Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 2 Jun, 2020

By S&P Global

In an unprecedented moment in modern history, many corporations are backing the widespread protests against police brutality and systemic racism in America amidst the global pandemic—highlighting the magnitude of the moment alongside efforts to address environmental, social, and governance (ESG) factors across markets and the world.

Twitter changed the image on its platform to a black and white version of its logo, and replaced its bio with the hashtag #BlackLivesMatter. Through its diversity account on the platform, the social media giant—with a market capitalization of $25 billion–wrote on May 28: “Racism does not adhere to social distancing. Amid the already growing fear and uncertainty around the pandemic, this week has again brought attention to something perhaps more pervasive: the long-standing racism and injustices faced by black and brown people on a daily basis.”

“In Minneapolis, the tragic death of George Floyd and the subsequent protest activity reflect the anger, anxiety, and grief the community and our nation feels,” Wells Fargo CEO Charles Scharf wrote in an email to the bank’s employees on May 29. “In Georgia, we saw the senseless killing of Ahmaud Arbery as he was out for a jog. In addition, the pandemic has brought a wave of bias against many in the Asian-American community, and we know that communities of color are being disproportionately impacted by COVID-19.”

“This is a painful time for our nation,” Mr. Scharf wrote. “As a white man, as much as I can try to understand what others are feeling, I know that I cannot really appreciate and understand what people of color experience and the impacts of discriminatory behavior others must live with. But, as the CEO of Wells Fargo, I can commit that our company will do all we can to support our diverse communities and foster a company culture that deeply values and respects diversity and inclusion.”

“Even though I'm the CFO of a global bank, the killings of George Floyd in Minnesota, Ahmaud Arbery in Georgia, and Breonna Taylor in Kentucky are reminders of the dangers black Americans like me face in living our daily lives,” Mark Mason, Citigroup’s CFO and one of the U.S.’s highest-ranking black executives on Wall Street, wrote in a May 29 blog post on the company’s website titled “I can’t breathe.”

“Despite the progress the United States has made, black Americans are too often denied basic privileges that others take for granted. I am not talking about the privileges of wealth, education or job opportunities,” Mr. Mason wrote. “I'm talking about fundamental human and civil rights and the dignity and respect that comes with them.”

Netflix, the streaming service with $187 billion in market capitalization, wrote on Twitter on May 30 that “to be silent is to be complicit. Black lives matter. We have a platform, and we have a duty to our black members, employees, creators, and talent to speak up.”

“We stand against racism. We stand for inclusion. We stand with our fellow black employees, storytellers, creators, and the entire black community. We must unite and speak out,” Disney, worth $215 billion in market capitalization, shared on May 31.

Such public stances on police violence and racial injustice show the fragility of race relations in the U.S., and throw into focus many companies’ efforts to prioritize stakeholders over shareholders. Corporations’ and executives’ eagerness to align their business objectives with ESG-oriented initiatives, as shaped by the U.N.’s Sustainable Development Goals, is evident. When protestors took to the streets in 2014 after the fatal shooting by police of Michael Brown, a black man in Ferguson, Mo., few, if any, companies released statements of support. Additionally, many companies that have expressed solidarity with the black community in the U.S. in recent days have come under scrutiny for the ways in which they have dealt with race in the past.

Nonetheless, as the coronavirus pandemic brought to light the materiality of ESG-related risks and the deep links between businesses and their stakeholders, companies that don’t account for social risks may face reputational ramifications that could inflict further damage to bottom lines already depressed by the crisis’ economic implications.

“ESG is just another channel through which people can align their values with their actions by incorporating these types of considerations into their investments,” Mona Naqvi, S&P Dow Jones Indices’ head of ESG Product Strategy for North America, told CNBC on June 1. “It’s also important through ESG to take into account things like diversity. How does a company actually [embody ESG]—what are its hiring practices? Is it diverse throughout broader business operations?... These are the types of issues that these protesters are demonstrating are very important to many people that ESG can help capture.”

