Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 30 Apr, 2020

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

In February 2020, S&P Dow Jones Indices (S&P DJI) and the Association of Mexican Insurance Companies (AMIS) conducted the second annual survey of insurance investment officers in Mexico about the state of the local insurance industry. While this survey was meant to help take the pulse of the Mexican insurance market, what we did not predict was that shortly after the survey concluded, the Mexican economy would feel the combined shocks of COVID-19 and lower global oil prices.

We recently published the results of this survey to highlight the perspectives of the insurance investment officers at a point in time, with the recognition that this survey assumes relatively “normal” market conditions, and importantly, these are now no longer “normal” market conditions. With that in mind, we want to highlight some of the changes that have already taken place during the past month.

Downgrades and Negative Ratings Outlooks

On March 26, 2020, S&P Global Ratings lowered its local and foreign currency ratings on Mexico to ‘BBB+’ from ‘A-’ and to ‘BBB’ from ‘BBB+’, respectively. In line with this downgrade, on March 27, 2020, S&P Global Ratings also lowered its ratings on several Mexican insurance entities whose investment portfolios had a significant portion of sovereign debt (the details of which are outlined in this report).

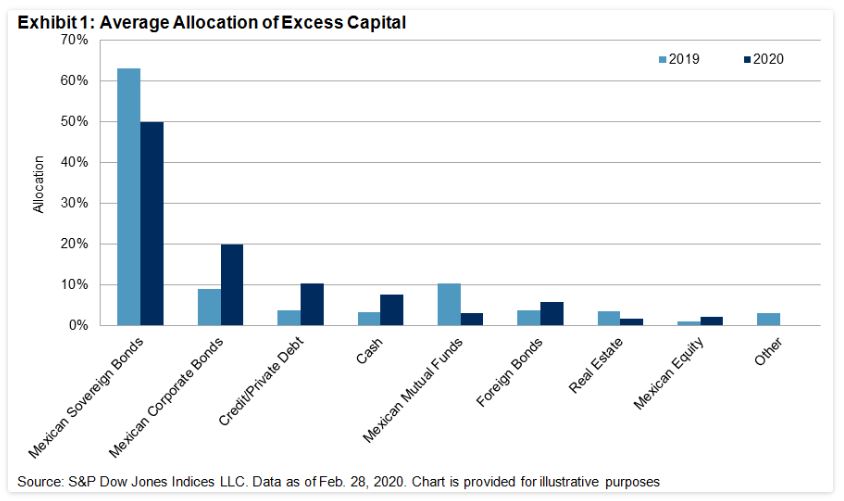

In our survey, we asked respondents to focus on the asset allocation of their excess capital, where they have a bit more latitude in what they can invest. Between the 2019 and 2020 surveys, companies decreased their allocation to sovereign bonds while they increased their allocation to corporate, private, and foreign debt; still, sovereign bonds comprised the majority of their allocation of excess capital (see Exhibit 1).

At the time of the survey, more than 20% of respondents said they expected to decrease allocations to Mexican sovereign bonds. Given the current market conditions and ratings outlook, it is likely that this percentage would be much higher today.

A Liquid but More Volatile Mexican Peso

As my colleague María Sánchez noted in her recent blog post, the Mexican peso was the Latin American currency most affected in March 2020, with a depreciation rate of 16% relative to the U.S. dollar. Still, the peso remains a highly liquid currency.

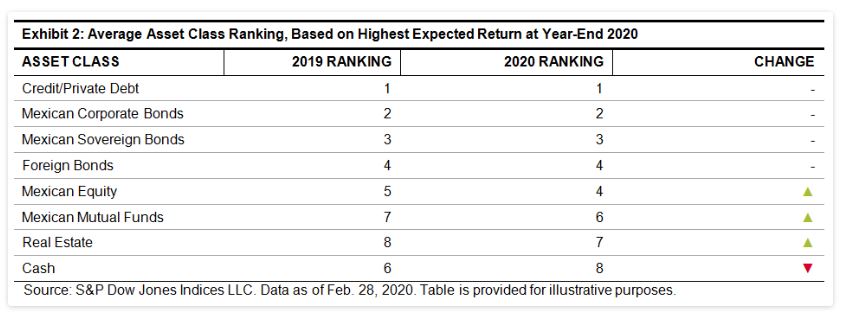

The insurers we surveyed had relatively low expectations for cash as an asset class in 2020 even before the market crisis. We asked them to order several asset classes in terms of expected return—irrespective of their allocations or risk tolerances—where “1” corresponded to the highest expected return. Exhibit 2 shows the average ranking of the asset classes based on highest expected return in 2020; respondents expected cash to have the worst performance.

Separately, 17% of respondents said they expected to decrease their allocations to cash. Again, it is likely that this percentage would be higher given today’s market conditions.

Join us for a webinar on May 6 where representatives from S&P DJI and S&P Global Ratings will discuss the impact of COVID-19 and how insurers can get ahead of the headwinds facing the local insurance market. A replay of the webinar will also be available at the same link.*

*The webinar will be in Spanish.