Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 4 Sep, 2020

By S&P Global

Roughly two weeks after recovering the entirety of the losses sustained during the pandemic and following nine days of historic highs, the S&P 500 tumbled 3.5% on Sept. 3 as technology stocks tanked. The Nasdaq Composite Index fell approximately 5.0% and the Dow Jones Industrial Average dropped 2.8%, or 807.77 points.

Apple Inc. shares plummeted 8%. Alphabet Inc. shares slumped 5.1%. Facebook Inc. shares fell 3.8%.

Disparities between the record stock market performance and economic situation have perplexed market observers as U.S. equity markets reached historic highs while the country’s economic downturn keeps millions unemployed. The U.S. equities benchmark’s retreat on Sept. 3 may signal a balancing, return-to-normal market correction—or that additional unpredictable behavior is yet to come.

"U.S. equities ... trade at truly record valuations, a full-blown mania," Kevin Smith, the founder and chief executive officer of the asset management firm Crescat Capital, told S&P Global Market Intelligence. "Ongoing policy rescue has perverted both free-market accountability and price discovery, creating a simultaneous zombie economy and stock market bubble, which is unsustainable."

“For tech specifically, the stocks are seeing large percent declines, but this comes after a massive recent rally,” Adam Crisafulli, the founder and president of market commentary firm Vital Knowledge, told CNBC. “Tech has been untethered from fundamentals for a while and momentum can work in both directions.”

Prior to the precipitous decline on Thursday, the S&P 500 was rallying 61% higher from its bottom low on March 23 and the information technology sector was soaring worldwide, up 118% from previous lows in Australia and 102% in Canada, according to S&P Dow Jones Indices.

On Sept. 2, one day before tech stocks sunk U.S. markets, Zoom Video Communications Inc.'s stock slipped 7.46% after skyrocketing 41% on Tuesday, as investors likely took their profits from the stock surge.

Against the backdrop of the U.S. equities benchmark’s historic ascent leading up to yesterday’s stall, the Chicago Board Options Exchange Volatility Index, or VIX, ticked up to 26.57. The so-called fear gauge peaked at 82.69 on March 16.

“It is worth emphasizing how unusual that is. Normally, an all-time-high in equities indicates a surefooted market: since the VIX began publication in the 1990s, S&P 500 highs have been accompanied by an average VIX level of 14.6,” Chris Bennett, director of index investment strategy at S&P Dow Jones Indices, said in a Sept. 3 note. “The current trend of outperformance in momentum and growth stocks has become reminiscently stretched. In short, stock prices may have already chosen their direction of travel, but VIX is sounding a clear warning that it may have been the wrong one.”

Today is Friday, September 4, 2020, and here is today’s essential intelligence.

Zoom's skyrocketing revenue, stock price to move even higher, analysts say

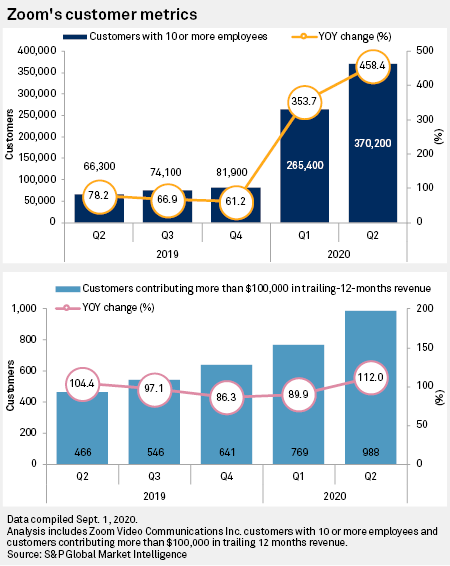

Multiple analysts increased their price targets on Zoom Video Communications Inc.'s stock after the company delivered record earnings, as usage continued to rise during the pandemic. Zoom continued to benefit from significant growth in its customer segment with 10 or more employees, which jumped 458.4% year over year in the company's fiscal 2021 second quarter to 370,200 customers. The company also ended the quarter with 988 customers contributing more than $100,000 in trailing 12 months revenue, up 112%.

—Read the full article from S&P Global Market Intelligence

Cyber Risk In A New Era: Insurers Can Be Part Of The Solution

The COVID-19 pandemic has changed the ways we shop, learn, and work with important implications for cyber risk. E-commerce is booming, brick-and-mortar retailers are shifting to digital platforms, and schools and offices have adopted online classes and home working. For organizations this has meant re-thinking digitalization strategies and doubling-down on information technology (IT) spending, cloud capacity, and infrastructure to boost bandwidth, ensure business continuity, and retain customers. S&P Global Ratings believes these digitalization trends are here to stay and will inevitably lead to a higher likelihood of cyber incidents, as companies increase their digital footprint or enter the space for the first time.