The movement against police violence and racial injustice is intensifying as the global health crisis disproportionally affects communities of color in the U.S. and against a backdrop of historical structural inequality that has perpetuated systems of oppression for centuries.

Black Americans make up 26% of COVID-19 cases in the U.S., according to the Centers for Disease Control, even though they account for just 13% of the population. Across almost every state with race data available, black populations have higher contraction and death rates from the coronavirus than any other group, according to the Brookings Institution, which notes that black people are “more likely to live in neighborhoods with a lack of healthy food options, green spaces, recreational facilities, lighting, and safety” in neighborhoods with histories of devalued assets and “in densely populated areas, further heightening their potential contact with other people.”

According to the COVID Racial Data tracker, a collaboration between the COVID Tracking Project and the Antiracist Research & Policy Center, at least 21,750 black Americans have died because of COVID-19.

Research by the non-partisan organization APM Research Lab shows that “the latest overall COVID-19 mortality rate for black Americans is 2.4 times as high as the rate for whites and 2.2 times as high as the rate for Asians and Latinos.”

Many protesters, activists, and commentators have expressed that the risks of racial inequality and police violence outweigh those of the coronavirus, stating that although the pandemic is devastating the black community, systemic racism has killed dramatically more black Americans.

The interplay of the civic unrest and the global health crisis is shining a stronger spotlight on the intersections of race, health, and socioeconomic inequality.

A higher proportion of black Americans are likely to be considered essential workers, while also highly likely to lose their jobs during the economic downturn. Black Americans make up 11.9% of the workforce but 17% of essential workers, according to an April 2020 Center for Economic Policy Research study. Comparatively, in April, the unemployment rate for black Americans rose to 16.7%, higher than that of Asians, at 14.5%, white Americans, at 14.2%, and that of the overall U.S. unemployment rate, at 14.7%—yet lower than that of Latinos, at 18.9%, according to the Bureau of Labor Statistics. “The rates for all of these groups, with the exception of blacks, represent record highs for their respective series,” the federal agency said.

Because black households hold less wealth and have lower levels of income, they don’t have the same liquidity as white households to stay afloat during periods of financial stress.

“The typical white family has 10 times the wealth of the typical black family and seven times the wealth of the typical Latinx family,” according to the Center for American Progress. In the period prior to and after the Global Financial Crisis, from 2005 to 2009, black households’ median net worth declined 53%, while white households’ dropped by only 16%, according to the Center for Global Policy Solutions.

“The current racial wealth gap is the consequence of many decades of racial inequality that imposed barriers to wealth accumulation either through explicit prohibition during slavery or unequal treatment after emancipation,” including segregation and discrimination in the labor market, according to the Cleveland Federal Reserve. Rising income equality is evident in “how little the racial wealth gap has changed over the past half century, even after the passage of civil rights legislation. In fact, the 2016 wealth gap [was] roughly the same as it was in 1962, two years before the passage of the Civil Rights Act of 1964, according to data from the Survey of Consumer Finances,” senior research economists Dionissi Aliprantis and Daniel R. Carrol wrote for the Fed in 2019.

This weekend marked 99 years since the 1921 Tulsa race massacre, when a white mob burned 1,200 homes across 35 city blocks, killing 300 black civilians, in an affluent Oklahoma community known as “Black Wall Street.”

This year, only four Fortune 500 CEOs are black, and all are men. One, Kenneth Frazier, CEO of the $200.8 billion market capitalized pharmaceutical company Merck, told CNBC on June 1 that “what the African-American community sees in that videotape [of the George Floyd incident] is that this African-American man, who could be me or any other African-American man, is being treated as less than human,” and that U.S. business leaders have the opportunity to be a “unifying force” to help calm the country’s unrest by creating jobs and opportunities.

Today is Tuesday, June 2, 2020, and here is today’s essential intelligence.

