Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global 22 Apr, 2024 Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Some Evidence of Nearshoring to Mexico, But Obstacles Remain

Supply chains have grown precarious — a pandemic, geopolitical conflicts and accidents have created bottlenecks and increased prices for end consumers. The longer the supply chain, the more opportunities there are for disruption. This has driven interest in nearshoring, or moving manufacturing closer to the site of consumption. Mexico is one potential beneficiary of this trend. However, the evidence of nearshoring to Mexico following the pandemic has been limited, and companies seem hesitant to commit too heavily to Mexico due to various factors.

“Mexico has some huge advantages for companies that are considering relocation, particularly for those who are interested in exporting to the US,” said Johanna Marris, S&P Global Market Intelligence senior analyst for Latin America country risk, during a recent "Energy and Country Risk" podcast. “The main one that I would highlight is the very extensive infrastructure that's already established across the country for those exporting to the US — [the] possibly unmatched level of transport connections … several large ports, airports as well.”

According to S&P Global Ratings, there is evidence that private nonresidential construction in Mexico has picked up over the past two years, which may mean that production capacity is being added to traditional manufacturing hubs. Private sector investment in nonresidential construction increased more than 20% in 2023, particularly in the country's north and center/Bajío regions. However, foreign direct investment was modest during the same period, indicating that additional manufacturing capacity has been limited.

Despite the advantages of infrastructure and existing trade with the US, Mexico faces challenges that may make companies hesitant to relocate operations. The crime rate remains elevated in Mexico, which adds security costs to any operations. Energy, particularly green energy, may not be sufficient to support an expanded manufacturing sector. While Mexico has a younger population, many manufacturing jobs require specialized training and education that Mexico would have to develop. Finally, there is the critical issue of water.

“The Mexican state water agency is highlighting [that] over the last decade, we've seen gradually worse drought conditions, with more parts of the country affected than previously,” Marris said. “Currently, about 40% of national territories [have] got some degree of drought. This is overwhelmingly in the north and center of the country rather than the south, where there's more rainfall. And so the arrival of all these new companies is definitely going to place more pressure on water supplies [and] exacerbate shortages where we already have them during periods of scarcity.”

S&P Global Ratings suggested that nearshoring would have to advance far more quickly to impact Mexican GDP substantially. Manufacturing growth in the country would have to double to drive GDP from 2.4% before the pandemic to 3% today. Doubling manufacturing growth would require addressing some or all of the issues causing companies to hold back.

Today is Monday, April 22, 2024, and here is today’s essential intelligence.

- Written by Nathan Hunt.

