Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 25 Aug, 2020

By S&P Global

Global coronavirus cases are climbing as sovereign debt piles higher and higher. Which problem is more important for countries to control?

“At this stage, I think, nobody is very worried about debt,” Peterson Institute for International Economics senior fellow Olivier Blanchard, a former chief economist for the International Monetary Fund, told the New York Times on Aug. 21. “It’s clear that we can probably go where we are going, which is debt ratios above 100% in many countries. And that’s not the end of the world.”

Glenn Hubbard, the former chairman of the Council of Economic Advisers under U.S. President George W. Bush, told the Wall Street Journal on Aug. 23 that “the war analogy is the right one” in determining the global community’s battle against the coronavirus pandemic. “We were and are fighting a war. It’s a virus, not a foreign power, but the level of spending isn’t the problem,” he said.

“With much economic activity suspended and fiscal revenues in free fall, many countries will be forced to default. Others will cobble together scarce resources to pay creditors, cutting back on much-needed health and social expenditures,” the Nobel Laurate economist and Columbia University professor Joseph Stiglitz and United Nations Department of Economic and Social Affairs chief of global economic monitoring Hamid Rashid wrote in a Guardian editorial earlier this month. “Still others will resort to additional borrowing, kicking the proverbial can down the road, seemingly easier now because of the flood of liquidity from central banks around the world.”

Prior to the pandemic, in the third quarter of last year, global debt levels soared to a historic $253 trillion, roughly 320% of global GDP, according to the International Institute of Finance. In the first quarter, global debt surged even higher—to 331% of GDP, according to the organization. As of last month, the debt-to-GDP ratio of the world’s advanced economies spiked to 128%, according to the International Monetary Fund. Entering the crisis, many emerging market economies carried such high levels of debt that it prevented their taking on expansive fiscal policies to fight the pandemic’s hit to their tourism- and commodities-dependent economies.

The U.S. deficit is now greater than the country’s GDP. At the end of June, the federal debt totaled a monumental $20.63 trillion. Congressional Budget Office analysts forecast in January that the debt would grow to be the same size as its output value by 2030, highlighting how the pandemic has dramatically accelerated indebtedness. The U.S. debt-to-GDP ratio is expected to grow to 136% by the end of the third quarter, according to research by The Balance, a financial advice and news organization.

Still, less than half (47%) of adult Americans say they believe the country’s deficit is “a very big problem,” according to a Pew Research Center survey conducted from June 16-22. In the autumn of 2018, 55% of adult Americans held that belief.

The British government has been borrowing at the highest rates seen since World War II, with its public spending surpassing £2 trillion last month for the first time in history, according to data released by the country’s Office for National Statistics.

“Today’s figures are a stark reminder that we must return our public finances to a sustainable footing over time, which will require taking difficult decisions,” U.K. Chancellor Rishi Sunak said on Aug. 21, signaling that the spending will eventually stop.

Downside risks to growth in emerging market economies have escalated as infections in those nations and advanced economies increase, according to S&P Global Ratings. The recovery for developing nations has been weak. Sovereign debt in Chile, Colombia, Indonesia, Mexico, the Philippines, and Saudi Arabia has reached the highest levels seen in the past two years.

“Many countries had pre-existing vulnerabilities and remaining policy distortions heading into the crisis,” the IMF said in its annual report on global discrepancies between saving and spending earlier this month. “Even though we forecast a slight narrowing of global imbalances in 2020, the situation varies around the world. Economies dependent on severely affected sectors, such as oil and tourism, or reliant on remittances, could see a fall in their current account balances exceeding 2% of GDP. Such intense external shocks may have lasting effects and require significant economic adjustments.”

Today is Tuesday, August 25, 2020, and here is today’s essential intelligence.

