Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global 26 Apr, 2024 Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

TMX Pipeline Opens New Markets for Canadian Crude

Today is Friday, April 26, 2024, and here is today’s essential intelligence.

- Written by Nathan Hunt.

SPIVA Japan Scorecard 2023: Misfortune For Japanese Stock Pickers

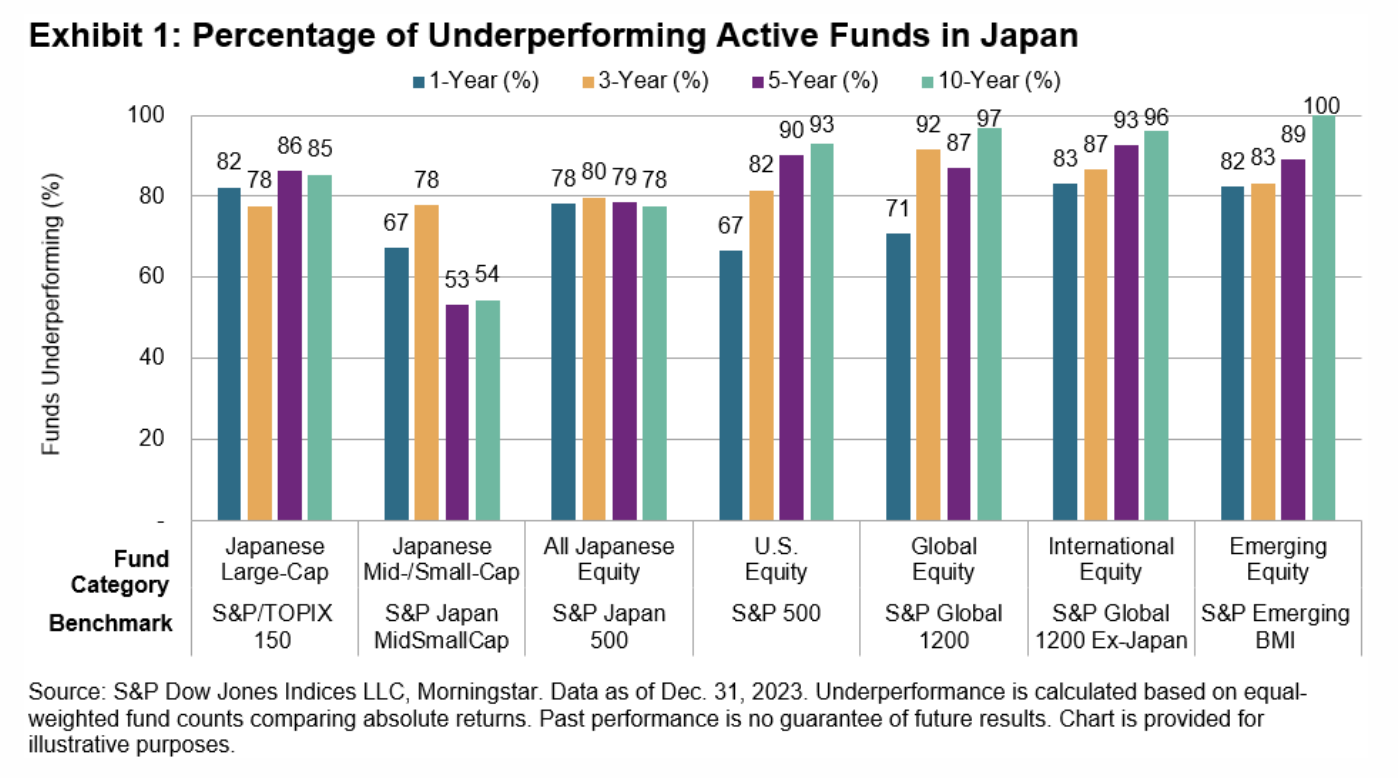

Since the first publication of the S&P Indices Versus Active (SPIVA®) US Scorecard in 2002, S&P Dow Jones Indices has regularly reported on the relative performance of actively managed funds versus benchmark indices across an increasing number of global fund markets and fund categories.