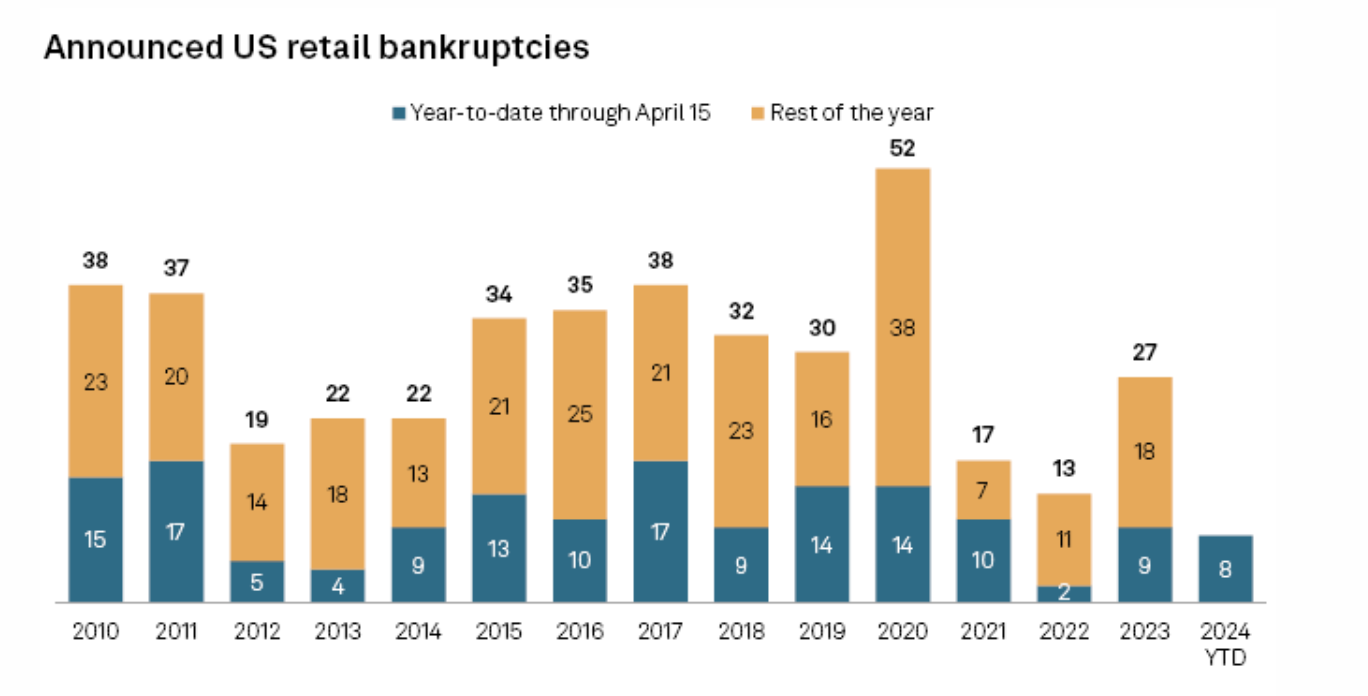

Online Shopping Fuels Surge In March US Retail Sales; 2 New Bankruptcies

US retail sales eclipsed expectations in March as consumers spent big online and at a wealth of other stores. Retail and food services sales rose 0.7% over February totals, according to US Census Bureau data released April 15. This exceeded the more subdued increase of 0.4% economists had anticipated for the month, according to data published by Econoday.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

