Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 8 Oct, 2020

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

After making landfall in southeastern Mexico on Wednesday and weakening from a Category 3 to a Category 1 storm, Hurricane Delta is expected by meteorologists to regain strength again in the next two days as it crosses the Gulf of Mexico and hits Louisiana by Friday. Delta is the latest in a flurry of extreme weather events to threaten energy companies’ physical assets. Coupled with the coronavirus crisis, the future for oil and gas is floating in turbulent waters.

Approximately 80% of the U.S. Gulf of Mexico’s oil production—accounting for nearly 1.5 million barrels a day of crude output—was shuttered by Oct. 7 ahead of the hurricane, according to S&P Global Platts, which counts at least seven refineries in Louisiana and four in Texas at risk.

“Delta is expected to grow in size as it approaches the northern Gulf Coast, where there is an increasing likelihood of life-threatening storm surge and dangerous hurricane-force winds beginning Friday, particularly for portions of the Louisiana coast," the U.S. National Hurricane Service said Oct. 7.

Climate change and the coronavirus pandemic’s economic implications pose long-term risks for the energy industry.

Rising ocean temperatures due to the warming atmosphere will cause hurricanes to become more frequent, and likely stronger. Sixty percent of companies in the S&P 500 benchmark equity index, holding physical assets across 68 countries and with a combined market capitalization of $18 trillion, have high exposure to at least one type of climate-change physical risk, including hurricanes, according to S&P Global research.

Although U.S. Vice President Mike Pence said during the Oct. 7 vice presidential debate that “there are no more hurricanes today than there were 100 years ago,” already this year 25 serious storms have risen from the Atlantic Ocean, with Delta set to be the tenth named hurricane to make landfall this season. This marks what is poised to be the most active season ever, according to the National Oceanic and Atmospheric Administration.

In late August, Hurricane Laura followed a pathway similar to Delta’s with maximum winds of 150 miles per hour, pummeling the Lake Charles, La. region. Substantial swathes of the area had waited more than a month for their power to be restored—and then Hurricane Sally hit in September, leaving more than 485,000 residents in Alabama, Florida, Georgia, and Louisiana without power.

Nearly 813,500 barrels per day of oil capacity in Delta’s path currently remain shut down from the previous hurricanes, according to S&P Global Platts.

Petrochemical operations in the region are also at risk. Six weeks after Laura ravaged the area, Lake Charles’ chemical producers "need to do whatever is needed to be prepared for this scenario again," a market source told S&P Global Platts.

The global oil and gas industries have weathered a brutal blow from the coronavirus crisis’ damping of demand and an equally sharp slashing of supply. Due to the global economy contracting and consumer behaviors dramatically changing, long-term oil demand has shrunk by 2.5 million barrels per day, with full-year demand to erase the six proceeding years of growth by declining 8.1 million barrels per day, according to S&P Global Platts Analytics’ Future Energy Outlooks. On the other hand, gas is threatened most by the pandemic, with demand likely to fall 9% by 2030.

“While COVID-19 will not abruptly usher in a new world order, it has forced oil and gas companies to reassess future investments and price assumptions, accepting that weaker demand is likely to keep oil prices lower over the long term,” S&P Global’s Energy Transition Lab said in a recent report.

Delta’s expected landfall in the southeastern U.S. would come as oil and gas companies struggle to regain their footing during ongoing dual crises.

“Still looks like Hurricane Delta will be a Category 3 hurricane when it hits Louisiana on Friday. Its landfall will be less than 100 miles from where Category 4 Hurricane Laura made landfall just six weeks ago,” meteorologist Eric Holthaus said on Twitter Oct. 7. “We are in a climate emergency.”

Today is Thursday , October 8, 2020, and here is today’s essential intelligence.

