Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 10 Aug, 2020

By S&P Global

Facing mounting credit exposure from struggling small businesses and consumers, surging defaults, and ongoing interest rates at or near zero, European banks may soon face their largest hurdle. Loan losses loom as the pandemic persists.

“If I go through my last eight years, we had a lot of mini-earthquakes, but never of the magnitude of what we are seeing now,” UBS CEO Sergio Ermotti told the Financial Times. “This is a crisis that is driven by fear in a different way . . . this time it’s not just about people losing their assets or savings, it’s about their life, it’s about their families. It’s so profound, so different.”

Twenty of the largest banks across Europe set aside $28 billion combined to tackle bad loans in the second quarter, according to a Bloomberg analysis of company filings. Data compiled by S&P Global Market Intelligence shows that since the start of this year, the banks’ market capitalization by assets has declined 40%—down to €466 billion as of July 31 from €776.5 billion on Jan. 1—due to the pandemic’s devastating economic implications and fears of a second wave.

British lenders have booked the biggest provisions and suffered the greatest swings in market value.

After setting aside £1.4 billion for loan losses during the first quarter, Lloyds Banking Group provisioned £2.4 billion for the second quarter. The crisis has prompted the bank to lose roughly half its market value. Additionally, HSBC expanded its full-year expected credit losses to between $8 billion and $13 billion—an increase from April’s full-year projections of between $7 billion and $11 billion—and shed €64 billion in value, falling to €77 billion from €141 billion, according to S&P Global Market Intelligence.

While the Bank of England believes U.K. banks have robust capital buffers to supply their lending activities, adjusting their projections of banks’ aggregate full-year loan losses to "somewhat less than £80 billion" on Aug. 6, the country’s major lenders reported an additional £18 billion in credit losses on outstanding loans in the first half of the year.

“Banks have the capacity to continue to provide credit to support the U.K. economy," the BoE said in its latest Financial Stability report. “There are costs to banks taking defensive actions, such as cutting lending, in order to try to widen the range of possible outcomes to which they would be resilient. By restricting lending, those actions could make the central outlook materially worse.”

Still, Europe’s 20 largest banks’ provisions don’t compare to those of the eight largest U.S. banks, which reserved $41.5 billion for loan losses in the second quarter, according to the Bloomberg analysis. U.S. banks have more capital and liquidity than their European counterparts in both business-as-usual and crisis scenarios, but are currently conducting business in the country hardest-hit by the pandemic.

Building back better and for resiliency appears to be at the forefront of European banks recovery plans, even in light of analysts’ predictions that a second wave of infections across Europe could push hundreds of billions of euros in cumulative credit losses across regional banks in the medium term.

“Fundamentally, notwithstanding the huge cost that we've paid and the sadness associated with this pandemic, it does open up an opportunity for us globally to be thinking about the idea of building the system back, but in a totally different way," Elsa Palanza, Barclay’s global head of sustainability and citizenship, told Market Intelligence’s ESG Insider podcast. “The transition to a greener, more resilient economy cannot only focus on the environment and decarbonization … It also means accounting for people's livelihoods and their futures and better global health and better access to social services.”

Today is Monday, August 10, 2020, and here is today’s essential intelligence.

As COVID-19 Wears On, Regulators Examine Moratorium Extensions, Cost Recovery

With the numbers of coronavirus cases fluctuating from day to day and the ebb and flow varying widely from state to state, utilities and their regulators are scrambling to decide whether to end or extend moratoriums on service disconnections that have been in place since March and how to address recovery of the related costs.

—Read the full article from S&P Global Market Intelligence

As utilities restore power to millions, a more active tropical season is forecast

On the heels of the havoc wrought by hurricane/tropical storm Isaias, with loads commensurately lighter and spot prices generally weaker than normal, experts have increased the number of named storms and hurricanes expected this season. As of about 3:30 pm ET Aug. 6, utilities were working to restore power to about 1.6 million customers in the regions of the Mid-Atlantic, Northeast, and Southeast affected by Isaias, according to PowerOutage.us.

