Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 17 Apr, 2020

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

In the SPIVA® Japan Year-End 2019 Scorecard, we evaluated the percentage of Japanese active funds that underperformed their respective benchmark indices, as well as the average fund returns on an equal- and asset-weighted basis. Equal-weighted returns are a measure of average fund performance, while asset-weighted returns are a measure of the performance of the total money invested in that category. In certain fund categories, such as the Japanese equity mid/small-cap funds, U.S. equity funds, and emerging equity funds, we noticed significant divergence in the equal-weighted and asset-weighted returns.

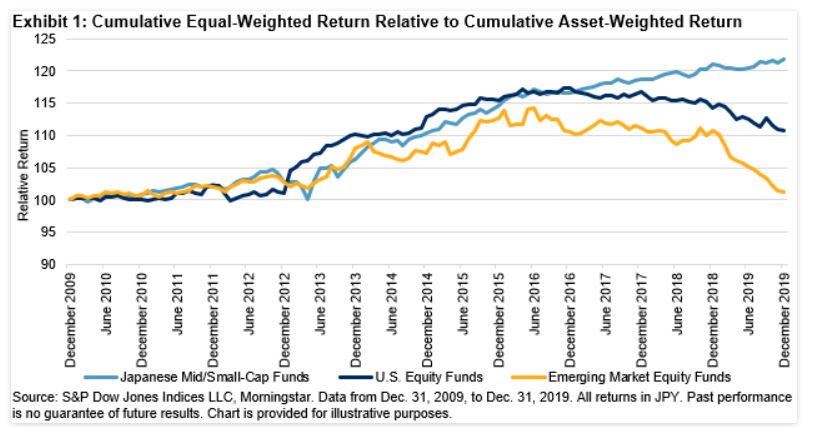

Exhibit 1 shows the cumulative equal-weighted performance relative to the asset-weighted performance across these three categories over the 10-year period ending in December 2019. The asset-weighted performance consistently lagged the equal-weighted performance in the Japanese equity mid/small-cap funds category. We also observed similar trends in the U.S. and emerging market equity fund categories between December 2009 and December 2015, though the trend reversed in the past three to four years. When equal-weighted returns outperformed asset-weighted returns, it implies smaller active funds outperformed their peers with larger sizes during the period.

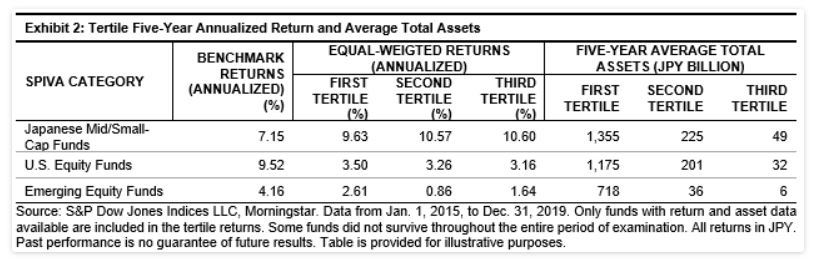

To further examine performance difference between larger and smaller funds for the Japanese equity mid/small-cap fund, U.S. equity fund, and emerging equity fund categories, we bucketed the funds into three tertiles based on each fund’s assets and tracked the tertiles’ performance for each category over the past five years.[1] The top tertile in the Japanese equity mid/small-cap fund category had five-year average total assets[2] of JPY 1,355 billion, accounting for 83% of average assets in the category, while the top tertile in the U.S. and emerging equity fund categories had five-year average total assets of JPY 1,175 billion and JPY 718 billion, accounting for 83% and 95% of average assets in their respective categories (see Exhibit 2).

In the Japanese mid/small-cap fund category, the third tertile (comprising funds with the smallest assets) outperformed the first and second tertiles, which further confirmed smaller funds outperformed larger funds in this category, and all three tertiles outperformed the benchmark over the past five years. In contrast, the top tertile (comprising funds with the largest assets) outperformed the second and bottom tertiles in the U.S. and emerging equity funds categories, showing larger funds outperformed their smaller peers in these two categories, though all three tertiles underperformed their respective benchmarks in the past five years.

These observations indicate pronounced small-cap premia was consistently captured by smaller funds in the Japanese mid-/small cap equity funds. For larger-sized funds, fund managers’ investment proposition may involuntary dip toward stocks with lower return potential due to the selection constraints to pick stocks with larger market capitalization and sufficient trading liquidity, aiming to construct lower-turnover strategies.[3] In contrast, smaller-sized fund categories had much more flexibility to chase investment pools of stocks that offered higher return premia in lieu of lower liquidity or float market capitalization. In addition, this also implies the economies of scale advantage played a less-prominent role in the outperformance of the Japanese equity mid/small-cap fund category.

1 Funds are dissected in tertiles based on assets for each month over the period from Dec. 31, 2014, to Nov. 30, 2019. The top 1/3 of funds with the highest assets are included in the first tertile, while the bottom 1/3 of funds with the smallest assets are included in the third tertile.

2 Five-year average total assets are the average monthly figures of total fund assets in each tertile within each respective SPIVA category for the period from Dec. 31, 2014, to Nov. 30, 2019.

3 Jeffrey, A., Busse, Tarun, Chordia, Lei, Jiang, and Yuehua, Tang (2014). “How Does Size Affect Mutual Fund Performance? Evidence from Mutual Fund Trades.” Research Collection Lee Kong Chian School of Business