arabia on a Long Journey to Diversification

Saudi Arabia, the oil bastion of the Middle East, relies heavily on oil rents to fuel its economic growth. Oil rents constitute most of the kingdom's export earnings and government revenue. During the early 2000s and 2010s, high oil prices helped fund infrastructure and education spending and bolstered a private sector heavily dependent on government contracts. But oil prices slumped in the mid-2010s, making economic reform and a strategy to achieve it ever more urgent. That strategy is Vision 2030, Saudi Arabia's blueprint to diversify economically and modernize nationally.

Vision 2030 has led to major project announcements across several corporate sectors, including digital infrastructure, real estate, tourism, healthcare, energy and utilities. But financing such transformational change is no small feat. Bankrolling Vision 2030 is the reimagined Public Investment Fund, or PIF, with $620 billion of assets under management. PIF, together with its portfolio companies, aims to grow Saudi Arabia's annual non-oil gross domestic product by about 7%.

In addition to the PIF, the kingdom leverages debt sales and bank loans while courting foreign direct investment, and capital markets are critical to powering corporate investment, according to S&P Global Ratings. Nevertheless, oil revenue forms the bedrock of funding for Vision 2030, even as state-owned oil giant Saudi Aramco invests in renewables.

As it imagines its place in a transformed future global energy system, Aramco is converting more of its oil to chemicals by expanding its liquids-to-chemicals capacity, S&P Global Commodity Insights reported. Aramco also has its sights set on renewables, notably hydrogen, and will be instrumental if Saudi Arabia is to realize its goal of becoming a global leader in supplying low-carbon hydrogen. TÜV Rheinland, an independent German testing, inspection and certification agency, recently certified Aramco subsidiaries Sabic Agri-Nutrients and Sasref for producing 37,800 metric tons of blue ammonia and 8,075 metric tons of blue hydrogen, respectively.

The Vision 2030 Neom project could be a flagship contributor to Saudi Arabia's future hydrogen exports. The $5 billion Neom project, currently under construction, aims to produce 650 metric tons per day of renewable hydrogen from 2026 and to process it into 1.2 million metric tons per year of green ammonia for export. For now, though — and even after Neom is online — most of Saudi Arabia's revenue will come from oil.

This past year was a boon year for Saudi Arabia as oil prices spiked and Saudi crude nestled into the emergent void in Europe's oil supply after several countries shunned Russian crude in the wake of the invasion of Ukraine. Higher prices were welcome news for Saudi government coffers shelling out money to fund Vision 2030 projects, but the world still plans to transition to less carbon-intensive energy sources.

Such a transition poses challenges to hydrocarbon-based economies. These challenges are perhaps less menacing for Saudi Arabia, with its Vision 2030 strategy setting a road map to economic diversification. And oil demand isn't disappearing anytime soon. After all, it's a transition, not an instantaneous pivot.

Today is Tuesday, December 20, 2022, and here is today’s essential intelligence. The Daily Update will return on Jan. 4, 2023, after a holiday break.

Written by Wyatt Scott.

