Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 30 Sep, 2021 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

The U.S. economy’s move into a post-pandemic recovery may not be smooth after all. Supply chain disruptions, the prevalence of the coronavirus delta variant, and inflationary pressures are tempering the rebound—and calling into question what the future state of the U.S. economy may be.

“The U.S. economy is resilient over the near term, but government bickering over infrastructure proposals and the threat of a government shutdown in October or, more ominously, a debt ceiling crisis, can't be ignored. Moreover, corporate debt levels are high, with a significant amount it speculative-grade ('BB+' and below),” S&P Global Ratings Chief U.S. Economist Beth Ann Bovino said recent report. “With a hot economy and interest rates at record lows, bond payments may be currently easy to manage. But when interest rates go up and the economic tide recedes, how many businesses will be left standing without a life preserver?”

S&P Global Economics revised its forecast for real full-year GDP growth in the U.S. to 5.7% for 2021 and 4.1% for 2022, from the June outlook of 6.7% and 3.7%, respectively.

Credit conditions in the U.S. remain largely favorable, but the risk that investors will push up borrowing costs remains, especially against the backdrop of uncertain variables, including the possibility of prolonged inflation or unprecedented events triggering additional market turbulence. S&P Global Ratings expects the Federal Reserve to announce its tapering of asset purchases this November and to begin doing so in December of this year, with a policy rate lift-off to come in December 2022 and two rate hikes each in 2023 and 2024.

“We believe inflation peaked in second-quarter 2021. While we expect it to continue to soften, supply-side price pressures will remain somewhat ‘sticky’ through 2022,” Dr. Bovino said in her report. “Average core CPI inflation will likely slow from 5.5% in 2021 to 2.7% and 2.5% in 2022 and 2023, respectively. The core Personal Consumption Expenditure deflator (PCE deflator), the Fed's preferred inflation measure, will slow to around 2.3% and 2.1%, respectively, for 2022 and 2023. The PCE deflator will near the Fed's 2% target later in 2023. A healthier economy and still-hot inflation will give the Fed reason to remove accommodation.”

For the time being, however, investors appear untroubled by the record high levels of corporate debt held by nonfinancial corporations—which Fed data showed skyrocketing by $1 trillion over the pandemic, to $11.2 trillion, more than 55% of U.S. GDP in 2020 and above pre-pandemic levels, according to S&P Global Market Intelligence.

"Clearly there is a point when credit investors will transform into credit vigilantes should corporations become too greedy in [their] use of credit, but we think that is far off in investment grade-land," Frank Rybinski, director of macro strategy at Aegon Asset Management, told S&P Global Market Intelligence. “If the [current economic recovery] slowdown is recession-like, then credit risk rises sharply and with it the premium needed to compensate for the increased credit risk.”

With the labor market is still 5.3 million jobs below the pre-pandemic peak and only 235,000 added in August, the U.S. employment picture still paints a portrait of uncertainty for the economy. Companies have raised wages and begun offering perks in efforts of luring potential employees to join their workplaces. Experts interviewed by S&P Global Market Intelligence believe that COVID-19 vaccine mandates could support the job market as employment gains lose momentum.

"You cannot keep hiring a million workers a month, regardless of the number of job openings," Joel Naroff, president of Naroff Economics, told S&P Global Market Intelligence, explaining that the U.S. jobs market will likely make gains from lows seen in August but at a slower pace than during the hiring surges seen earlier this year. "There is too much friction and too many mismatches between [the] unemployed and job openings in the labor market for that to be sustained."

S&P Global Economies anticipates that the U.S. economy will entirely regain the 22.4 million jobs lost due to the coronavirus crisis by the fourth quarter of 2022, and that the country’s unemployment rate will dip beneath the pre-pandemic 3.6% range—last seen in the second half of 2019—in the middle of 2023.

Today is Thursday, September 30, 2021, and here is today’s essential intelligence.

