Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 25 Aug, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

A Bridge to Sell You – Infrastructure and Yield

As interest rates and inflation continue their game of monetary chicken, the search for yield has grown challenging for investors. Sluggish profits have marred equity markets, and inflation has chipped away at fixed income. However, infrastructure owners and operators have managed to eke out a steady return even in these bearish times. Infrastructure is more than just bridges and roads; it includes datacenters and wastewater facilities too.

“Uncertainty is rising as markets grapple with multiple headwinds,” Kieran Kirwan, director of investment strategy for ProShares, wrote in a recent guest blog for S&P Dow Jones Indices, a division of S&P Global. “Against this backdrop, investors may put a premium on consistency and stability. Infrastructure owners and operators typically have long-term agreements that help deliver consistent fundamental results.”

Transportation infrastructure suffered predictably under pandemic lockdowns due to limited revenues and international border restrictions. As travel and trade have picked up, so have the fortunes of bridges, roads, ports and airports. S&P Global Ratings sees ongoing risks related to a return of border restrictions or lockdowns and to adjustments in mobility trends due to pandemic-related changes in consumer behavior.

According to S&P Global Ratings, other issues for transportation infrastructure include access and affordability, and how they affect communities that depend on this infrastructure. Physical risk related to climate change — like droughts, wildfires and flooding — is becoming a critical issue for infrastructure. Quantifying the financial impact of these climate-related risks is turning into a pressing issue for investors and operators of infrastructure.

Inflation and drought are creating challenges for companies that operate water infrastructure. While inflation and higher costs in material and labor have played a role in rate increases in California and Missouri, public utility American Water attributed the hikes to its accelerated infrastructure investment program. The company has water rate increases pending in Illinois, Pennsylvania and New Jersey.

Climate and sustainability issues are also a high priority for investors and operators of digital infrastructure such as datacenters, fiber networks and wireless communication towers. In Europe, environmental concerns are increasingly important for investors and are also seen as a way to drive operational efficiency. Private equity funds are looking to sustainability as a way of maximizing the value of their investments in digital infrastructure.

Trade, travel, clean water, flushing toilets and the bars on your cell phone all depend on infrastructure investment, and a range of investors have taken notice.

Today is Thursday, August 25, 2022, and here is today’s essential intelligence.

Written by Nathan Hunt.

