Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 9 Sep, 2020

By S&P Global

U.S. President Donald Trump is doubling down on his enthusiasm about the economy as the country continues to bear the biggest health burden of the coronavirus pandemic, entering the crucial homestretch until the presidential election on Nov. 3.

“Biggest & Fastest Financial Recovery In History. Next year will be BEST EVER, unless a very Sleepy person becomes President and massively raises your taxes – In which case, CRASH!” President Trump wrote on Twitter Sept. 7, suggesting that the American economy under Democratic nominee Joe Biden would collapse.

In a press conference that same day, President Trump said the U.S. “experienced the smallest contraction of any major western nation” and that the country’s “rise is spectacular and we’re rebounding much more quickly from the pandemic.”

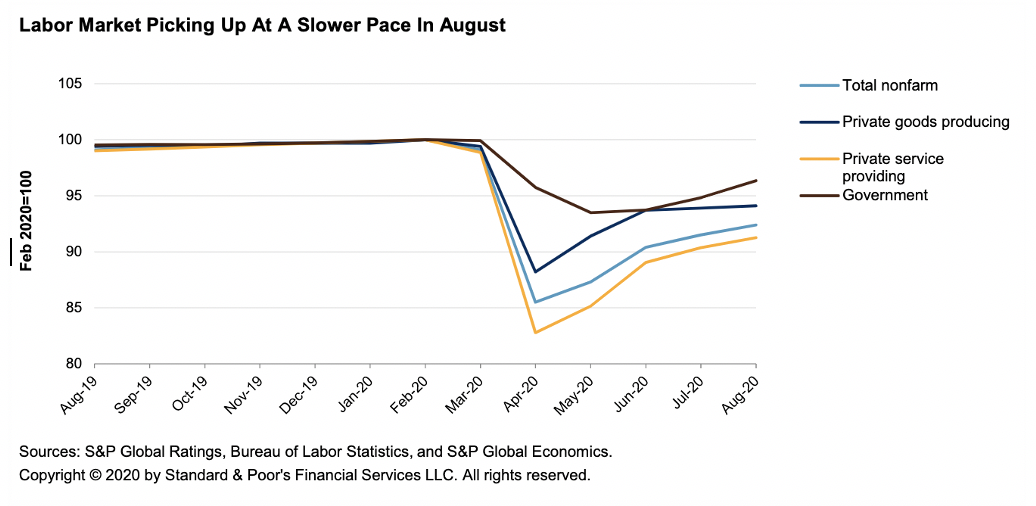

To be sure, the U.S. economy hasn’t yet fully recovered from the coronavirus-caused recession that pushed GDP down an annualized 32.9% in the second quarter. While last month saw headline unemployment shrink to 8.4%, from April’s peak of 14.7%, and the addition of almost 1.4 million jobs, according to the U.S. Labor Bureau, the pace of growth in employment signals that the recovery may be prolonged.

“We expect to see the jobs market slow further this year, with net job gains to remain well under 1 million for the foreseeable future. That will likely leave the total number of jobs lost still in the millions as the New Year arrives,” S&P Global Ratings’ Chief U.S. Economist Beth Ann Bovino said in a Sept. 4 report. “We do not anticipate total employment numbers will return to pre-pandemic levels before 2022.”

Both economic experts and public health officials have largely agreed throughout the crisis that countries’ economic health depends intrinsically on populations’ health. Much of the hope surrounding the prospects of the global economy’s return to normal is tied to the creation and dissemination of an effective vaccine to prevent COVID-19.

However, the development of a vaccine “would not necessarily transform the immediate economic outlook,” Capital Economics’ Group Chief Economist Neil Shearing said in a recent report. “At one end of the spectrum [of short-term outcomes for economies] lies a highly effective vaccine that is produced and distributed quickly. At the other, lies a less effective vaccine that faces significant production and distribution challenges, and would be in relatively short supply in 2021. Both situations would be better than the current state of not having a vaccine at all. But in most scenarios, it is likely that containment measures, including social distancing and restrictions on some foreign travel, will remain in place for the foreseeable future.”