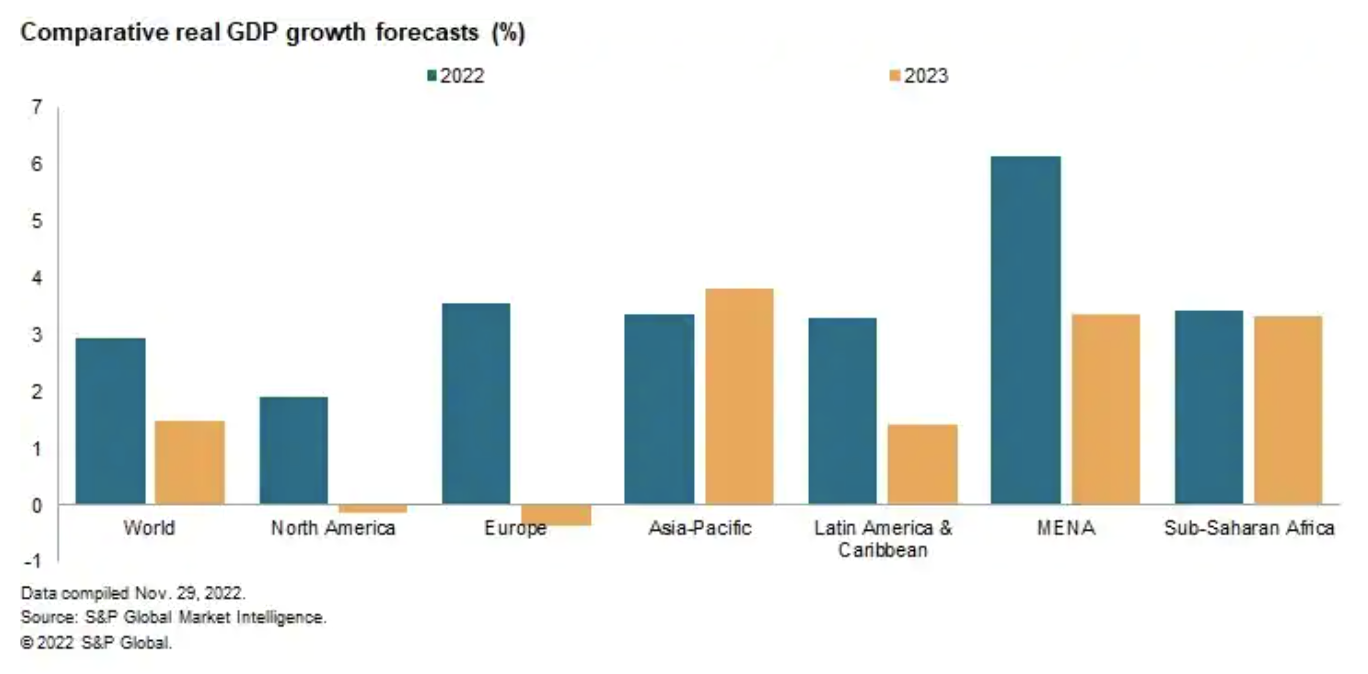

MENA Region’s Economic Growth To Slow After Strong 2022

Economic activity in the Middle East and North Africa (MENA) region is expected to sharply decelerate in 2023 after strong growth in 2022. Real GDP growth is forecast to decline to around 3.5% in 2023-24 from an 18-year high of 6.1% in 2022, outpacing the broad performance of the global economy over the same period. The headline growth figure masks a stark contrast between two groups of countries: the net energy exporters and the net energy importers. For the MENA hydrocarbon exporters group, S&P Global Market Intelligence forecasts real GDP growth will move down from 6.7% in 2022 to around 3.5% in 2023-24. For the MENA hydrocarbon importers group, it anticipates a real GDP growth slowdown from 4.2% in 2022 to 2.9% in 2023 and 3.1% in 2024.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

2022 Year In Review Infographic: Key Investment Banking Trends

Real Estate and Information Technology have been the top sectors in terms of transaction value in 2022 year-to-date, generating $353 billion and $349 billion in total deal value, respectively. This year saw a decrease in deal value across all industries. Industrials sector proved to be the most active M&A market with 7,274 deals recorded in 2022 YTD, but that total is down 16% compared to last year's 8,634 deals. Information Technology and Real Estate follow with 5,670 and 5,148 total deals, respectively, while Energy saw a 31% decline in activity.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

