Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

Events

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

Events

About S&P Global

Corporate Responsibility

Culture & Engagement

Once considered an alternative trend, cryptocurrencies have become mainstream and appear here to stay. Beyond blockchain technology beginning to democratize global energy trading, Latin American banks are taking advantage of the recent boom and even central banks around the world are exploring the creation of their own digital fiat currency.

Published: January 19, 2021

Brexit has created disruption and uncertainty for the U.K.'s fintech sector, but industry insiders say that there is a silver lining. The U.K.'s departure from the bloc leaves it free to forge its own regulatory path in fintech and cryptocurrency.

Not only could this spur innovation, it could help the U.K. to reinvent itself as a hub for crypto and decentralized finance, or DeFi. These comments come shortly after the U.K. regulator opened a consultation on cryptoasset regulation, with a focus on stablecoins, which will run until March 31. The U.K. is also in the midst of a government-backed fintech review, launched in July 2020, which will make recommendations for how best Britain can nurture its fintech industry following Brexit.

The U.K. formally left the EU at 11 p.m. London time Dec. 31, 2020. Although British Prime Minister Boris Johnson clinched a deal with the bloc Dec. 24, 2020, the ability of U.K.-based financial services firms to do business on the continent still hangs in the balance, since the EU has yet to agree on equivalence of financial regulation.

For PayPal, Visa and Mastercard, Cryptocurrencies Could Unlock New Revenues

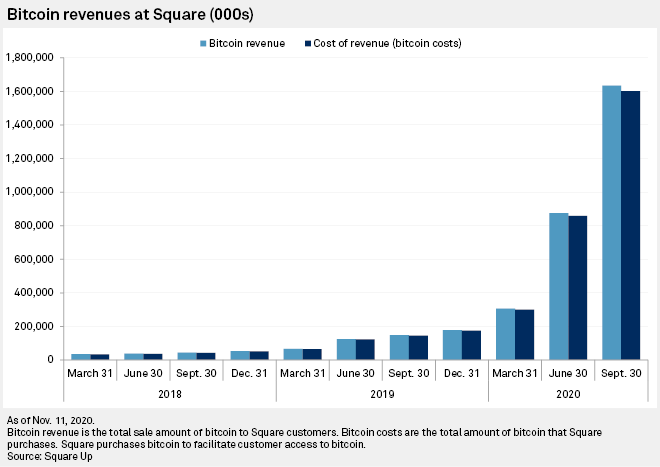

PayPal caused a stir in October when it announced that it will enable users in the U.S. to buy, sell and hold cryptocurrency via their accounts. But it is by no means a first for U.S. cards and payments majors. Square has allowed users to transfer cryptocurrency since 2018, while Visa and Mastercard have both ramped up their cryptocurrency debit card plans in recent years. Cryptocurrency may appear to be a niche or even experimental segment for these companies, but they are treating it with increasing seriousness, according to industry experts.

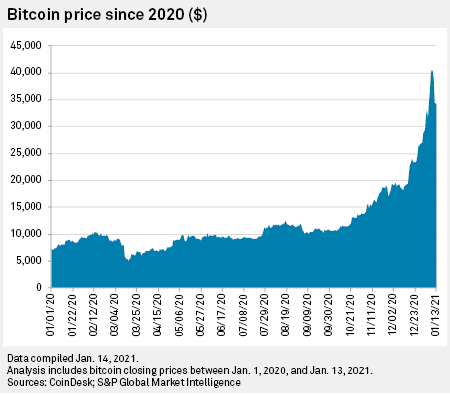

The recent enthusiasm for Bitcoin is reminiscent of the Gold Rush in the western U.S. from 1848-1860. With fits and starts, U.S. enthusiasm for gold exploded over this time period. Gold was the most popular safe haven and store of value in the 19th century. Viewed as one of the least volatile commodities, gold prices during that time were surprisingly tepid in comparison to the current, highly volatile moves from Bitcoin. Less liquid than other established stores of value, Bitcoin’s recent move has been parabolic in nature.

Distro is an electricity microgrid project based in the port of Rotterdam, a partnership between S&P Global Platts and BlockLab that brings together local solar and storage assets and enables automated trading between the users participating in the trial.

In the latest Platts Future Energy podcast, Janjoost Jullens, Energy Lead at the at the Blocklab innovation lab in the Netherlands, and James Rilett, Senior Director of Innovation at S&P Global Platts, tell Henry Edwardes-Evans about Platts AI trading platform Distro. Rotterdam's blockchain-based microgrid has driven user costs down 11% and producer returns up 14% - now its developers are looking to extend its reach within the port and roll the system out elsewhere.

Exploring Distro: Rotterdam Port’s New High-Frequency Trading Platform

-James Rilett, senior director of innovation at S&P Global Platts

Henry Edwardes-Evans spoke to Janjoost Jullens, energy lead at the BlockLab innovation hub in the Netherlands, and James Rilett, senior director of innovation at S&P Global Platts. This article is a written Q&A of the podcast conversation.

