Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 14 Sep, 2020

By S&P Global

The coal industry was struggling even before the coronavirus pandemic transformed the global economy. But as governments pledge to invest in sustainable solutions to build back better from the current economic downturn, the situation has darkened for the fossil fuel industry.

As the crisis appears to accelerate the transition from fossil-based systems of energy production and consumption to renewable energy sources like wind and solar, demand for coal has fallen faster than expected.

“It makes no sense economically to burn money on coal plants that will soon become stranded assets," U.N. Secretary-General Antonio Guterres said in a Sept. 3 online address on climate change hosted by Japan’s Environment Ministry. During the address, he urged countries to prioritize climate change issues across all aspects of decision-making, create jobs in clean energy industries, and stop subsidizing fossil fuel usage. “There is simply no rational case for coal power in any investment plan."

Coal exports from the U.S. to South Korea, India, Brazil, and Japan—the top four destinations for such trade—all declined by more than 20% during the second quarter as compared to activity in the first three months of this year, according to data compiled by S&P Global Market Intelligence. Total U.S. coal exports from April to June dropped by 41.7% year-over-year.

A Market Intelligence analysis of federal mining industry data showed that production plunged across many of the top coal mines in the U.S. during the second quarter. Overall production dropped by approximately 28.2% quarter-over-quarter in the Northern Appalachian region. The top 25 mines in the Central Appalachian region, which includes parts of West Virginia, Kentucky, and Tennessee, saw their production slide 24.7% quarter-over-quarter and 26.2% year-over-year. In the Powder River Basin, encompassing southeastern Montana and northeastern Wyoming, coal production declined 21.5% in the second quarter as compared to the previous period. Production across the Illinois Basin's top coal mines decreased by 20% for the 12-month period ended June 30.

In 2019, prior to the pandemic, coal production in the U.S. was at its lowest level since 1978, according to the U.S. Energy Information Administration, which anticipates that this year’s decline will be even greater—likely to push production to levels comparable to those in the 1960s.

As thermal coal producers lose ground to natural gas and renewables in power-generating plants across the U.S., their competitive advantage relative to other mining companies has suffered,” S&P Global Ratings said in an Aug. 17 report. “Credit quality has weakened sharply since 2019 because the ongoing secular decline of thermal coal and the collapse of seaborne prices, exacerbated by the pandemic-induced economic slowdown, shrank earnings. The steady pace of coal-fired plant retirements represents a permanent form of demand destruction, which is leading to asset impairments. Environmental, social, and governance (ESG) concerns have intensified over the past year, making capital markets less accessible to thermal coal company issuers and raising questions about the sustainability of their capital structures.”

Companies around the world have fast-tracked existing plans to retire their coal power plants. Committed to closing all of its coal-fired energy capacity by 2025 as part of Italy’s National Energy and Climate Plan in accordance with the European Commission, Enel announced on Sept. 9 that it will close three coal plants as early as next year. Italy’s reliance on coal-fired generation dimmed to account for just 1% to 2% of the country’s energy mix during July and August, according the market operator GME.

"We'll do it faster than we expected just one year ago," Antonio Cammisecra, the head of global power generation at Enel, which is Italy’s largest power generator, said of decommissioning the coal plants in a July interview with S&P Global Platts. "No doubt, by 2025, Enel will be out of coal in Italy and, mostly, around the world."

“We're basically not burning coal right now,” Mr. Cammisecra said. “I think this [dynamic] is here to stay … So better to close these plants now.”

To be sure, not all market participants are bearish about coal’s future in a post-pandemic world. South Africa's domestic and export coal industry is tentatively upbeat that, after enduring initial supply disruptions, coal-fired energy growth in developing nations could cement a concrete foundation for the country’s coal exports in the long-term as coal exports now start to increase in the immediate term. The Trump Administration rolled back standards last month on how coal plants discharge polluted wastewater in an effort to rescue the U.S. coal industry. The move is likely to save utilities $140 million annually due to its allowance of less expensive cleaning protocols, according to the Environmental Protection Agency, as well as keep older coal plants in production for longer. Environmentalists warned that the relaxed rule will expose those who live within three-mile radiuses of the plants to mercury, arsenic, and other pollutants that are disposed of in public water sources.