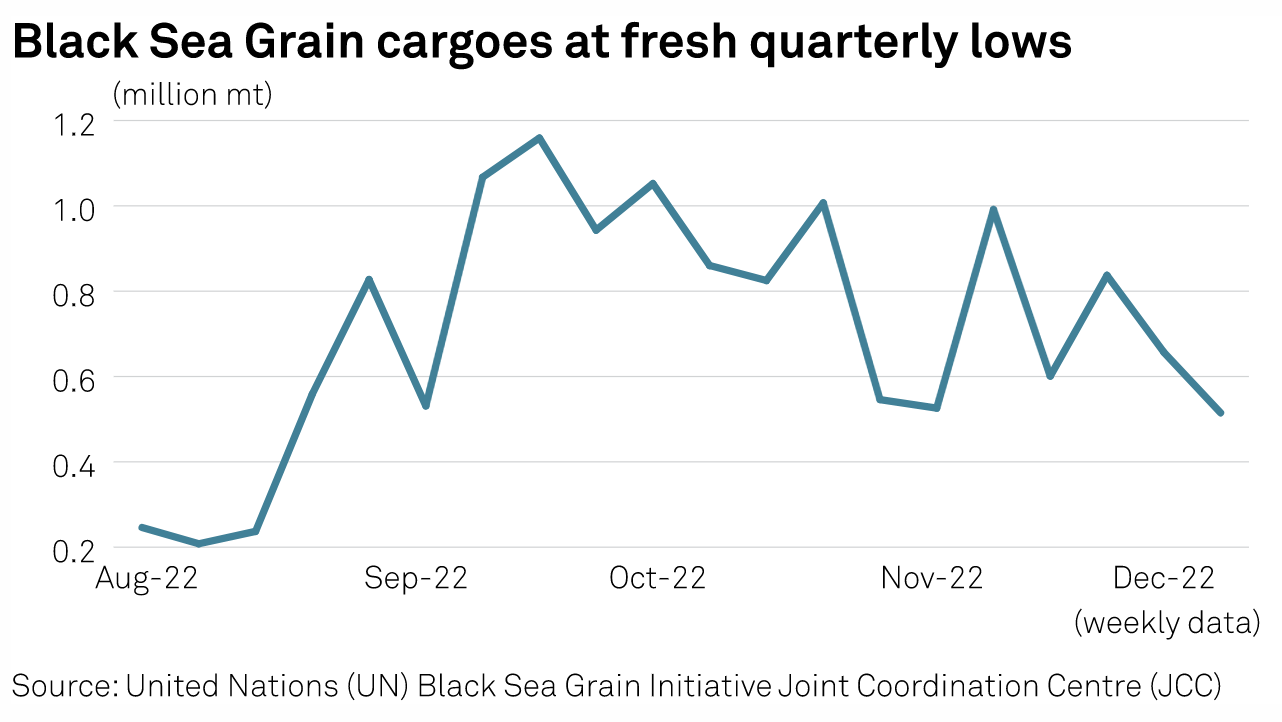

Black Sea Watch: Weekly Ukrainian Seaborne Grain Flows Reach Fresh Quarterly Lows

Seaborne Ukrainian grain flows through the Black Sea slumped another 22% on the week to reach 514,848 mt during the Dec. 12-18 period, with the average cargo size shrinking by 26% on the week to 25,742 mt, an analysis of UN's Black Sea Grain Initiative Joint Coordination Centre data by S&P Global Commodity Insights showed Dec. 19. "We'll probably see an improvement by February or March," said a shipbroker, pointing to unfavorable weather, harvest delays and bombing as the major factors pushing weekly Ukrainian grain seaborne exports to the lowest levels observed since August.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