Read the Full Article

A new trading platform called shape Q aims to bring digital trading to the green energy sector, emulating a model that has become familiar to the more traditional financial markets, the platform's founders told S&P Global Platts in an interview.

The founders said that one of shape Q's main objectives is to bring more transparency to the market. The platform will publish market data, as well as permit users to discover new counterparties and communicate with them. After publishing the market data on the platform, shape Q will print anonymized trade data on a public blockchain. In this way, the market data will become public and not only accessible to the platform's users.

Key Takeaways

A string of applications from cryptocurrency companies seeking national trust bank charters in the final months of 2020, and an approval in the first few weeks of 2021, are clearing a path through the ambiguity surrounding crypto regulation and could open the door for incumbent banks to enter the field.

Crypto's 2020 Boom Sparks Interest from LatAm Legacy Banks

As price rallies took cryptocurrency market caps to all-time-highs in recent weeks, Latin America's legacy banks started to take a closer look at an asset class that could soon be integrated into their products and services offering.

Adoption is surging — with Bitcoin leading the way — in countries like Venezuela and Argentina, where individuals and businesses seek to protect their income against inflation and currency controls.

Discussions around Central Bank Digital Currencies (CBDCs) have undoubtedly shifted gears in the past few months. While the fundamental features of these instruments are still unclear, as is the timing of any launch, S&P Global Ratings believes that central banks will have a clear preference for a CBDC model where banks and other financial institutions continue to play a strong role.

Based on this assumption, S&P Global Ratings believes that CBDCs could ultimately have a moderate impact on banks' business models. However, they could exacerbate pressure on the revenue profile of certain activities (such as payments).

There are many reasons why central banks and governments may consider the adoption of CBDCs. For example, to improve payment infrastructure and process, enhance financial inclusions, and spur innovation. However, central banks' key mandate—to ensure financial stability—remains unchanged.

Central Bank Digital Money Faces 'Inflection Year' but Banks Will Stay Relevant

Discussions around Central Bank Digital Currencies, or CBDCs, have heated up in recent months, but even if they eventually hit the mainstream, commercial banks are unlikely to be rendered irrelevant by this new form of exchange, according to analysts.

However, banks will have to take steps to be ready for the introduction of CBDCs, which are digital versions of fiat currency and are a store of value in their own right.

Next year could be an "inflection year" for the adoption of CBDCs, given the range of pilot projects underway, said Csilla Zsigri, senior research analyst of blockchain/DLT and data marketplaces at 451 Research, an S&P Global Market Intelligence company.

Read the Full Article

Digital asset marketplace startup Bakkt Holdings LLC is set to become a publicly traded company by merging with blank-check firm VPC Impact Acquisition Holdings. The deal will form a company with an enterprise value of about $2.1 billion. Bakkt investors will roll their equity into the combined company, with Intercontinental Exchange Inc., which launched Bakkt in 2018, infusing $50 million more in capital.

The combined entity will be named Bakkt Holdings Inc. and listed on the New York Stock Exchange. Gavin Michael, former head of technology at Citigroup Inc.'s Global Consumer Bank, joins Bakkt as CEO, effective Jan. 11. Bakkt's interim CEO, David Clifton, will join the combined company's board at the deal's closing, which is expected to occur in the second quarter.

Bakkt is a digital asset management platform and marketplace that works with commercial clients to allow customers to transact in cryptocurrencies. It currently supports 30 loyalty programs and 200 gift card merchants, and it is integrated as a payment method on the Starbucks app. Bakkt plans to launch a full consumer-facing app in March.

The merger is expected to result in over $500 million of cash on the combined company's balance sheet. This reflects a contribution of up to $207 million of cash held in VPC Impact Acquisition Holdings' trust account and a $325 million concurrent private placement of class A common stock of the combined company, priced at $10.00 per share.

SoFi Going Public via SPAC Deal with Profitability Expected in '21

Unicorn digital lender SoFi expects to become profitable this year, and if it succeeds in launching a national bank, its outlook gets even rosier, executives said. It now deals in everything from mortgages to credit cards to allowing clients to trade fractional shares and cryptocurrencies on its platform.

Read the Full ArticleFilipino Boxing Champ Manny Pacquiao Seeks to Pack Fintech Punch

World boxing star Manny Pacquiao, whose sporting career has cooled amid the coronavirus pandemic, is hoping to turn his celebrity status in the Philippines and beyond into commercial success for his two financial technology ventures in an increasingly crowded market.

Read the Full ArticleSEC Offers Limited Safe Harbor to Broker/Dealers Working with Digital Assets

The top U.S. securities regulator is allowing broker/dealers to offer digital asset services without threat of enforcement action for five years, provided that the companies follow its guidelines for protecting customers.

Read the Full Article