Still, some nations are taking strong steps to cut their dependence on coal production. Zimbabwe banned all mining in its national parks on Sept. 9 following a public outcry about Chinese companies’ being granted coal exploration permits in the Hwange National Park, home to more than 50,000 elephants. Poland announced on Sept. 8 that it plans to invest $40 billion into nuclear energy generation and $35 billion into wind generation. If the climate strategy is approved by the government, the efforts will nudge one of the largest coal-producing economies in the European Union towards the bloc’s climate goals.

The International Energy Agency expects power sector coal demand to contract sharply this year, with “coal showing the greatest uncertainty of all fuels used for power,” according a report tracking the energy source’s progress.

Today is Monday, September 14, 2020, and here is today’s essential intelligence.

Shipping alliances help container industry boost freight rates in coronavirus pandemic

Container shipping has sailed through the coronavirus pandemic largely unscathed, as ship-sharing alliances and supply curbs to bolster freight rates have helped operators to offset tepid trade demand. These new approaches to manage capacity will help the industry cope with the long-term challenge of overcapacity in the years ahead.

—Read the full article from S&P Global Platts

Food in Focus: August consumer price gains moderate, wholesale rises slightly

U.S. food retail prices continued to rise at a more moderate pace in August from sharp increases earlier in the year fueled by coronavirus-related supply chain issues, but the gain in on-the-shelf prices outpaced a slight bump in wholesale prices and likely padded grocery margins during the month.

—Read the full article from S&P Global Market Intelligence

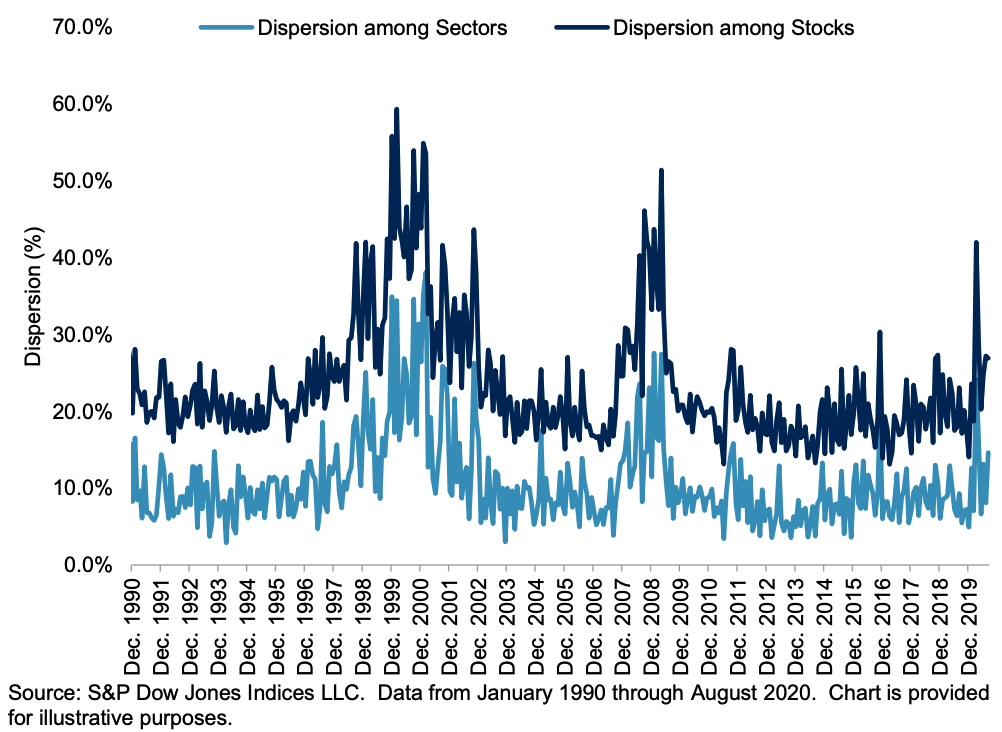

Sector Effects During Elections

The value of stock selection skill rises when dispersion is high; a larger gap between winners and losers means that active equity managers have a better chance to display their selection abilities. This logic also applies to active managers operating at a higher level of aggregation, for example by expressing tactical market views through sector rotation. The importance of sectors tends to be greater than average during the Novembers when U.S. federal (and especially presidential) elections take place.