—Read the article from S&P Dow Jones Indices

Access more insights on the global economy >

Asia-Pacific Banking Country Snapshots: Stable Ratings As Property Risks Persist

A worsening in property-sector stress is the key risk stalking the Asia-Pacific financial institutions sector in 2024. "Asia-Pacific banks are managing property sector risks and the vast majority have stable rating outlooks," said S&P Global Ratings credit analyst, Gavin Gunning. "We see limited upside ratings potential, given persistent property sector risks, higher-for-longer interest rates and weaker economic growth. More so, if downside risks emerge in property or other areas, it could be tougher for banks to maintain outlooks at current levels."

—Read the article from S&P Global Ratings

Access more insights on capital markets >

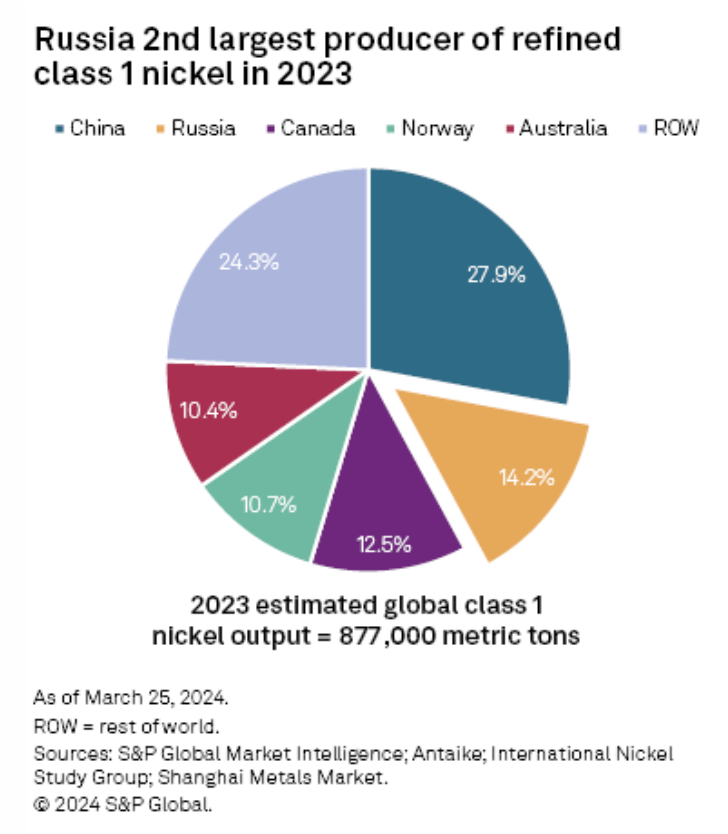

What Do UK, US Sanctions On Russia-Origin Metal Mean For Global Nickel Market?

On April 12, the US and UK governments imposed sanctions on Russia-origin metals for the country's invasion of Ukraine. To comply with the sanctions, the London Metal Exchange (LME) announced a ban on the delivery of Russia-origin nickel, aluminum and copper produced on or after April 13 into its warehouses. According to S&P Global Market Intelligence estimates, Russia is the world's second-largest producer of refined class 1 nickel, the only LME-deliverable primary nickel product, behind China.

—Read the article from S&P Global Market Intelligence

Access more insights on global trade >

Listen: Does The UK Need The North Sea For Its Energy Future?

As a UK general election looms, energy security and the transition to net-zero are high on the agenda. In this episode of the Commodities Focus podcast, S&P Global Commodity Insights experts sift through the policy options, from windfall taxes to licensing bans, and discuss why they matter, not just for the UK, but for Europe and beyond. Nick Coleman, senior editor for oil news, is joined by Gethin Baker, senior technical research analyst specialising in the North Sea, and Stuart Elliott, news reporter focusing on the UK and European gas markets.

—Listen and subscribe to Commodities Focus, a podcast from S&P Global Commodity Insights

