Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 21 Apr, 2021

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

The networks that transmit electricity from producers to consumers in every country around the world have long been powered by fossil fuels such as natural gas and coal. But as both the physical effects of climate change and the urgency of the energy transition intensify, utilities and other power providers are betting big on renewable energy.

“The proliferation of renewables is having the desired effect of making the grid greener, but also resulting in other meaningful changes. Economically, the notable aspect of the renewables cost structure is that they have low (read: zero) variable costs, making them fully dispatchable,” S&P Global Ratings said in a recent report. “This means renewables are fundamentally changing the shape of the dispatch curve.”

U.S. President Joe Biden aims to decarbonize the country’s power sector by 2035, in part by pushing clean energy infrastructure and tax incentives as a mechanism to create long-distance transmission projects powered by solar, wind, and other renewable sources. The Federal Energy Regulatory Commission is exploring undertaking reforms to its rules for interregional transmission planning and financial incentives for new power lines and other grid-enhancing technologies, to allow for the speed and scale of building needed to double or even triple the country’s transmission capacity.

"We're certainly at a pivotal moment in our country for transforming our energy generation and consumption, and it's going to take some preparation in order for us to deliver on that," Peggy Simmons, president and chief operating officer for the Public Service Company of Oklahoma, said during an April 7 webinar hosted by Americans for a Clean Energy Grid.

Maintaining grid reliability and resilience in the event of extreme weather events is high on the American agenda, after two recent events—raging wildfires in California and a polar vortex in Texas—were exacerbated by energy grid failures.

"These events ... may be once-in-100-year events, but we cannot treat it as that's what's going to be the case, especially given the economic loss customers face any time the power goes out,” Ms. Simmons said, emphasizing the need for utilities to conduct more scenario planning. “The more that we can identify what can be done now to prepare for some of that, to be able to put a value on that and to put some regulatory or legislative processes in place to effect that, I think the better off we're going to be … But I don't think that being reactionary is how we should be planning for events moving forward.”

Existing infrastructure, including the natural gas plants that power electrical grids, may be transitioned to support renewable replacements.

"I don't think about gas plants today as just gas plants. I look at them as opportunities for new uses," Christina Scalzo, vice president of corporate development and strategy at Vistra Corp, said at the Global Power Markets Conference hosted by S&P Global Platts on April 13-14. “So, I think there is a great number of opportunities for [efficient] gas assets ... to continue to have useful life in and of themselves but also to transition, whether it's with battery storage or perhaps even, if the land is there, solar assets or otherwise … Beyond providing continued reliable power to the grid, affordable power, it will also help with the job space, the communities, as we make this transition from a predominantly fossil-supplied grid into the future where we'll have much more renewables."

European utilities are already racing toward achieving net-zero emissions across their output. Nineteen of the 22 largest power and gas utilities on the continent have now set targets, according to an S&P Global Market Intelligence analysis. But while many have made significant strides toward achieving these goals, others still operate carbon-intensive operations. Natural gas, long viewed as the fuel that would power the energy transition, is falling out of favor with Europe’s largest energy producers due to its carbon emissions. However, many utilities are still building new power plants that burn the fuel.

Elsewhere in the world, India is focusing on hydrogen to drive the country’s energy transition—and is planning to blend it with the natural gas that currently powers its extensive energy grid.

"This is important because India is expanding the gas grid all over various parts of the country,” the president of the Hydrogen Association of India, R. K. Malhotra, said April 15 at the Hydrogen Economy: New Delhi Dialogue conference.

Today is Wednesday, April 21, 2021, and here is today’s essential intelligence.