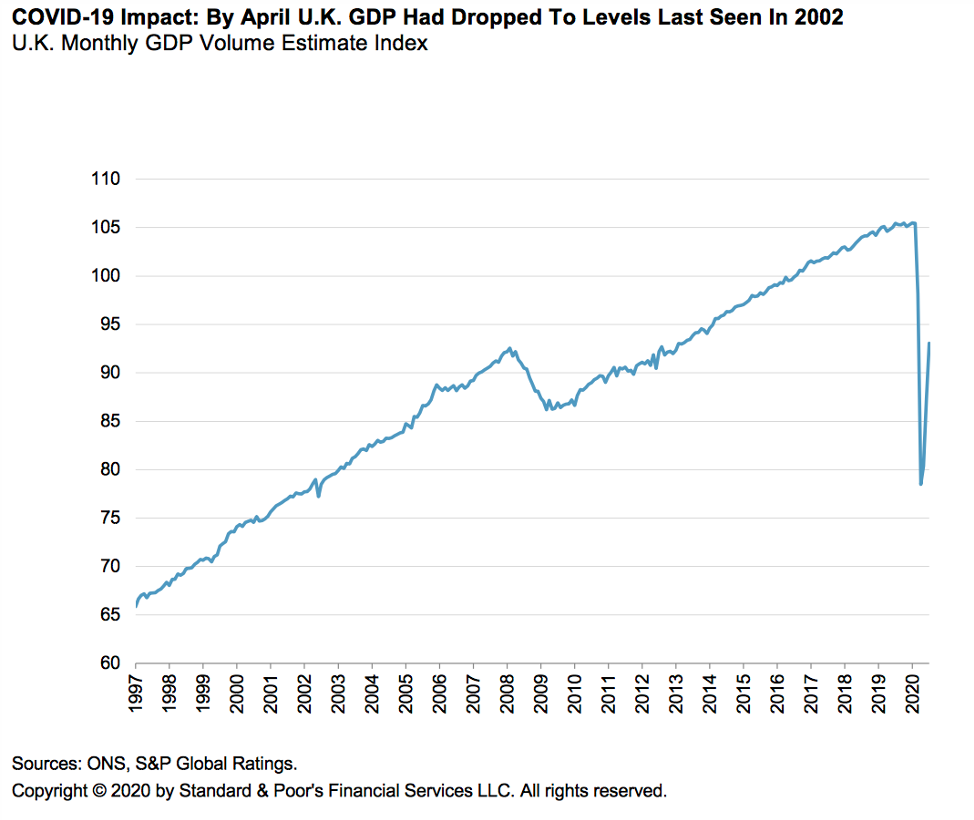

Economic Research: The Second Wave And Brexit Will Test The U.K. Recovery

The U.K. recovery continues. Just as the lockdown-induced absence of consumers in shops and the wider economy triggered the downturn, the return of the consumer is now igniting a rebound, following the removal of the most severe COVID-19 restrictions. Data available so far suggest the U.K. economy could grow 15% in third quarter, following the unprecedented 20% drop a quarter earlier. S&P Global Ratings’ Senior Economist Boris S. Glass forecast a 9.7% contraction in GDP for this year as a whole and a 7.9% rebound in 2021.

—Read the full report from S&P Global Ratings

U.S. Stock Volatility Spikes After Trump Calls Off Stimulus Talks – Risk Monitor

Another turbulent day in U.S. politics caused the stock market's volatility gauge to spike again Oct. 6, after President Donald Trump tweeted that he was ruling out another stimulus package until after the Nov. 3 election. The CBOE Volatility Index, or VIX, jumped from 28.0 to 29.5, its highest level since Sept. 10. A reading of 30.0, a historically high level, has preceded average daily movement of 1.3% in the S&P 500. The S&P 500 dropped 2.05% in the last hour and a half of trading Oct. 6 after Trump tweeted, "I have instructed my representatives to stop negotiating until after the election."