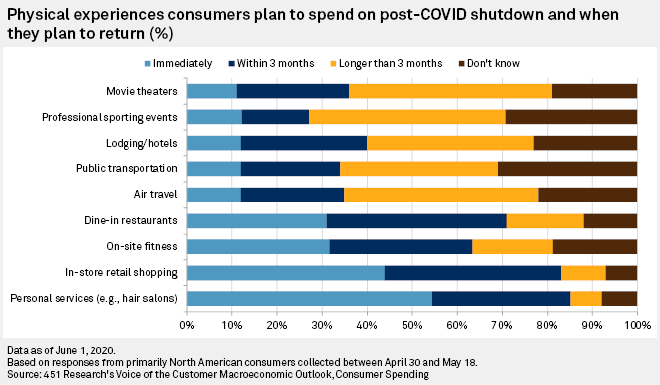

Consumers want to get back to shopping in stores but are wary on travel – survey

Consumers are still scaling back on their spending, but they are eager to head back to hair salons and physical stores as coronavirus-inspired restrictions on movement start to ease, according to a new survey. Forty-four percent of consumers surveyed by 451 Research, an offering of S&P Global Market Intelligence, said they plan to start shopping at retail stores as soon as state and local restrictions on movement and nonessential businesses ease. They are even more eager to get a hair cut or a massage. "The Voice of the Customer Macroeconomic Outlook, Consumer Spending" survey found that 55% of respondents would immediately spend money at "personal services" establishments like hair salons and massage parlors.

—Read the full article from S&P Global Market Intelligence

Retail property's post-virus recovery will be bumpy, but not without opportunity

If there was any doubt that a retail apocalypse was taking place before the coronavirus-related economic shutdown, it is now impossible to deny the retail space is facing profound change. "Things are extremely fluid right now in the retail sector as a whole, and that covers all retail property types," Tom Dobrowski, vice chairman of Newmark Knight Frank's capital markets group, told S&P Global Market Intelligence. The nation's malls and shopping centers are beginning to reopen after a weekslong closure to stem the spread of the coronavirus, but there will be many vacant shops and department stores, and there is no telling how long it will take for foot traffic to return. The last three years have already seen plenty of retailer bankruptcies as outmoded concepts shriveled, and analysts expect many more in the coming months.

—Read the full article from S&P Global Market Intelligence

Update: Coronavirus-related US revolving credit drawdowns rise to $298B

LCD last week captured approximately $1 billion of corporate drawdowns from existing revolving credit facilities, across 13 deals. Some $298 billion via 737 borrowers has been captured since March 5. The activity reflects the intense corporate focus on liquidity, amid the economic shutdown due to the coronavirus pandemic. In more ordinary times, these revolving credits might go largely undrawn.

—Read the full article from S&P Global Market Intelligence

Distressed debt CLO managers trip on deal terms amid COVID-19 downgrades

Some credit vehicles in the U.S. CLO market are struggling to move liquidity into the riskier markets they sought to capitalize upon in times of economic distress. A debut manager in 2017, Ellington Management Group LLC raised cash for CLOs that carried higher-than-usual allotments for CCC rated debt, a level just a few notches above default. Ellington specifically said it could take advantage of other credit managers’ limits on owning lower-rated assets, which during a downturn would eventually force some to sell out of those positions, at a discount. "Ellington does not want to pursue the same assets as those managers looking for collateral for a standard CLO," said Rob Kinderman, head of credit strategies at Ellington Management, in a February 2019 interview with Capital Structure. "Although our ultimate CLO structure may look a lot less efficient than others, it will allow us to retain flexibility to rotate and invest the portfolio." But that scenario is not playing out exactly as expected in the age of COVID-19.