With Inflation Cresting, The Global Economy Can Achieve A Soft Landing

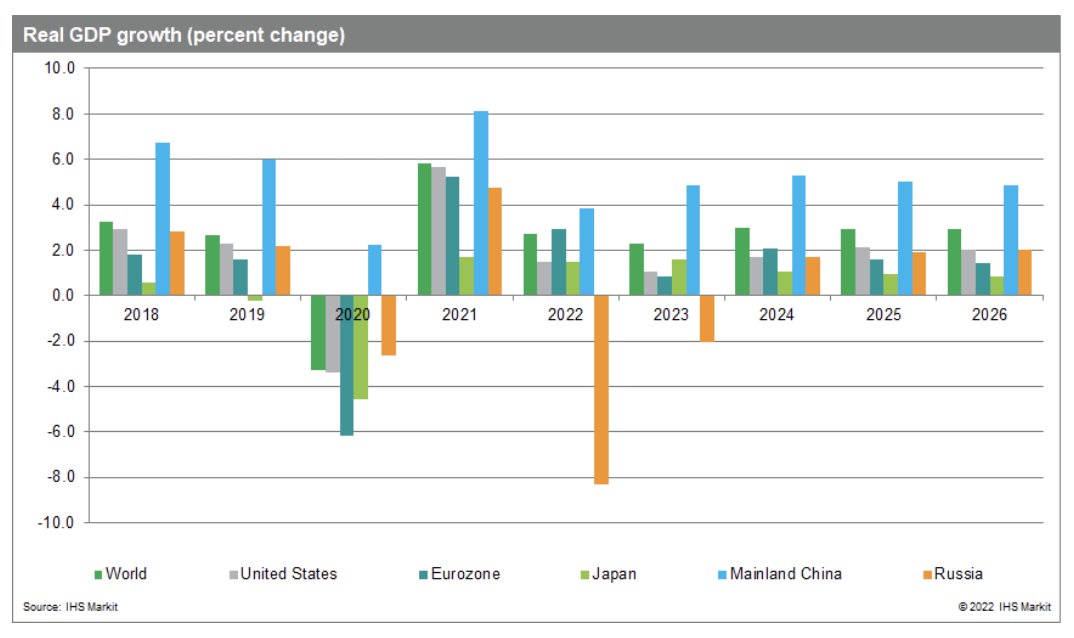

Two shocks pushed the economy off course in the second quarter — Russia's invasion of Ukraine on Feb. 24 and COVID-19 lockdowns in mainland China. After growing at annual rates of 6.2% quarter on quarter (q/q) in the fourth quarter of 2021 and 2.6% in the first quarter of 2022, world real GDP fell at a 1.8% rate in the second quarter. Recent data suggest the global economy is back on track, led by resilient emerging markets.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Ukrainian Banks' Profits Crushed By War-Related Loan Loss Provisions

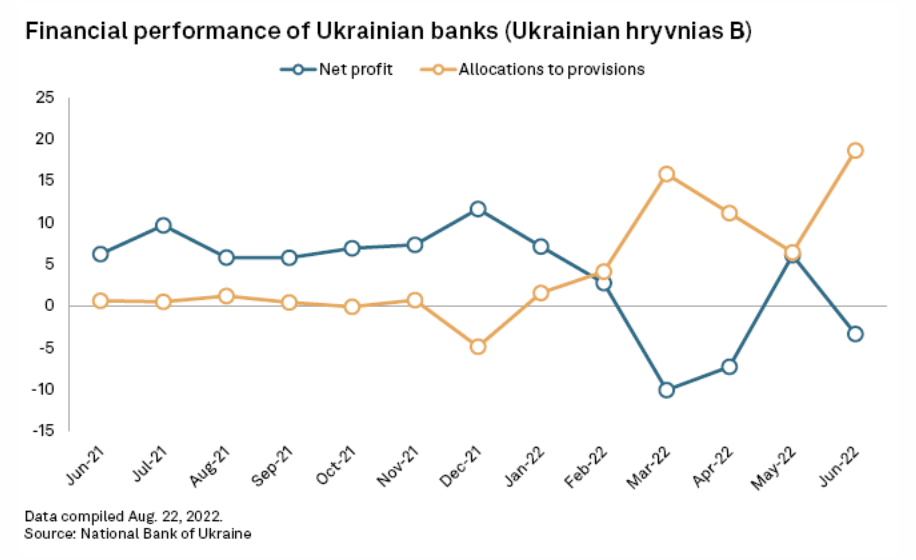

Losses in the Ukrainian banking industry deepened in the second quarter as lenders ramped up provisions for bad loans, a trend that the country's central bank expects to continue amid the war with Russia. Banks in Ukraine posted an aggregate net loss of 4.5 billion hryvnia in the second quarter, pushing the first half losses to 4.6 billion hryvnia, the National Bank of Ukraine said. Provisions for losses expected due to the war reached 57.9 billion hryvnia at June-end, of which 52.1 billion hryvnia was allocated in the second quarter.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

Higher U.S. Crude Flows To Europe Help Shrink Physical Premium, Boost Tanker Rates