—Read the full report from S&P Global Market Intelligence

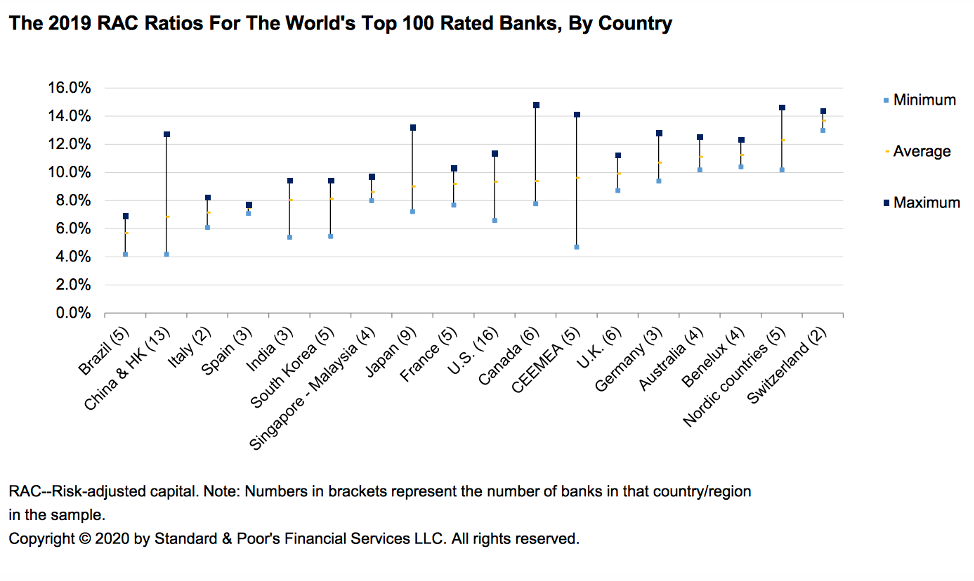

Top 100 Banks: COVID-19 To Trim Capital Levels

S&P Global Ratings has updated its risk-adjusted capital (RAC) ratios in its annual capital review for the world's top 100 rated banks. This year's review indicates that the RAC ratios of the top 100 banks have improved slightly in 2019 compared with those in 2018. The average RAC ratio ticked up to 9.0% in 2019 from 8.8% for the prior year. However, the asset quality and revenue deterioration stemming from COVID-19 will hit internal capital generation.

—Read the full report from S&P Global Ratings

Bank Disruptors Doubling Down On Mobile Payments In China

Ant Group Co. Ltd., which plans to go public, and Tencent Holdings Ltd. continue to hold the lion's share of the mobile payments market in China, based on the 2020 edition of the Asia Consumer Insights survey from Kagan, which is part of S&P Global Market Intelligence. Each of their payment apps saw a 95% adoption rate among respondents. Besides having a customer base that frequently uses their apps for everyday transactions, the two wallets have become the payment rails supporting many e-commerce, ride-hailing and food-delivery platforms.

—Read the full article from S&P Global Market Intelligence

VC Funding For Fintechs Is Down, But Big Banks Are Quietly Investing In Startups

Venture capital funding available for fintechs may have dropped during the pandemic, but major European banks are set to remain consistent if low-key investors in the sector. Lenders such as UniCredit SpA, ABN AMRO Bank NV and Groupe BPCE have participated in a variety of venture and growth funding rounds for up-and-coming fintechs, even in the depths of the COVID-19 crisis, and industry insiders expect that there is more to come.