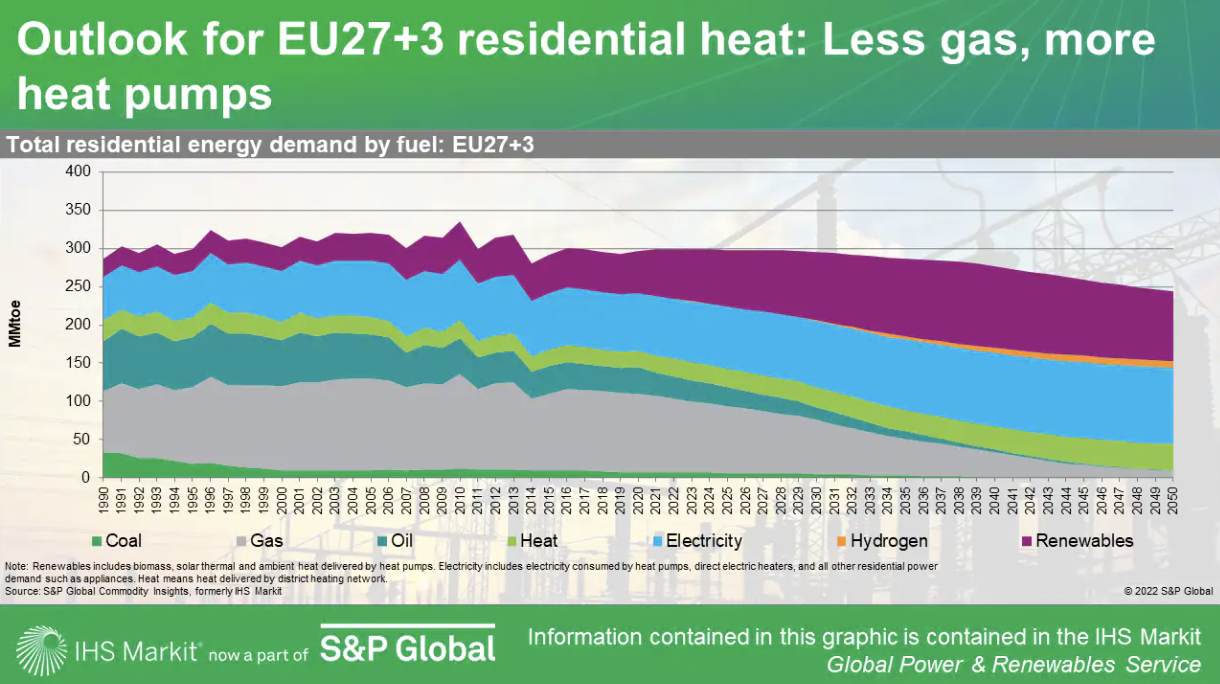

Global Power And Renewables Research Highlights, December 2022

The global energy crisis sparked by the Russia-Ukraine war has cast a spotlight on the region's reliance on a single gas source. Policymakers continue to face a balancing act of securing energy supply and mitigating price volatility. Amid the complex set of near-term challenges, renewable penetration grows worldwide, and questions on maintaining grid reliability arise. The following reports showcase government policy responses to the energy crisis, renewable growth and the decarbonization challenges in the power system.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

Listen: Magic 8 Ball Shows ‘Outlook Good’ For U.S. Oil Producers In 2023, Analyst Agrees

What will 2023 have in store for the oil sector? EY principal Pat Jelinek is expecting healthy oil prices next year, increased investment in oil companies' traditional businesses and adjacent lower carbon options and "a pretty good outlook" for U.S. oil and gas producers in the near term. Jelinek, EY's oil and gas leader for the Americas, joined the podcast to give his take on what's to come for the U.S. oil industry as it contends with continued geopolitical instability, the uncertainty of domestic politics and dueling forces to promote energy security and decarbonization.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

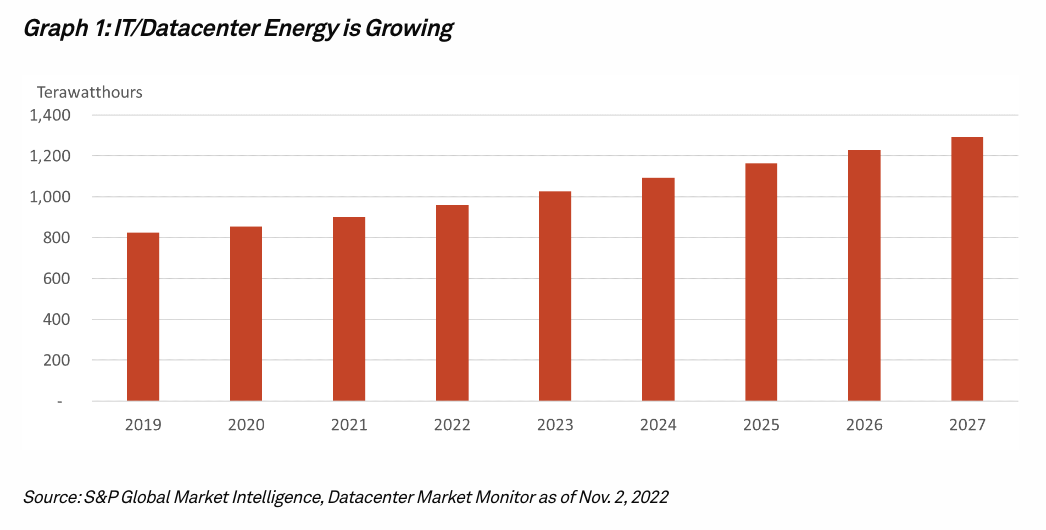

The Big Picture For 2023: Tech Sector Remains Ever-Changing Thanks To ESG, Inflation, And New IT Equipment Strategies

Global markets have been mired by inflationary pressures, geopolitical disruption and the threat of a potential recession for much of 2022. What lies ahead for 2023? In S&P Global Market Intelligence’s recent Big Picture webinar, Kelly Morgan, research director for datacenter services & infrastructure at S&P Global Market Intelligence, discussed how the tech sector has been impacted by ESG, inflation and other elements addressed in our Big Picture Outlook report for the TMT sector.

—Read the article from S&P Global Market Intelligence