—Read the full article from S&P Dow Jones Indices

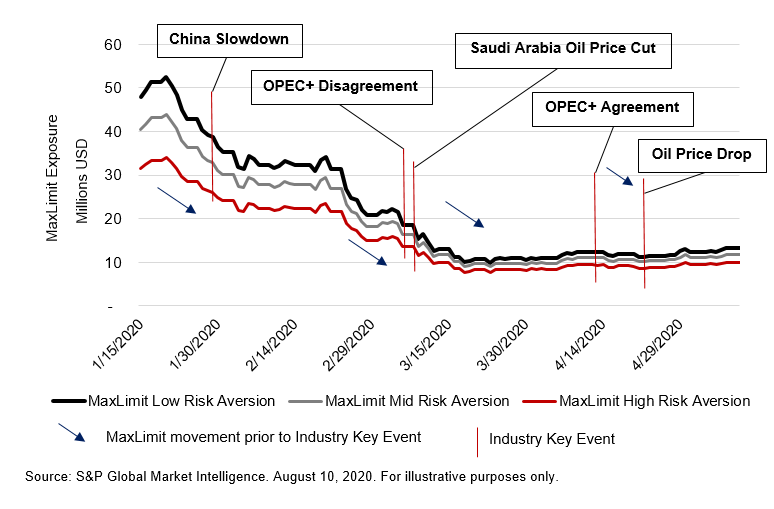

Managing Trade Credit Exposures in Times of Crisis: Impact of COVID-19 and an Oil Price War

Staying on top of trade credit exposure is fundamental for companies to help manage working capital and mitigate liquidity issues. This aspect of supply chain management and treasury operations is even more crucial during periods of market volatility and stressed economic conditions. For example, many companies within the Oil and Gas industry became insolvent and filed for bankruptcy during the first half of 2020, a time that was characterized by COVID-19 and an oil price war. This period of disruption offers a valuable timeframe to test how an exposure management tool could perform, helping companies assess their exposures to counterparties and minimize losses in the event of defaults.

—Read the full article from S&P Global Market Intelligence

Simon JV to rescue J. C. Penney; Brookfield seeks $1.3B Simply Self Storage sale

While uncertainty still clouds many corners of the commercial real estate market, the worst of the pandemic-generated storms seem to be clearing as business activity slowly resumes. A team of analysts at Baird noted that investment sales activity in direct real estate "appears poised to recover" given a recent uptick in the signed confidentiality agreements that attend such deals. The rate of year-over-year decline in signed confidentiality agreements is significantly less now than it was earlier in the year — about 17% at the end of July instead of 74% in late April to early May.

—Read the full article from S&P Global Market Intelligence

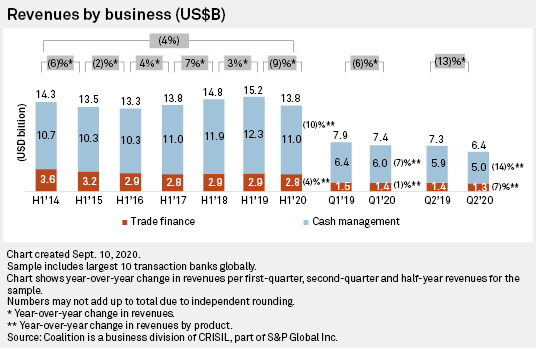

Global transaction banking revenue slump deepens in Q2 – Coalition

The revenue decline at the world's 10 largest transaction banks accelerated in the second quarter amid interest rate cuts and the continuing deterioration in global economic activity due to the COVID-19 pandemic, research company Coalition said in its latest sector index. Total transaction banking revenues fell 13% year over year to $6.4 billion in the second quarter, more than double the 6% decline in the first quarter. Over the first half, transaction banking revenues fell 9% year over year to $13.8 billion. This was the first drop after three consecutive years of growth, Coalition said.