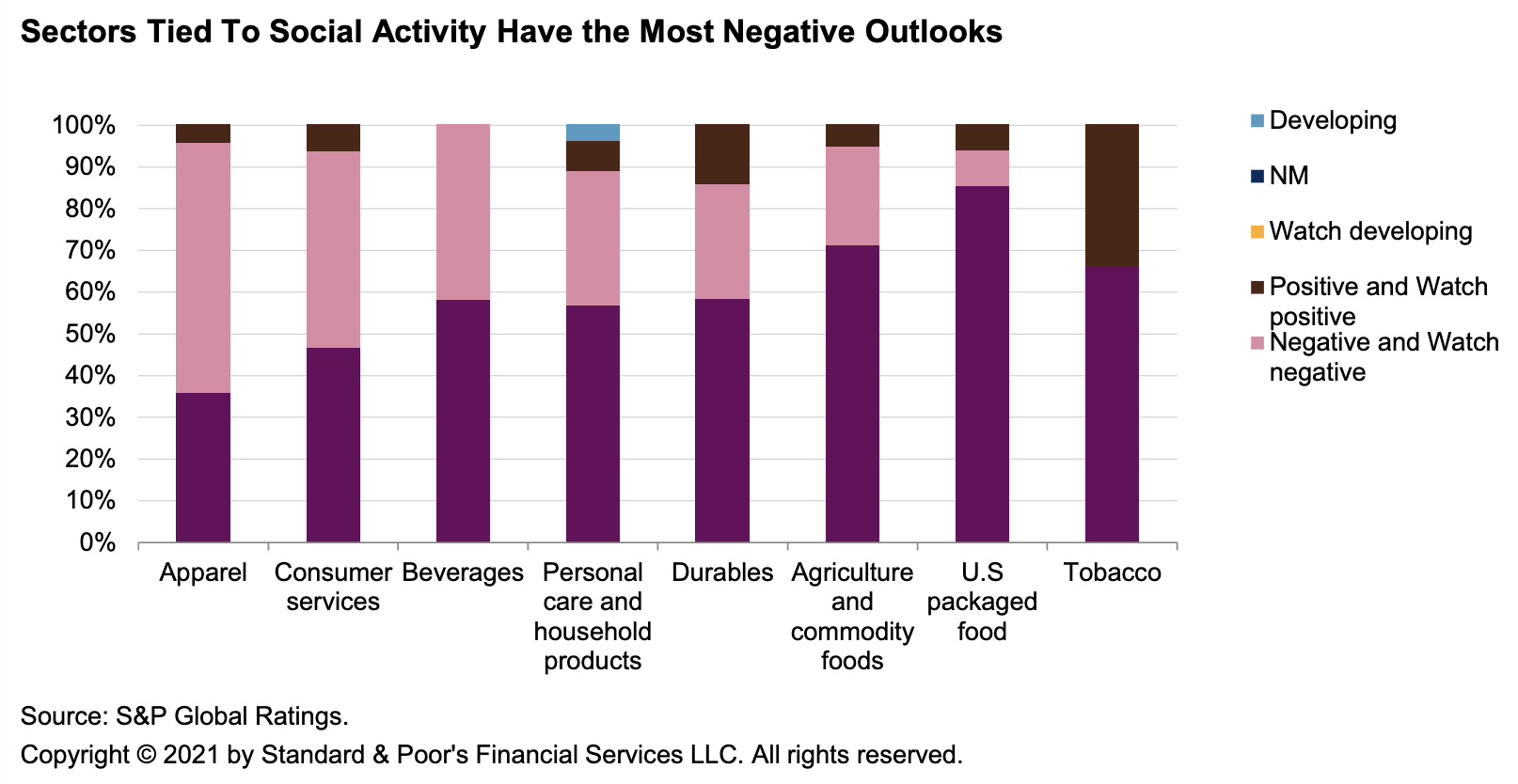

Data-Driven Analytics And Agile Supply Chains Are Transforming The U.S. Consumer Products Industry

The pandemic has transformed many aspects of the consumer products industry with more companies increasing the use of on data-driven analytics to boost sales and decrease costs. Companies continue to investment in technology to improve innovation, increase speed to market, and meet consumers changing needs and desires. The ability to grow in the e-commerce channel has become a more critical part of industry competition. Overall credit quality is mixed but markets are settling and S&P Global Ratings is seeing more stable outlooks and fewer downgrades in discretionary subsectors.