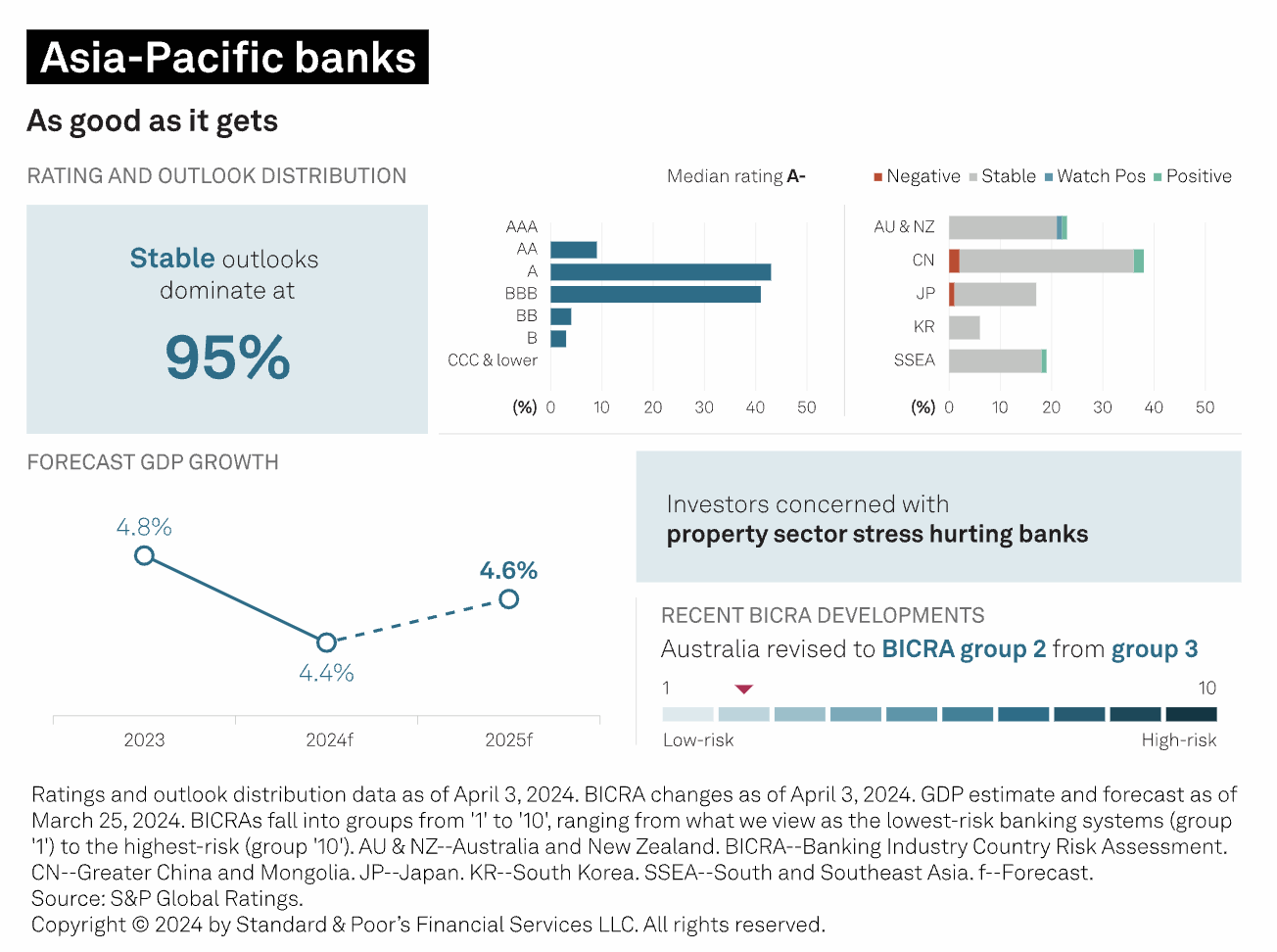

Asia-Pacific Financial Institutions Monitor 2Q 2024: As Good As It Gets

Bank rating stability is likely to persist through 2024 in Asia-Pacific. This is even considering ongoing property sector risks, persistent higher interest rates and lower growth, and continuing high public and private sector indebtedness. Risks unambiguously remain on the downside, however.