—Read the full article from S&P Global Market Intelligence

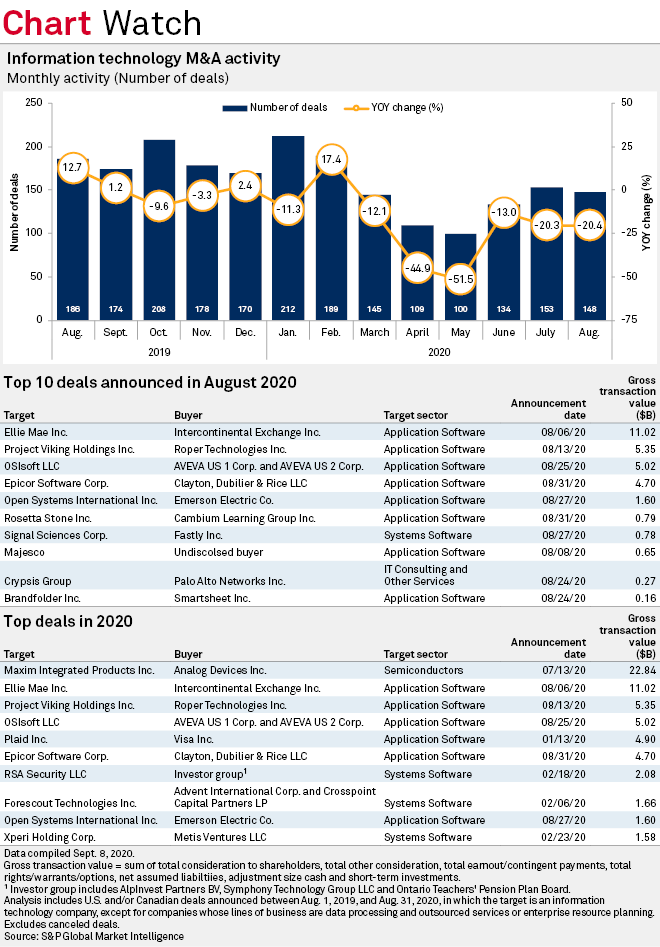

Surging fintech demand drives tech M&A activity in August

Information technology M&A deal volume was depressed again in August, but it was definitively a month of recovery. There were 20.4% fewer deals announced in the sector in August compared to the same month in the prior year. However, August 2019 was a tough comparison, up 12.7% over the prior year, and the current-year month saw the sector's second-largest deal announcement of the year—Thoma Bravo LLC's sale of Ellie Mae Inc. to Intercontinental Exchange, Inc. for $11.02 billion.

—Read the full article from S&P Global Market Intelligence

Explore the Fast-Growing S&P Composite 1500 Internet & Direct Marketing Retail Index

Technological advancements and resulting social transformations have changed our daily lives. Traditional retailers have increased their usage of business channels such as the internet, mail order, and TV home shopping to attract their customers. The trend of this business transition has been reflected in the stock market. Among all the 68 industry indices in the S&P Composite 1500® as of July 31, 2020, the Internet & Direct Marketing Retail industry stood out with its rapid growth of market share. Within the S&P Composite 1500, the weight of the S&P Composite 1500 Internet & Direct Marketing Retail Index grew from 0.06% at the end of 1994 to 5.00% as of July 31, 2020.

