Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 29 Oct, 2020

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

With nearly 50 COVID-19 vaccines in clinical trials worldwide, the frenzied race has been changeable. When treatments triggered successful immune responses in patients, both markets’ and people’s hopes raced upwards. Comparatively, challenges and delays in clinical trials due to low efficacy have diminished investors’ attitudes about the potential and progress of the development.

“I think the industry’s involvement in vaccine development and treatments for COVID-19 really highlights to the public the important role the industry plays in treating diseases,” S&P Global Ratings’ pharmaceutical credit analyst Tulip Lim said on the latest episode of the Beyond the Buzz podcast.

U.S. President Donald Trump had promised a coronavirus vaccine would be available before the Nov. 3 presidential election. Political pressure surrounding when and how the immunizations would be made available have lowered trust in pharmaceutical makers, despite companies’ plans to make the drugs affordable and accessible for all.

"For us, the election is an artificial milestone. This is going to be not a Republican vaccine or a Democratic vaccine," Pfizer CEO Dr. Albert Bourla told analysts on the company’s Oct. 27 earnings call, according to S&P Global Market Intelligence. The New York-based company, in partnership with German biopharmaceutical firm BioNTech SE, has more than 42,000 participants in multiple clinical trials and said it will share Phase 3 data in the third week of November. Previously, Pfizer’s chief executive had committed to sharing data from the treatment’s Phase 3 trial in October. "[This] will be the vaccine for the cities of the world, and this is how we see it."

To combat the perceived politicization of the vaccine-development process, Pfizer has published real-time Phase 1 trial data, published an open letter to the public providing clarity around the company’s development timelines, and committed alongside other pharmaceutical companies to develop a quality vaccine following an ethical process. Dr. Bourla said that once the vaccine is available, Pfizer will expand its educational efforts on the treatment’s safety and will target minority communities that have been disproportionately hurt by the coronavirus.

Dr. Anthony Fauci, the U.S.’s leading infectious-disease doctor said on Oct. 28 that a vaccine won’t be available until January or later.

"I think it will be easily by the end of 2021, and perhaps even into the next year, before we start having some semblances of normality," he said during a panel discussion hosted by the University of Melbourne.

Vaccine experts have expressed concern surrounding the specifications for which drugs will be able to receive emergency use authorizations from the U.S. Food and Drug Administration. The FDA says that COVID-19 vaccines should be able to prevent the virus or limit its severity in at least 50% of those who are immunized. During an Oct. 22 meeting of the FDA's 18-member Vaccines and Related Biological Products Advisory Committee, several suggested that the federal government’s requirements may be too relaxed, according to S&P Global Market Intelligence.

The U.S. could end up with a vaccine that treats mild COVID-19 "but actually does very little to address what we really care about, which is serious disease and death," Sheldon Toubman, a staff attorney at New Haven Legal Assistance Association, who was the consumer representative on the committee, said.

Worldwide, 44.4 million cases of coronavirus have been confirmed and 1.2 million people have died, according to Johns Hopkins University data. In the U.S. alone, 8.9 million people have contracted the virus and more than 227,600 people have died from the disease.

Today is Thursday, October 29, 2020, and here is today’s essential intelligence.