—Read the full report from S&P Global Ratings

COVID-19 Impact Will Shrink Number Of New US Smart City Projects

The U.S. smart cities market that has been fragmented and uncertain now has an added complication: COVID-19. The stress that the pandemic is putting on local budgets is making smart city programs that might have seemed necessary now look like a luxury. As a result, Kagan expects smart city deployments to fall by 7% in 2021, and revenue to be flat over the near term. The effect of this new environment will focus cities on revenue-generation for their smart cities programs. Newer business models like smart cities as-a-service that lower up-front costs will likely get a closer look, as local governments struggle to meet budgets. In addition, new FCC rules have cooled mobile network operators on smart cities markets, further diminishing the near-term outlook for smart cities.

—Read the full article from S&P Global Market Intelligence

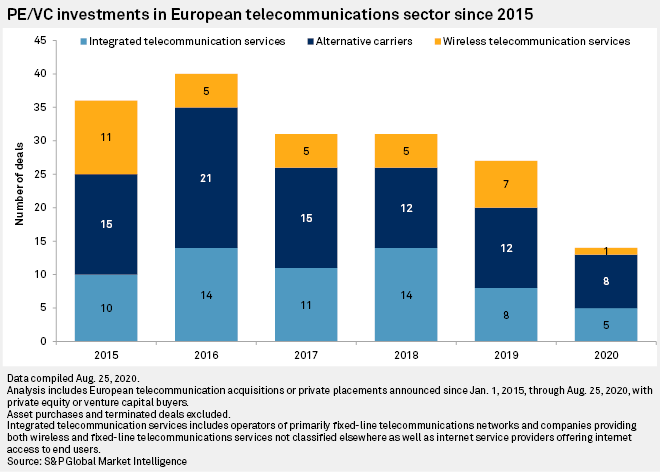

PE interest in Europe's telcos is rising due to COVID-19 – experts

After a dip in transactions in 2019, the coronavirus pandemic could see private equity companies target European telecom operators, experts told S&P Global Market Intelligence. As demand for telecom services increased during the pandemic, the industry offers cash flow visibility, as well as some potential bargains, the experts said. "Fixed networks gained importance as a utility during COVID-19," Hendrik Wiersma, a senior credit analyst who covers tech, media and telecoms at ING, said. "Private equity tends to target sectors with predictable cash flow generation with high margins."

—Read the full article from S&P Global Market Intelligence

LPs commit to PE despite uncertainty, but not all funds reap the benefits

Limited partners continue to commit to private equity funds following the global spread of coronavirus, but not all managers have been beneficiaries. The bifurcation between funds that are able to raise large sums and those that may face difficulty seen earlier this year continues, although some of the factors affecting certain raises have evolved. Virtual fundraising combined with LP rules about meeting managers in person means some funds may be unable to win over new commitments in the short term. Likewise, many investors are attracted to sectors that have weathered the worst of the COVID-19 uncertainty, leaving appetite for those that have not blunted.

—Read the full article from S&P Global Market Intelligence

Braced for losses, card lenders wind down pandemic relief

After two quarters of massive additions to credit loss reserves, some major credit card lenders are already exiting special COVID-19 payment deferral programs for borrowers. Forbearances have helped keep delinquencies low, despite a spike in unemployment. Credit performance has also been supported by extra unemployment insurance and direct government checks to households that kept aggregate personal income higher from April through July than it was before the pandemic.

—Read the full article from S&P Global Market Intelligence

Listen: Can Russia cope with its own bear market?

Russia's slashing of crude output is well documented, but how are its internal markets coping with the impact of COVID-19? Joel Hanley asks Russia experts Elza Turner and Thomas Washington what the energy superpower can do to stem volatility at home.

—Listen and subscribe to Oil Markets, a podcast from S&P Global Platts

Navalny poisoning triggers German calls for action on Nord Stream 2 gas link

The poisoning of Russian opposition politician Alexei Navalny has led to new calls for Germany to end its support of the Nord Stream 2 gas pipeline and for the EU to take coordinated action against the controversial project. The German government on Sept. 2 said Navalny had been poisoned with a Novichok nerve agent and called on Russia to answer "serious questions" about the incident. German Chancellor Angela Merkel has up to now supported the 55 Bcm/year Nord Stream 2 pipeline, which is almost complete with just 160 km of the line left to lay in Danish waters. As recently as July, Merkel said it was "right" to complete Nord Stream 2 despite the threat of US sanctions against the project. But the poisoning of Navalny has prompted a new wave of criticism from German politicians.