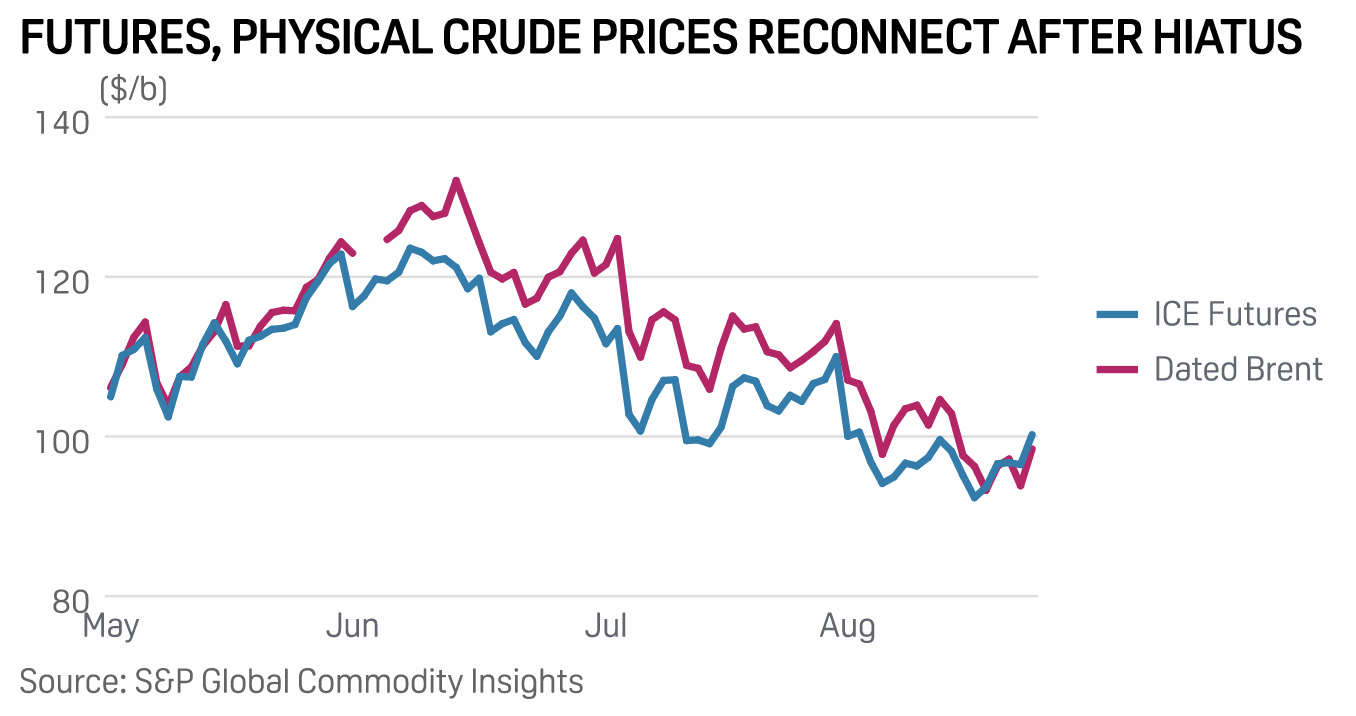

Rising volumes of U.S. crude exports to Europe as the region replaces Russian supplies are supporting dirty tanker rates and helping to lower a recent price premium for physical crude, market sources told S&P Global Commodity Insights. U.S. seaborne crude exports to Europe have risen by almost 300,000 b/d on average since March and are expected to hit a record 1.6 million b/d in August, according to vessel analytics provider Kpler, supported largely by rebounding volumes of U.S. shale.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Which ASEAN Countries Will Be The Front-Runners To Decarbonize Their Power Sectors?