—Read the full report from S&P Global Ratings

Stirred By Futures Crash, USGC Crude Pricing Gains Transparency

Now a year removed from the April 20, 2020 price collapse of WTI futures into deeply negative territory, the center of gravity for physical crude pricing in the US continues to shift to the Gulf Coast.

—Read the full report from S&P Global Market Intelligence

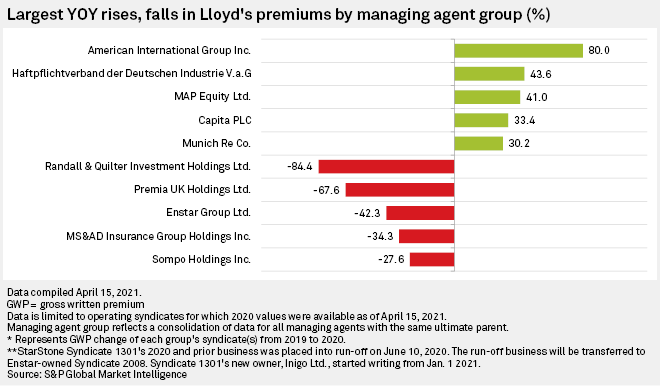

Amid Positive Signs, Lloyd's Of London Turnaround Still Work In Progress

Remediation work continued at Lloyd's of London in 2020, with some businesses paring back their books and others even exiting the market altogether. But Lloyd's also welcomed some new businesses; several managing agents are growing strongly amid much improved pricing.

—Read the full report from S&P Global Market Intelligence

UK To Create Fintech 'Scale Box,' New Sandbox For Distributed Ledger Tech

U.K. Chancellor Rishi Sunak unveiled plans for the creation of a "scale box" to support growing financial technology companies, and a new sandbox specifically for companies using distributed ledger technology, or DLT, during a speech at U.K. Fintech Week on April 19.

—Read the full article from S&P Global Market Intelligence

As Nordic Banks Aim To Go Greener, Lending Lags Asset Management Pledges

The greener investment strategies of Nordic banks' asset management units compared with their lending businesses underscores a sustainability gap that lenders will want to close to meet their climate targets and to manage reputational risk.

—Read the full article from S&P Global Market Intelligence

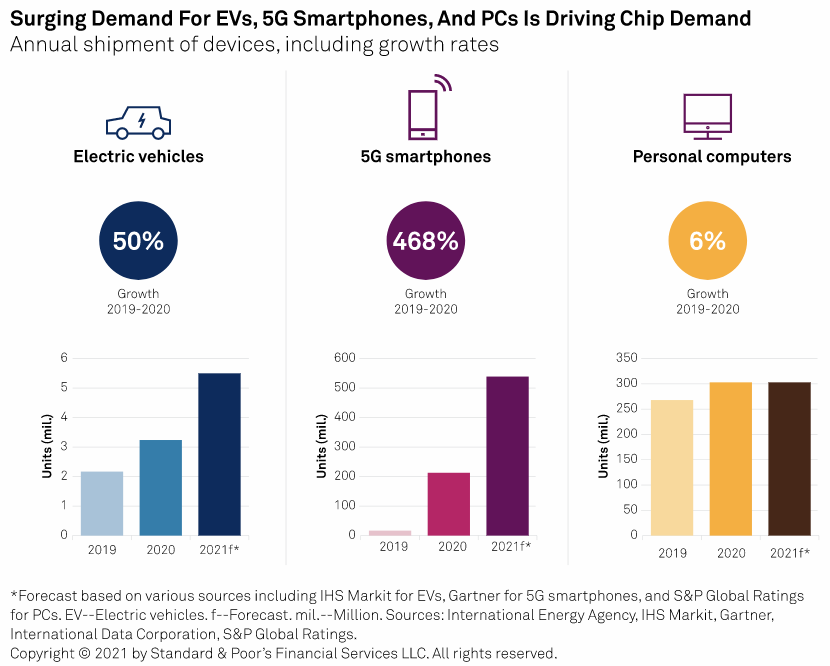

Global Chip Shortage Engulfs A Growing List Of Tech Players

Exploding demand and factory outages are creating acute chip shortages. The effect of supply shortfalls is spreading beyond carmakers to any firm that relies heavily on semiconductors, such as smartphone and PC makers. There are winners and losers from this shortage, which S&P Global Ratings expects to drive the profit and revenues of large tech firms over the next year.