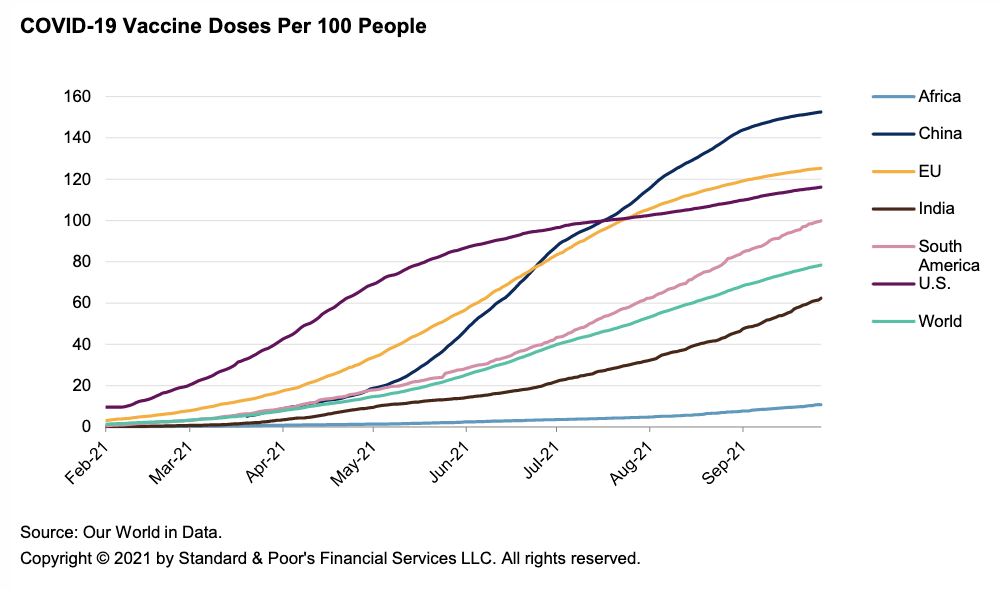

Economic Outlook Q4 2021: Global Growth Is Steady As Delta Spurs Wide Regional Swings

Although the worst of the COVID-19 pandemic appears to be behind us, regional infection dynamics and related policy responses continue to underpin relative economic outcomes. The global growth outlook for 2021 is broadly unchanged from S&P Global Ratings’ last update, albeit with sizable moves in some regional forecasts: Growth in Europe and many emerging markets looks stronger, while in the U.S. and China, it looks weaker. Inflation pressures appear to be peaking, with some emerging market central banks raising rates, the U.S. Federal Reserve moving up its tapering timeline, and the ECB firmly on hold for now. The risks to S&P Global Ratings’ baseline remain on the downside owing to uncertainties about the pandemic, elevated debt levels and a lack of policy space in some countries, and the growth path for China.

—Read the full report from S&P Global Ratings

Labor And Supply Chain Woes Chill Retail Spirits For Holidays And Beyond

An ongoing merchandise supply-and-demand imbalance and labor shortages will pressure retailers' performance and profitability well into 2022. COVID-19 variants create additional uncertainty for the industry. S&P Global Ratings believes most large investment grade issuers have cushion in their credit metrics to absorb modestly higher costs. S&P Global Ratings thinks speculative-grade issuers could be more at risk because they have less leverage with suppliers, smaller scale to absorb cost increases, and less flexibility to manage labor shortages.