—Read the full article from S&P Dow Jones Indices

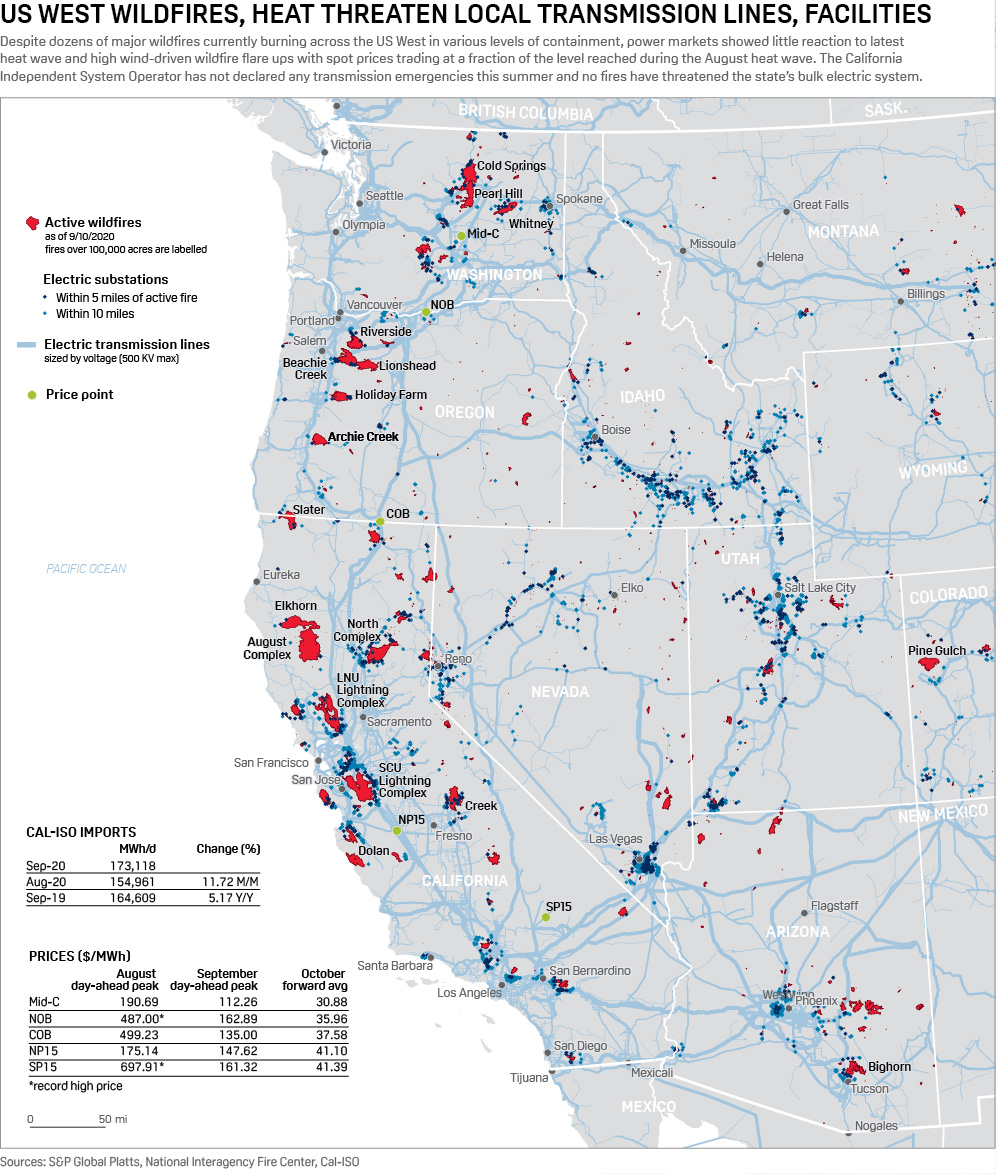

Power restoration continues after proactive outages from US West heat, wildfires

Despite apocalyptic images of the raging US West wildfires and days-long heat wave, power markets have shown little reaction to the situation, and power has been restored to nearly all customers who experienced preventative outages as part of local utilities' Public Safety Power Shutoff program. With 29 major wildfires burning across California, no fires have threatened the bulk electric system, California Independent System Operator spokeswoman Anne Gonzales said. While Cal-ISO does not oversee maintenance of transmission assets, the grid operator has a set of emergency measures if reduced transmission causes reliability concerns.

—Read the full article from S&P Global Platts

Spotlight on Japan: How Carbon-Efficient Indices Can Shape the ESG Landscape

The S&P Global Carbon Efficient Index Series is designed to reduce carbon exposure while maintaining similar levels of risk/return to the benchmark. Most notably, the index series incentivizes behavioral change among companies by uniquely encouraging two things: greater corporate transparency by rewarding companies that disclose greenhouse gas (GHG) emissions with a 10% boost in index weight; and the diversification of company business models toward low-carbon alternatives as companies seek to improve their standing in the index.

—Read the full article from S&P Dow Jones Indices

Financing markets for renewable energy rebound, tax equity could top 2019

Despite hitting a snag earlier in 2020, renewable project and acquisition financing seems to be healthy, with the tax equity market expected to grow by $3 billion over 2019 and capital markets "flush with liquidity," according to investors and developers at the virtual REFF Wall Street, which ran from Sept. 9-10. "There was certainly a big disruption back in March and April, so we had to be patient," said Bernardo Goarmon, CFO and executive vice president of finance at EDP Renewables North America LLC, speaking on one panel.