—Read the full article from S&P Global Platts

Insight from Moscow: Russian Arctic oil and gas development continues despite climate concerns

In early June, coverage of the environmental damage caused by a major gasoil leak at a facility owned by Nornickel in Russia’s Arctic region shocked both domestic and international audiences. Russian President Vladimir Putin declared a state of emergency, and ordered lawmakers to strengthen environmental legislation. There is little sign that the incident is causing Russian oil and gas companies to rethink their development plans in the region, however. The Arctic remains a strategic development priority for the Russian government, despite high costs, Western sanctions and logistical issues compounding the growing environmental concerns. The Russian energy ministry estimates that Arctic oil production will account for 26% of overall output by 2035, up from 11.8% in 2007.

—Read the full article from S&P Global Platts

Brazil's high corn prices here to stay; impact on exports not significant

he uptrend in Brazil's corn prices, even during the final stages of harvest, is not showing signs of a pullback, and are likely to remain elevated during the 2019-2020 season, analysts who spoke with S&P Global Platts said. The corn price indicator tracked by Brazil's Centro de Estudos Avançados em Economia Aplicada, or CEPEA, hit Real 61.25/60 kg on Aug. 31, the highest nominal price since it started tracking prices in 2004. An array of factors have pushed up domestic corn prices in Brazil, even as international prices remained low or muted. Among others, this year's opening stocks was 30% lower compared with a year ago at 10.2 million mt, following last season's record high exports.

—Read the full article from S&P Global Platts

US ELECTIONS: Trump, Biden race holds big oil policy impacts for shale, sanctions

The US presidential election in November presents a stark contrast for the next four years of US oil policy that could shape supply/demand dynamics domestically and abroad, with implications for shale, sanctions, trade and OPEC relations. The greatest domestic impact could come from a promise by Democratic nominee Joe Biden to stop issuing drilling permits for federal lands and waters, which would shrink US oil production by up to 2 million b/d by 2025, primarily from New Mexico's Delaware Basin and the Gulf of Mexico, according to S&P Global Platts Analytics.

—Read the full article from S&P Global Platts

Harbor Island crude terminal project needs funding, pipelines after legal debate resolved

The lengthy legal fight for the Harbor Island crude export terminal was resolved amicably, but the Texas port project still requires more financial support, new pipelines and, perhaps most importantly, recovered global oil demand in order to ever move forward with construction. The Port of Corpus Christi and the tourist-friendly city of Port Aransas announced on Aug. 31 that they would settle their litigation, but Port CEO Sean Strawbridge acknowledged that a lot of pieces must still come together to make the Harbor Island project a reality even if he remains bullish on its long-term prospects. In a Sept. 2 interview, Strawbridge said he's glad the port and the city are "finally aligned" on the project with city services now set to receive more funding from the port.

—Read the full article from S&P Global Platts

US oil, gas rig count rises by three to 285 heading into last trimester of 2020

The US oil and natural gas rig count rose by three on the week to 285, rig data provider Enverus said Sept. 3, as the final trimester of the year approaches with the drilling arena not showing much change. Two of the three rigs added in the week that ended Sept. 2 were oil-focused, as that number rose to 196. The other rig was gas-focused, for a total of 89. The big jump for the week came from the Permian Basin of West Texas/New Mexico, which saw an increase of four rigs to 131. Both the Eagle Ford Shale of South Texas and the Haynesville Shale of East Texas/Northwest Louisiana gained one rig each, for totals of 11 and 37, respectively. "The Permian rig additions were from larger companies that may be able to make $44/b WTI economical," Matt Andre, an analyst for S&P Global Platts Analytics, said.

—Read the full article from S&P Global Platts

US Labor Day travel seen subdued as summer ends on a quiet note: AAA

ravel over the long US Labor Day weekend is expected to be very different than in previous years, as the coronavirus pandemic continues to negatively impact plans for the weekend, which traditionally signals the end of summer across the nation. Rather than millions of Americans flying, driving or taking buses or trains to holiday destinations, many will be hunkered down at home or staying close to home. "This is a year without precedent due to restrictions to slow the spread of the coronavirus," said Robert Sinclair, Jr., manager of media relations for AAA Northeast. Because of the widespread impact of the coronavirus, AAA did not issue its usual national travel forecast for Labor Day.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Language