—Read the full report from S&P Global Ratings

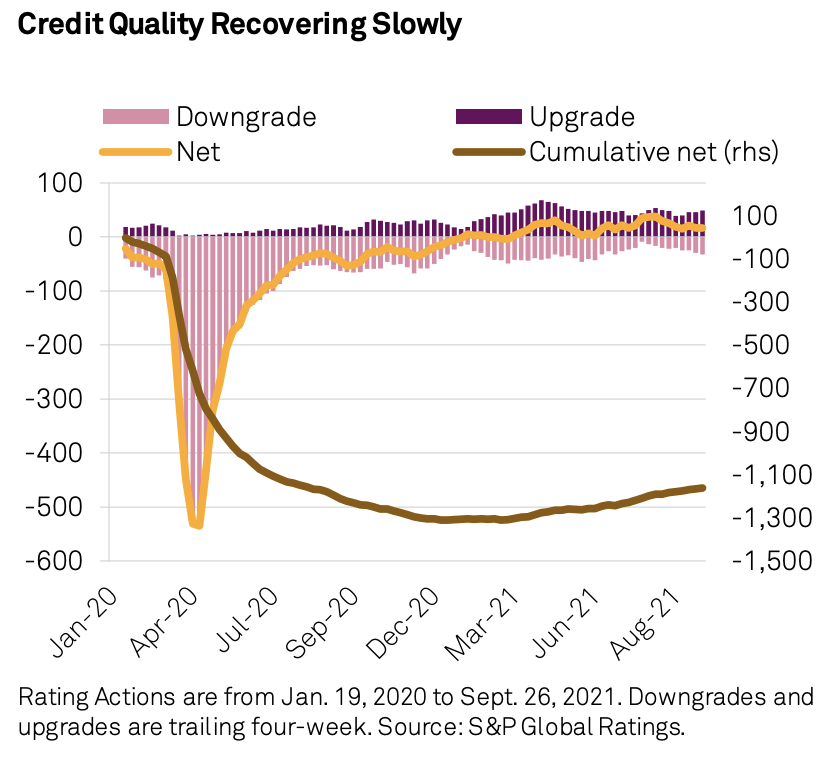

Global Credit Conditions Q4 2021: Supply Chain Strain, Inflation Pain

Globally, credit quality continues to recover slowly from a lower ratings base, as the world adapts to the dominant Delta variant and growth regains resilience. Rating upgrades are outpacing downgrades this year, although net upgrades so far represent only about 12% of the net COVID-induced downgrades in 2020. Credit outlooks in aggregate have stabilized and returned to pre-pandemic levels, while default rates have fallen sharply and are trending toward their long-term average. However, a confluence of headwinds could challenge the credit environment as we reach an inflection point for monetary policy and central banks start their gradual path toward normalization at different paces around the world.

—Read the full report from S&P Global Ratings

Default, Transition, and Recovery: The Global Weakest Links Tally Reaches Pre-Pandemic Levels

The number of weakest links--issuers rated 'B-' or lower by S&P Global Ratings with negative outlooks or ratings on CreditWatch with negative implications--decreased to 260 as of Aug. 31, 2021, and reached pre-pandemic levels not seen since December 2019 when the tally was 282 issuers. Accommodative financing and the global economic recovery helped increase positive rating actions through August 2021, most of which have been changed from negative outlook/CreditWatch to stable as credit metrics stabilize across the speculative-grade rating spectrum.

—Read the full report from S&P Global Ratings

Economic Research: Credit Markets Update Asia-Pacific Q4 2021

Asia-Pacific speculative-grade spreads widened significantly in July. August saw spreads partially reversed some of that increase for high-yield spreads, followed by another spike in September after the Evergrande liquidity shock.

—Read the full report from S&P Global Ratings

The Decline Of The Index Effect

The growth of passive investing has spurred suggestions that stock returns may be influenced by a so-called “index effect,” as trading by index funds responds to changes in index membership. If this were true, stocks added to the index would initially outperform amid buying pressure, while index deletions would underperform.

—Read the full article from S&P Dow Jones Indices

White House Sounds Alarm About Rising Gasoline Prices After Oil Crosses $80/B

The Biden administration continues to engage with OPEC producers and look "at every means we have to lower gas prices," White House Press Secretary Jen Psaki said Sept. 28, a day after crude oil futures settled above $80/b for the first time in three years.

—Read the full article from S&P Global Platts

New Oil Price Spikes Possible In October Before Return Toward $70/B: Platts Analytics

Gas-to-oil switching and improving demand in Asia amid tighter inventories could boost crude prices, currently at a three-year high, through October, before increased supply from the OPEC+ producer grouping and elsewhere limits upside.

—Read the full article from S&P Global Platts

NYMEX Henry Hub Gas Nears $6 On Supply Concerns, Lingering Ida Impact

The NYMEX Henry Hub prompt-month natural gas contract continued a four-day rally Sept. 28, nearing heights last seen in February 2014, as a slow restart to Gulf of Mexico gas production following Hurricane Ida compounds supply tightness in global gas markets.