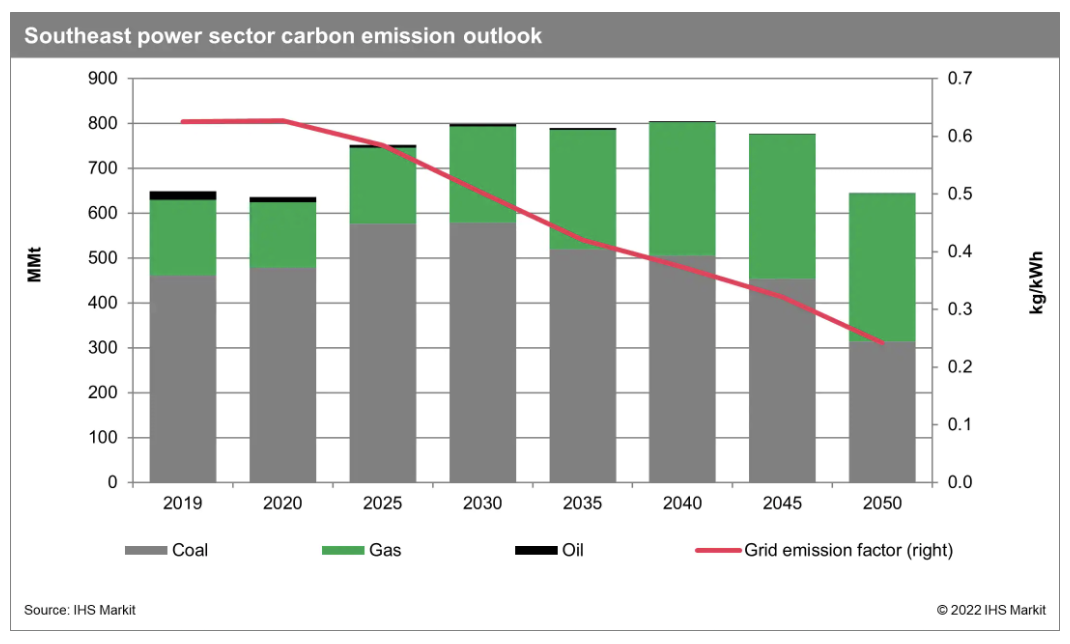

Given its location and proximity to oceans, ASEAN is one of the most vulnerable regions to the impact of global warming. In recognizing the risks, the region has set decarbonization targets, pledged reduction plans in their nationally determined contributions (NDCs) and passed laws and policies to address climate change.