—Read the article from S&P Global Ratings

Access more insights on capital markets >

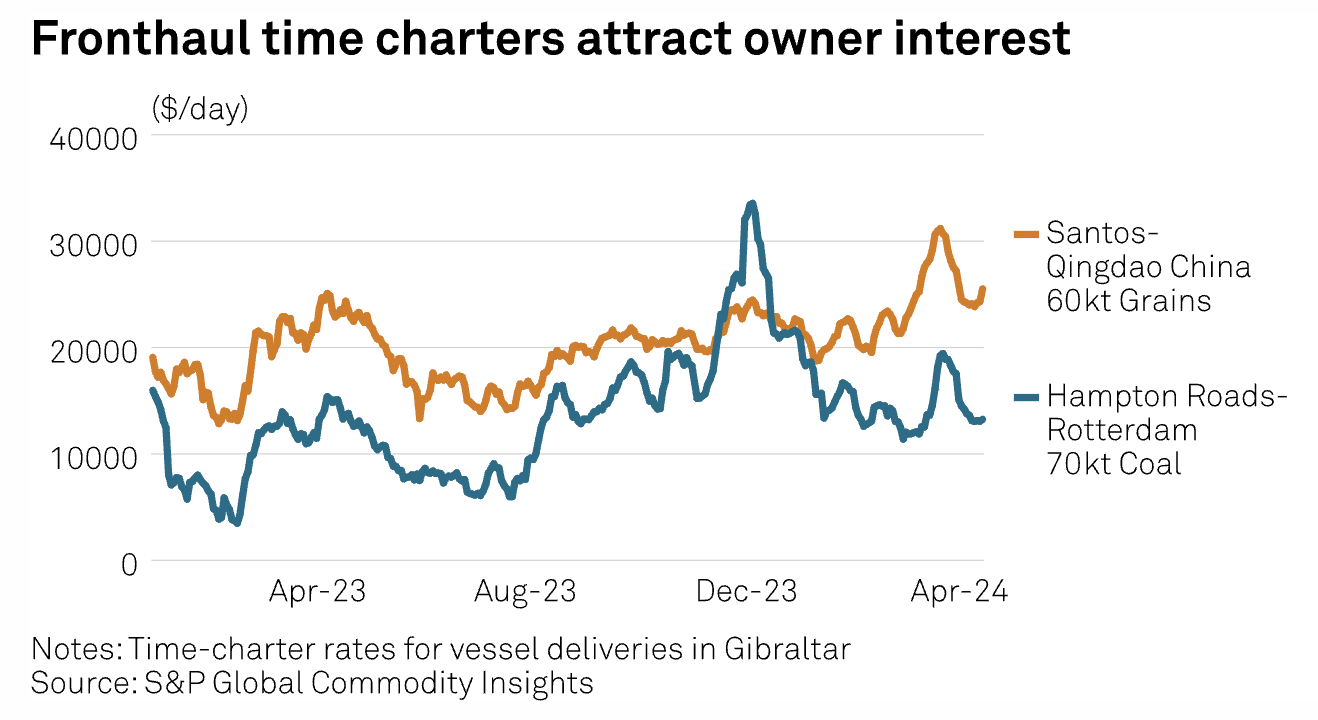

US-Brazil Met Coal Freight Slumps As Shipowners Shift Focus To ECSA Grains

After a trading lull during the Lunar New Year in early February, US-Brazil met coal freight has dipped further, as time-charter rates dropped to mid-$13,000s/d on April 16, from the high $16,000s at the beginning of March. This fall was fueled by heightened by more-profitable grain-loading activity in East Coast South America, according to market sources. Rates climbed to the $14,000s on April 17, however, on shifted positive sentiment in the North Atlantic.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