—Read the full article from S&P Global Platts

New England Winter-22 Gas Forwards Top $20 As Region Faces Tight Import Market

The winter 2022 forwards contracts at Algonquin city-gates are trading at record highs recently as New England's gas market prepares to compete in the global LNG arena for peak-season cargoes.

—Read the full article from S&P Global Platts

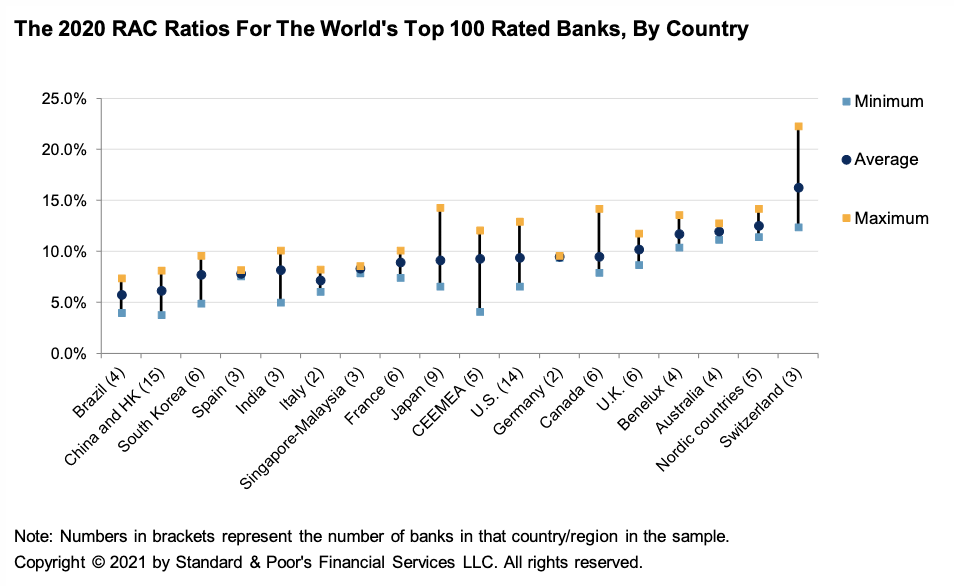

Top 100 Banks: Capital Ratios Show Resilience To The Pandemic

S&P Global Ratings expects risk-adjusted capital ratios for the top 100 banks to remain resilient in the next two years, with some variation across countries. Bank capital around the world held up well during COVID-19, demonstrating the effectiveness of Basel rules for capital and strengthening of bank supervision in the past 10 years.

—Read the full report from S&P Global Ratings

Portuguese Banks' Nonperforming Assets Set To Rise As Loan Moratoriums End

As Portugal nears the end of loan moratoriums granted to tackle the economic effects of COVID-19, the threat of worsening asset quality looms over the country's banks.

—Read the full article from S&P Global Market Intelligence

Czech Banks' Dividend Payouts Imminent After Central Bank Removes Restrictions

Some Czech banks announced plans to share part of their 2019 and 2020 profits with shareholders after the country's central bank relaxed COVID-19-related dividend restrictions, and further payouts are lined up for 2022.

—Read the full article from S&P Global Market Intelligence

Japanese Banks Eye CLO Investments On Expectation Of Fed Rate Rise

Japanese banks, the largest investors in CLOs outside the U.S., could return to the $1 trillion market amid a resurgence of supply and rising expectations of an earlier-than-expected liftoff of the federal funds rate.