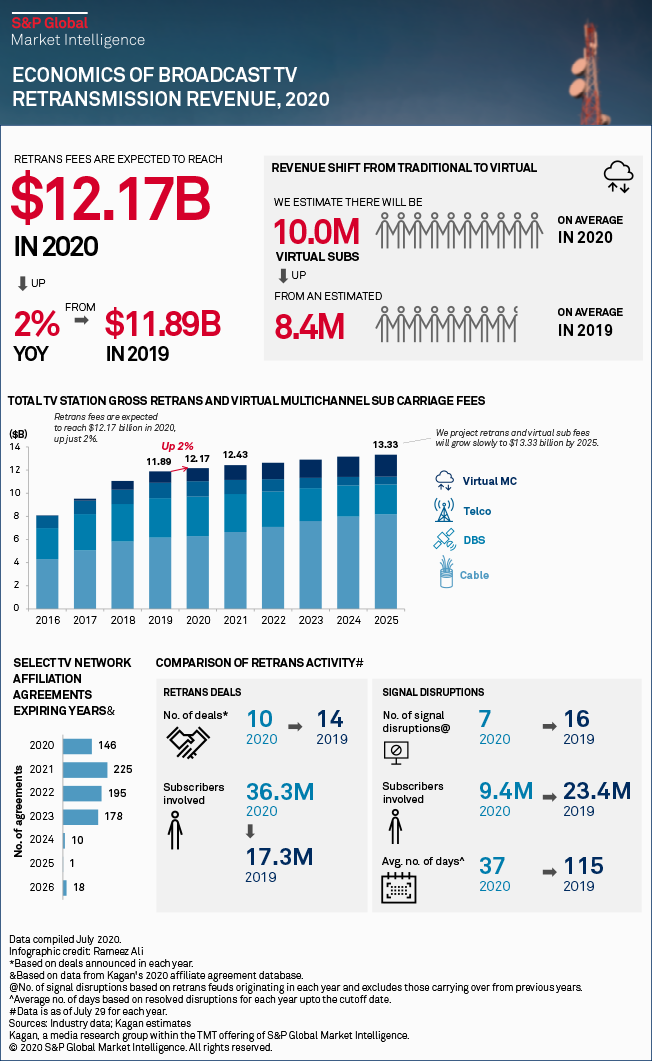

Economics of Broadcast TV Retransmission Revenue 2020

Amid the COVID-19-induced recession fueling an ongoing trend in households dropping traditional multichannel video subscription in favor of cheaper virtual alternatives, S&P Global Market Intelligence revised down projections covering U.S. TV station owners' retrans fees from traditional and virtual multichannel service providers. S&P Global Market Intelligence’s projections now show retrans fees are expected to reach $12.17 billion in 2020, up just 2% from $11.89 billion in 2019.

—Read the full article from S&P Global Market Intelligence

A Stable Regime

In recent days the S&P 500 reached multiple new highs, despite the still-uncertain nature of the economy’s recovery from the COVID-19 pandemic. Year to date through Aug. 20, 2020, the S&P 500 is up 6% while the S&P 500 Low Volatility Index is down 6%. Market volatility remains high, as evidenced by the charts in Exhibit 1. In all sectors of the S&P 500, volatility spiked in March and, though it has leveled off, remains above average. Similar to three months ago, Energy and Financials were among the sectors with the greatest volatility increase.