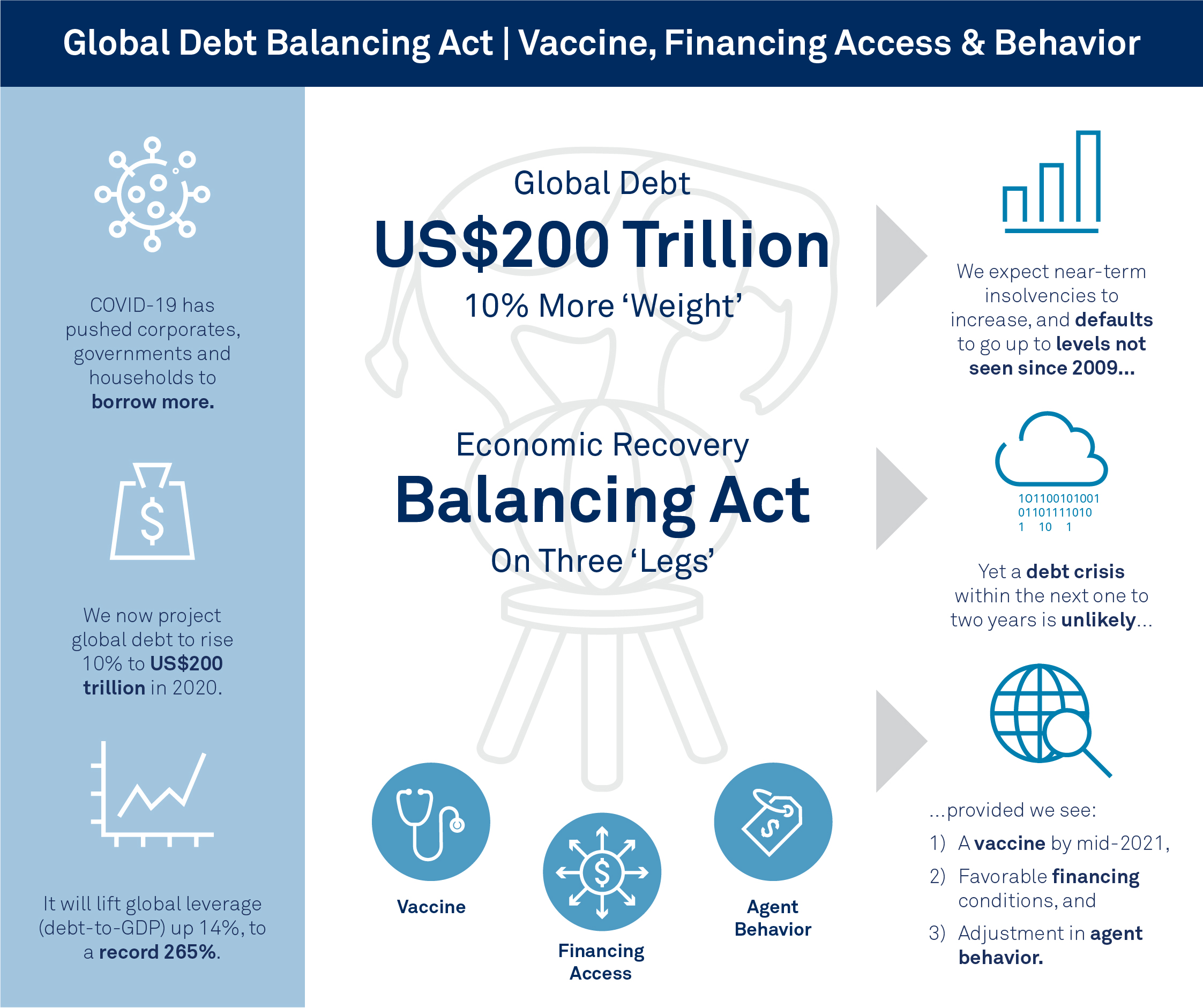

Global Debt Leverage: Risks Rise, But Near-Term Crisis Unlikely

Although S&P Global Ratings projects global debt-to-GDP in 2020 to jump 14% to a record 265%, a debt crisis within the next two years is not likely given the expected economic recovery, a vaccine by mid-2021, favorable financing conditions, and sovereign, corporate and household spending and borrowing behaviors.

—Read the full report from S&P Global Ratings

How a Big Election Win for the Democrats Could Affect U.S. Telecom and Cable Companies

S&P Global Ratings answers some specific questions about how a blue sweep in the upcoming U.S. election could affect the telecom sector.

—Read the full report from S&P Global Ratings

COVID-19- and Oil Price-Related Public Rating Actions on Corporations, Sovereigns, and Project Finance to Date

The tally of negative actions related to the COVID-19 pandemic and the oil-price dislocation decreased slightly to 19 this week—roughly 7% the peak weekly amount.

—Read the full report from S&P Global Ratings

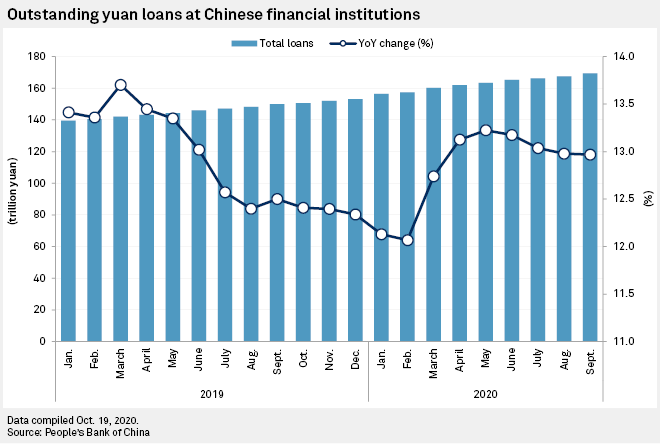

Chinese Bank Lending Likely to Grow More Slowly After Hitting Record in Q3

Chinese banks' loan books are likely to expand more slowly in the coming quarters, analysts said, after growing to a new record in the third quarter as banks heeded the government's call to lend more aggressively to the pandemic-hit economy.

—Read the full article from S&P Global Market Intelligence

Two New UK Digital Banks Take Aim at Profitable 'Mass Affluent' Market

Two new digital banks, Pennyworth and Monument, are taking aim at the "mass affluent" or "aspiring affluent" demographic, a segment that has been almost exclusively the preserve of big banks up until now.