—Read the full article from S&P Global Market Intelligence

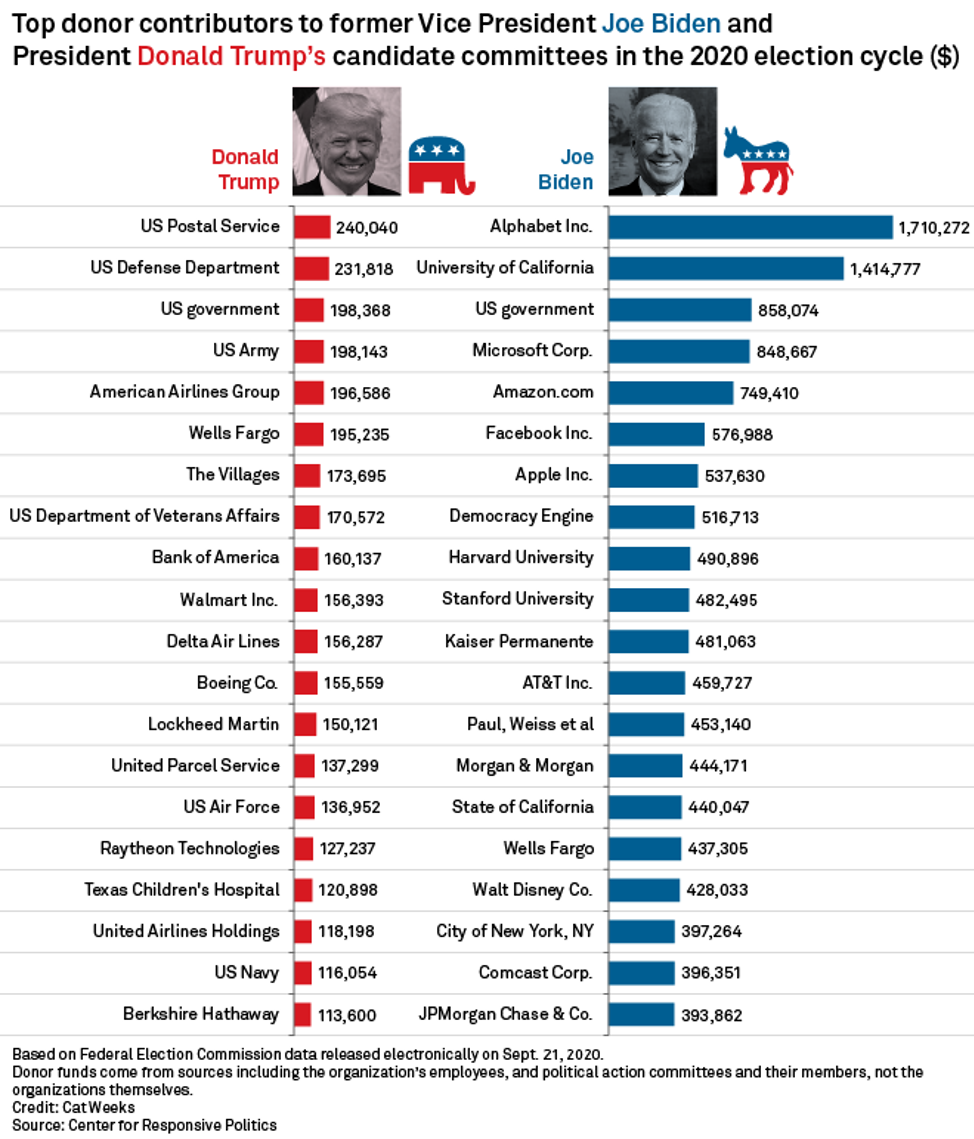

Donors Affiliated With Amazon, Big Tech Throw Support Behind Biden Campaign

Donors and political action committees affiliated with Amazon.com Inc. and other Big Tech companies are throwing their money behind former Vice President Joe Biden's presidential campaign, part of a historic trend of fundraising support to Democratic candidates over the past several decades, experts say. The companies are prohibited from donating directly to campaigns, but donors associated with them, including the companies' employees and PACs, can give money to candidates. Donors affiliated with Google parent Alphabet Inc. have given a total of $1.7 million to the candidate committee of the Democratic contender, according to federal election data compiled by the Center for Responsive Politics, a nonpartisan research group.

—Read the full report from S&P Global Market Intelligence

Robo-Advisers Catching On In China, Industry Looks Poised For Growth

Chinese consumers appear to have a keen interest in robo-advisers, an optimistic sign for the growing number of financial institutions that are launching automated investment advisory services on the back of China's pilot mutual funds advisory scheme. Roughly 38% of adult internet users in China are currently using robo-advisers, according to a 2020 survey from Kagan, a research division within S&P Global Market Intelligence. Interest was also remarkably high among non-users, with 68% expressing some level of interest in using robo-advisers.