—Read the full article from S&P Dow Jones Indices

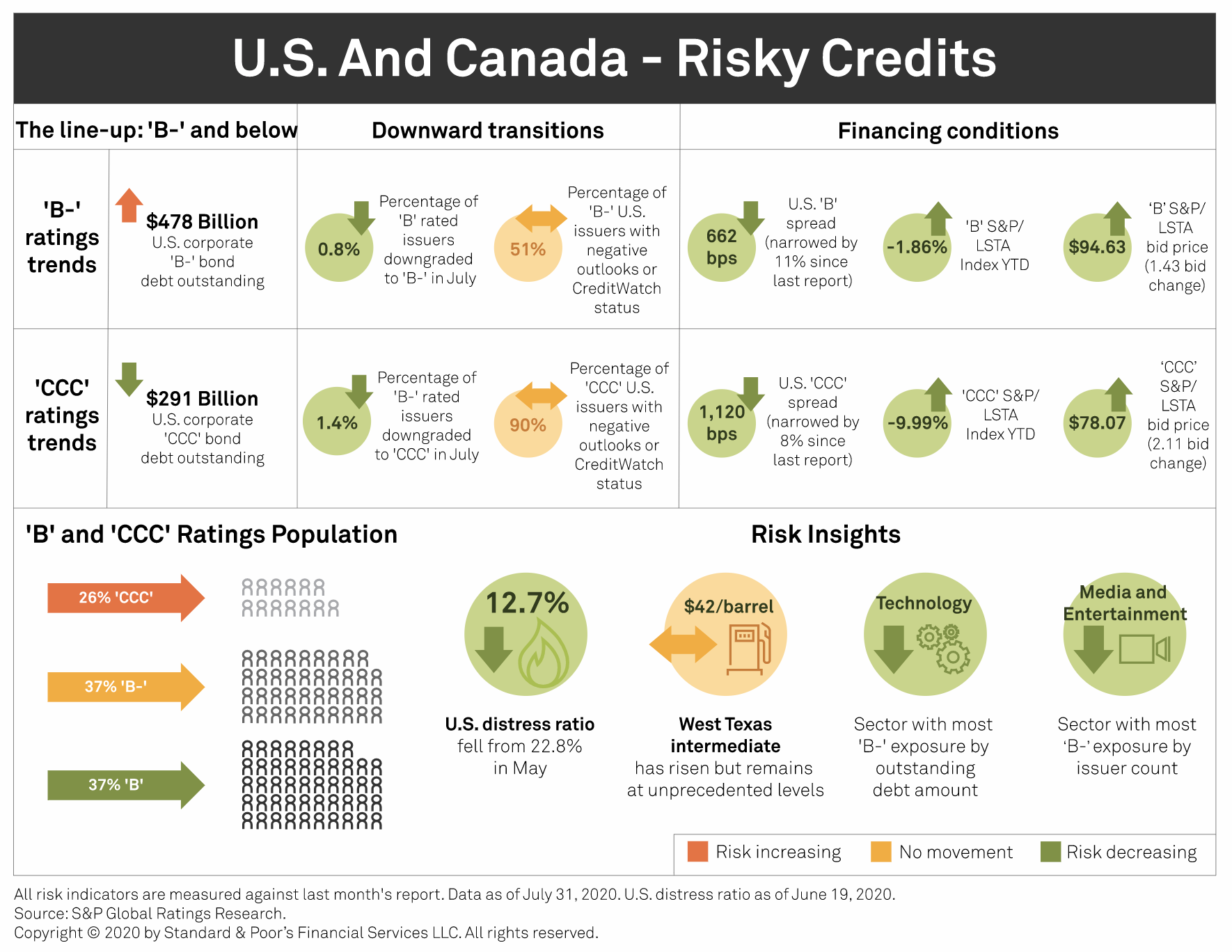

Credit Trends: Risky Credits: The 'CCC' Category Remains Large As Market Risks Ease

The 'CCC' category shrinks: The number of 'CCC' category ratings shrank in July to 249 from its all-time high of 256 in June. The slight drop is attributable to a consistently elevated number of defaults, offset by a downward trend of issuers transitioning into the 'CCC' category. The category accounts for 93% of the defaults in the U.S. and Canada so far this year. Only 1.4% of 'B-' rated companies transitioned to the 'CCC' rating category in July, as opposed to 2.0% in June and 14.5% in April (an all-time high). As a result, the three-month weighted average of these transitions dropped two-thirds compared with June.

—Read the full report from S&P Global Ratings

Level COVID-19’s Early Impact on Public Companies’ Fundamental Credit Risk – Asia Pacific

Recently, there have been many articles published using market data to evaluate the impact of COVID-19 on corporate credit risk across different countries and industries. However, as countries are emerging from lockdown, stock markets around the globe are soaring back to pre-pandemic levels, betting on a quick economic recovery. Under such circumstances, solely relying on market data to measure the change of a company’s credit profile may not fully reflect how the global shutdown affected businesses, as many had to leverage the fiscal, liquidity, and monetary stimuli offered by governments and central banks in support of the economy. In this article, S&P Global Market Intelligence conducts a retrospective study to assess the credit risk “scars” left by the COVID-19 pandemic on publicly-traded businesses, with a focus on the Asia Pacific region.

—Read the full article from S&P Global Market Intelligence

California’s Cash Position Remains Strong Despite Budgetary Deficit

California's recently released cash flow projection for fiscal 2021 based on its enacted 2021 budget indicates its cash position will remain strong in S&P Global Market Ratings’ view, at least for the current fiscal year, despite budgeted drawdowns in the state's rainy-day fund. However, large projected out-year budget gaps could reduce the state's cash position in future years, absent structural budget adjustments next year and beyond.

—Read the full report from S&P Global Ratings

Singapore Banks' Bad Loans, Margins May Stabilize In Second Half Of 2020

Singapore's banks may steady their bad loans and net interest margins after a pandemic-ridden first half of the year, analysts say, an indication that the worst may be over for the local lenders. Profits at the three Singapore-listed local banks came under pressure during the first half of 2020 as the coronavirus hurt borrowers' finances, requiring the lenders to step up provisions for possible bad loans. After a weak first quarter, Oversea-Chinese Banking Corp. Ltd. and United Overseas Bank Ltd. both posted a 40% year-over-year decline in net profit for the second quarter, while DBS Group Holdings Ltd.'s earnings dropped 22% in the April-to-June period.

—Read the full article from S&P Global Market Intelligence

Listen: How A Biden Victory Could Influence Decarbonization Plans For Oil And Gas Companies

A victory in November for former Vice President Joe Biden in November could influence oil and gas companies' decarbonization plans, given Biden's climate and clean energy proposals. European oil majors tend to outpace their US counterparts in terms of climate goals, likely due to the European Green Deal, but could a Democratic victory this fall encourage companies to adopt stricter emission reduction targets?