President Trump said during the Sept. 7 press conference that “we could have a vaccine soon, maybe even before a very special date. You know what day I’m talking about,” in reference to Election Day.

“It’s unlikely that we’ll have a definitive answer at that time,” Anthony Fauci, the director of the U.S. National Institute of Allergy and Infectious Diseases and a member of the White House’s coronavirus task force, said during the Research! America 2020 National Health Research Forum on Sept. 8. “The only way you can see that scenario come true is if there are so many infections in the clinical trial sites that you get an efficacy answer sooner than you would have projected.”

In an unprecedented move seen as a response to global governments’ frenetic hurriedness to control the contagion, nine biopharmaceutical companies in the U.S. and Europe—including AstraZeneca, BioNTech, GlaxoSmithKline, Johnson & Johnson, Merck, and Moderna—released a joint statement on Sept. 8 in which they pledged “to uphold the integrity of the scientific process as they work towards potential regulatory filings and approvals of the first COVID-19 vaccines.”

Last week, the U.S. Centers for Disease Control and Prevention instructed states to prepare for large-scale vaccine distribution as early as Nov. 1. Last month, the Food and Drug Administration issued guidance that coronavirus vaccines may not need to undergo Phase 3 clinical trials, during which large-scale testing is implemented to ensure drugs’ efficacy and safety, in order to make treatment available in the immediate term.

More than 6.3 million coronavirus cases have been confirmed in the U.S. and nearly 190,000 people have died, according to Johns Hopkins University data.

Today is Wednesday, September 9, 2020, and here is today’s essential intelligence.

Economic Research: U.S. Biweekly Economic Roundup: Job Gains Slow Amid Signs Of A Long Recovery To Come

The Bureau of Labor Statistics reports the U.S. economy regained 1.37 million payroll jobs in August; nearly half of the jobs lost in March and April have now been recouped. However, the pace of job gains continues to slow, and there are already signs that the recovery could be lengthy. Meanwhile, the unemployment rate fell to 8.4% in August, a quicker-than-expected retracement from the 14.7% peak in April, but remains twice as high as the pre-pandemic rate from February. The lower-than-expected unemployment rate will have few monetary policy implications for now, given the Fed's recent announcement that it will adopt a new monetary framework that formalizes its intention to pursue a more dovish policy path than in the last expansion.

—Read the full report from S&P Global Ratings

Checks And Imbalances: Delayed Australian State Government Budgets Will Embrace More COVID-19 Stimulus

Transparency is impeded by Australia's state governments postponing their annual budgets from Q2 2020 to Q4 or later. Tens of billions of dollars in health and economic support measures will contribute to large cash deficits. Additional stimulus is likely. The forward infrastructure pipeline is already large. Delivering more capital spending could intensify the downward pressure on state credit metrics.

—Read the full report from S&P Global Ratings

Oil Producers' Share Values Still At Fraction Of Pre-Pandemic Levels

This has been a difficult year for independent oil and gas producers on all fronts, and their stocks have not been immune to the damage. Companies that had already seen share prices slide in recent years have been battered over the course of 2020, with most seeing their stocks lose one-third of their value or more since Jan. 1. The negative trend for independent producer stocks was exacerbated in early March when Saudi Arabia and Russia decided to increase production in an already oversupplied market. Share prices immediately went off a cliff, and while most have regained some of their losses, they remain well below pre-March levels.