—Read the full article from S&P Global Market Intelligence

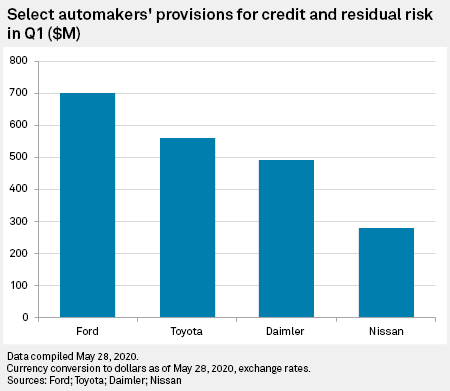

Global automakers' finance arms brace for impact from coronavirus crisis

In an earnings season not short of dire warnings across every sector about the escalating impact of the coronavirus pandemic, global automakers had their fair share of doom and gloom to offer. Japan's Nissan Motor Co. Ltd. was the last major automaker to report results, announcing on May 28 a dramatic fall in income compared to its February forecast and echoing concerns of peers in recent weeks about the impact of the pandemic on earnings in the coming quarters. Nissan is reportedly planning to lay off 20,000 employees in Europe and some emerging markets. On top of falling sales due to coronavirus lockdowns across most developed markets between January and March, Nissan and many other global automakers have seen first-quarter profits hit by increased risk provisioning at their captive finance arms. The fincos, which are responsible for hundreds of billions of dollars' worth of vehicle leases and loans to consumers, companies and dealerships around the world, are preparing for significant credit losses and lower resale values for formerly leased cars as the pandemic shakes the global economy. Nissan's financial services businesses collectively booked ¥30 billion in losses in the three months to March 31, it said. Other major global automakers warn the long-term pain may be worse than expected.

—Read the full article from S&P Global Market Intelligence

The Worst Is Yet To Come: Ad Agencies Expect Q2 Revenues Below '09

The world's Big Four advertising groups agree it is too early to predict the precise effects of COVID-19 on their businesses over the year. Publicis Groupe SA, Interpublic Group of Cos. Inc., Omnicom Group Inc., and WPP PLC reported their first-quarter results, highlighting declines in Asia while expecting their results from the rest of the world to be hit the hardest in the second quarter. Advertising budgets started to fall in March for Europe and the U.S., and the four agency groups' CEOs warned of the pandemic's more worrying impact on the second quarter, with expectations for double-digit declines in revenues.

—Read the full article from S&P Global Market Intelligence

Latin America COVID-19 Bi-Weekly Update

This report covers research and rating actions produced by S&P Global Ratings analysts in Latin America and provides investors and market participants with a quick credit overview to start the week.

—Read the full report from S&P Global Ratings

COVID-19 To Dim, But Not Darken, Brazilian Electric Utilities' Operations

S&P Global Ratings expects economic conditions in Brazil to worsen as the COVID-19 pandemic spreads in the country, and social-distancing measures and quarantine halt commercial activity. We now expect Brazil to fall into a recession in 2020 with GDP contracting 4.6% and returning to growth in 2021. The unprecedented pandemic will also affect, in our view, the historically resilient utilities sector. This is mainly because of the depth of the economic damage the coronavirus will cause, potential political pressure to provide relief to cash-strapped electricity users, and boost to economic recovery once the lockdown is lifted. Still, we believe electric utilities that we rate will absorb temporarily lower cash flows. This is because most of them have stronger intrinsic repayment capacity (which we refer to as stand-alone credit profiles), while Brazilian sovereign ratings cap those on the companies given the regulated nature of their business.

—Read the full report from S&P Global Ratings

Listen: Energy Evolution: Former DOE chief envisions jobs revival from energy transition

Tapping into the potential of new energy technologies could be the key to avoiding some of the worst impacts of climate change and creating employment opportunities as global economies begin to heal from coronavirus-related shutdowns, according to former U.S. Department of Energy Secretary Ernest Moniz. Until the pandemic struck, the transitioning energy sector created jobs at about twice the pace of the economy as a whole, Moniz told S&P Global Market Intelligence's "Energy Evolution" podcast. Moniz now leads the Energy Futures Initiative, a think tank that recently partnered with the American Federation of Labor and Congress of Industrial Organizations to create a framework focused on creating and preserving jobs in the context of addressing climate change.

