Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 31 Aug, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Protectionism in Carbon Markets

Carbon emissions show no respect for national boundaries. Carbon added to the atmosphere in any country will have global climate implications. However, many countries are introducing restrictions that limit or eliminate the export of carbon credits. As carbon markets develop, many middle-income countries are getting priced out of their own carbon credits, which can make their climate commitments unreachable.

According to the World Bank, there are more than 30 emissions trading systems, or ETSs, globally. These systems are more commonly known as “cap and trade.” Under an ETS, a government or governing organization creates an emissions cap in one or more sectors where participants can trade their emissions allowances. The value of these allowances can help establish a price for carbon. One of the largest and best established ETSs was set up in 2005 by the EU and covered about 17% of global greenhouse gas emissions in 2021.

As the price of carbon has gone up in higher-income countries, an active international trade in carbon credits has developed. Most internationally traded carbon credits are issued by carbon registries, such as Verra's Verified Carbon Standard and Gold Standard. However, some countries are beginning to question whether exporting their carbon credits is in their best interest.

India is the fourth country to have planned or announced bans on the sale of carbon credits in recent months, following Papua New Guinea, Indonesia and Honduras. Between 2010 and June 2022, India issued 35.9 million carbon credits, accounting for about 17% of the total credits issued worldwide, according to Platts Analytics, an offering of S&P Global Commodity Insights.

All signatory countries have carbon targets under the Paris Agreement on climate change. When they allow domestically sourced carbon credits to be sold internationally, foreign buyers can bid up the price and make carbon credits prohibitively expensive for domestic companies. However, critics believe that banning exports will hinder new investment in carbon project developments and prompt changes in business strategies, according to S&P Global Commodity Insights. Carbon projects can be a significant source of income, particularly when the credits are priced on the international market.

Not everyone believes that the fragmentation of carbon markets is a bad thing.

“Markets that are designed with the needs of local social and economic goals should emerge around the world,” Richard L. Sandor, chairman and CEO of the American Financial Exchange, said in an interview with S&P Global Commodity Insights. “A grand plan for one worldwide market is neither realistic nor practical. These markets will be integrated ultimately after they are developed to meet the needs of their local constituents.”

It's not unusual for assets to be priced differently in different locations, although the extent of the arbitrage may be one measure of market maturity. The question for carbon market participants is whether the market will grow quickly and be more effective locally or internationally.

Today is Wednesday, August 31, 2022, and here is today’s essential intelligence.

Written by Nathan Hunt.

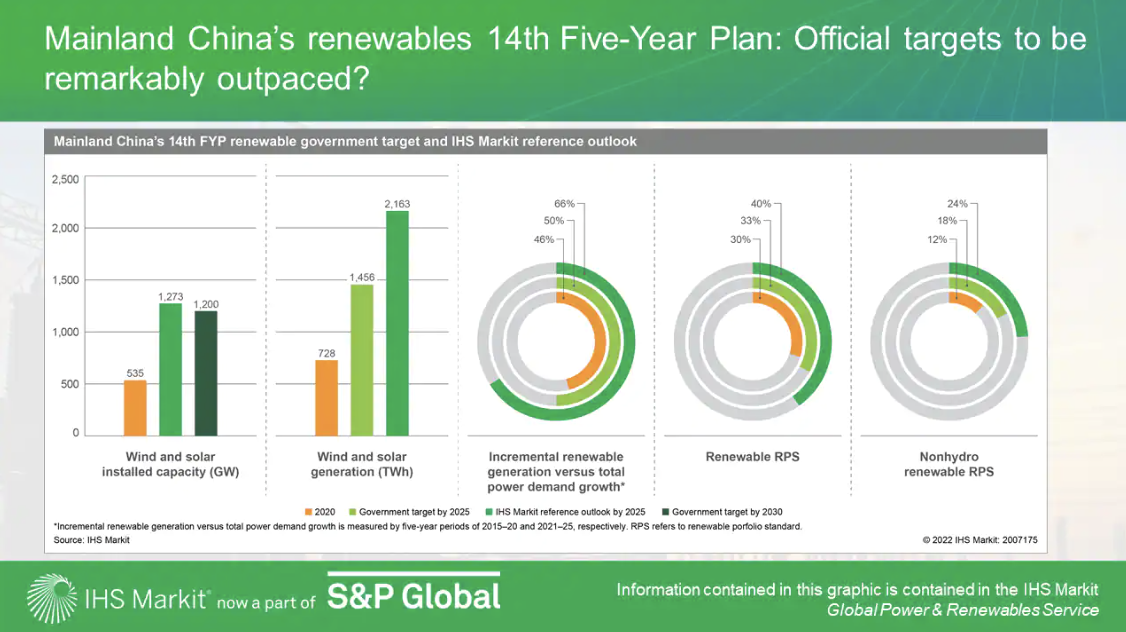

Global Power And Renewables Research Highlights, August 2022

July reports showcase the impacts of sustained high fuel prices on power markets around the world, in addition to highlighting renewables growth in mainland China and discussing the recent U.S. Supreme Court decision on regulating carbon emissions from existing power plants and the Inflation Reduction Act. On the back of tight fuel markets from last year, the Russia-Ukraine crisis has pushed coal, gas and oil prices around the world to record highs — feeding directly into high wholesale power prices.