—Read the full article from S&P Global Market Intelligence

AVIA: Building The Case For Satellite 5G

Amid the backdrop of the COVID-19 pandemic, industry leaders advocated for greater inclusion of satellite services in the global 5G ecosystem at the Asia Video Industry Association's Satellite Industry Forum, held virtually Sept. 24-25. Historically the most expensive broadband option, satellites are still critical for remote countryside and mid-ocean connectivity.

—Read the full article from S&P Global Market Intelligence

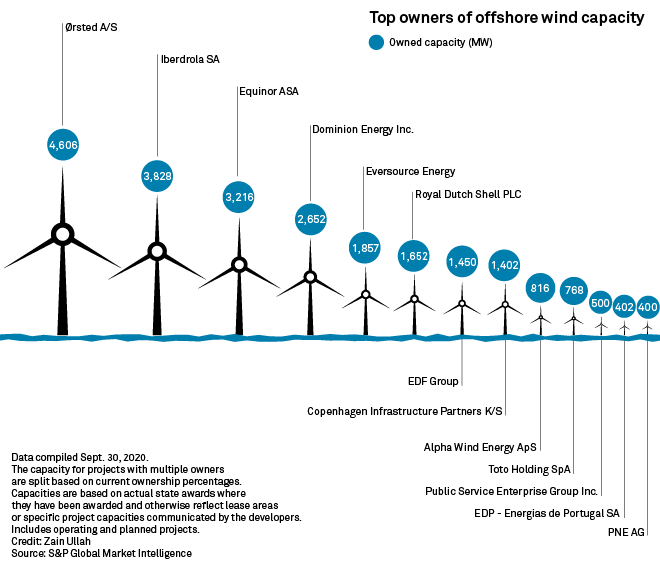

European Developers Build Out Dominance In US Offshore Wind Race

Utilities and oil majors from Europe are slicing up the Eastern Seaboard when it comes to the burgeoning U.S. offshore wind industry, with fewer domestic-owned developers so far putting money into a sector that is expected to balloon over the coming decade. BP PLC became the latest company to enter the fray in September, when it bought into two offshore wind developments owned by Norway's Equinor ASA, the Beacon Wind and Empire Wind projects, which between them have development potential of 4,400 MW, including an 816-MW state contract already awarded for Empire Wind.

—Read the full report from S&P Global Market Intelligence

Corporate Green Power Deals Grow Larger as ESG Pressure Intensifies

Spurred by rising pressure to reduce emissions, corporations are increasingly buying electricity from wind farms and solar parks — and as demand for such deals grows, so does their scale and complexity.

—Read the full article from S&P Global Market Intelligence

Climate Change, Poor Planning Led To August Blackouts – Calif. Regulators

California's rolling blackouts in mid-August, the state's first since the 2000-2001 energy crisis, resulted from a "climate change-induced extreme heat storm" across the U.S. West along with poor planning for higher levels of variable renewable energy and actions by participants in the California ISO's day-ahead energy market that "exacerbated the supply challenges," top state energy officials said in an Oct. 6 letter to Gov. Gavin Newsom that accompanied their preliminary report.