—Read the article from S&P Global Commodity Insights

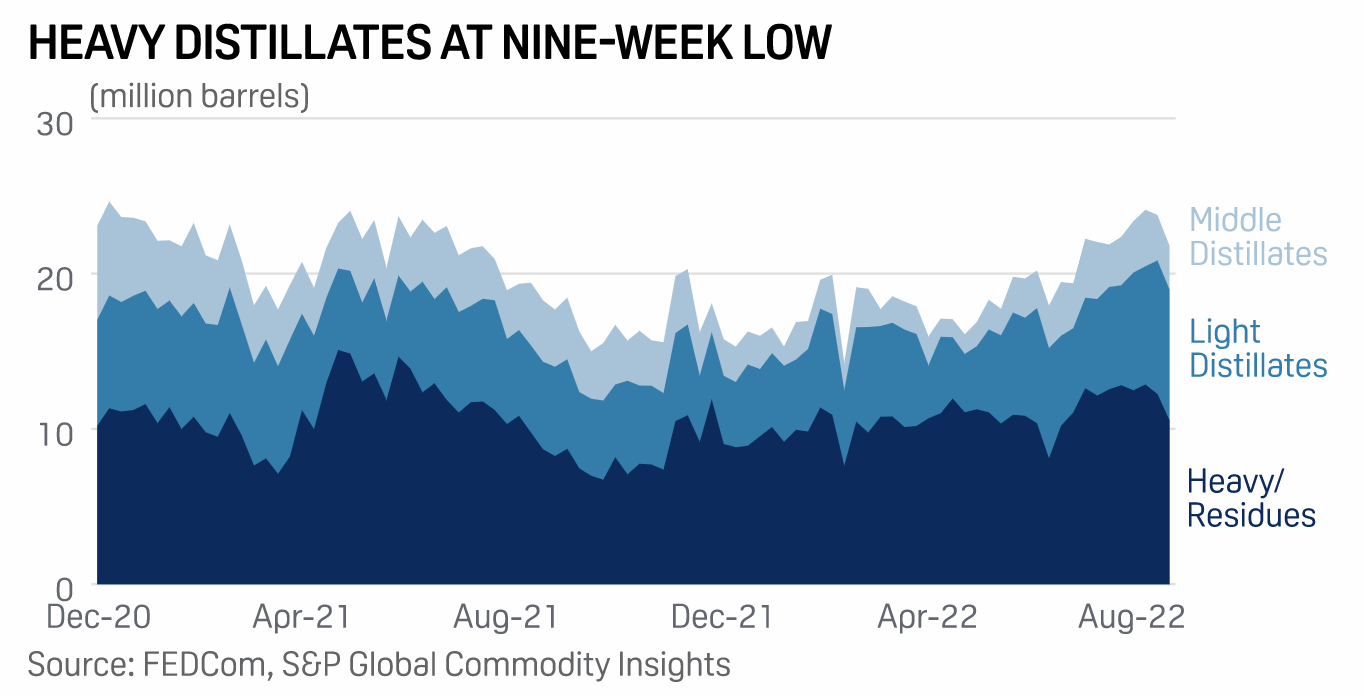

Oil Product Stocks Drop To 8-Week Low As Demand Picks Up

Oil product stockpiles at the UAE's Port of Fujairah fell to an eight-week low led by a 14% decline in fuels used for shipping and power generation for the week ended Aug. 22, according to Fujairah Oil Industry Zone data. The total inventory was at 21.787 million barrels as of Aug. 22, down 8.3% from a week earlier and the lowest since June 27, the port data provided exclusively to S&P Global Commodity Insights on Aug. 24 showed.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

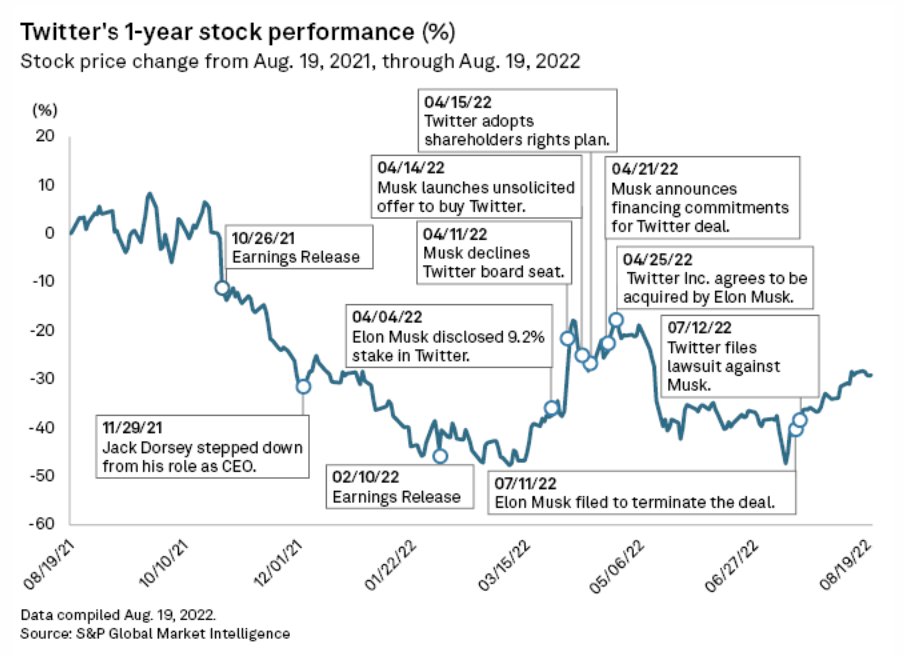

Odds Increasingly Favor Settlement Between Elon Musk, Twitter, Analysts Say

As the fight for Twitter Inc. continues, a path forward seems likely to hinge on what the company's shareholders are willing to accept. Many are growing impatient with the volatility hitting the company's stock price amid a tumultuous market and contentious negotiations between Twitter and Tesla Inc. CEO Elon Musk over the company's proposed sale. Musk offered to pay $54.20 per share for Twitter in April but rescinded the offer in July. As the disputed deal heads to an Oct. 17 court date, industry observers said a settlement appears increasingly likely, and Musk may be forced to pay close to his original offer.

—Read the article from S&P Global Market Intelligence

Access more insights on technology and media >