—Read the article from S&P Global Commodity Insights

Access more insights on the global economy >

U.S. Private Equity Interest In China Declines As Economic Activity Weakens

Investments by U.S.-based private equity and venture capital firms in mainland China have declined this year amid concerns about the country's macroeconomic picture. S&P Global Market Intelligence data shows a downward trend in M&A and new funding rounds in mainland China involving U.S. private equity companies, with second-quarter deal values dropping 78.5% year over year. By comparison, private equity deals worldwide experienced a more modest decline of 29.4% year over year during the same period.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

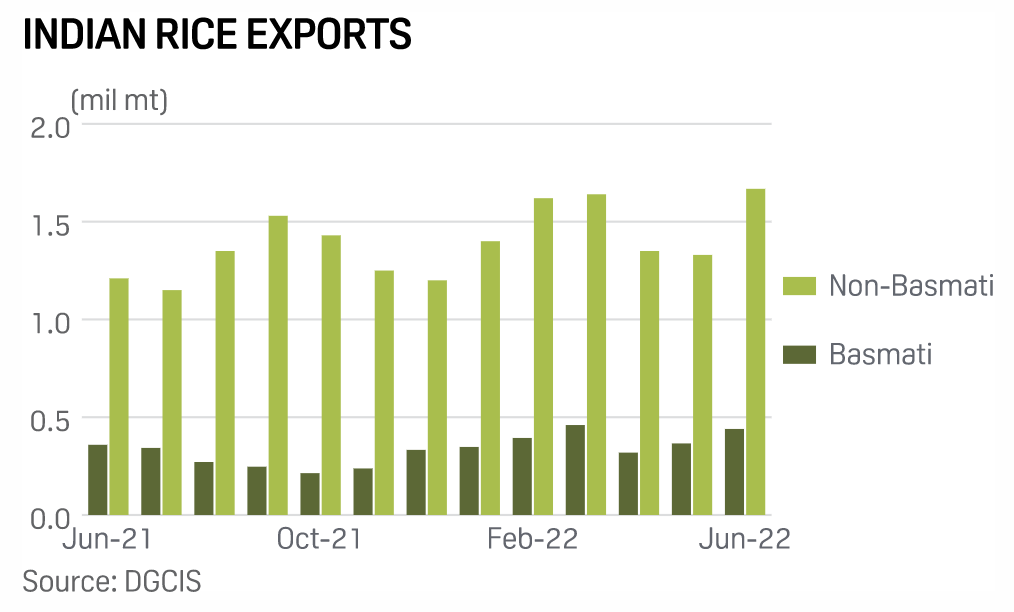

Indian Broken Rice Prices Stable Amid Export Curb Concerns

The Indian market has been rocked in recent days by reports that the country's government is considering a broken rice export ban — or other curb — to ensure domestic supplies. While there is no official decision from the government on a potential restriction, the market — which accounts for 40% of the global rice trade — was gloomy on the prospect.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