—Read the full article from S&P Global Market Intelligence

Fewer Retailers Seek US IPOs, Fetch Less In 2020 Amid Coronavirus Pandemic

Retailers have pursued fewer IPOs and fetched far less from public trading debuts in 2020 so far than the same period a year ago, according to an analysis by S&P Global Market Intelligence. A total of seven retail companies have gone public in 2020 during the coronavirus pandemic as of Sept. 4, raising $987.78 million in gross proceeds. In comparison, 10 retailers fetched a combined $3.13 billion in their public debuts during the same period in 2019. The analysis includes Market Intelligence-covered companies with a primary industry classification of retailing, household and personal products, or consumer durables and apparel, and secondary industry classification of retailing that completed their IPOs on the Nasdaq, the New York Stock Exchange or the American Stock Exchange between Jan. 1 and Sept. 4.

—Read the full article from S&P Global Market Intelligence

EMEA Private Equity Market Snapshot: Issue 26

This is the 26th issue of the EMEA Private Equity Market Snapshot (PEMS), a quarterly publication focusing on the Private Equity (PE) market in Europe, the Middle East and Africa (EMEA) from S&P Global Market Intelligence. Economies may be re-opening across Europe, but as S&P Global Market Intelligence’s analysis shows, it is clear that deal-making activity in EMEA has not yet recovered from the COVID-19 shut-down. Not only did the region hit record lows in Q2, but previously high-performing sectors – IT in particular – witnessed stark reductions in deal value and aggregate capital deployed.

—Read the full report from S&P Global Market Intelligence

Quarterly U.S. Credit Card Quality Index: Issuance Declines 80% In Second-Quarter 2020, But Performance Remains Steady

U.S. credit card asset-backed securities (ABS) new issuance volume declined over 80% to approximately $2.5 billion in the first half of 2020 from $12.6 billion in the first half of 2019. Spreads widened as market uncertainty rose in March when COVID-19-related restrictions and state quarantines peaked. As of Feb. 21, 2020, five-year 'AAA' credit card ABS spreads were 28 basis points (bps) to swaps, widening out to 336 bps as of March 20, and have since come back to 28 bps as of Aug. 14. Approximately $25.4 billion in credit card ABS matured during the first half of 2020, which far outpaced the $2.5 billion in new issuance volume over the same period

—Read the full report from S&P Global Ratings

US Corporate Bankruptcy Count In 2020 Nears 500 As Filings Continue To Climb

Corporate bankruptcies in the U.S. continue to grow during the coronavirus crisis as 24 companies joined 2020's list of casualties and pushed the year-to-date total closer to 500, according to an S&P Global Market Intelligence analysis. A total of 470 companies have gone bankrupt this year as of Sept. 7, more than the number of filings during any comparable period since 2010. Market Intelligence's bankruptcy analysis includes public companies or private companies with public debt. Public companies included in the list of companies with public debt must have at least $2 million in either assets or liabilities at the time of the bankruptcy filing. In comparison, private companies must have at least $10 million in assets or liabilities.

—Read the full article from S&P Global Market Intelligence

European Retail Property Companies' First-Half Results Highlight Looming Risks

The steep drop in retail demand in Europe, due to measures to contain the pandemic, hurt the first-half results of retail property owners, particularly in countries where lockdowns were strictest and in place the longest. The wide range of rental income decreases stemmed not only from differences between countries, but also from the type of shopping center, with conveniently located ones faring somewhat better than larger destination malls. Moreover, property valuation declines averaging 2%-5% from January to June 2020 added to pressure in the second half of 2019 linked to a steady increase in online shopping.

—Read the full report from S&P Global Ratings

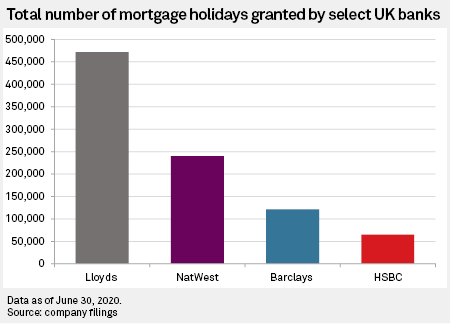

UK Banks Likely To Hold Fire On Home Repossession After Pandemic, Say Analysts

Repossessing homes will become harder for U.K. banks seeking to recover properties when borrowers fail to keep up with payments on mortgages in the wake of the coronavirus pandemic, said analysts. Recent guidance from the Financial Conduct Authority, or FCA, told banks to offer a range of "tailored repayment options" to mortgage borrowers affected by the coronavirus after the existing scheme offering a three-month payment holiday is withdrawn at the end of October. Customers will still be able to claim a three-month mortgage payment holiday, which in some cases could be their second or third deferral, up until the deadline.