—Read the full report from S&P Global Ratings

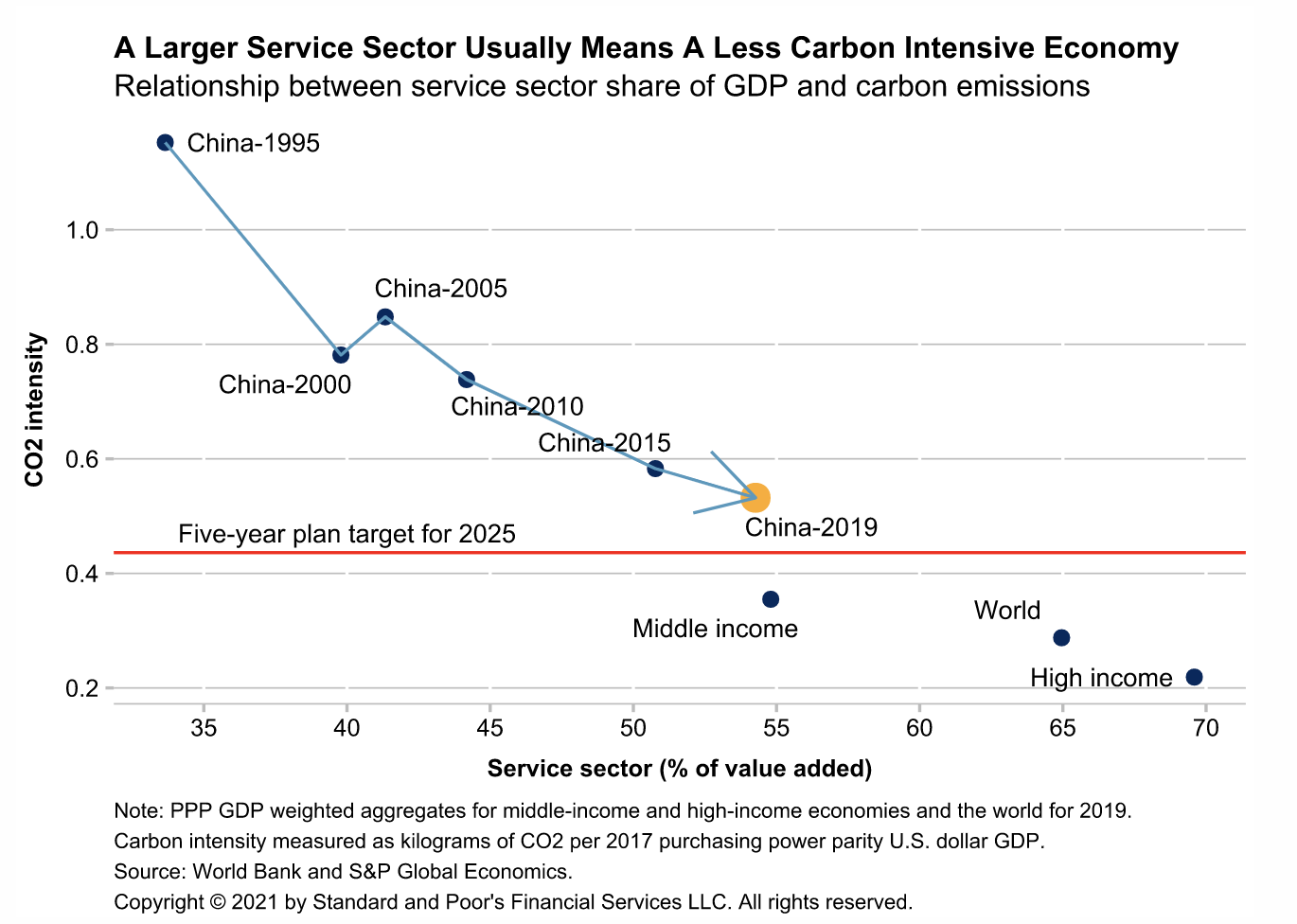

China's Climate Ambition Restrained By Supply Security

Economic rebalancing is essential if China is to decarbonize its economy, but rebalancing lost prominence in the latest Five-Year Plan. The pledge to cut carbon intensity in 2025 by 18% does not suggest greater ambition much beyond Paris Agreement commitments. The government may under-promise and over-deliver but, for now, the focus on supply chain security is holding back the country's climate ambition.

—Read the full report from S&P Global Ratings

DOE, EPA Officials Offer Advice As FERC Turns Focus To Environmental Justice

In a further sign of a shift in focus at the Federal Energy Regulatory Commission, the agency got advice from US Department of Energy and Environmental Protection Agency officials about how to improve engagement and better consider environmental justice issues as the commission makes key energy infrastructure decisions.

—Read the full article from S&P Global Platts

U.S. Interior Revokes Trump Order On Alaska Petroleum Reserve

Interior Secretary Deb Haaland has issued an order rescinding a previous Interior department order, under President Donald Trump, to expand acreage available for oil and gas leasing in the 23-million-acre National Petroleum Reserve in northern Alaska.

—Read the full article from S&P Global Platts

Expectations Of Agreement High As EU Climate Law Talks Start: Sources

Expectations were high that the EU's decision-making bodies would be able to find agreement on a revamped 2030 emission reduction target in the latest three-way talks taking place April 20.

—Read the full article from S&P Global Platts

Global Energy CO2 Emissions Forecast To Rise 5% In 2021 On Revived Coal Burn: IEA

Global energy-related CO2 emissions are on course to surge by almost 5% in 2021 to 33 billion tonnes, the second-largest increase in history, the International Energy Agency said April 20 in its Global Energy Review 2021.

—Read the full article from S&P Global Platts

Surging Demand For Battery Metals Drives Push To Mine Ocean Floor

The world is moving closer to mining the deep sea to accommodate surging demand for battery metals needed in the global energy transition, but opposition to the practice is mounting. After years of review, the International Seabed Authority, or ISA, is close to completing the exploitation regulations that would allow entities to begin collecting lumps of metal from the deep ocean. While some tout the process as a greener alternative to terrestrial mining, several ocean scientists and environmental groups are urging caution due to potential and unknown environmental consequences.