—Read the full article from S&P Global Market Intelligence

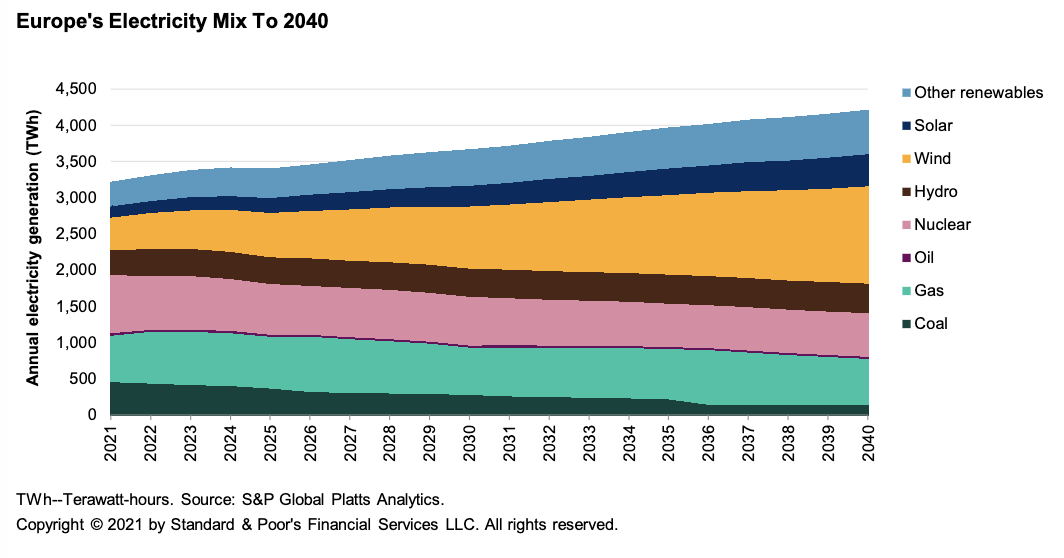

Decarbonization Efforts Are Shaking Up Global Energy Markets

Major support policies for rapid decarbonization—such as "Fit For 55" in Europe and a potential $3.5 trillion U.S. clean energy framework proposed by President Biden—represent a significant investment opportunity for electric utilities. However, recent inflation in the cost of renewables production could stall growth if it endures and challenges the 40% cost decline anticipated over the next decade. For 2021, S&P Global Platts Analytics forecasts a rise in costs of 10% for solar photovoltaic plants, 8% for onshore wind projects, and 4% for offshore wind projects.

—Read the full report from S&P Global Ratings

Oil Group's Net-Zero Goal Shuns Emissions Cuts That Would Threaten Core Assets

Twelve of the world's largest oil companies plan to cut their carbon and methane emissions by 50 million metric tons annually by 2025. But what the companies excluded from a recent pledge to reach net-zero emissions by 2050 may increasingly weigh on the sector.

—Read the full article from S&P Global Market Intelligence

Blue Hydrogen Under Microscope Over Emissions, Role As Transition Fuel

Touted as a key lever in global decarbonization, so-called "blue" hydrogen has sparked a debate in recent weeks among scientists and energy experts, calling into question the supposedly low-carbon fuel's green credentials.

—Read the full article from S&P Global Market Intelligence

APPEC: Collaborative Funding, Favorable Policy Key To Cut CO2 Emissions In South Asia

South Asia, responsible for about 8% of global CO2 emissions, requires collaborative government funding and a favorable policy framework to cut its carbon footprint and boost the use of clean fuels and technology, Vivek Sharma, senior director, CRISIL Infrastructure Advisory said at the S&P Global Platts Asia Pacific Petroleum Conference Sept. 28.

—Read the full article from S&P Global Platts

Credit Suisse Sees A $20 Trillion Opportunity In China's Carbon Neutrality Goal

China's road to carbon neutrality could generate potential investments worth up to 130 trillion yuan, or $20 trillion, according to Credit Suisse. The country may need to invest between 100 trillion yuan and 130 trillion yuan in green projects over the next 30 years to achieve its goal of net-zero emissions by 2060, according to Credit Suisse analysts speaking at a Sept. 29 webinar.