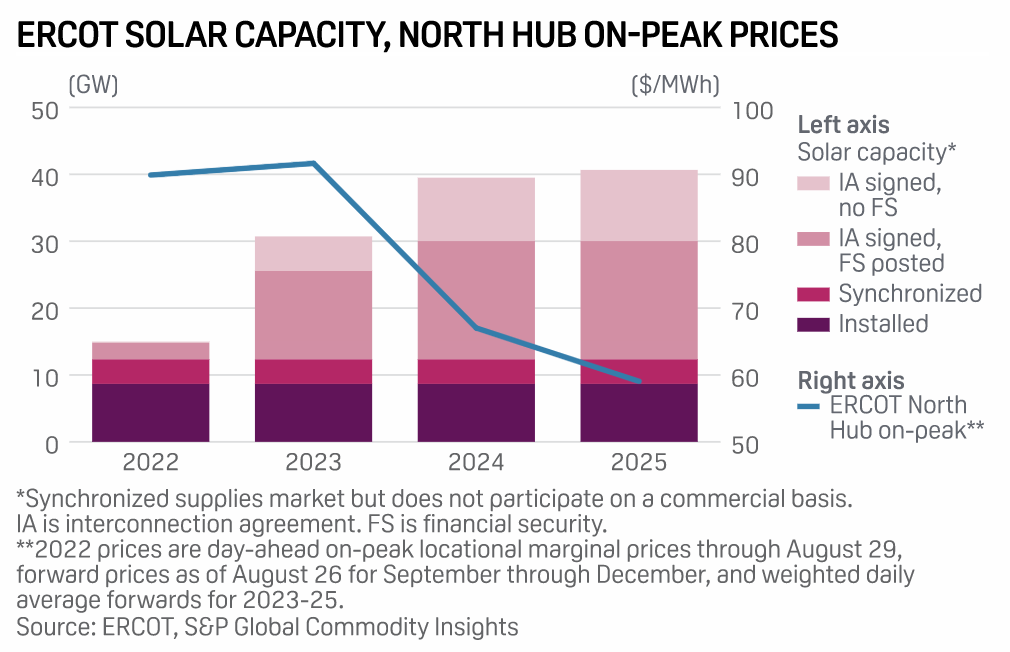

Solar Power Exceeding 20 GW Gives Much Less Reliability Boost To Texas Grid: Consultant

Solar power's reliability contribution to the Electric Reliability Council of Texas may be nearly exhausted if solar capacity reaches 20 GW by 2023, a consultant told stakeholders Aug. 29, which would necessitate increased dispatchable and flexible resources to meet increasing ramping needs. Electrical engineers define effective load-carrying capability as the amount a system's loads can increase when a generator is added while maintaining the same reliability index, typically the loss-of-load expectation.

—Read the article from S&P Global Commodity Insights

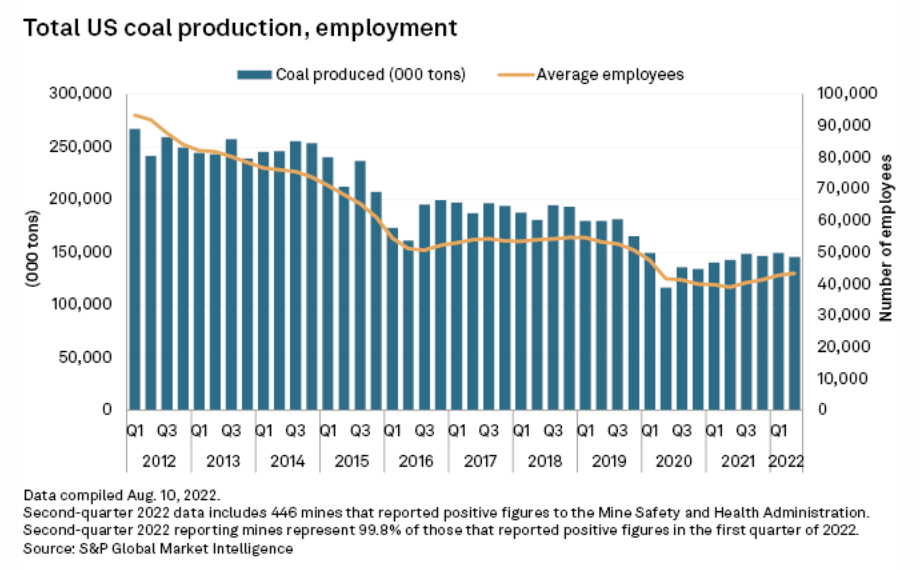

Rising Demand For U.S. Coal Pushes Workforce Numbers Up In Q2'22

Total U.S. coal production rose in the second quarter compared to a year earlier, and a sustained rise in demand for the fuel used in domestic and power generation allowed companies to increase their worker head counts. On a year-over-year basis, average employment rose 11.3% in the second quarter, and coal volumes improved about 2.0%, according to S&P Global Market Intelligence data.

—Read the article from S&P Global Market Intelligence

Access more insights on energy and commodities >

Listen: Next In Tech | Episode 80: Blockchain In DeFi And Web3

The various pieces of decentralized finance (DeFi), Web3 and cryptocurrencies all share a common foundation in blockchain, but they’re often lumped together. Blockchain has a distinct set of uses and benefits and analyst Alex Johnston joins host Eric Hanselman to talk about the insights from a recent study that looks at enterprise uses. Understanding is maturing, but some are delaying deployment as they wrestle with skills gaps. As with DeFi, platforms that abstract complexity can help.

—Listen and subscribe to Next in Tech, a podcast from S&P Global Market Intelligence

Access more insights on technology and media >