—Read the full article from S&P Global Market Intelligence

CVR Energy hedges bets as it focuses on renewable diesel

Small Midwestern refiner CVR Energy has embarked on its plan to make renewable diesel at its two Midwest refineries, taking advantage of tax credits and lowering RINs costs in a period of weak refining margins. The initial step is conversion of the 18,700 b/d hydrocracker at its 74,500 b/d Wynnewood, Oklahoma, refinery to renewable diesel service. But the conversion will not stop CVR from reverting to hydrocarbon processing when economics warrant.

—Read the full article from S&P Global Platts

Russia's environmental watchdog files US$2B claim against Norilsk over oil spill

Russia's environmental watchdog filed a claim Sept. 10 of 147.78 billion Russian rubles against Arctic mining group PJSC Norilsk Nickel Co. over a catastrophic fuel spill at the end of May at its OJSC Norilsk-Taimyr Energy Co. subsidiary. The environmental agency known as Rosprirodnadzor previously requested Norilsk to settle the US$1.96 billion claim voluntarily, before threatening legal action in September. Norilsk set aside US$2.1 billion in the first half of the year to cover the accident, reducing its net profit for the period to just US$45 million from close to US$3.0 billion a year earlier.

—Read the full article from S&P Global Market Intelligence

VW aims to increase battery supply chain transparency

As automaker Volkswagen continues to ramp up it electric vehicle offering, it said it had decided to ensure the supply chain of its battery raw materials is as transparent as possible by signing a strategic agreement with analytics outfit RCS Global. The focus of the partnership will be on auditing suppliers' conformance with human rights, safe working conditions and environmental protection along the supply chain all the way back to the mines.

—Read the full article from S&P Global Platts

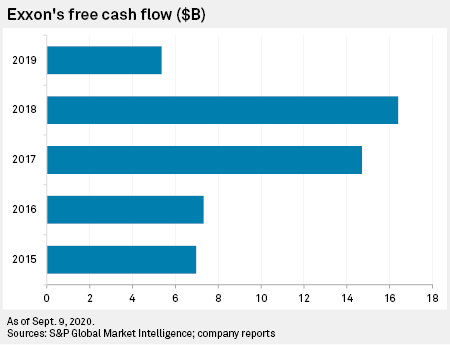

Exxon could cut dividend in 2021 if oil market recovery drags on, analysts say

Looking for ways to bolster its bottom line in the aftermath of the pandemic-fueled oil price crash, Exxon Mobil Corp. must do more to rein in its massive spending program, which could include slashing the dividend in 2021 if petroleum demand continues to wallow and oil prices hold near $40 per barrel, analysts said. "The company cannot continue to fund its large cash-flow deficit for years to come without starting to compromise the strength of its balance sheet. A recovery in oil prices and the company's end-markets and/or a large reduction in capital spending is needed to support its balance sheet over time," Edward Jones analyst Jennifer Rowland said in a Sept. 8 email.

—Read the full article from S&P Global Market Intelligence

Russian oil companies clash with finance ministry over tax changes

Russia's finance ministry is hoping to pass a law amending the excess profit tax for oil fields as early as this fall, despite open opposition from oil companies warning of a potential long-term slump in production. Russian oil producing companies have been enjoying tax breaks on four groups of fields since 2019, when the government applied the EPT tax regime to boost greenfield development by primarily taxing profits from crude sales and reducing the role of mineral extraction tax and export duty.

—Read the full article from S&P Global Platts

High-low grade iron ore blends losing cost advantage over medium grades in sintering

Rising prices of high- and low-grade iron ore fines are making combining them to produce sinter a more expensive proposition than using just medium-grade fines, according to market participants and an analysis by S&P Global Platts. Using a blend of high- and low-grade fines was Yuan 5/wmt (73 cents/wmt) more expensive than using medium-grade fines alone as of Sept. 10, when doing so a week ago on Sept. 3 made it Yuan 20/wmt ($2.95/wmt) cheaper, according to calculations using prices of port stocks compiled by Platts.

—Read the full article from S&P Global Platts

Listen: Prospects brighten for European floating diesel storage

There is rising supply for European diesel and while demand is recovering it is still short of last year's levels, the pronounced contango this is prompting comes when many clean tankers are choosing to stay in the region, meaning the stars are aligning for floating storage. Middle distillates expert Virginie Malicier and clean tanker specialist Chris To tell Joel Hanley the latest.

—Listen and subscribe to Global Oil Markets, a podcast from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language