—Read the full article from S&P Global Market Intelligence

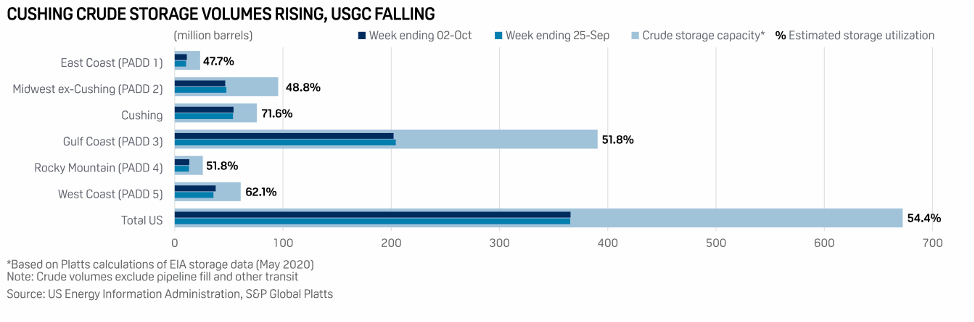

ANALYSIS: US Crude Inventories Climb As Production Normalizes After Hurricanes

US crude inventories edged higher in the week ended Oct. 2 as rising production met a slowdown in exports, US Energy Information Administration data showed Oct. 7. Commercial crude stocks climbed 500,000 barrels last week to 492.93 million barrels, EIA data showed, leaving them around 12% above the five-year average for this time of year. US West Coast crude stocks climbed 2.19 million barrels during the week, representing the bulk of the nationwide build, while Atlantic Coast stocks moved 690,000 barrels higher. In contrast, an uptick in refinery demand in the Midwest and US Gulf Coast supported regional draws, pushing inventories down 590,000 barrels and 2.06 million barrels, respectively.

—Read the full report from S&P Global Platts

BP 'Deeply Concerned' As Pipeline Attack Raises Stakes In Azerbaijan Conflict

BP said Oct. 7 it was "deeply concerned" about the expansion of the armed conflict between Armenia and Azerbaijan over Nagorno-Karabakh and particularly the targeting of the BTC crude pipeline, Azerbaijan's main export route to world markets, after Azerbaijan accused Armenia of a rocket attack on the line.

—Read the full article from S&P Global Platts

Major Caucasus Oil, Gas Pipelines Unaffected By Rocket Attack: Azerbaijan's Socar

The 1 million b/d Baku-Tbilisi-Ceyhan oil pipeline and the 25 Bcm a year South Caucasus gas pipeline are fully operational, Azerbaijan's state oil company Socar said Oct. 7, after the country's government accused Armenian forces of a missile attack on the major oil and gas export routes to Europe. Azerbaijani government officials said late Oct. 6 that Armenian forces had fired a cluster rocket which struck 10 meters away from the BTC line in the central-western Yevlakh region, ejecting more than 300 cluster bomblets. It added, however, that the pipelines were not damaged.

—Read the full article from S&P Global Platts

BP Could Wait For Oil Price Recovery Before Putting UK Assets Back On Market

Producer Premier Oil PLC backed out of its agreement to purchase aging North Sea upstream assets from BP PLC, and the London-based oil major may not be in a rush to find a new buyer given the currently depressed market environment, analysts said. Even assuming a rebound in commodity prices as well as the injection of fresh capital, it will still remain a challenging time for the completion of asset deals, energy consultancy Enervus said in an Oct. 5 summary of its third-quarter upstream M&A report.

—Read the full article from S&P Global Market Intelligence

Poland hits Gazprom with $7.6 billion fine over Nord Stream 2 project

Poland's anti-trust authority has imposed a fine of more than Zloty 29 billion ($7.62 billion, Eur6.48 billion) on Russia's Gazprom for building the Nord Stream 2 gas pipeline without its approval, in a move likely to send shockwaves through the European gas industry. The Office of Competition and Consumer Protection (UOKiK) said Oct. 7 it had also imposed a total of Zloty 234 million in fines on the five western European companies it says are financing the pipeline.

—Read the full article from S&P Global Platts

Listen: South Of The Border Heating Up: A Dive Into The Long-Awaited Developments In The Mexican Natural Gas Market

Ira Joseph, head of gas and power for S&P Global Platts Analytics, and Ryan Ouwerkerk, manager of Americas natural gas pricing for S&P Global Platts, are joined by John Hilfiker, S&P Global Platts Analytics in-house Mexico natural gas expert, to discuss the impact that the long-awaited infrastructure developments in Mexico will have on supply reliability, pricing on both sides of the border, and the long-term impact on the global LNG market.

—Listen and subscribe to Commodities Focus, from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language