—Read the full article from S&P Global Platts

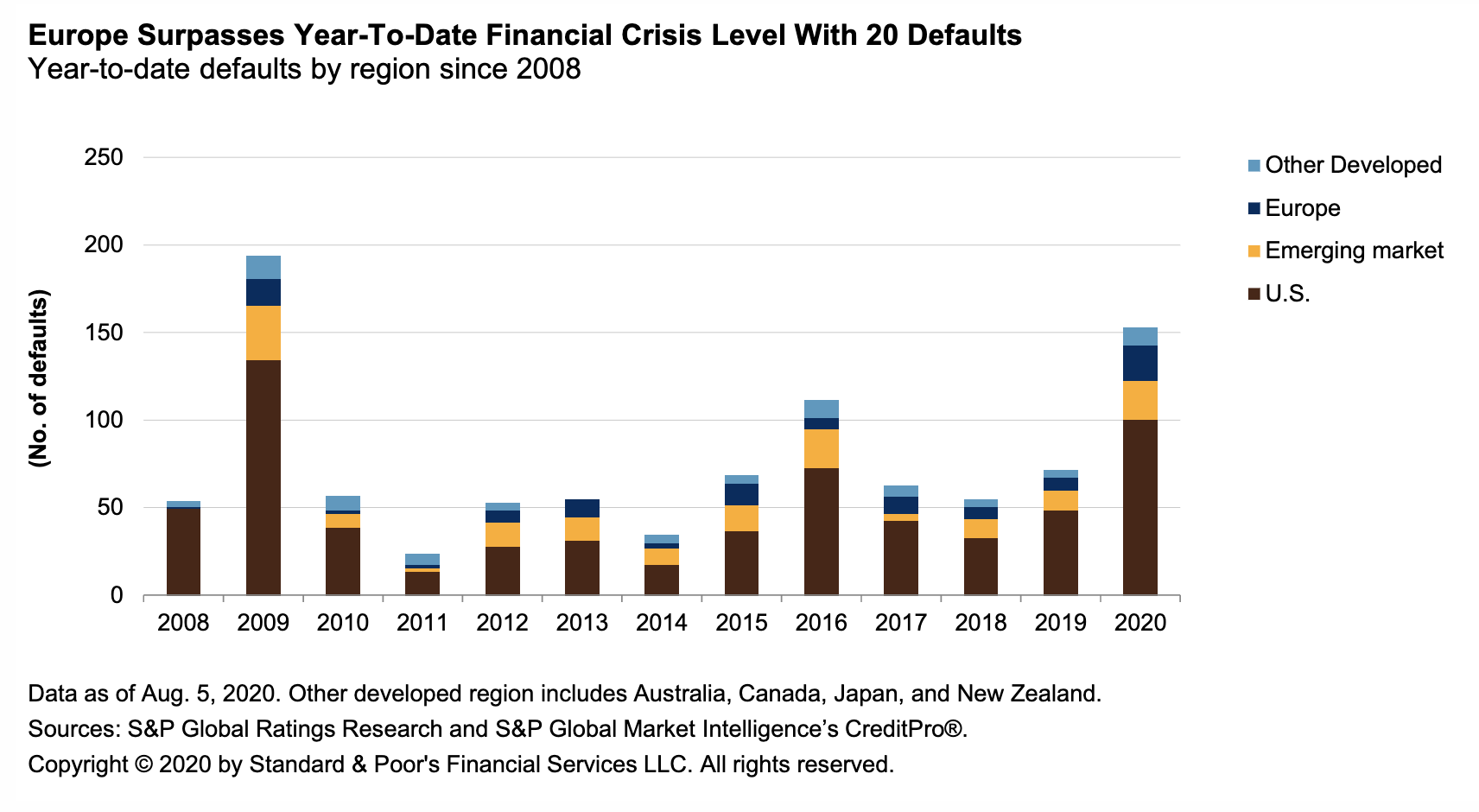

Default, Transition, and Recovery: U.K.-Based Defaults This Week Boost The European Corporate Default Tally To A New High

—Read the full report from S&P Global Ratings

Leveraged Finance: Monitoring Middle Market Entities Amid COVID-19

The one-two punch of the COVID-19 pandemic and the supply and demand shock in the energy markets have abruptly ended the longest economic expansion in U.S. history, damaging businesses across almost all parts of the global economy. For the full-year 2020, we expect U.S. GDP to contract 5% while our 12-month forecast for the U.S. speculative-grade corporate default rate (including both corporate bonds and loans) was 12.5% by March 2021.

—Read the full report from S&P Global Ratings

UK banks' COVID-19 loan losses likely to be under £80B, says BoE

The Bank of England has revised downwards its estimate of future COVID-19-connected losses for U.K. banks, saying their capital buffers are robust enough to allow them to keep lending to the real economy. Despite British lenders reporting an additional £18 billion of credit losses on outstanding loans in the first half of 2020, the BoE revised its future aggregate loss estimate to "somewhat less than £80 billion" on the back of more-benign GDP predictions from its monetary policy committee. Banks have set aside billions for expected losses as a result of the pandemic, with some increasing provisions in the second quarter.

—Read the full article from S&P Global Market Intelligence

Uncertainty has banks holding off on PPP forgiveness process

Many financial institutions are holding off on accepting Paycheck Protection Program loan forgiveness applications until the regulatory and legislative picture becomes clearer. Banks must ensure their borrowers are taking the necessary steps to receive forgiveness for their Small Business Administration loans that were part of the program Congress created in March to help businesses cope with the COVID-19 pandemic. But banks are grappling with the complexities of the PPP forgiveness application, and some are concerned that legislation will soon change the rules that govern the process.