—Listen and subscribe to Energy Evolution, a podcast from S&P Global Market Intelligence

EPA updates Clean Water Act rule to help pipelines get permits from states

The U.S. Environmental Protection Agency released the final version of a rule meant to prevent states from blocking natural gas pipelines and other infrastructure projects by denying critical water quality permits. Section 401 of the Clean Water Act gives states authority to review whether federally approved infrastructure complies with standards set for protecting local water quality. Major pipeline projects have hit permitting roadblocks in recent years during state Section 401 reviews. The final EPA rule released June 1 makes it more difficult for states to use their Section 401 authority to block construction.

—Read the full article from S&P Global Market Intelligence

Ceres' latest climate lobbying campaign targets federal financial agencies

Under a new lobbying initiative, sustainability advocate Ceres has published a report calling on U.S. federal financial regulators to treat climate change as a systemic threat to capital markets in their regulations and policies, including in COVID-19 economic recovery stimulus and lending programs. "These recommendations outline the affirmative steps that regulators should take to protect the financial system and economy from potential climate-related shocks that can flatten an economy and grind it to dust," Sarah Bloom Raskin, a former member of the Federal Reserve Board of Governors and former U.S. Deputy Secretary of the Treasury, wrote in the forward to the report.

—Read the full article from S&P Global Market Intelligence

VW preparing for mass-scale EV manufacturing: Roskill

Volkswagen is one of the few automakers already implementing its long-term electrification strategy and preparing for mass-scale electric vehicle manufacturing, despite the negative outlook for the auto industry due to the coronavirus pandemic, Roskill analysts said June 1. The company announced May 29 that it had moved to increase volume of electric vehicle models and infrastructure in China by signing letters of intent with the government of Anhui province to invest around €1 billion ($1.1 billion) to acquire a 50% share in government-owned Anhui Jianghuai Automobile Group (JAG), the parent company of its joint venture partner JAC. The move will increase its share in its e-mobility joint venture JAC Volkswagen to 75% from 50%, giving it management control.

—Read the full article from S&P Global Platts

Asian countries accelerate hydrogen plans with policies and projects

Countries in the Asia-Pacific region, such as India, Japan, South Korea, China and Australia, are planning to set up projects as well as speed up policy formulation, as they step up efforts to make hydrogen a part of their energy mix. While most hydrogen exists in its molecular or compound forms, such as in water and organic fossil fuels, increasingly, hydrogen molecules are being looked upon as a potential energy carrier. Hydrogen can be produced from a wide array of pathways and feedstocks. But three pathways have garnered attention -- steam methane reformation, biomass reformation, and electrolysis.