—Read the full article from S&P Global Market Intelligence

Japan's Regional Bank Profits May Sink Deeper As Loan-Loss Provisions Surge

Smaller regional banks in Japan are likely to report the lowest earnings in at least eight years in the current fiscal year ending March 2021, analysts say, after community and rural lenders more than doubled their loan-loss provisions in the fiscal first quarter as COVID-19 was added to their growing list of challenges. Credit costs, or called loan-loss provisions in other markets, of 26 regional banks that disclosed consolidated earnings for the April-to-June periods in both 2019 and 2020 totaled ¥18.02 billion in the end-June quarter, up from ¥8.56 billion a year earlier, according to S&P Global Market Intelligence. And on an unconsolidated basis, credit costs of 78 regional banks in Japan in the fiscal first quarter rose 46% to ¥67.9 billion from a year ago, according to an Aug. 17 report by Mitsubishi UFJ Morgan Stanley Securities Co.

—Read the full article from S&P Global Market Intelligence

Uncertain Outlook For US Banks Sends Some Investors To The Exits

Some investors are pulling back from the bank space in response to a return to a zero-rate environment and loan portfolios riddled with credit quality questions. But others are sticking with the sector, seeing opportunity in depressed valuations. Castine Capital Management LLC, a community bank investment fund, shut down and sent a letter to shareholders, calling the banking sector "un-investable" and expressing skepticism about the reliability of banks' financial statements. Other investment funds have reduced their holdings of banks. Banc Funds Co. LLC exited positions in 15 banks, but the fund added five to its portfolio and the total value of its holdings stayed pat.

—Read the full article from S&P Global Market Intelligence

India's Targeted Relief Plan May Help Banks Avoid Sharp Rise In Bad Debt

The Indian central bank's targeted relief plan for borrowers whose businesses have been thrown off-gear by the coronavirus pandemic will likely help lenders avoid booking a sizable chunk of troubled loans as bad debts, analysts say. The Reserve Bank of India on Sept. 7 unveiled financial parameters such as liquidity and debt-service ratios that lenders need to consider while assessing requests under its framework for the resolution of loan accounts that became stressed due to the pandemic.

—Read the full article from S&P Global Market Intelligence

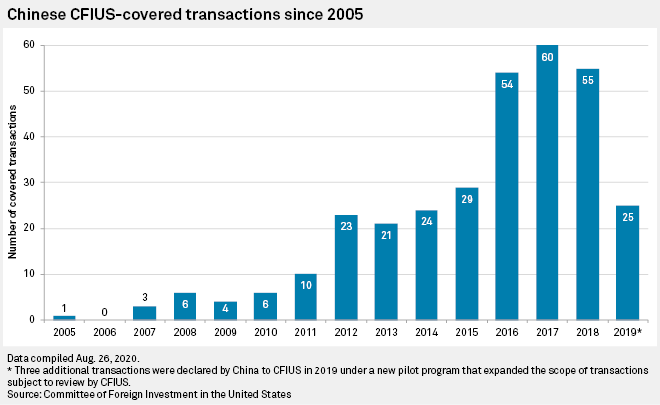

Scrutiny Of Chinese Investments In US Tech To Continue Under Trump Or Biden

The Trump administration's intense scrutiny of Chinese acquisitions is not likely to diminish under a Biden administration, according to foreign investment analysts, though the latter could bring more certainty to the process. According to data released in annual reports to Congress by the Committee on Foreign Investment in the United States, which reviews the national security risks of foreign investments in the U.S., Chinese transactions dropped substantially from 2017, the first year of the Trump administration, to 2019. Whereas 60 Chinese transactions were covered by CFIUS in 2017, just 25 were covered two years later.