—Read the full article from S&P Global Market Intelligence

Disney surges on 'Mulan' streaming plans; Microsoft sees TikTok deal boost

The S&P 500 rebounded this week as some major technology companies reported positive earnings results and others revealed M&A news. Walt Disney Co.'s shares jumped the week ended Aug. 7, even after the company reported a $2.9 billion income hit for its June quarter due to impacts from the coronavirus pandemic. Disney's parks, experiences and products segment took the biggest blow, reporting revenues of $983 million for the fiscal third quarter, down 85% year over year. All of Disney's domestic parks and resorts, its cruise line business and Disneyland Paris were closed for the entirety of the just-ended period as social-distancing measures and shelter-in-place mandates took effect globally.

—Read the full article from S&P Global Market Intelligence

Nintendo profits up over 400% as COVID-19 drives game sales

Nintendo Co. Ltd.'s profits surged more than 400% in its fiscal first quarter ended June 30, as demand for the company's Switch console and Animal Crossing video game skyrocketed amid the COVID-19 pandemic. The Japanese video game company shipped more than 5.7 million Switch consoles in the quarter, up 166.6% year over year. The shipments included about 3 million of the original Switch device and 2.6 million units of the portable-only Switch Lite model. As of June 30, lifetime-to-date sales of the Switch consoles reached 61.44 million units worldwide.

—Read the full article from S&P Global Market Intelligence

Podcast: European banks sharpen ESG focus as COVID-19 highlights risk

Climate change remains in sharp focus for European banks amid the coronavirus crisis, sustainability leaders at some of Europe's largest lenders said in exclusive interviews for the latest episode of "ESG Insider," an S&P Global podcast about environmental, social and governance issues. Banks face tough challenges as they make the transition to a more carbon-neutral economy, potentially losing business in the process. Find "ESG Insider" on Spotify or Apple Podcasts.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Market Intelligence

BP likely to sell legacy oil, gas assets amid low-carbon, renewables move

BP PLC's plan to shrink its oil and gas production by 40% in the next ten years will force the supermajor to amplify upstream divestments as it sheds its most carbon-intensive assets and accelerates its transition into an integrated energy company, analysts and company executives said. "BP has set out ambitious targets for the realignment of its business within five- and ten-year time frames. An overhaul of this scale will require significant movements in the M&A market if it is to be delivered in the targeted timeframe," Will Scargill, managing oil and gas analyst at analytics firm GlobalData, wrote in an Aug. 5 note.

—Read the full article from S&P Global Market Intelligence

Offshore energy integration could contribute 30% of UK's net zero emissions target: OGA

Integration of the UK's offshore energy systems could potentially deliver 30% of the country's 2050 net-zero carbon dioxide emissions target, primarily through carbon capture and storage as part of hydrogen production, a report published by offshore energy regulator the Oil and Gas Authority said Aug. 5. To achieve this level of reduction, national coordination of crude oil, natural gas, renewables, hydrogen production and associated carbon capture and storage would be required, the report said, while additional offshore renewable power generation in the form of wind, wave and tidal energy, could contribute a further 30% reduction to the overall legally binding target.

—Read the full article from S&P Global Platts

Japan starts regulatory discussions on phasing out inefficient coal-fired power plants

Japan's Ministry of Economy, Trade and Industry Aug. 7 launched formal policy discussions to consider a regulatory framework to ensure the country phases out inefficient coal-fired power plants by 2030, with measures including limiting new construction of inefficient plants. The latest move followed a directive announced July 3 by Minister of Economy, Trade and Industry Hiroshi Kajiyama to start drawing up a new, more effective framework to ensure the phasing out of inefficient coal-fired power plants by 2030 as part of Japan's strategic energy plan.

—Read the full article from S&P Global Platts

Asia shrugs off OPEC supply rise as refiners grapple with crippled demand

Middle Eastern sour crude supply is expected to increase this month after OPEC+ members on July 15 agreed to pare back their production cut commitment. But Asian consumers, who under normal circumstances would have welcomed the move, have barely taken notice. It remains to be seen where all this excess oil will eventually end up as Asian buyers grapple with crippling demand and have to tweak refining strategies to minimize losses.

—Read the full article from S&P Global Platts

Steel demand expected to improve as China plans water projects to prevent floods

A standstill in construction activities following heavy rain and massive floods in China recently dampened local steel demand in certain regions, but market watchers believe demand will benefit from water infrastructure projects worth 1.29 trillion Chinese yuan that the Chinese government recently committed to construct for long-term flood prevention.

—Read the full article from S&P Global Market Intelligence

Essential Energy Insights: July 2020 - Issue 2

Chevron Corp. CEO Michael Wirth called the assets of Noble Energy Inc. "complementary to Chevron's global portfolio" when he announced Chevron's $13 billion takeover of the independent producer, but not all analysts agree that Noble's holdings are a good fit. The rather cheap price tag, on the other hand, could make the move more than worthwhile for Chevron.

—Read the full article from S&P Global Market Intelligence

UK bucks trend of flatlining European oil demand recovery

The UK's fuel demand continued to recover last week, narrowing the gap to pre-crisis levels in its main European economic peers where activity indicators have now stagnated for almost a month, according to new data. Road fuel sales in the UK rose to 88% of pre-lockdown levels last week, according to official figures, as mobility activity in Europe's second-biggest economy picks up.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language