—Read the full article from S&P Global Platts

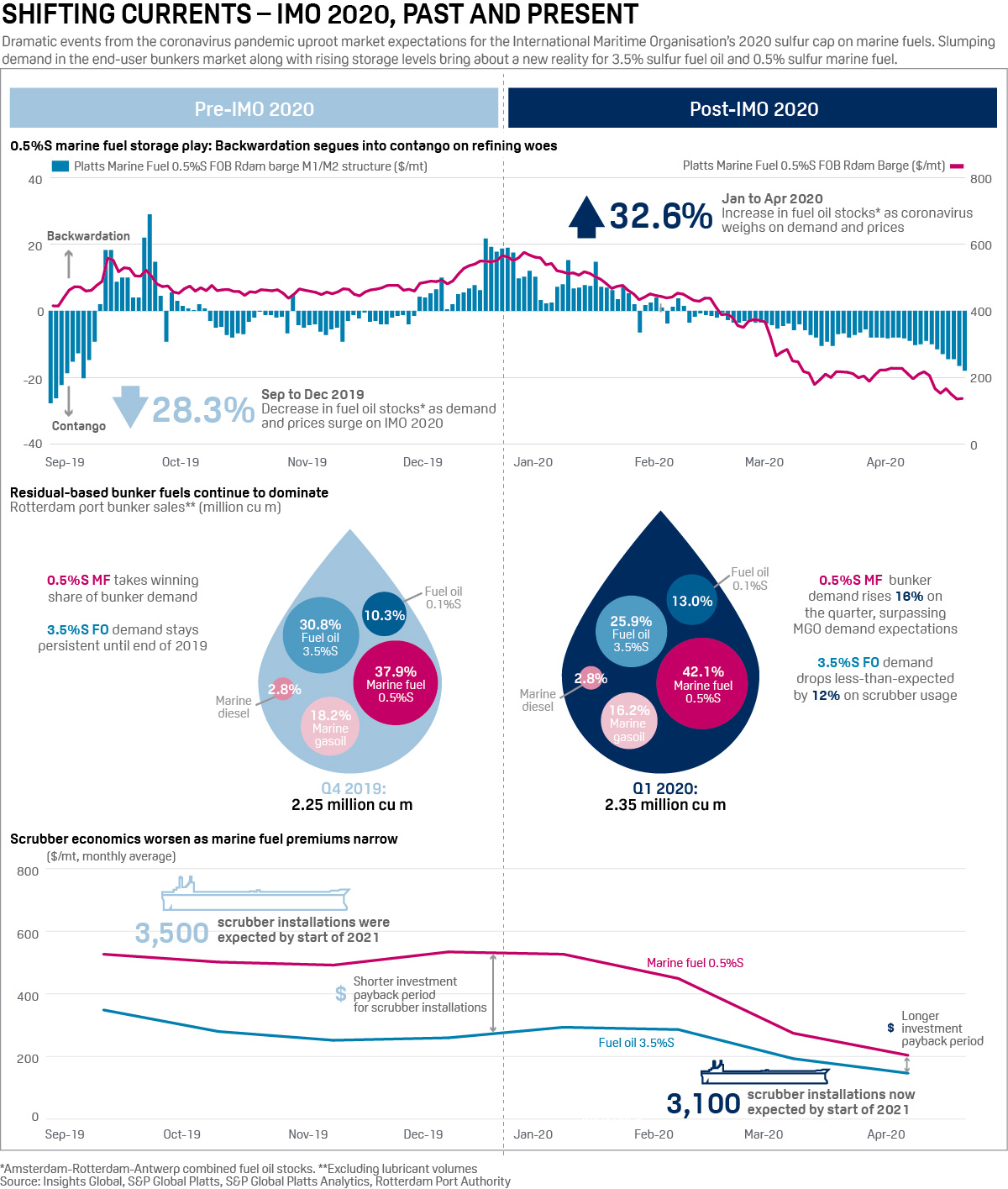

Infographic: Shifting Currents - IMO2020, past and present

Unprecedented times hit the marine fuel market as coronavirus casts a shadow over demand, bucking many expectations for the year that IMO 2020's sulfur cap on marine fuels took effect. Concerns over limited supply and price spikes for 0.5% sulfur marine fuel are now a distant memory as the market turns to grapple with muted demand and rising inventories instead.

—Read the full article from S&P Global Platts

Saudi Arabia takes steps to revive economic growth stalled by pandemic, oil price crash

Saudi Arabia, the world's largest crude exporter, has taken steps to revive economic growth hurt by the COVID-19 pandemic and oil price crash, including making an unprecedented transfer of government funds to the sovereign wealth fund. The country's economy has been severely hit this year. Saudi Arabia's budget for 2020, announced in December, assumed an oil price of $60/b, and the country's fiscal breakeven price is $80/b, according to the International Monetary Fund. That compares with a front-month Brent crude price of $37.84 at the end of May.

—Read the full article from S&P Global Platts

Watch: Market Movers Europe, June 1-5: Supply, demand and generating fuel mixes in flux

In this week's highlights: OPEC+ group gears up for a crucial three-day virtual meeting; steel markets will be looking for signs of production rebounding; and a last hurrah for German coal.

—Watch and share this Market Movers video from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language