Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global Platts — 23 Jan, 2020

The global recycled plastics market will continue to grapple with unfavorable economics in 2020.

In the long term, demand for recycled plastics is expected to grow significantly, along with recycling rates for core materials PET, PE and PP.

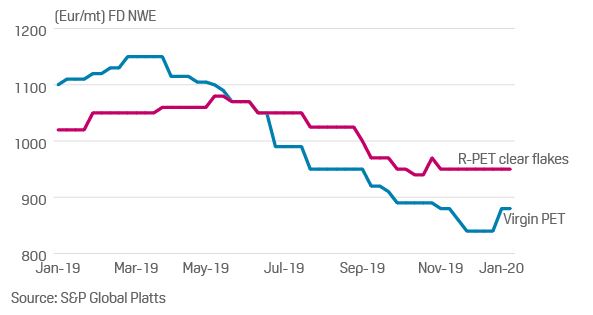

But in the short term, there is likely to be a mismatch globally between the high demand for recycled plastic and the available supply, which should see a further disconnect in pricing mechanisms between virgin and recycled plastics as recyclers try to maintain margins.

The bearish sentiment in the virgin plastics market due to significant production capacities planned to come online both in China and the US will test brand owners’ commitments to purchasing recycled plastics in 2020.

In China, around 1.7 million mt/yr of PET capacity will be added. In the US, 34.35 million mt/yr of polyethylene capacity will be added in the 2020s and, in the near future, the market is awaiting LyondellBasell’s 550,000 mt/yr HDPE plant to start up in 2020 in the Houston Ship Channel.

In the face of cheaper virgin material, brand owners will either bite the bullet and continue buying the more expensive recycled material, or reduce recycled plastic purchasing to minimum levels. This poses a different problem, since milestone brand owner commitments to minimum recycled plastic content in their packaging are fast approaching. The latest Ellen Macarthur Foundation New Plastics Economy annual report shows that many of the largest brand owners are far away from their proposed targets.

The latter scenario seems the more likely. Media and consumer pressure alone seemed enough in 2019 to keep demand for recycled plastics high. The question now is whether supply can increase sufficiently to meet demand.

Go deeper: More on recycled plastics in S&P Global Platts’ report, Global petrochemical trends: H1 2020

S&P Global Platts Analytics forecasts growth in recycled plastics supply globally, with PET leading the way as the most mature market and with HDPE and PP also showing good growth. Globally, recycled plastics are expected to replace around 8% of virgin polymer demand in 2020, a modest increase from 7% in 2019. Again, PET leads here, as the global consumer packaging market is expected to replace far greater volumes of virgin polymers with recycled material than the polymer markets in general.

There are also bans coming into force across the globe for commonly used single use plastics, such as plastic bags, straws and cutlery. These bans pose other questions, including what materials will be used to replace them, how much they will cost and, importantly, how much more environmentally friendly they actually are.

One polymer that could face a tricky demand year is PVC, a versatile plastic used in everything from upholstery to food packaging, as many signatories to the New Plastic Economy propose to eliminate the difficult-to-recycle polymer in 2020. For PET, in particular, this could put further strain on supply as it becomes the go-to replacement polymer for PVC.

While 2020 looks to be a challenging year for recycled plastics markets globally, there are some positive signs coming through, particularly with the expected growth of recycled plastic supply and planned investment in infrastructure globally.