—Read the full article from S&P Global Market Intelligence

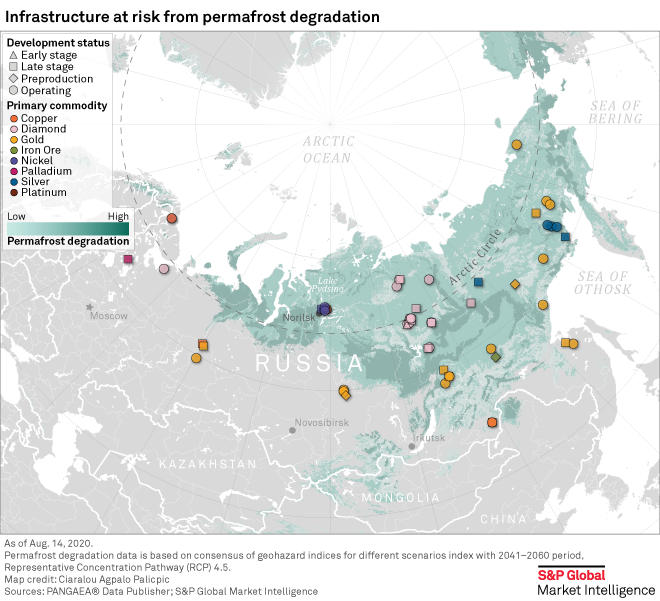

Rising Temperatures Leave Russia's Arctic Ambitions On Thin Ice

Rising temperatures and several environmental catastrophes over summer have revealed the underlying risks to Moscow's ambitious plans to develop everything from military bases to mines and associated infrastructure in Russia's far-flung eastern and northern regions, including the increasingly strategically important Arctic. Record temperatures and wildfires in Siberia this summer — following Russia's mildest winter yet — were accompanied by a series of highly polluting incidents in the High North, including one of the worst oil spills ever seen in the rapidly warming region.

—Read the full article from S&P Global Market Intelligence

Poland Proposes Accelerated Cut In Coal Generation Market Share To 2030

Poland is targeting reducing coal's share of electricity generation from around 75% today to between 37.5%-56% in 2030 and to 11%-28% in 2040, the Ministry of Climate said Sept. 8. The share of hard coal and lignite in power generation will depend on the evolution of CO2 prices in the next decade, the ministry said. Higher allowance prices would lead to deeper cuts in coal generation. The targets are included in the latest version of the Polish Energy Policy to 2040 (PEP2040) and are more ambitious than those in the previous version released last November.

—Read the full article from S&P Global Platts

Global Oil Demand, GHG Emissions May Already Have Peaked: DNV GL

Global oil demand may have peaked in 2019 ahead of COVID-19, but the world is nowhere near being on track to limit global warming to 2 degrees Celsius, consultancy DNV GL said in its fourth annual Energy Transition report Sept. 8. Pandemic-linked behavioral shifts, such as remote working and reduced commuting, would have a lasting effect on energy use, DNV GL said, potentially bringing forward peak energy-related CO2 emissions five years to 2019. "Despite flat energy demand and a growing renewable share, the energy transition is nowhere near fast enough to deliver on the Paris Agreement. Most likely we are heading towards 2.3°C warming by the end of the century," it said.

—Read the full article from S&P Global Platts

Watch: Chinese Demand Drives Up Us Soybean Prices; Crude Oil Imports Seen Dipping

The highlights in Asia this week with S&P Global Platts Senior Editor Nora Juma'at: China soybean crushes look to US for prompt bargains for November demand; LNG stakeholders to tackle post-COVID response; clean tanker demand seen easing; capesize dry bulk rates seen making a turn after dropping last week; ethylene prices rise on supply concerns; and Asian coal demand remains tepid.