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Platts

US ELECTIONS: Biden Called Climate Champion, Even As Dem Platform Criticized

The messaging was clear at the Democratic National Convention: the planet cannot survive another four years of regulatory rollbacks and pro-fossil fuel policies, and Americans can put their trust in former Vice President Joe Biden to right the ship and usher in the bold policies demanded by science and the scale of the climate crisis. Biden has put forth a four-year, $2 trillion plan to invest in infrastructure and clean energy. The aggressive climate plan calls for 100% clean electricity generation by 2035 and a carbon-neutral economy nationwide by 2050.

—Read the full article from S&P Global Platts

Insurers, Officials Counting The Cost Of Devastating Midwest Derecho

Early indications show that the derecho that tore through several Midwest states Aug. 10 did heavy damage to crops and grain storage structures, with Iowa's corn and soybean industries taking an especially hard hit. Diane Weidner, vice president for communications for Great American Insurance Group subsidiary American Financial Group Inc., said it will take several weeks for crop insurers to calculate the extent of the damage. She said in an email that the storm was "unique" in that it came when the corn crop was at a later stage of maturity and therefore more vulnerable to wind damage.

—Read the full article from S&P Global Market Intelligence

Interview: From Retail Fuel To Hydrogen – BP Eyes To Widen India Energy Footprint

The aspiration of bp to transform to an integrated energy company will strengthen its hands to play a much bigger role in India's transition toward cleaner fuels like gas, hydrogen and renewables, Sashi Mukundan, India president and senior president of bp group told S&P Global Platts in an exclusive interview. While bp will be pushing ahead with its retail fuel and gas production strategies with its partner Reliance Industries, it will also be pursuing investments in various low-carbon energy segments. "As we grow our business footprint in the country, we seek to support India's energy transition, directly and through our partners, to deliver cleaner and more affordable energy," Mukundan said.

—Read the full article from S&P Global Platts

Q2 Power Forecast Snapshot: Amid A Pandemic, Green Electricity Charts A Course Forward

Demand losses associated with economic contraction and pandemic mitigation measures impacted spark spreads during the second quarter, a period when spark spreads are seasonally weak to begin with. Virtually every market had spark spread declines, with key power hubs trading in single digits. MISO Indiana Hub saw the highest spark spreads in the Eastern Interconnect, as tightness in generation makes its presence felt. PJM Western Hub also saw adequate spreads despite a highly competitive generation landscape. Northeast hubs continued to see low and declining spark spreads as renewable energy expands into these markets. Western U.S. hubs, typically impacted by peak hydro availability, saw spreads fall still further due to pandemic impacts.

—Read the full article from S&P Global Market Intelligence

ESG High-Yield Indexes Outperformed Amid The Pandemic, But Do They Guarantee Alpha?

The dispute over ESG-based investing, discussed in S&P Global Market Intelligence previous article, has heated up in recent days. Leading asset managers, including Franklin Resources, State Street Corp. and Vanguard Group, sent letters asking the U.S. Department of Labor to reconsider investment rules floated by the department in June. The proposed regulations would require administrators of retirement plans to base their selection of investments solely on financial considerations. Administrators would be prohibited from subordinating return or increasing risk in pursuit of non-financial objectives.

—Read the full article from S&P Global Market Intelligence

Listen: How Texas' Energy Policies Are Working To Shape ERCOT's Energy Transition

Amy Gasca, Manan Ahjua and Mark Watson of S&P Global Platts talk with Brett Perlman, CEO of the Center for Houston's Future and ex-Public Utility Commissioner of Texas, about the state's energy policies and the energy transition.

—Listen and subscribe to Commodities Focus, a podcast from S&P Global Platts

Watch: Market Movers Europe, Aug 24-28: Energy and commodity markets brace for September; Europe burns gas to stay cool

In this week's highlights: Lukoil may detail OPEC+ and coronavirus impact; gas-fired power generation rises with the mercury; where next for carbon prices after their return to pre-pandemic levels? And key contract price talks loom the petrochemicals market.

—Watch and share this Market Movers video from S&P Global Platts

Analysis: Pipechina To Work On Future Pipeline, Terminal Access Policies After Asset Transfers

China's pipeline reforms, which progressed with the transfer of assets from national oil companies to the newly created PipeChina this year, have left some questions unanswered over the status of commercial contracts tied to LNG terminals, and usage rights of pipeline and terminal capacity. So far, executives have said that asset transfers were primarily related to ownership and no changes were expected in commercial contracts, and current LNG terminal capacity and pipeline injection rights.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language