Access more insights on sustainability >

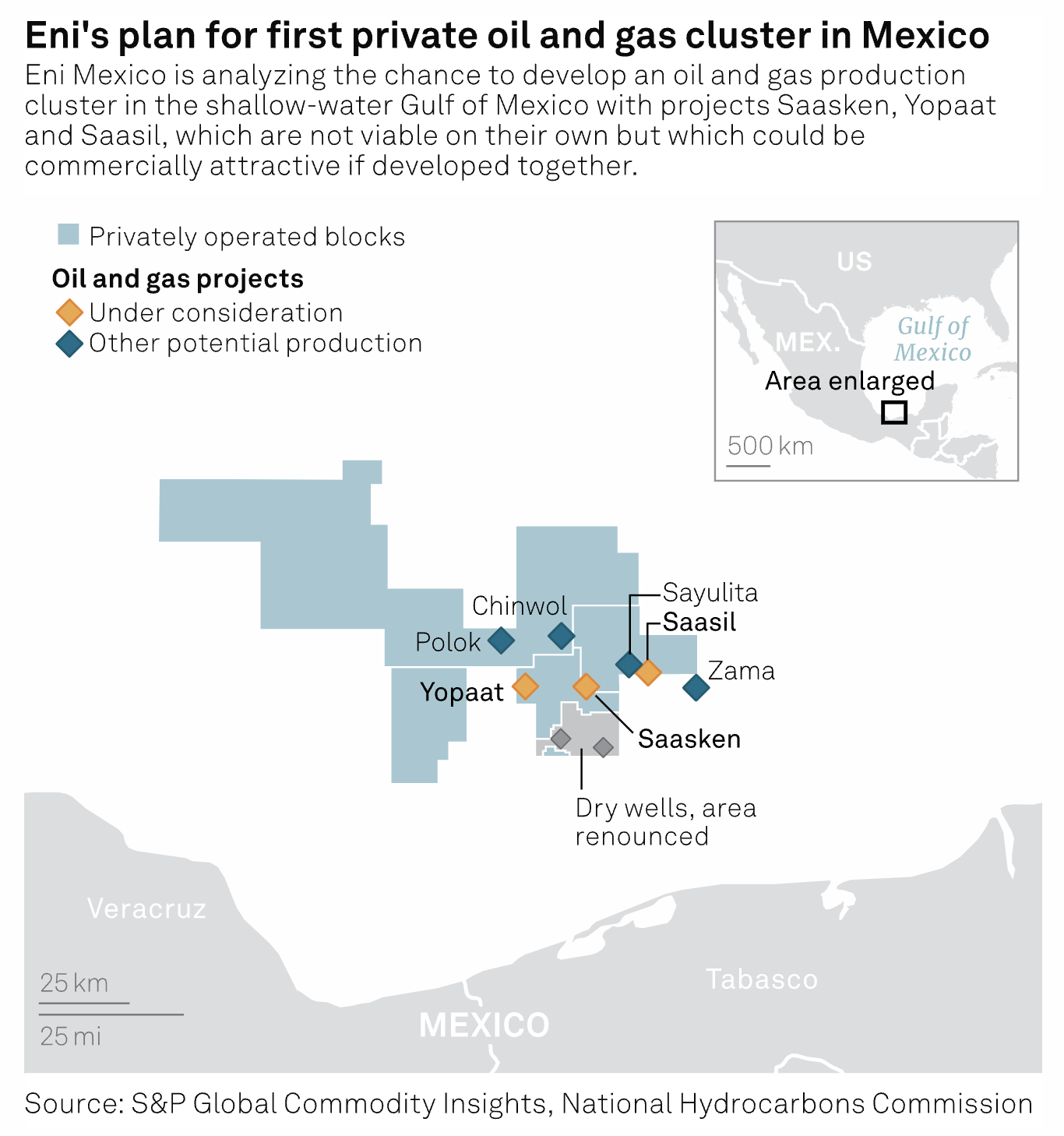

Eni Gains Mexico OK For Exploration Well That Could Form Country's First Private Oil, Gas Cluster

Eni Mexico on April 23 received authorization from Mexico's upstream regulator to drill an exploration well called Yopaat 1 in its Area 9 blocks the Italian company operates in the deepwater Gulf of Mexico. Yopaat is one of the three wells Eni Mexico is considering to develop an oil and natural gas production cluster in the area with projects that may not be viable on their own, but which could be commercially attractive if developed together.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Semiconductor Digest: A Roundup Of The Latest Developments

AI, particularly the training of generative AI large language models (LLMs), continues to drive the majority of semiconductor market activity. NVIDIA Corp.'s launch of its Blackwell graphics processing unit (GPU) in March at the company's GPU Technology Conference (GTC) was the centerpiece and attracted record crowds of developers, data scientists, GPU cloud clustering vendors and systems makers to San Jose, Calif.

—Read the article from S&P Global Market Intelligence