—Read the full article from S&P Global Market Intelligence

HSBC Reinforces Commitment to Hong Kong, Asia Despite Geopolitical Concerns

HSBC Holdings PLC CEO Noel Quinn is confident the bank can navigate through U.S. sanctions on China over Hong Kong, but he made it clear at third-quarter results that HSBC regards future growth in Asia as vital.

—Read the full article from S&P Global Market Intelligence

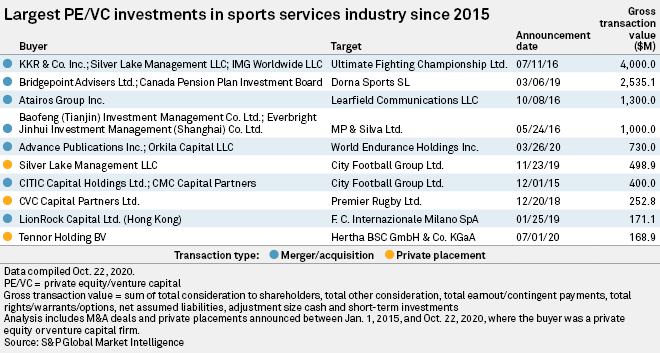

Sports Assets Set to Score More Cash from PE Players

Lucrative media rights deals have driven private equity interest in the sports sector, but factors such as a desire to capitalize on both the industry's professionalization and passionate fan base have also stoked appetite for these investments.

—Read the full article from S&P Global Market Intelligence

Octopus Tentacles as Surgical Tools; Spider Web Imaging; Antibiotic Wasp Venom

Researchers at the University of Illinois have turned to an unlikely source to create material used in surgery and wound healing: the suckers that line the tentacles of an octopus.

—Read the full article from S&P Global Market Intelligence

Podcast: CFTC Commissioner Wants Financial Regulators to Act Urgently on Climate

Rostin Behnam, a commissioner at the U.S. Commodity Futures Trading Commission, talks to ESG Insider about a report in which the CFTC's Climate-Related Market Risk Subcommittee concluded that climate change poses a "major risk" to the stability of the American financial system and the broader economy.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Market Intelligence

Countries Across Asia Plan Cost-Reduction Strategies to Advance Hydrogen Fuel Use

Countries across the Asia-Pacific, notably Australia and Japan, have set up projects and devised policies to include hydrogen as part of their energy mix with lower costs.

—Read the full article from S&P Global Platts

India Looks to Roll Out Hydrogen Roadmap in Pursuit of Cutting Energy Imports

India aims to roll out a roadmap for hydrogen as well as provide incentives to attract private sector investment as New Delhi looks at ways to scale up production in an effort to reduce costs and make it affordable to end-users, government officials and experts told the India Energy Forum by CERAWeek.

—Read the full article from S&P Global Platts

Female-Led Moneghetti to List on ASX as Junior Miners Lag in Diversity

Pure-play gold explorer Moneghetti Minerals Ltd. is planning to list on the ASX in mid-2021 with an all-female board.

—Read the full article from S&P Global Market Intelligence

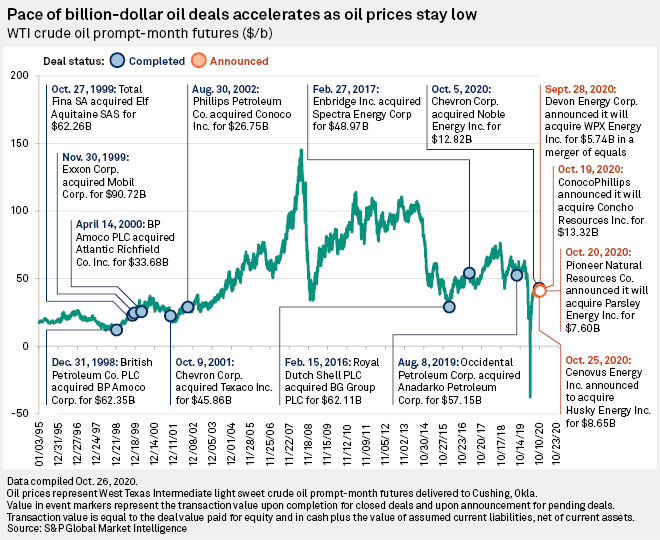

Knocked Out by COVID-19, Does U.S. Oil and Gas have the Juice to Rally Again?

The speed and severity of the latest downturn, coupled with the uncertainty of a global pandemic on an industry that is on the verge of an energy transition, has even the most optimistic industry veterans wondering if oil and gas will ever see another boom.

—Read the full article from S&P Global Market Intelligence

Two-Thirds of U.S. Gulf Crude Offline Ahead of Category 2 Hurricane Zeta

Two-thirds of the US Gulf of Mexico's crude oil volumes were shut in Oct. 28 ahead of Hurricane Zeta, which strengthened into a Category 2 storm just hours before an anticipated landfall near New Orleans.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Language