—Watch and share this Market Movers video from S&P Global Platts

Host Of Energy Issues Hang In The Balance In Down-Ticket Races

The 2020 election cycle has the potential to reshape energy and environmental issues across the federal landscape and state lines. Much of the national discussion has focused on the presidential race between Donald Trump and Joe Biden, but voters will face a host of ballot choices that will influence the power, gas and oil markets for years to come. At the federal level, control of the U.S. Congress is up for grabs. Democratic control could usher in a new era of clean energy policymaking, while a split could cement political gridlock and disrupt presidential ambitions. At the state level, high-impact ballot measures face voter review on Nov. 3.

—Read the full article from S&P Global Market Intelligence

Iraq Forges US Energy Ties, But White House Race May Shape Oil Strategy

Fresh off a trip to Washington, Iraqi Prime Minister Mustafa al-Kadhimi faces no shortage of challenges turning much-hyped deals he signed into actual investment for the beleaguered energy sector. However, the US presidential election in November could have an even bigger impact on Baghdad's future oil and energy strategy. US President Donald Trump has been eager to support Kadhimi as he tries to rebuild the country after years of war amid a fractured political landscape. But Trump's tough stance on Iran has threatened Iraq's internal stability. This could change under Democratic Party opponent Joe Biden, who is thought to be more conciliatory towards Tehran.

—Read the full article from S&P Global Platts

German Divisions On Nord Stream 2 Laid Bare As Regional Leader Rejects Calls To Halt Project

German politicians are divided on whether action on the almost complete Nord Stream 2 gas pipeline should be considered in response to the poisoning of Russian opposition politician Alexei Navalny. Manuela Schwesig, the governor of the state of Mecklenburg-Western Pomerania, home to the landing points for both the existing Nord Stream pipeline and Nord Stream 2, said Sept. 8 that the Navalny case should not be used to threaten the pipeline project.

—Read the full article from S&P Global Platts

Year In Pipelines: 2019 Growth Declined As Megaproject Buildout Wound Down

The total value of U.S. interstate natural gas transportation and storage assets in 2019 saw a smaller increase than previous years as midstream infrastructure caught up to production and as the pipeline sector slowed down on a yearslong buildout. Contributing to the 2019 growth were a pair of TC Energy Corp. projects that came online in the beginning of the year: Columbia Gas Transmission LLC's Mountaineer XPress gas pipeline and Columbia Gulf Transmission LLC's Gulf XPress project, which combined provide up to 2.7 Bcf/d of incremental transportation capacity between the Northeast and the Gulf Coast.

—Read the full article from S&P Global Market Intelligence

Ferc Order On Nyiso Proposal Again Draws Future Of Capacity Market Into Question

A recent US Federal Energy Regulatory Commission order rejecting the New York grid operator's efforts to accommodate the state's aggressive climate goals has added to tensions that could sway the state to take back resource adequacy responsibility and dismantle its capacity market. New York, other states within the Eastern regional transmission organizations and clean energy advocates have grown increasingly frustrated with FERC's steps to address states' out-of-market resource procurement actions through market mechanisms that administratively raise the capacity market bids of resources receiving state subsidies.

—Read the full article from S&P Global Platts

Listen: The Rise Of Proprietary Traders In Oil Markets: A Conversation With Onyx Capital CEO

Oil markets have experienced a quiet revolution for over the last decade as proprietary trading houses have gradually replaced the participation of banks. Andy Critchlow, head of news in EMEA for S&P Global Platts, recently caught up with Greg Newman, CEO of London-based prop trader Onyx Capital Group, to discuss the latest developments in oil and the outlook for more participants entering the market.

—Listen and subscribe Commodities Focus, a podcast from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language