—Read the full article from S&P Global Market Intelligence

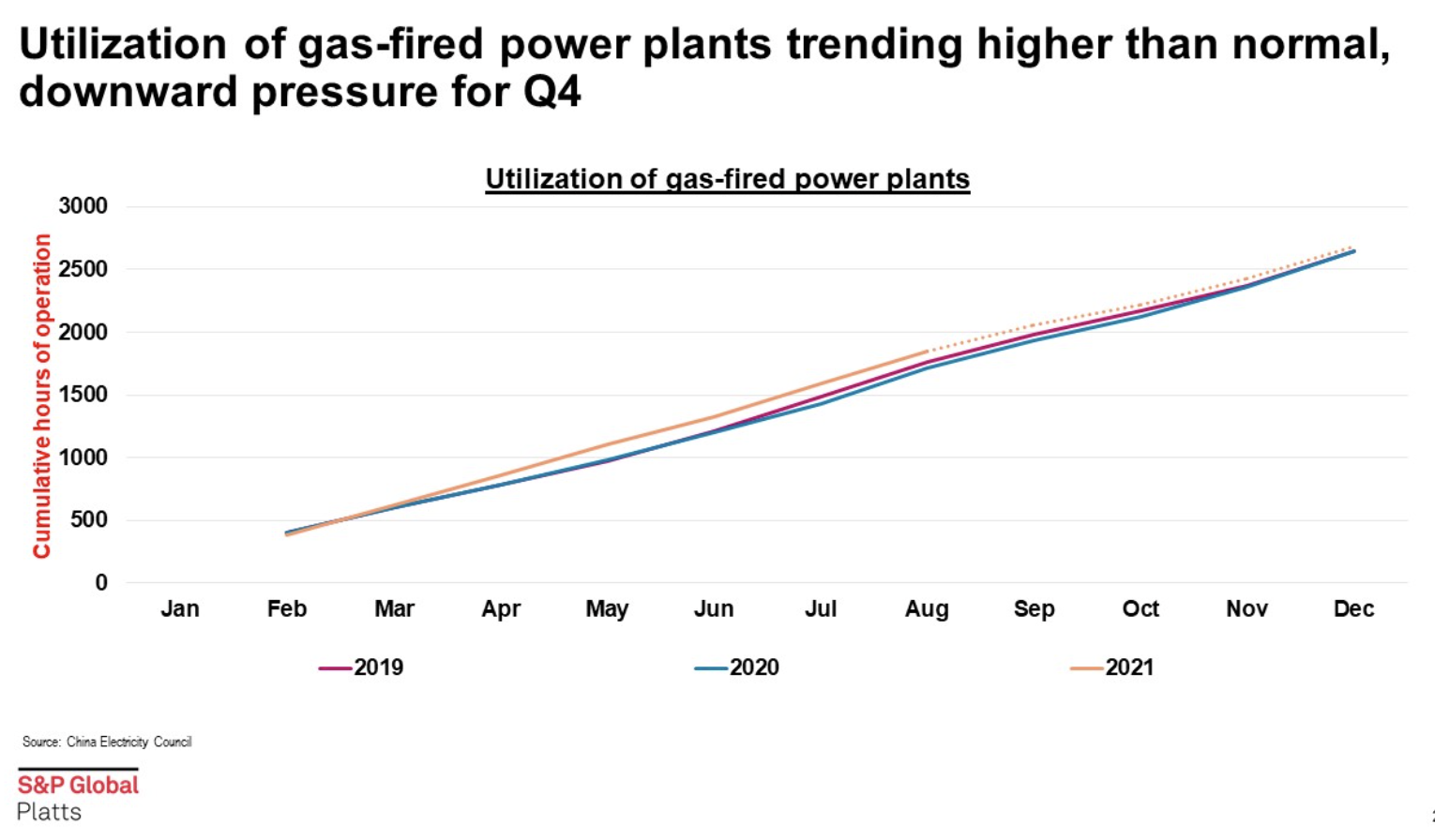

Spotlight: China's Use Of Gas For Power Generation Likely To Soften For Q4

In China, every province sets the power price for the different fuels in the fuel mix. A common stipulation, albeit not identical in all provinces, gives a higher power price for operators of gas plants that run for less than 3500 hours per year.

—Read the full article from S&P Global Platts

Analysis: China's Power Curbs Impact Long Steel Output, Squeeze Flat Steel Demand

China's steelmaking industry is facing disruption from widespread power rationing, with production of long steel currently more impacted than flat steel—but a much wider impact on manufacturing is set to rapidly squeeze demand for flat steel in the near term.

—Read the full article from S&P Global Platts

Analysis: China's Energy Intensity Caps Poorly Timed Amid Ongoing Fuel Shortages

China's latest measures to cap energy consumption have been widely blamed for causing the current power crisis, but the curbs more likely ignited a tinderbox of issues accumulating for months around soaring fuel prices and coal shortages.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language