—Read the full article from S&P Global Market Intelligence

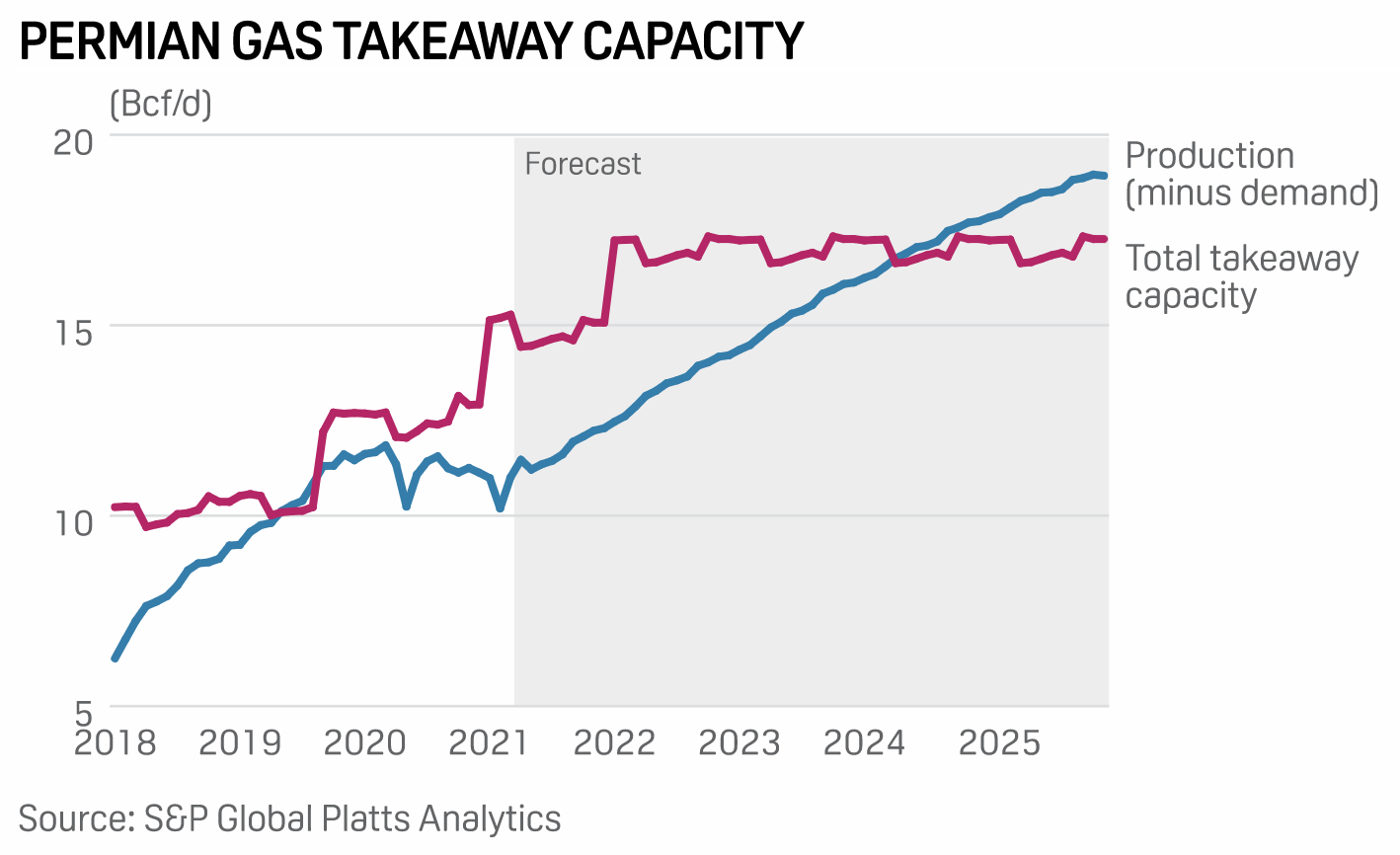

North American Midstream Gas Sector Prepares Q1 Earnings Amid Demand Recovery

Operators of North American pipelines, processing facilities and liquefaction terminals are preparing to release first-quarter financial results amid a recovery in demand a year after the first impacts from the coronavirus pandemic began to occur.

—Read the full report from S&P Global Platts

Midstream To Feel Texas Freeze In Q1 Results But Benefit From COVID-19 Rebound

Financial losses due to a severe winter storm in February should not materially overshadow the outlook for demand recovery in the natural gas midstream sector as companies release first-quarter earnings results, industry experts said.

—Read the full article from S&P Global Market Intelligence

Volatility In Store For Chad's Oil Industry After President's Death

The death of Chad's President Idriss Déby is likely to trigger political instability in the key oil-producing country and the wider central African region, with a potential impact on its oil sector, industry sources said April 20.

—Read the full article from S&P Global Platts

India's Gasoline Demand To Stall As COVID-19 Cases Surge To Record Highs

India's strong rebound in domestic gasoline consumption will likely hit a roadblock in the near term, amid fresh lockdowns in several states as the country fights a renewed battle against COVID-19.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Language