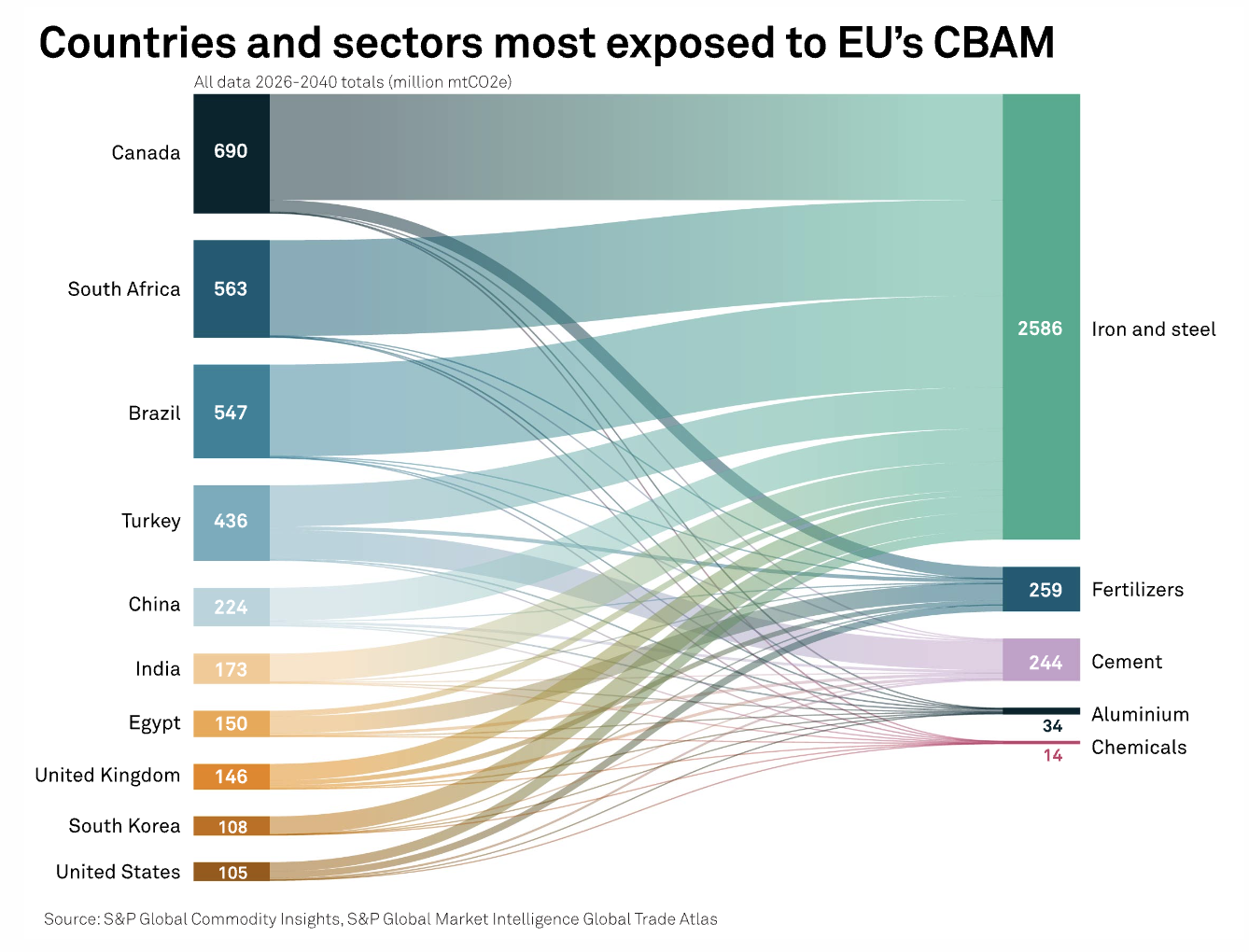

EU's CBAM To Spur Other Countries To Introduce Carbon Border Levies: IETA

The EU's introduction of a Carbon Border Adjustment Mechanism is prompting some countries to introduce their own carbon border levies while others are considering retaliatory measures, the International Emissions Trading Association said April 18. IETA, in a report, gave an overview of country-level responses to CBAM, finding that some — including Australia, Turkey and the UK — were developing their own carbon border levies in response.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

Listen: Exploring West Africa's Oil Product Flows In A Changing Refining Landscape

Ahead of ARDA Week 2024 in Cape Town, South Africa, S&P Global Commodity Insights reporters Matthew Tracey-Cook, Kelly Norways and Elza Turner join Joel Hanley to discuss the changing dynamics of oil products markets in West Africa following the fresh development that Nigeria’s giant Dangote refinery has exported its first refined product cargo destined for Europe. In this episode of the Oil Markets podcast, S&P Global Commodity Insights experts delve into the light and middle-distillate dynamic in West Africa and provide the latest refinery news from the region.

—Listen and subscribe to Oil Markets, a podcast from S&P Global Commodity Insights S&P Global Commodity Insights

Access more insights on energy and commodities >

AI Regulation Is In The Works, With Strong Consumer Support

The recent explosion of AI has resulted in ongoing debate regarding its benefits and risks. In a prior report, S&P Global Market Intelligence explored how consumers largely recognized practical uses for more evolved AI tools, but their concerns over its potential for job replacement, fraud and misuse — and even to gain sentience — were still highly prevalent. The US population appears to have moved toward a consensus on the need for regulations regarding AI. This would provide guidance in an uncertain time.

—Read the article from S&P Global Market Intelligence